Table of Contents

Top Reasons to Use Remote Bookkeeping Services

What Are Remote Bookkeeping Services?

Remote bookkeeping services refer to the process of managing a business’s financial transactions, records, and reports through cloud-based accounting software. Unlike traditional bookkeeping, which requires an in-house accountant, remote bookkeeping allows businesses to handle their finances from anywhere. With the rise of digital technology, businesses are increasingly relying on online bookkeeping services to streamline financial management.

These services are managed by professional bookkeepers who handle financial tasks such as data entry, transaction reconciliation, financial reporting, and tax preparation. Businesses can access their financial data securely at any time, ensuring better decision-making and financial transparency.

Why Businesses Are Shifting to Online Bookkeeping Services

The shift to online bookkeeping services has been driven by several factors, including:

- Cost Efficiency: Hiring an in-house accountant can be expensive. Remote bookkeeping services help businesses save money by offering affordable financial management solutions.

- Time-Saving: Business owners can focus on core operations while professional bookkeepers handle their financial records.

- Access to Expertise: Remote bookkeeping services provide businesses with access to experienced professionals who understand tax regulations, compliance, and financial management.

- Technology Integration: With online accounting software like QuickBooks, Xero, and Zoho Books, businesses can automate financial processes and reduce errors.

- Security and Data Backup: Cloud-based online bookkeeping services ensure that financial data is stored securely and backed up regularly.

- Scalability: Whether a small startup or a large corporation, remote bookkeeping services can be tailored to fit the unique needs of a business.

How Remote Bookkeeping Services Work

Remote bookkeeping services function through cloud-based accounting software, allowing businesses to send financial data digitally.

- Initial Setup: Businesses share their financial data with the remote bookkeeping provider.

- Data Entry and Categorization: The bookkeeper records transactions and categorizes them appropriately.

- Bank Reconciliation: Transactions from bank accounts are matched with recorded entries to ensure accuracy.

- Financial Reporting: Monthly or quarterly reports are generated to provide insights into business performance.

- Tax Preparation: Remote bookkeepers assist in tax filing by organizing financial records and ensuring compliance.

- Expense and Income Tracking: Businesses can monitor cash flow and profitability using online accounting tools.

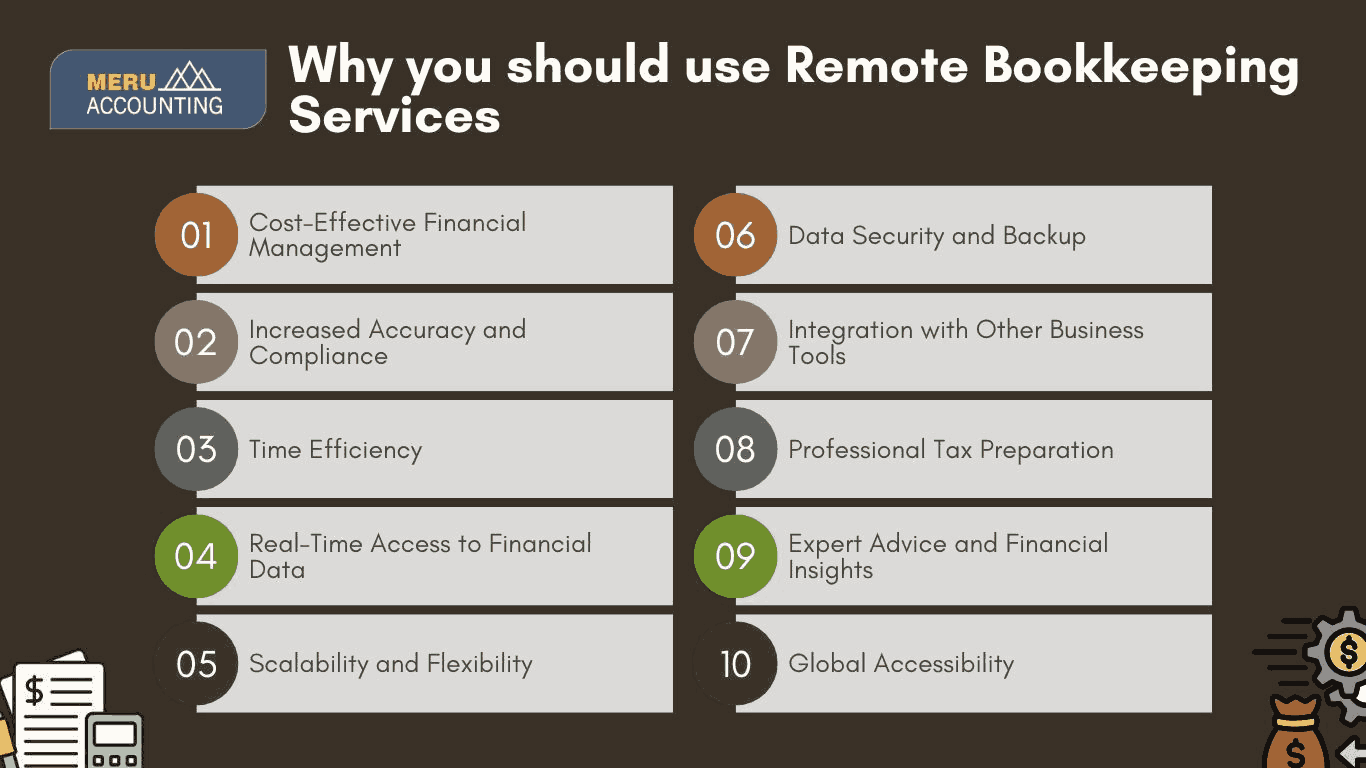

Why you should use Remote Bookkeeping Services

Remote bookkeeping services have revolutionized financial management, helping businesses streamline accounting processes while saving time and money.

