Table of Contents

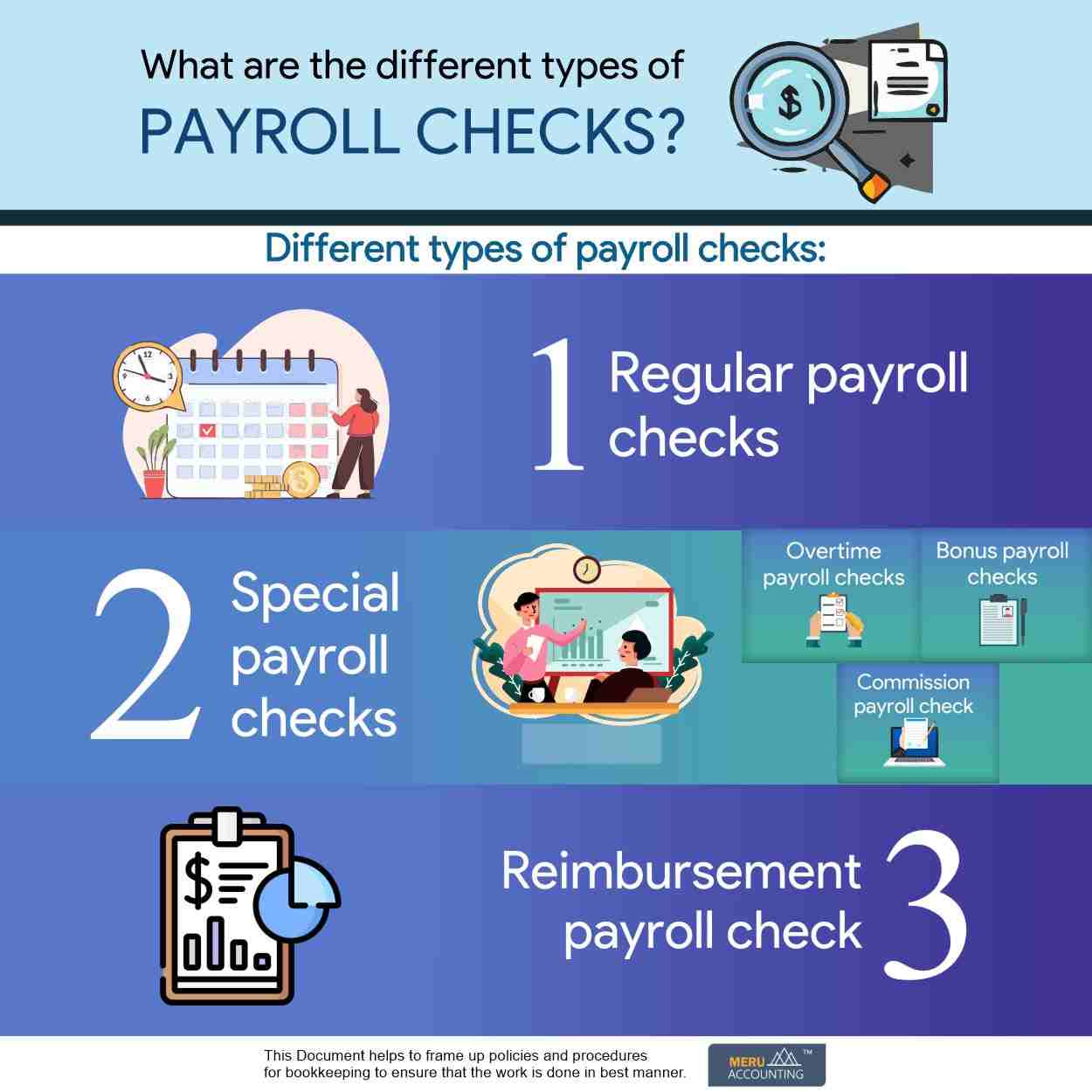

What are the different types of payroll checks?

Payroll processing is a critical function for businesses, ensuring that employees are paid accurately and on time. To streamline this process, many organizations turn to outsourced payroll services or payroll service providers.

A payroll check is a check issued by the employer to its employees as compensation for their work. Payroll checks are now replaced by direct deposits and electronic transfers.

In this article, we will delve into the various types of payroll checks and how they relate to these services, highlighting the benefits they offer businesses.

- Regular Payroll Checks: Regular payroll checks form the foundation of employee compensation. They encompass the base salary or hourly wages earned by employees for a specific pay period. When utilizing outsourced payroll services or payroll service providers, the responsibility of generating accurate regular payroll checks falls on these entities. Their expertise in payroll calculations ensures that employees receive their rightful earnings promptly.

- Special Payroll Checks:

- Overtime Payroll Checks: Employees who work beyond their regular working hours are entitled to overtime pay. Payroll services accurately calculate overtime wages, taking into account factors like time-and-a-half or double-time rates, and generate separate overtime payroll checks for employees.

- Bonus Payroll Checks: Bonuses are often used to incentivize and reward employees. Payroll services can handle the processing of bonus payments, generating bonus payroll checks on top of regular compensation. These checks reflect the additional monetary rewards employees receive based on predetermined criteria, such as performance targets or company profits.

- Commission Payroll Checks: Sales representatives and agents often receive commissions based on their sales performance. Payroll services accurately calculate and distribute commission payroll checks, reflecting a percentage or fixed amount of the sales or deals closed by employees during a specific period.

- Reimbursement Payroll Checks: Employees incur business-related expenses such as travel expenses, purchases, or mileage reimbursement, which can be reimbursed through payroll checks. Outsourced payroll services or payroll service providers ensure that reimbursement requests are accurately processed and that employees receive reimbursement payroll checks in a timely manner.

Role of Outsourced Payroll Services

Outsourced payroll services offer businesses the convenience and expertise of delegating their payroll processes to specialized providers. These services handle various aspects, including calculating wages, taxes, and deductions; generating payroll checks or facilitating direct deposits; managing payroll tax filings; and ensuring compliance with employment regulations. By leveraging outsourced payroll services, organizations can focus on their core operations while entrusting their payroll responsibilities to professionals.

Benefits of Outsourcing Payroll Services to Meru Accounting

- Accuracy and Compliance: We have a dedicated team of experienced and qualified payroll experts with thorough knowledge of payroll regulations, tax laws, and laboratory standards. This expertise ensures accurate calculations, timely tax filings, and adherence to legal requirements, reducing the risk of errors and penalties.

- Time and Cost Efficiency: By utilizing payroll services, businesses can save time and money associated with maintaining an in-house payroll department. Outsourcing payroll functions to us frees up valuable resources, allowing organizations to allocate them to other critical areas of operation. Additionally, we charge affordable hourly rates for services availed, which makes using us fit everyone's pocket.

- Data Security and Technology: Meru Accounting employs robust security measures to protect sensitive employee data. Additionally, we utilize advanced payroll software and systems that streamline processes, provide employee self-service portals, and generate accurate payroll checks efficiently.

Streamline your processing of payroll checks with us. Book an obligation-free appointment with us now