Table of Contents

- 1 What Are Virtual Bookkeeping Services?

- 2 How a Virtual Bookkeeper Differs from a Traditional Bookkeeper

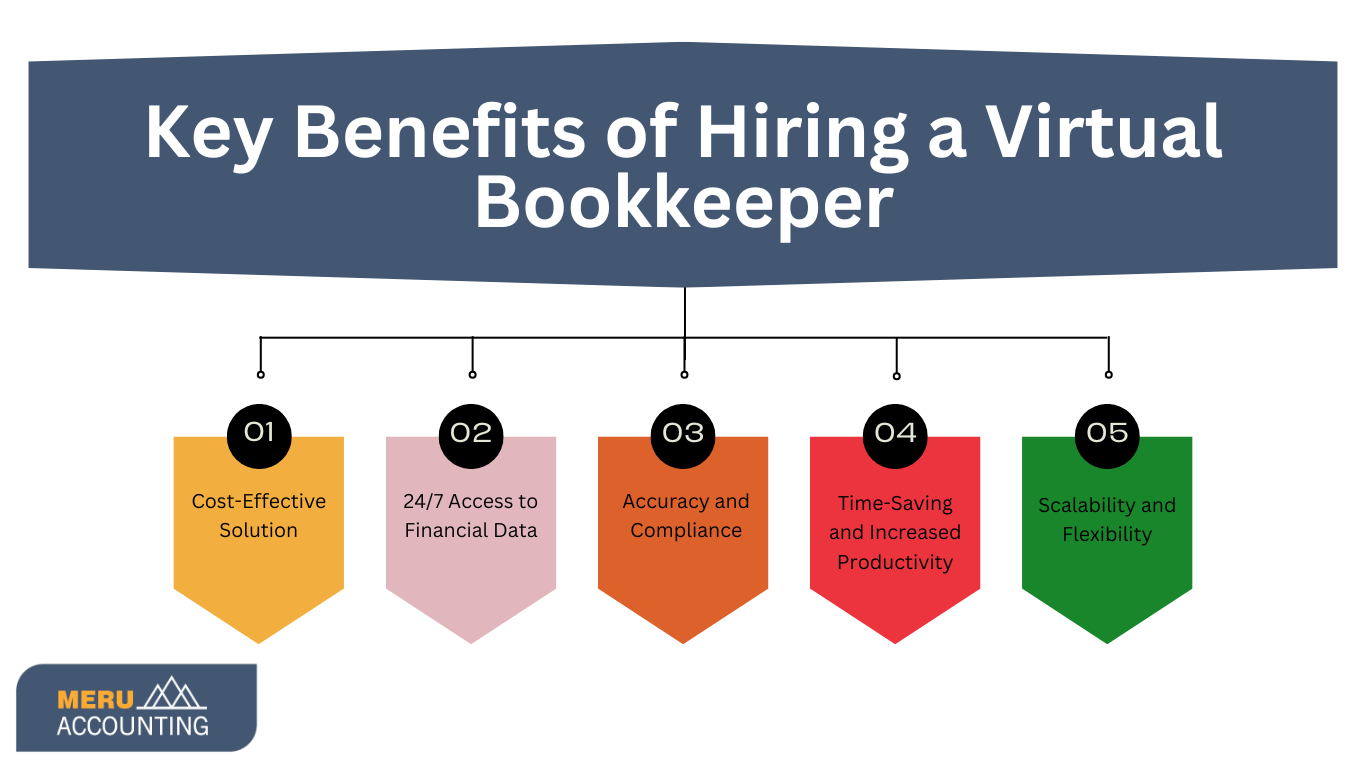

- 3 Key Benefits of Hiring a Virtual Bookkeeper

- 3.1 1. Cost-Effective Solution

- 3.2 2. 24/7 Access to Financial Data

- 3.3 3. Accuracy and Compliance

- 3.4 4. Time-Saving and Increased Productivity

- 3.5 5. Scalability and Flexibility

- 4 Who Needs Virtual Bookkeeping Services?

- 4.1 1. Small Businesses Looking for Affordable Financial Management

- 4.2 2. Startups Needing Scalable and Flexible Bookkeeping Solutions

- 4.3 3. Freelancers and Solopreneurs Who Want to Focus on Their Work

- 4.4 4. E-Commerce Businesses with High Transaction Volumes

- 4.5 5. Companies Managing Remote Teams and International Clients

- 4.6 6. Nonprofits and NGOs

- 4.7 7. Real Estate Agents and Property Management Firms

- 5 Why Choose Accounts Junction for Virtual Bookkeeping Services?

- 5.1 Conclusion

- 5.2 FAQs

Revolutionize Your Finances with Virtual Bookkeeping Services!

What Are Virtual Bookkeeping Services?

Virtual bookkeeping services provide businesses with online bookkeeping solutions, allowing them to manage their financial records remotely. A virtual bookkeeper uses cloud-based software to track income, expenses, payroll, and taxes. This ensures financial accuracy without needing in-house staff. An online bookkeeping service provides real-time financial data and automates invoicing. It also helps manage cash flow while reducing operational costs. This approach removes the need for physical paperwork and reduces administrative work. It also gives businesses instant access to their financial health anytime, anywhere.

