Tips for better virtual bookkeeping for the US based business

Managing a business in the US needs clear and updated records. Bookkeeping helps track money coming in and going out daily. Virtual bookkeeping allows business owners to handle accounts online. It saves time and keeps financial tasks simple and easy to manage. These tips for virtual bookkeeping help small and mid-size businesses stay organized.

By following simple steps and using cloud tools, you can reduce errors. This guide shares the most useful virtual bookkeeping tips to use now.

Understanding Virtual Bookkeeping

Virtual bookkeeping is managing your accounts online with software. It allows business owners and bookkeepers to work from anywhere. All records, invoices, and reports are saved safely in the cloud. This makes access quick and simple for both parties anytime. US businesses prefer this system because it saves money and time.

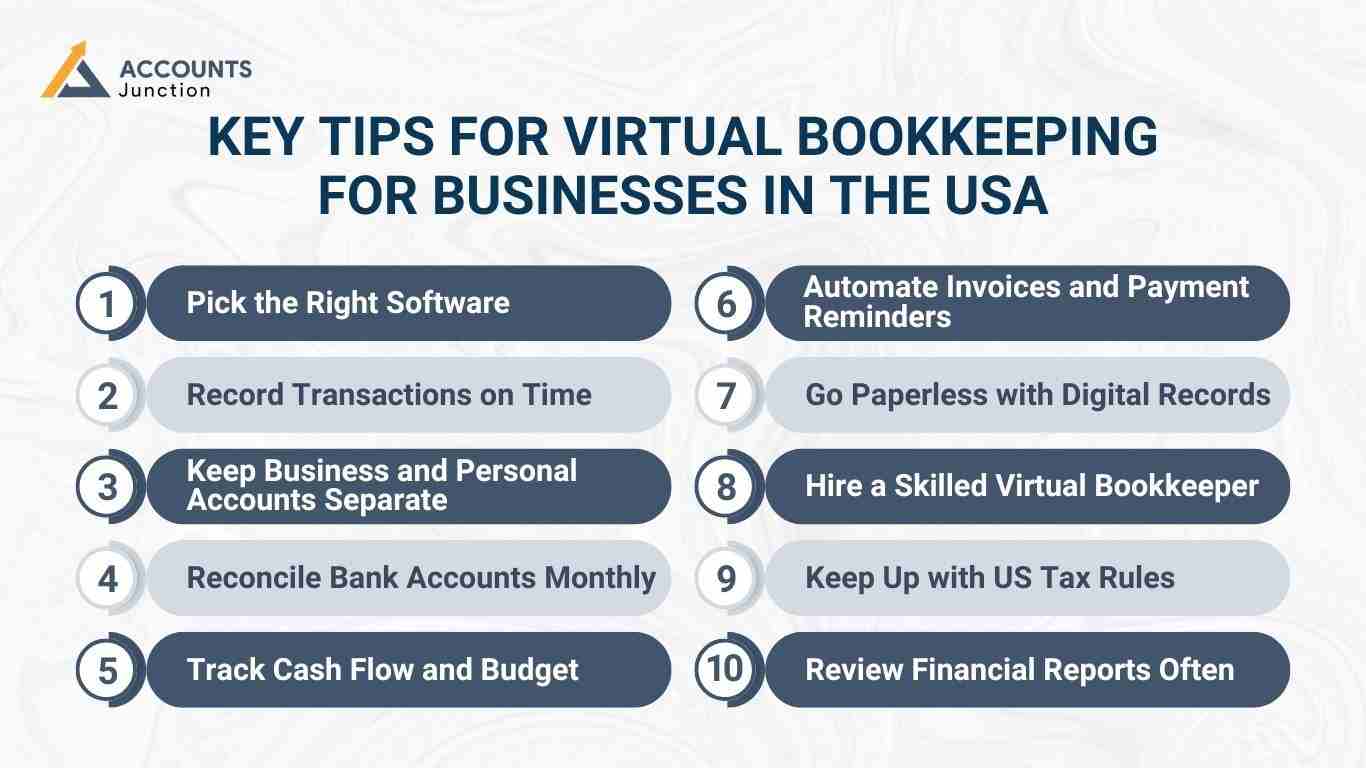

Key Tips for Virtual Bookkeeping for Businesses In the USA

1. Pick the Right Software

Choosing good software is a top tip for virtual bookkeeping. These virtual bookkeeping tips help you pick tools that work with US taxes and rules. These tools help you send invoices and record payments quickly. Pick software that works with US taxes and rules easily. Try free trials to check which tool fits your needs best.

2. Record Transactions on Time

Always record income and spending without delay for accuracy. This is a key virtual bookkeeping tip to avoid mistakes. Update your records daily or at least once each week. Late entries can cause wrong totals and tax problems later. Use software to enter transactions automatically and save effort.

