Table of Contents

- 1 Introduction to Outsourcing Bookkeeping Services

- 2 Why CPAs are Turning to Outsourced Bookkeeping Services

- 3 Key Benefits of Outsourcing Bookkeeping Services for CPA Firms

- 3.1 1. Cost Savings

- 3.2 2. Increased Efficiency

- 3.3 3. Access to Experienced Professionals

- 3.4 4. Improved Accuracy and Compliance

- 3.5 5. Scalability and Flexibility

- 3.6 6. Access to Advanced Accounting Technology

- 4 Essential Bookkeeping Services for CPA Firms

- 5 Why Choose Accounts Junction for Outsourcing Bookkeeping Services?

- 5.1 Conclusion

- 5.2 FAQs

The Benefits of outsourcing Bookkeeping Services for CPA

Introduction to Outsourcing Bookkeeping Services

Outsourcing bookkeeping services has become a go-to solution for businesses and CPA firms looking to streamline financial management. Companies can outsource bookkeeping to specialized accounting firms instead of managing it in-house. This approach not only saves time but also enhances accuracy, compliance, and financial efficiency.

As financial regulations become more complex, outsourcing bookkeeping ensures accurate records without overwhelming internal teams. Many CPA firms outsource to lighten workloads, cut costs, and focus on financial advisory services.

Why CPAs are Turning to Outsourced Bookkeeping Services

The accounting industry is changing fast, requiring CPA firms to offer advisory services while keeping accurate records. As a result, many CPAs are turning to outsourced bookkeeping services to streamline operations, reduce workload, and enhance efficiency. Outsourcing helps CPA firms focus on financial planning while ensuring accurate and timely bookkeeping.

One of the primary reasons CPAs choose outsourcing is cost efficiency. Hiring and maintaining an in-house bookkeeping team can be expensive due to salaries, benefits, and ongoing training costs. Outsourcing gives CPA firms affordable access to professional bookkeeping, improving resource allocation. This also eliminates the overhead costs associated with office space, software, and employee benefits.

Another key factor driving outsourcing is the need for specialized expertise. Professional bookkeeping service providers have a deep understanding of accounting principles, financial reporting, and compliance regulations. They stay current with industry standards, providing CPA firms with quality bookkeeping without requiring in-house training. This expertise helps minimize errors and improves financial accuracy.

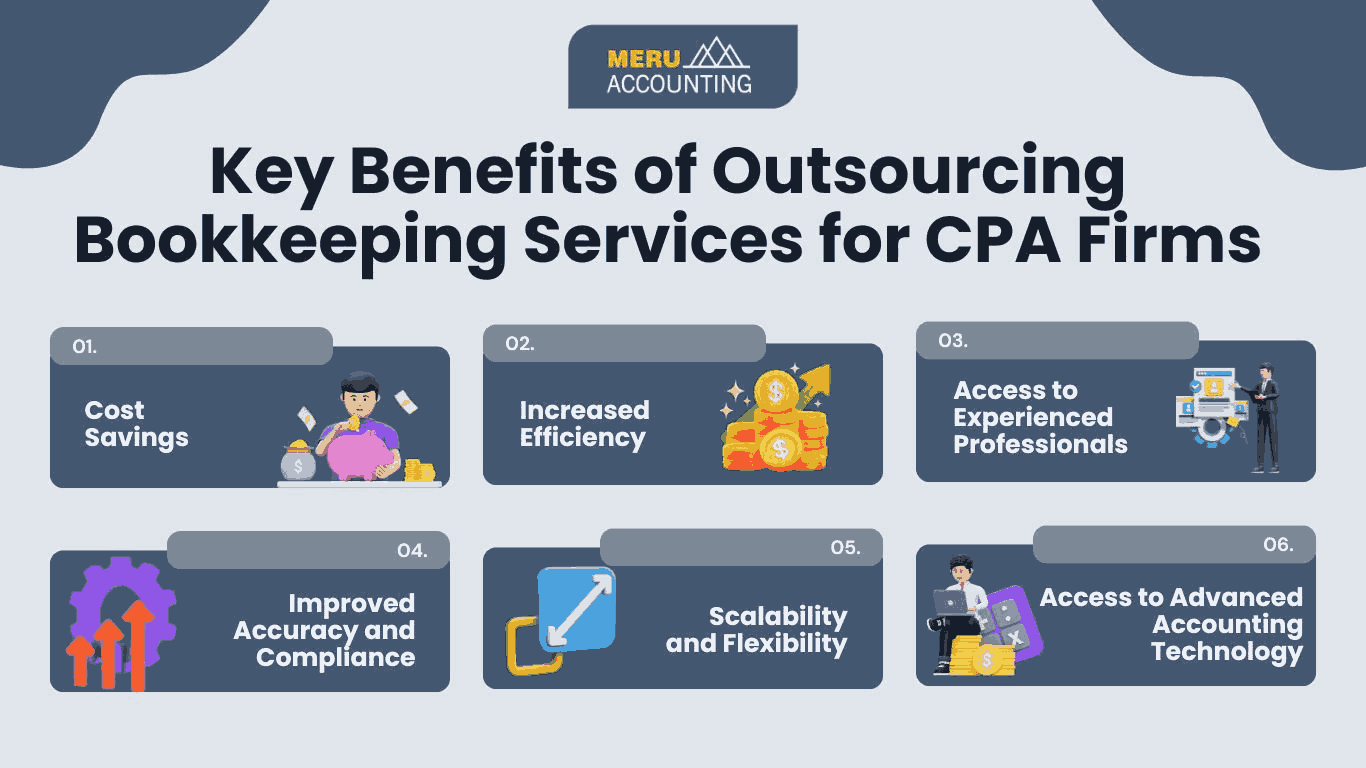

Key Benefits of Outsourcing Bookkeeping Services for CPA Firms

Outsourcing bookkeeping services offers CPA firms several strategic advantages, improving efficiency, accuracy, and cost-effectiveness. Here are the key benefits:

1. Cost Savings

- Lowers expenses related to employing full-time bookkeeping staff.

