Table of Contents

- 1 Comprehending Cash Management Systems

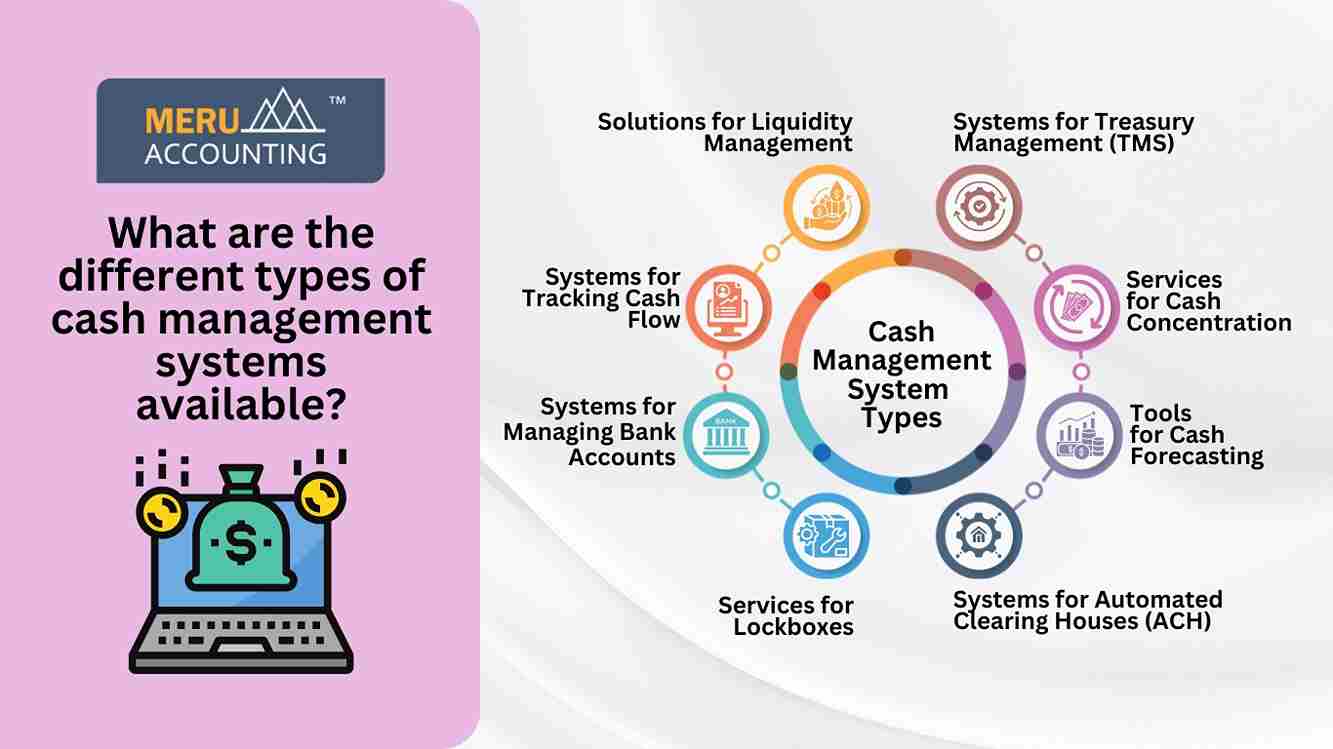

- 2 Cash Management System Types

- 2.1 1. Systems for Treasury Management (TMS)

- 2.2 2. Services for Cash Concentration

- 2.3 3. Tools for Cash Forecasting

- 2.4 4. Systems for Automated Clearing Houses (ACH)

- 2.5 5. Services for Lockboxes

- 2.6 6. Solutions for Liquidity Management

- 2.7 7. Systems for Tracking Cash Flow

- 2.8 8. Systems for Managing Bank Accounts

- 2.8.1 Conclusion-

What are the different types of cash management systems available?

For organizations to maintain financial stability, maximize cash flow, and guarantee liquidity, an effective cash management system is essential. We will examine the different kinds of cash management systems that are available to assist businesses in effectively managing their finances in this blog. There are a variety of solutions to meet various corporate demands, ranging from sophisticated automated systems to more conventional techniques like human cash handling and bank reconciliations.

We'll go over common systems and emphasize their special characteristics and benefits, including cash concentration, zero balance accounts, cash pooling, and treasury management systems. Whether it's centralizing finances, increasing cash visibility, or simplifying financial operations, each system has its own benefits. Gaining knowledge about these systems can assist companies in selecting the best option to improve their cash management services, lower financial risk, and gain more control over their monetary resources.

Comprehending Cash Management Systems

A tool, or collection of tools, called a cash management system (CMS) is intended to maximize the management of a business's cash flow. It guarantees that an enterprise may fulfill its immediate obligations while optimizing the utilization of its monetary assets. These systems are essential for managing investments, preserving liquidity, and making sure that debts are paid on time.

Cash Management System Types

1. Systems for Treasury Management (TMS)

- One all-inclusive tool for managing financial transactions and assets for firms is a Treasury Management System. It has modules for risk management, compliance, liquidity management, and cash flow forecasting. For larger companies with intricate financial procedures, TMS is perfect.

2. Services for Cash Concentration

- The process of combining money from multiple accounts into one main account is known as cash concentration. This solution makes managing several accounts easier, increasing cash resource visibility and control. It is especially helpful for companies that have subsidiaries or several locations.

3. Tools for Cash Forecasting

- Businesses can forecast their future cash flows with the use of cash forecasting tools, which use planned activities and previous data. These resources are necessary for organizing and making sure the business keeps

4. Systems for Automated Clearing Houses (ACH)

- The electronic transfer of money between banks is made easier by ACH systems. They are employed in electronic transactions such as bill payment and direct deposit. ACH systems provide a safe, practical, and economical way to handle regular cash transfers.

5. Services for Lockboxes

- Banks provide lockbox services to handle payments that companies receive. Direct payments are made to a designated P.O. box, which is handled by the bank on behalf of the company. By speeding up receivables collection, this solution enhances cash flow and lessens the administrative load on the company.

6. Solutions for Liquidity Management

- The goal of liquidity management solutions is to make the best use of a business's cash and liquid assets. Cash management services assist companies in striking the correct balance between having enough cash on hand to meet obligations and investing surplus cash for returns. They are crucial for businesses looking to maximize their financial efficiency.

7. Systems for Tracking Cash Flow

-

Systems for tracking cash flow offer up-to-date information on a company's financial situation. These systems provide a thorough picture of cash transactions by tracking both incoming and departing funds. Businesses can respond swiftly to cash flow problems and seize opportunities with the aid of real-time monitoring.

8. Systems for Managing Bank Accounts

-

Cash management services aid companies in efficiently managing several bank accounts. They offer a consolidated platform where users can keep an eye on transactions, bank fees, and account balances. Managing bank accounts well lowers the chance of overdrafts and guarantees that money is spent wisely.

Conclusion-

Businesses looking to maintain a healthy cash flow and optimize their financial operations must select the appropriate cash management system. Different business demands are catered for by the distinct features and benefits offered by each type of system.

Accounts Junction offers professional cash management services to assist companies in setting up and running these systems efficiently. With Accounts Junction’s guidance, businesses may better their financial control, improve liquidity, and achieve their financial goals. Get in touch with us right now to find out how we can help you choose and put into practice the finest cash management strategies for your company.