Table of Contents

- 1 Xero Tips for Transaction Reconciliation

- 2 What is Xero and How It Simplifies Accounting?

- 3 Importance of Reconciling Transactions in Xero

- 4 Understanding Transaction Reconciliation in Xero

- 4.1 What is Transaction Reconciliation?

- 5 How Xero Automates the Reconciliation Process

- 6 Step-by-Step Guide to Reconciling Transactions in Xero

- 6.1 Connecting Your Bank Accounts to Xero

- 7 Matching Bank Transactions with Invoices and Bills

- 8 Handling Bank Statement Lines and Unmatched Transactions

- 9 Best Xero Tips for Efficient Transaction Reconciliation

- 9.1 Using Bank Rules to Automate Reconciliation

- 10 Using Xero Reports for Financial Accuracy

- 11 Setting Up Regular Reconciliation Checks

- 12 Why Choose Accounts Junction for Xero Bookkeeping and Reconciliation Services?

- 12.1 Conclusion

- 12.2 FAQs

TIPS ON XERO: RECONCILING TRANSACTIONS

Xero Tips for Transaction Reconciliation

Managing business finances efficiently is crucial for financial stability and growth. One of the essential accounting tasks is transaction reconciliation, which ensures that financial records match actual bank transactions. Reconciling transactions in Xero is a seamless process that helps businesses maintain accurate financial statements. In this blog, we will explore Xero, how it simplifies accounting, and the importance of transaction reconciliation. We will also provide useful Xero tips to enhance the reconciliation process and improve financial accuracy.

What is Xero and How It Simplifies Accounting?

Xero is a cloud-based accounting software designed to help businesses manage their finances with ease. It simplifies accounting by offering automation, real-time financial tracking, and easy collaboration with accountants and bookkeepers. One of its most powerful features is transaction reconciliation, which ensures that bank transactions align with accounting records.

With Xero, businesses can:

- Automate data entry and reduce manual errors.

- Monitor cash flow in real time.

- Generate financial reports instantly.

- Streamline reconciling transactions with bank feeds.

Importance of Reconciling Transactions in Xero

Reconciling transactions is a critical part of financial management. It involves matching bank transactions with invoices, payments, and other financial records to maintain accuracy. Failing to reconcile transactions can lead to discrepancies, incorrect financial reporting, and compliance issues.

Key reasons why transaction reconciliation is important in Xero:

- Error detection: Helps identify duplicate or missing transactions.

- Accounting records are precisely aligned with bank statements, guaranteeing financial accuracy.

- Fraud prevention: Detects unauthorized transactions.

- Regulatory compliance: Helps businesses stay compliant with financial regulations.

Understanding Transaction Reconciliation in Xero

What is Transaction Reconciliation?

Transaction reconciliation is the process of verifying and matching bank transactions with accounting records. We record all financial transactions in Xero; this provides a clear view of a company's financial health.

The reconciliation process involves:

- Importing bank transactions into Xero.

- Matching transactions with corresponding invoices or payments.

- Investigating discrepancies and making necessary adjustments.

- Confirming that all records are accurate.

How Xero Automates the Reconciliation Process

One of the best Xero tips is to use its automation features. Xero simplifies reconciling transactions by automatically fetching bank transactions and suggesting matches. This streamlines processes, minimizing manual effort and boosting productivity.

Xero’s reconciliation automation includes:

- Bank feeds: Directly importing transactions from bank accounts.

- Matching suggestions: Xero identifies potential matches for each transaction.

- Bank rules: Automating recurring transaction matches.

- Bulk reconciliation: Allowing multiple transactions to be reconciled simultaneously.

Step-by-Step Guide to Reconciling Transactions in Xero

Connecting Your Bank Accounts to Xero

To start reconciling transactions, you need to connect your bank accounts to Xero. This allows for automatic transaction imports.

Steps:

- Go to “Accounting” > “Bank accounts.”

- Click “Add Bank Account.”

- Select your bank and enter your login details.

- Allow Xero to sync transactions automatically.

Matching Bank Transactions with Invoices and Bills

Once bank transactions are imported, Xero allows users to match them with invoices, bills, and other financial records.

Steps:

- Open the “Reconcile” tab.

- Review suggested matches for each transaction.

- Click “OK” to confirm the match.

- If no match is found, manually categorize the transaction.

Handling Bank Statement Lines and Unmatched Transactions

If a transaction doesn’t have a match, it may require manual entry.

Steps:

- Locate the unmatched transaction in the “Reconcile” tab.

- Click “Find & Match” to search for an existing invoice or bill.

- If necessary, create a new transaction to balance the records.