- Cuts costs associated with wages, benefits, workspace, and employee training.

- Provides access to skilled professionals at a fraction of the cost.

2. Increased Efficiency

- Allows CPA firms to focus on high-value services like tax planning and financial consulting.

- Reduces the administrative burden of managing bookkeeping staff.

- Enhances workflow efficiency with streamlined bookkeeping processes.

3. Access to Experienced Professionals

- Outsourced bookkeeping firms employ trained accountants with expertise in multiple industries.

- Ensures financial statements are accurate and compliant with regulations.

- Provides ongoing support and expert advice on complex bookkeeping issues.

4. Improved Accuracy and Compliance

- Reduces human errors in transaction recording and financial reporting.

- Ensures adherence to tax laws, accounting standards, and regulatory requirements.

- Minimizes the risk of penalties or audits due to bookkeeping mistakes.

5. Scalability and Flexibility

- Adjust services flexibly to match changing business demands.

- Supports CPA firms during peak tax seasons by handling high volumes of transactions.

- Offers customized solutions tailored to each firm’s specific requirements.

6. Access to Advanced Accounting Technology

- Uses the latest bookkeeping software like QuickBooks, Xero, and NetSuite.

- Provides cloud-based access to financial records from anywhere.

- Protects data through encryption and routine backup procedures.

Essential Bookkeeping Services for CPA Firms

Effective bookkeeping is the backbone of financial accuracy and compliance for CPA firms. With increasing regulatory requirements and financial complexities, having a reliable bookkeeping system in place is crucial. By outsourcing bookkeeping services, CPA firms can ensure accurate financial records while focusing on high-value client advisory services.

- Managing accounts payable and receivable: It is one of the most important bookkeeping tasks in a CPA firm. Bookkeepers track outstanding invoices, process payments, and ensure that all financial transactions are recorded accurately. This ensures steady cash flow, prevents late payments, and enhances financial stability for CPA firms and their clients.

- Bank and credit card reconciliation: Regular reconciliation ensures that recorded transactions match actual bank and credit card statements. This process helps detect errors, fraudulent activities, or discrepancies early, ensuring that financial records remain accurate and reliable.

Why Choose Accounts Junction for Outsourcing Bookkeeping Services?

Outsourcing bookkeeping services can significantly benefit CPA firms, but choosing the right provider is crucial. Accounts Junction is a reliable choice for CPA firms seeking accurate, efficient, and affordable bookkeeping solutions. Here’s why:

1. Expertise in Bookkeeping for CPA Firms: Accounts Junction has a team of experienced bookkeeping professionals with deep knowledge of accounting principles and tax regulations. We understand the unique needs of CPA firms and ensure financial records are maintained with precision and compliance.

2. Cost-Effective Solutions: Managing an internal bookkeeping team comes with high costs. Accounts Junction offers affordable outsourcing bookkeeping services that reduce overhead costs while maintaining high-quality financial management. CPA firms can optimize their budgets without compromising on efficiency.

3. Time Savings and Increased Productivity: Outsourcing bookkeeping allows CPA firms to focus on core tasks like tax planning, financial advisory, and client management. Accounts Junction manages bookkeeping, allowing CPAs to focus on growth and client expansion.

4. Advanced Technology and Secure Systems: We use leading accounting software like QuickBooks, Xero, and Sage, ensuring seamless bookkeeping operations. Our secure cloud-based systems protect sensitive financial data, reducing the risk of fraud or data loss.

5. Customized Bookkeeping Services: Every CPA firm has different requirements. Accounts Junction offers tailored solutions, from managing accounts payable and receivable to payroll processing, bank reconciliations, and financial reporting. Their flexible approach ensures that CPA firms get the services they need.

6. Compliance and Accuracy: With a strong focus on regulatory compliance, Accounts Junction ensures that all financial records meet industry standards. Our careful approach minimizes errors and ensures accurate reporting, helping CPA firms avoid penalties and legal issues.

7. Scalability for Growing Firms: As CPA firms grow, their bookkeeping needs become more complex. Accounts Junction offers flexible solutions that grow with businesses, providing ongoing support as firms expand.

Conclusion

Outsourcing bookkeeping is a cost-effective, efficient, and scalable solution for CPA firms. It allows CPA firms to focus on tax planning, financial advisory, and client relations without managing routine tasks.

A major benefit of outsourcing is reducing expenses. It eliminates expenses associated with hiring in-house bookkeepers, such as salaries, benefits, and office space. Additionally, CPA firms gain access to experienced professionals who ensure accuracy, compliance, and timely financial reporting. This reduces the risk of errors, penalties, and financial mismanagement.

FAQs

- What are outsourcing bookkeeping services?

Hiring external professionals to manage financial records, reducing workload and ensuring accuracy.

- Why should CPA firms outsource bookkeeping?

It saves costs, improves accuracy, and allows CPAs to focus on tax and advisory services.

- Is outsourcing bookkeeping secure?

Yes, providers use encrypted systems and comply with financial regulations for data security.

- Can outsourcing help during tax season?

Yes, it ensures accurate records, timely reconciliations, and smooth tax preparation.

- Why choose Accounts Junction?

They offer expert bookkeepers, customized solutions, and cost-effective services for CPA firms.