Table of Contents

Understanding Balance Sheets: A Comprehensive Overview

Introduction to Balance Sheets

A balance sheet is an important financial statement for a business. It indicates a company’s financial position at a particular time. This document includes assets, liabilities, and equity, helping business owners and investors understand the company’s financial health. A balance sheet example can help small business owners identify financial strengths and weaknesses. By reviewing a sample balance sheet, entrepreneurs can make informed decisions about their business operations.

The importance of a balance sheet for small businesses goes beyond just tracking numbers. It helps assess financial stability, measure growth, and plan for future expansion. Business owners who regularly review their balance sheets can ensure long-term success by making data-driven decisions.

Key Components of a Balance Sheet

A balance sheet for small business consists of three primary sections:

1. Assets

Assets represent what a business owns. They are categorized into two types:

- Current Assets: Cash, accounts receivable, inventory, and prepaid expenses are assets. These can be turned into cash within a year.

- Non-Current Assets: Long-term investments, property, equipment, and intangible assets like patents. These assets are kept for long-term business use and growth.

2. Liabilities

Liabilities include everything the business owes to external parties. They are divided into:

- Current Liabilities: Short-term debts like accounts payable, wages, and taxes, which must be paid within a year.

- Long-Term Liabilities: Loans and mortgages that are due over an extended period.. These obligations extend beyond one year and are crucial for financing business expansion.

3. Equity

Equity shows the owner's share in the business. It includes retained earnings and capital contributions from shareholders. If a company's assets exceed its liabilities, it has positive equity, which indicates financial stability.

An example of a balance sheet illustrates how these three components are organized, giving a clear picture of financial status. Reviewing a sample balance sheet regularly helps business owners understand their company's net worth.

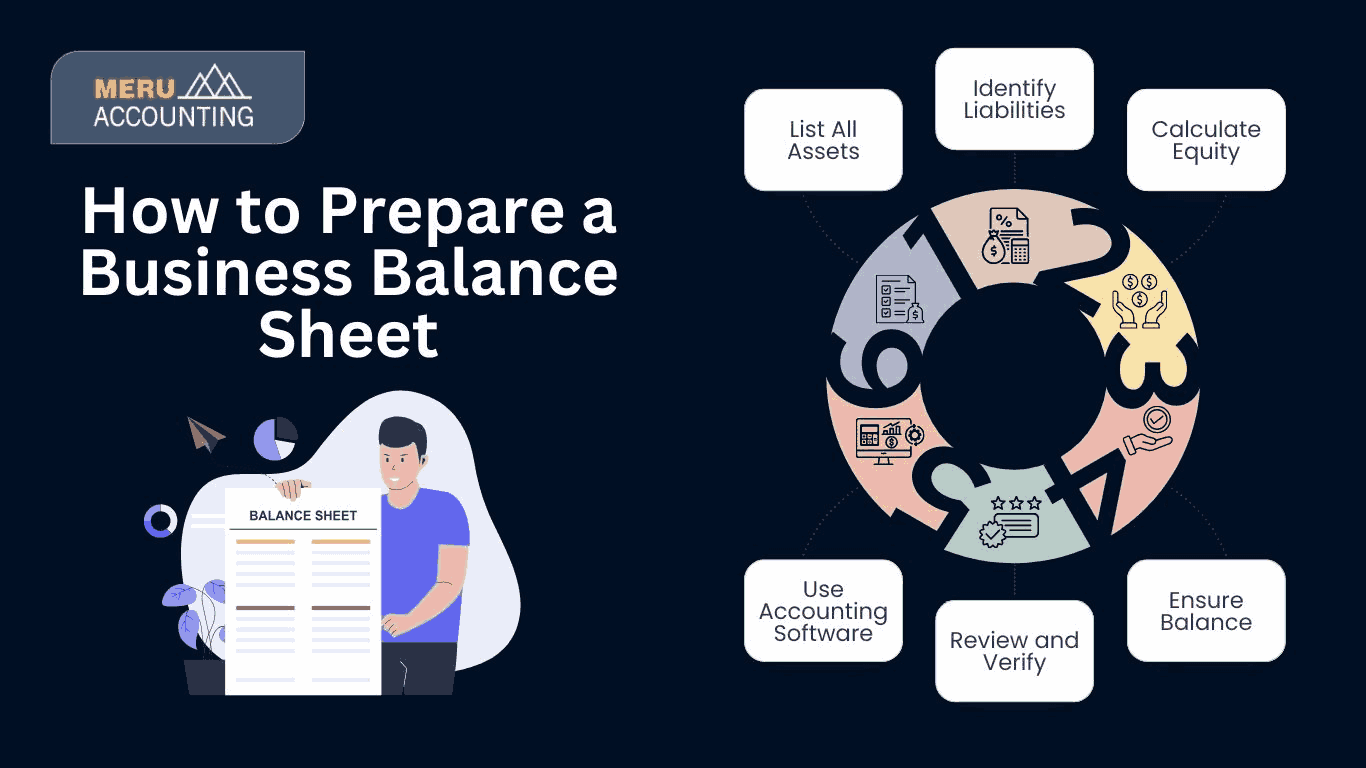

How to Prepare a Business Balance Sheet

Creating a business balance sheet requires accurate data collection and categorization. Here’s a step-by-step guide:

- List All Assets: Identify and total all current and non-current assets.