3. Keep Business and Personal Accounts Separate

Do not mix personal and business money. Use separate bank accounts and cards for business spending. This is a simple Tip for virtual bookkeeping that saves time. It makes reports easy and tax filing much faster. Mixing accounts can cause mistakes and extra work for audits.

4. Reconcile Bank Accounts Monthly

Check your bank statements against your records each month. This is a smart virtual bookkeeping tip for clean books. It helps find missing or wrong entries early on. Regular checks stop fraud or accidental payments from going unnoticed. Set a fixed day each month to do this task.

5. Track Cash Flow and Budget

Know how much money comes in and goes out clearly. This Tip for virtual bookkeeping helps you plan your spending. Set a budget and compare it with what you actually spend. It helps avoid shortages and keeps the business safe. Use simple graphs or charts in your software to watch trends.

6. Automate Invoices and Payment Reminders

Use software to send invoices and reminders automatically. This is a useful virtual bookkeeping tip to save time. Automation reduces late payments and manual mistakes significantly. It keeps customers aware of payments without your constant follow-up. Automation frees your time to check reports and plan growth.

7. Go Paperless with Digital Records

Save receipts, bills, and invoices online in the cloud. This Tip for virtual bookkeeping makes records easy to find. Digital files are safe, can be shared, and do not get lost. Use Google Drive or Dropbox for storing documents securely. Back up files often to avoid data loss from errors or crashes.

8. Hire a Skilled Virtual Bookkeeper

A trained bookkeeper keeps records correct and up-to-date. This is an important virtual bookkeeping tip for all businesses. They know US tax rules and how to track money correctly. Hiring one saves time and lowers the chance of mistakes. Check reviews and credentials before hiring any bookkeeper or firm.

9. Keep Up with US Tax Rules

Follow federal and state tax rules to stay safe. This Tip for virtual bookkeeping helps avoid fines or penalties. Keep a record of deductible expenses like rent or office tools. Prepare reports regularly so filing taxes is easier. These tips for virtual bookkeeping help stay compliant with US tax rules. Ask a tax expert if new rules or credits apply to you.

10. Review Financial Reports Often

Look at reports each month to check money flow. This virtual bookkeeping tip helps you see where money goes. Check balance sheets, income statements, and cash flow reports carefully. Reports show growth, losses, and areas that need attention. Regular reviews give you confidence and control over your finances.

Key Benefits of Virtual Bookkeeping

- Saves Money

No need to hire staff or rent office space, saving you money.

You pay only for the services you need. - Flexible

Work with your bookkeeper anytime, from any place.

Adjust work hours to match your schedule. - Accurate

Tools help avoid mistakes and give clear reports.

Errors are caught early, so numbers stay correct. - Scalable

Add more services as your business grows with ease.

Your bookkeeping grows with your company needs. - Safe

Cloud storage and backups keep your data secure.

Your files stay safe even if devices fail. - Time-Saving

Automated tasks save time for your core work.

Focus more on your business, not on data entry. - Better Insights

See real-time data and simple reports to guide choices.

Make smart decisions based on facts, not guesswork. - Eco-Friendly

Use less paper with digital records, helping the planet.

Go green while keeping your records neat and clear.

These tips for virtual bookkeeping help your business stay smart, safe, and efficient.

How to Start Virtual Bookkeeping

1. Pick the Right Software

- Choose software that fits your business. Look for tools that can automate tasks, connect to your bank, and make reports easy.

2. Set Up Safe Online Storage

- Keep your documents and records in a secure cloud system. You can reach files anytime and stay protected.

3. Hire a Trusted Bookkeeper

- Work with a virtual bookkeeper or firm with good reviews and experience. Make sure they know your industry.

4. Update Records Regularly

- Follow these tips for virtual bookkeeping to update accounts weekly or monthly. Consistency keeps your books accurate.

5. Check Reports Often

- Look at reports to track progress and spot mistakes. These tips for virtual bookkeeping help you act fast and stay in control.

6. Track Expenses

- Use apps to record all expenses in real-time. This keeps nothing missing and helps with taxes.

7. Back Up Your Data

- Save records in more than one place. This keeps your business safe from tech issues or cyber risks.

8. Keep Communication Clear

- Talk to your bookkeeper regularly. Use email, chat, or video calls to share updates and questions.

Common Mistakes to Avoid

1. Record Transactions on Time

- Entering transactions late or skipping updates can cause errors. Keep your books current to track money and make fast, smart decisions.

2. Keep Personal and Business Money Separate

- Mixing accounts makes it hard to see profits and taxes. Use separate accounts for clear records.

3. Check Reports and Reconcile Often

- Ignoring reports can hide mistakes. Review statements and reconcile accounts each month to stay accurate.

4. Back Up Receipts and Files

- Lost receipts or digital files can cause problems for taxes or audits. Keep both paper and digital copies safe.

5. Follow New Tax Rules

- Tax rules change often. Missing updates can cause fines or lost deductions. Stay informed to stay compliant.