Best Xero Tips for Efficient Transaction Reconciliation

Using Bank Rules to Automate Reconciliation

Xero tips suggest using bank rules to automate frequent transactions. Bank rules save time by categorizing and matching transactions automatically.

Steps to set up bank rules:

- Find the 'Bank accounts' option, and from there, pick 'Bank Rules.

- Click “New Bank Rule.”

- Define conditions (e.g., payee, reference, amount range).

- Assign categories and tax rates.

- Save and apply the rule to future transactions.

Using Xero Reports for Financial Accuracy

Xero offers various reports that help monitor reconciliation accuracy. Regularly reviewing financial reports ensures that all transactions are properly recorded.

Useful reports for transaction reconciliation:

- Bank Reconciliation Summary: Displays unreconciled transactions.

- Trial Balance: Ensures balances are correct.

- Profit and Loss Statement: Tracks revenue and expenses.

Setting Up Regular Reconciliation Checks

One of the best Xero tips for maintaining accuracy is to reconcile transactions regularly. Daily or weekly reconciliation prevents backlog and ensures up-to-date financial records.

Steps to establish routine reconciliation:

- Schedule reconciliation sessions (daily, weekly, or monthly).

- Review bank feeds and confirm correct matches.

- Investigate and resolve any discrepancies immediately.

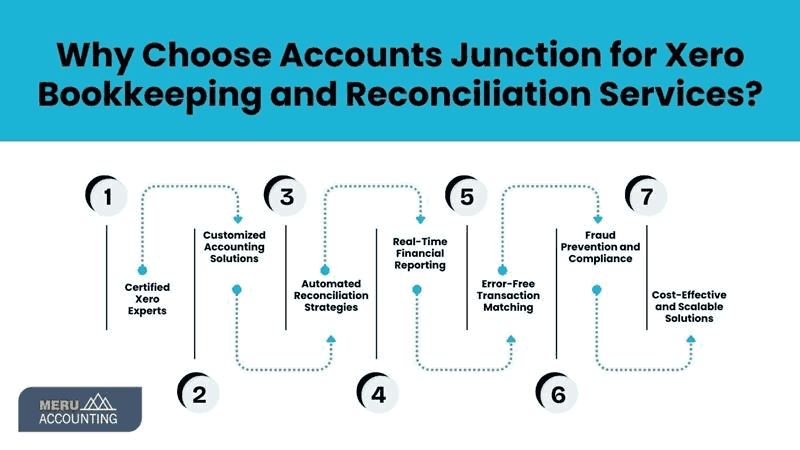

Why Choose Accounts Junction for Xero Bookkeeping and Reconciliation Services?

- Certified Xero Experts: Accounts Junction has a team of certified Xero professionals with extensive experience in reconciling transactions and maintaining accurate financial records.

- Customized Accounting Solutions: Customized bookkeeping and transaction reconciliation services designed to meet the specific needs of different industries.

- Automated Reconciliation Strategies: Implementation of Xero with bank rules and AI-driven automation to streamline reconciliation.

- Real-Time Financial Reporting: Ensuring businesses have up-to-date financial data for informed decision-making.

- Error-Free Transaction Matching: Expertise in identifying and resolving unmatched transactions to maintain financial accuracy.

- Fraud Prevention and Compliance: Regular transaction reconciliation helps in detecting discrepancies, unauthorized transactions, and ensuring compliance with financial regulations.

- Cost-Effective and Scalable Solutions: Affordable Xero bookkeeping services that scale with business growth, reducing overhead costs.

Conclusion

Transaction reconciliation is a crucial accounting task that ensures financial records align with bank transactions. Xero simplifies this process with automation, bank feeds, and intelligent matching. By following the above Xero tips, businesses can streamline their reconciliation process and improve financial accuracy. With Accounts Junction, you can stay ahead in financial management by using Xero’s powerful features and implementing best practices for seamless transaction reconciliation.

FAQs

1. What is the purpose of transaction reconciliation in Xero?

Transaction reconciliation ensures that bank transactions match accounting records, improving financial accuracy and compliance.

2. How often should I reconcile transactions in Xero?

For best results, reconciling transactions should be done daily or weekly to maintain up-to-date financial records.

3. Can Xero automatically reconcile transactions?

Yes, Xero offers automated reconciliation by importing bank transactions and suggesting matches based on previous entries.

4. What are some top Xero tips for reconciliation?

Reconcile transactions frequently, and set up bank rules; these are useful Xero tips for accurate accounting.

5. Why should I choose Accounts Junction for Xero reconciliation services?

Accounts Junction provides expert Xero bookkeeping, automated transaction reconciliation, and customized financial solutions for businesses of all sizes.