Table of Contents

VAT accounting services

How Accounting Entries for VAT works

Knowing about Accounting Entries for VAT

There are some indirect tax and charges made and charged on the supply of goods and rendering items which are collectible by the taxpayer. This is collectively known as VAT.

Manufacturer, wholesaler and retailer of taxable suppliers will pay vat on the cost addition but they are entitled to take rebate of such vat. The very last consumer of products are paid all the vat payable quantity.

Points to be remembered that VAT is not earnings or charges of the agency. This is charged on the goods or services on invoice quantity. If any bargain exist on invoice amount, VAT might be charged after subtracting change cut price and cash cut price,.I.E on internet invoice quantity.

The whole value is made on the self-assesment and the entries which are charged and scoped by the suppliers. These charges are specific and based on various method indications.

How the record of goods are calculated in the VAT

Every manufacturer of taxable supply shall have to be maintained right and whole statistics of supplied goods. The manufacturer and dealer shall be maintained sufficient statistics to ensure that Vat legal responsibility may be effectively assessed.

Records have to be entire and genuine to support all tax credit that may be claimed. However, each dealer and producer shall have to maintained the following data:

-

The Accounting Entries for VAT is charged on the purchase of items. For example, when the suppliers make the purchase of items through various manufacturers and vendors then the purchase VAT is applicable onto the same. This is done on the basis of the MRP of the item.

-

The sales record are the next thing which is taken into consideration. The sales of item depends on various subjects. When the sales are being made then the sales record are updated with the verifying amount.

-

Vat Account to be sincerely stated regarding total output tax, overall enter tax and internet tax payable or excess tax credit score which to be refunded or adjusted with the output tax.

In respect of sales, it is how VAT accounting is done

The following journal to be passed when goods are sold:

Trade Receivable A/c (including Vat)Debit

Sales A/c (excluding Vat)Credit

Vat Payable A/c (output tax)Credit

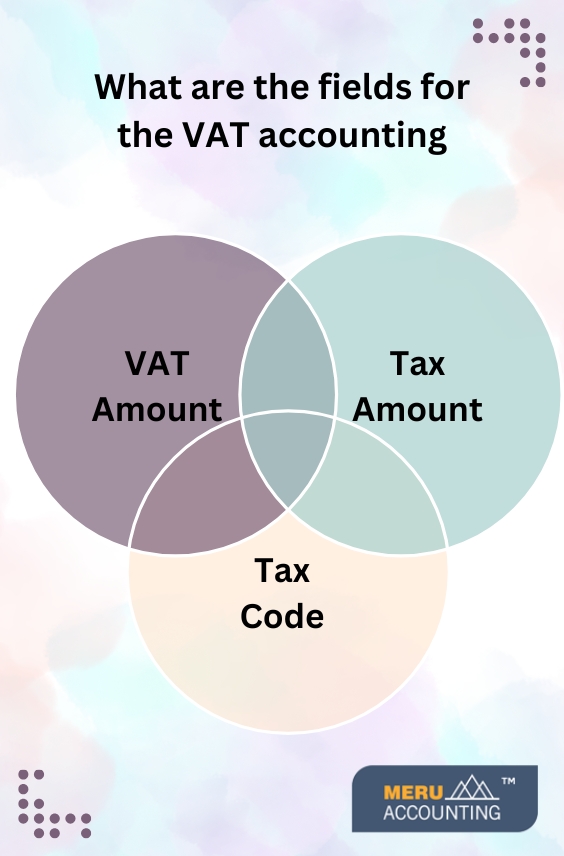

What are the fields for the VAT accounting

Here are the three things which are considered

VAT Amount: A wide variety that identifies the actual amount. Type debits with no sign or a plus signal (+). Type credits with a minus sign (-) both before or after the quantity.

Tax Amount: This is the amount assessed and payable to tax authorities. It is the overall of the VAT, use, and income taxes (PST).

Tax Code: A consumer defined code (00/EX) that controls how a tax is classified and distributed to the general ledger sales and rate bills.

Conclusion:

For the calculations of the basic VAT accounting, these are the things taken into account. These basic things make the whole accounting process and collectibles which are to be processed. Contact us for more information about VAT accounting.