-

Cost-Effective Financial Management: Managing in-house bookkeeping can be expensive, requiring salaries, benefits, and office space. Remote bookkeeping services eliminate these costs by offering affordable solutions tailored to business needs.

-

Increased Accuracy and Compliance: Professional online bookkeeping services ensure that financial records are accurate and compliant with tax regulations. This reduces the risk of errors and penalties, keeping businesses financially secure.

-

Time Efficiency: Business owners can focus on growing their companies while expert bookkeepers handle financial records, tax preparation, and reporting. This saves valuable time that can be invested in business development.

-

Real-Time Access to Financial Data: With online accounting, businesses can access financial reports and data anytime, from anywhere. Cloud-based systems provide real-time updates on cash flow, expenses, and profitability.

-

Scalability and Flexibility: As a business grows, its financial needs change. Remote bookkeeping services offer flexible solutions that scale with business expansion, ensuring continued financial support without the need for hiring additional in-house staff.

-

Data Security and Backup: Cloud-based online bookkeeping services provide strong security measures, including encryption and regular backups, ensuring that financial data remains protected against cyber threats and data loss.

-

Integration with Other Business Tools: Online accounting software integrates with invoicing systems, payroll processing, and inventory management, creating a seamless financial workflow. This enhances efficiency and minimizes manual work.

-

Professional Tax Preparation: Remote bookkeepers assist in preparing accurate tax filings, reducing the chances of audits and penalties while maximizing tax deductions. They stay updated with tax laws and ensure compliance with tax authorities.

-

Expert Advice and Financial Insights: Bookkeeping professionals provide valuable insights into cash flow, profit margins, and cost-saving opportunities, helping businesses make informed financial decisions.

-

Global Accessibility: Whether operating locally or internationally, businesses can manage their finances remotely with cloud-based online bookkeeping services. This is particularly beneficial for companies operating across multiple locations or managing remote teams.

Why Choose Accounts Junction for Online Bookkeeping Services

Accounts Junction is a trusted provider of remote bookkeeping services, offering customized solutions for businesses of all sizes.

- Experienced Professionals: Our certified accountants have industry-specific expertise, ensuring compliance and best financial practices. We stay updated on financial regulations to provide accurate and reliable bookkeeping.

- Advanced Technology: We utilize top accounting software like QuickBooks, Xero, and Zoho Books for seamless bookkeeping. Our cloud-based solutions enable real-time tracking and automated financial reporting.

- Affordable Pricing: Our bookkeeping services offer cost-effective financial management without compromising on accuracy. We provide flexible pricing plans to fit businesses of all sizes.

- Customized Solutions: We tailor bookkeeping services to meet unique business needs, ensuring efficiency and accuracy. Our scalable solutions adapt to business growth and changing financial requirements.

- Secure Data Handling: We implement strong encryption and multi-layer security to protect sensitive financial data. Our strict confidentiality measures ensure complete data privacy and compliance.

- Seamless Integration: We integrate bookkeeping software with existing systems for smooth operations and efficiency. Our experts assist in setup, migration, and ongoing support for hassle-free management.

Conclusion

Businesses can enhance efficiency, accuracy, and cost-effectiveness by utilizing remote bookkeeping services. Partnering with Accounts Junction, a trusted professional bookkeeping service, ensures smooth financial management and long-term business success. With expert support, businesses can focus on growth while maintaining compliance and gaining valuable financial insights.

FAQs

1. What is the difference between traditional and remote bookkeeping services?

Ans: Traditional bookkeeping involves an in-house accountant managing financial records, while remote bookkeeping services use cloud-based software to handle transactions remotely.

2. Is online bookkeeping secure?

Ans: Yes, online bookkeeping services use encrypted cloud-based platforms, ensuring financial data security and regular backups.

3. Can I switch from my current bookkeeper to a remote bookkeeping service?

Ans: Yes, transitioning to remote bookkeeping services is easy. Most providers assist with data migration and system setup.

4. What software is used for online accounting?

Ans: Popular online accounting software includes QuickBooks, Xero, Zoho Books, and FreshBooks.

5. How do I get started with remote bookkeeping services?

Ans: To get started, contact a reputable online bookkeeping services provider, discuss your needs, and set up an account with cloud-based accounting software.

6. What industries does Accounts Junction cater to for online bookkeeping services?

Ans: We serve real estate, e-commerce, healthcare, IT, hospitality, and more with industry-specific expertise.

7. Can Accounts Junction assist with migrating from another accounting software?

Ans: Yes, we ensure a seamless migration from QuickBooks, Xero, Zoho Books, and other platforms with minimal disruption.

8. How secure is my financial data with Accounts Junction?

Ans: We use encryption, multi-layer security, and strict confidentiality protocols to protect your financial data.