6. Categorize Expenses Correctly

- Wrong expense categories make statements and taxes hard to manage. Record each expense in its proper group.

7. Watch Cash Flow Regularly

- Follow these tips for virtual bookkeeping to watch cash flow, save time, and reduce stress.

Data Security Best Practices

- Use strong passwords and two-step verification for accounts.

- Change passwords often to keep information safe.

- Limit access to only trusted employees or bookkeepers.

- Back up data on multiple platforms for extra security.

- Watch for unusual account activity or unauthorized access attempts.

Good security keeps your books safe and builds trust.

Why US Businesses Prefer Virtual Bookkeeping

1. Compliance with Tax and Reporting Rules

- US companies follow strict tax and reporting rules. These tips for virtual bookkeeping help keep records correct and ready for audits.. It reduces the risk of penalties or fines from missed deadlines.

2. Clear Reports for Investors and Planning

- It makes reports clear for investors or business planning easily. Financial statements can be generated anytime to support smart decisions. Business owners gain insights into profits, expenses, and growth opportunities.

3. Supports Remote Work Trends

- It supports remote work trends that many US companies now follow. Teams can access records and reports from anywhere at any time. This flexibility improves efficiency and helps businesses respond quickly.

4. Better Cash Flow Management

- Virtual bookkeeping tracks income and expenses accurately in real time. It helps business owners see cash flow trends and avoid shortages. You can plan payments, payroll, and investments without delays or errors.

5. Enhanced Security of Financial Data

- Data is stored securely in the cloud with backups and encryption. It reduces the risk of physical loss or damage to records. Access can be restricted to authorized personnel, keeping information safe.

6. Scalable for Growing Businesses

- Virtual bookkeeping services grow as your business expands. You can add more features, users, or reporting options easily. This ensures the bookkeeping system stays useful as business needs change.

Virtual bookkeeping allows US businesses to track money easily and safely. Following these Tips for virtual bookkeeping reduces errors and saves time. These virtual bookkeeping tips also help with taxes and reports. Consistency, digital tools, and expert help make bookkeeping smooth. Accounts Junction offers safe and simple online bookkeeping for small and mid-size US businesses. Our certified experts keep clear records of income, costs, and taxes. We make sure your business stays organized and ready. Focus on growth while we manage your finances. Partner with us for trusted support.

FAQs

1. What is virtual bookkeeping?

- It is keeping your business money online. You can see it from any place.

2. Why use virtual bookkeeping in the US?

- It saves time and cuts costs. It also keeps the money records clear.

3. Which software works best for virtual bookkeeping?

- QuickBooks, Xero, and FreshBooks. They track bills, pay, and bank info.

4. How often should I update my books?

- Do it daily or once a week. This keeps your records right.

5. Is virtual bookkeeping safe for my business?

- Yes, if you use strong passwords. It keeps your money data safe.

6. Do I need a professional bookkeeper?

- Yes, they keep records right. They stop mistakes and follow tax rules.

7. What is the main benefit of virtual bookkeeping tips?

- They help sort money and cut mistakes. They also save you time.

8. Can virtual bookkeeping help with taxes?

- Yes, it tracks all bills and pay. It makes filing taxes easy.

9. How do I separate business and personal finances?

- Use different bank accounts. Track each one for clear records.

10. How do I reconcile bank accounts?

- Check your bank and books each month. Fix any wrong numbers fast.

11. Can virtual bookkeeping save money?

- Yes, it cuts staff and office costs. It also stops costly mistakes.

12. Is automation necessary in virtual bookkeeping?

- Yes, it saves time and cuts errors. It alerts you when bills are due.

13. How can I keep digital records safe?

- Use cloud storage and backups. Limit who can see your files.

14. Should I review financial reports regularly?

- Yes, check reports each month. They show growth and cash flow.

15. What are common bookkeeping mistakes to avoid?

- Late updates and mixed accounts.

- Also, do not skip taxes or receipts.

16. Can small businesses benefit from virtual bookkeeping?

- Yes, it saves time and shows money clearly. It helps plan and track cash.

17. How do I track cash flow effectively?

- Check income and bills each week. Update your budget each month.

18. Can virtual bookkeeping work for remote teams?

- Yes, cloud tools let teams work from anywhere. Everyone can add or see records.

19. How often should I back up financial data?

- Back up weekly or after key updates. Keep copies in more than one place.

20. Can virtual bookkeeping prevent fraud?

- Yes, check books often and limit access. It flags odd activity fast.

21. How do I choose the right software?

- Try free trials first. Pick what fits your business needs.

22. Are digital receipts accepted for tax purposes?

- Yes, scanned receipts are fine. Keep them linked to bills.

23. How do I know if my books are accurate?

- Check and reconcile monthly. Fix any missing or wrong entries.

24. Can virtual bookkeeping help plan future growth?

- Yes, reports show trends and guide choices. You can plan cash, costs, and new projects.