- Identify Liabilities: Document both current and long-term liabilities.

- Calculate Equity: Determine equity by subtracting total liabilities from total assets.

- Ensure Balance: The balance sheet should follow the equation:

Assets = Liabilities + Equity

- Review and Verify: Double-check the accuracy of all entries.

- Use Accounting Software: Tools like QuickBooks or Xero can automate balance sheet preparation.

Using a sample balance sheet can help guide the process and ensure all necessary details are included. A well-prepared balance sheet for small businesses ensures financial transparency and simplifies tax reporting.

Why Small Businesses Need Accurate Balance Sheets

Maintaining an accurate balance sheet for small business is essential for several reasons:

- Financial Clarity: Having a clear understanding of cash flow, assets, and liabilities enables better business decision-making.

- Loan Applications: Lenders require a business balance sheet before approving loans. A strong balance sheet increases the likelihood of securing funding.

- Investor Confidence: Investors analyze balance sheets to assess financial stability and growth potential.

- Tax Compliance: Accurate records help in proper tax reporting and compliance, reducing the risk of audits.

- Decision Making: Helps business owners strategize for growth, allocate resources efficiently, and manage risks.

- Business Valuation: A well-maintained balance sheet helps small businesses understand their true value. This is important for potential sales, mergers, or partnerships.

By reviewing a balance sheet example, small businesses can improve financial tracking and planning. A sample balance sheet provides insights into financial trends, helping business owners identify potential challenges early on.

How Accounts Junction Can Help with Balance Sheet Management

Accounts Junction offers expert financial management services, including balance sheet preparation and analysis, ensuring businesses maintain financial accuracy and stability.

- Professional Bookkeeping: Ensuring accurate record-keeping for financial transparency, reducing errors, and maintaining organized financial records.

- Custom Reports: We provide a detailed business balance sheet tailored to specific needs. It offers insights for better financial decision-making.

- Financial Forecasting: Using sample balance sheets to project future growth and identify areas for improvement, helping businesses strategize effectively.

- Compliance Assistance: We ensure your balance sheets follow regulatory standards and industry best practices. This helps minimize the risk of penalties or legal issues.

- Ongoing Support: Regular updates and monitoring of financial statements to keep businesses informed about their financial health, enabling proactive financial management.

Conclusion

A properly structured balance sheet is essential for small businesses. It provides financial clarity, helps in decision-making, and ensures compliance. Regularly reviewing balance sheets helps business owners track growth, secure funding, and maintain investor confidence. With expert assistance from Accounts Junction, businesses can ensure accuracy, streamline financial reporting, and make informed strategic decisions. By utilizing professional bookkeeping and financial forecasting, small businesses can enhance stability and plan for long-term success.

FAQs

1. What is a balance sheet?

Ans: A balance sheet is a key financial report that outlines a company’s assets, liabilities, and equity at a given point in time. It offers valuable insights into the business’s financial stability and overall health.

2. Can I create a balance sheet for my small business on my own?

Ans: Yes, you can. Using a balance sheet example can help with accuracy. Seeking professional help from Accounts Junction ensures compliance with financial standards.

3. How often should I update my balance sheet?

Ans: It is best to update your business balance sheet regularly. It can be performed on a monthly, quarterly, or yearly schedule. The frequency depends on your financial goals and reporting needs.

4. Where can I find a sample balance sheet?

Ans: You can find a sample balance sheet in accounting software or on financial websites. Professional bookkeeping services like Accounts Junction also provide them.

5. What sets a balance sheet apart from an income statement?

Ans: A balance sheet provides a snapshot of a company’s financial position at a given time, while an income statement outlines revenue and expenses over a specific period.

6. How does Accounts Junction help with balance sheet reconciliation?

Ans: Accounts Junction keeps your small business balance sheet accurate. We reconcile transactions, verify financial data, and find errors before they become problems.

7. Can Accounts Junction assist with balance sheet audits?

Ans: Yes, Accounts Junction offers detailed balance sheet audit services. We help businesses stay compliant, maintain financial accuracy, and follow regulations.