Sole Trader Accounting 101: Essential Tips for Managing Your Finances

Handling and managing vast finances can be a major hustle, especially for sole traders. With the unique challenges of being your own boss or sole trader accountant, understanding essential accounting principles becomes vital. Therefore sole trader accounting can come to the rescue for handling and monitoring finances and reports efficiently, Also hiring a sole trader accountant is the perfect solution.

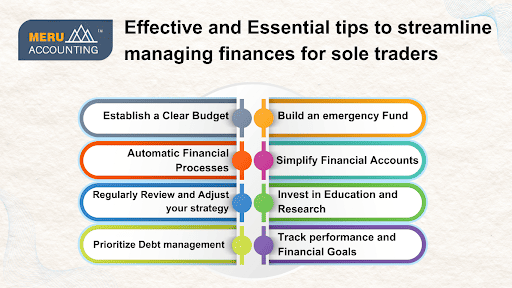

Essential Tips to streamline managing finances for Sole traders

1. Establish a Clear Budget

- Track Income and Expenses: Document all trading profits, commissions, and related expenses (e.g., trading software, data feeds, and subscriptions).

- Set a Monthly Budget: Allocate funds for trading, living expenses, and savings. This keeps you accountable and prevents overspending on high-risk trades.

2. Automate Financial Processes

- Automate Bill Payments: Set up auto-pay for recurring expenses like data feeds and trading platforms to avoid late fees.

- Savings Automation: Create automatic transfers to a savings account or investment account, ensuring you save consistently.

3. Regularly Review and Adjust Your Strategy

- Performance Review: Sole trader accountant should conduct a monthly review of your trades to analyze what worked and what didn’t.

- Adjust Your Budget: After reviewing performance, adjust your budget for trading expenses and savings based on your trading results.

4. Prioritize Debt Management

- Identify High-Interest Debt: If you carry debt (like credit card debt), prioritize paying it down first for sole trader accounting.

- Consider Margin Use Carefully: If using margin, understand the implications. Also managing and monitoring the costs associated with borrowing is essential.

5. Build an Emergency Fund

- Establish a Buffer: Aim for 3-6 months’ worth of living expenses in a liquid savings account. This protects you from unexpected expenses.

- Separate Trading Capital: Keep your trading funds distinct from your emergency fund to avoid the temptation to dip into your trading capital in tough times.

6. Simplify Financial Accounts

- Consolidate Accounts: Reduce the number of brokerage accounts and bank accounts to simplify tracking and management.

- Centralizing Records: Keeping all accounting and financial documents systematically and easily accessible.

7. Invest in Education and Research

- Continuous Learning: Sole trader accountants should also be informed about market trends, demand and strategies. Consider subscribing to reputable financial news sources, attending webinars, or enrolling in trading courses.

- Use Tools Wisely: Invest in tools that help analyze market trends or backtest strategies. These can pay off by improving your trading decisions.

8. Track Performance and Financial Goals

- Set Clear Goals: Defining specific, measurable financial goals for sole trader accounting is very essential (e.g., a target ROI, income level, or growth percentage).

- Use Performance Metrics: Regularly measure your performance against your goals to stay focused and adjust your strategies as needed.

Conclusion

In conclusion, Accounts Junction offers invaluable support for sole traders by simplifying accounting tasks, ensuring tax compliance, and providing insightful financial reporting. Its user-friendly features, cloud accessibility, and robust customer support empower sole traders to manage their finances effectively, allowing them to focus on growing their businesses.