How a Virtual Bookkeeper Differs from a Traditional Bookkeeper

A virtual bookkeeper offers the same services as a traditional bookkeeper but operates remotely. Here’s how they compare:

|

Feature |

Virtual Bookkeeper |

Traditional Bookkeeper |

|

Work Location |

Online, remote access |

In-office or on-site |

|

Software Usage |

Cloud-based accounting software (Xero, QuickBooks, FreshBooks) |

Mostly desktop software |

|

Availability |

Flexible, can work across time zones |

Fixed office hours |

|

Cost |

More affordable due to no overhead costs |

Higher salary and office expenses |

|

Security |

Encrypted cloud storage for financial data |

Physical files and local computer storage |

By opting for an online bookkeeping service, businesses can experience a seamless, paperless accounting process while maintaining financial transparency.

Key Benefits of Hiring a Virtual Bookkeeper

1. Cost-Effective Solution

Hiring a virtual bookkeeper is significantly more affordable than employing a full-time, in-house bookkeeper. It eliminates expenses related to salaries, employee benefits, office space, training, and bookkeeping software licenses. A virtual bookkeeping service lets you pay only for what you need. This makes it a budget-friendly choice for any business.

2. 24/7 Access to Financial Data

Cloud-based online bookkeeping services give real-time access to financial reports, invoices, and bank reconciliations. This flexibility is especially beneficial for business owners who travel frequently or manage remote teams. With secure logins, you can monitor cash flow, track transactions, and generate reports anytime. This ensures complete transparency in financial management.

3. Accuracy and Compliance

A professional virtual bookkeeper ensures precise financial tracking, reducing errors in bookkeeping, payroll processing, and tax calculations. They stay updated with tax laws, financial regulations, and compliance requirements, helping businesses avoid costly penalties and audits. Advanced bookkeeping software further minimizes human errors and maintains consistency in financial records.

4. Time-Saving and Increased Productivity

Bookkeeping is time-consuming and requires meticulous attention to detail. Outsourcing bookkeeping to a virtual bookkeeper helps business owners save time. They can focus on growth, customer relations, and strategic decisions. This leads to higher efficiency and better time management.

5. Scalability and Flexibility

A virtual bookkeeping service can adapt to your financial needs. It works for freelancers, startups, small businesses, and large enterprises. As your business grows, your virtual bookkeeper can adjust services as needed. They can handle simple financial reports or manage complex transactions and multi-currency accounting.

Who Needs Virtual Bookkeeping Services?

Whether you are a small business owner, freelancer, or international company, a virtual bookkeeper can help. Outsourcing bookkeeping ensures financial accuracy, compliance, and efficiency.

1. Small Businesses Looking for Affordable Financial Management

For small business owners, managing day-to-day financial transactions while handling operations can be overwhelming. A virtual bookkeeper keeps financial records organized, tracks expenses, and generates invoices. This helps ensure timely tax compliance without the cost of a full-time accountant. This allows small businesses to focus on growth while keeping finances in check.

2. Startups Needing Scalable and Flexible Bookkeeping Solutions

Startups often experience fluctuating financial needs, requiring bookkeeping services that can scale as they grow. A virtual bookkeeping service provides:

- Scalable financial management solutions

- Budgeting and cash flow tracking

- Automated expense categorization

- Tax and compliance support

This flexibility ensures that startups can adapt their financial management as their business expands.

3. Freelancers and Solopreneurs Who Want to Focus on Their Work

Freelancers, independent contractors, and solopreneurs often juggle multiple roles, from client acquisition to service delivery. Managing invoices, tracking expenses, and preparing taxes can be time-consuming. With an online bookkeeping service, freelancers can:

- Keep track of income and expenses effortlessly

- Automate invoicing and payment tracking

- Ensure accurate tax calculations and deductions

- This allows them to focus more on their core work without worrying about financial management.

4. E-Commerce Businesses with High Transaction Volumes

Online stores and e-commerce businesses process a large number of daily transactions. Managing sales, refunds, multiple payment gateways, and inventory tracking can become complex. A virtual bookkeeper helps by:

- Categorizing transactions and reconciling accounts

- Handling multi-currency payments and tax calculations

- Integrating with e-commerce platforms like Shopify, WooCommerce, or Amazon

- Providing real-time sales reports and profit analysis

This ensures e-commerce businesses have a clear financial overview and can optimize profits.

5. Companies Managing Remote Teams and International Clients

Businesses with remote employees and international clients often face challenges related to:

- Payroll management across different locations

- Multi-currency transactions and exchange rate tracking

- International tax compliance

- Managing payments to vendors in different countries.

A virtual bookkeeping service specializes in handling these financial complexities, ensuring seamless financial operations across different time zones and jurisdictions.

6. Nonprofits and NGOs

Nonprofit organizations require transparent and accurate bookkeeping to manage grants, donations, and expenses. A virtual bookkeeping service can assist with:

- Tracking donor contributions and funding sources

- Preparing financial reports for audits and compliance

- Budgeting and financial planning for projects

- Ensuring proper allocation of funds

7. Real Estate Agents and Property Management Firms

Real estate businesses must manage rental income, property expenses, mortgage payments, and client transactions. A virtual bookkeeper helps:

- Keep track of rental income and expenses

- Generate financial reports for tax filing

- Reconcile multiple property accounts

Regardless of your industry, a virtual bookkeeper can provide customized solutions to meet your financial needs.

Why Choose Accounts Junction for Virtual Bookkeeping Services?

At Accounts Junction, we provide excellent virtual bookkeeping services tailored to your business. Here’s why we stand out:

- Expert Bookkeepers

Our team consists of highly skilled and certified professionals with deep expertise in handling finances across various industries. From small businesses to large enterprises, our bookkeepers ensure accurate financial management, helping you maintain compliance and streamline operations.

- Advanced Technology

We use the latest cloud-based bookkeeping solutions like Xero, QuickBooks, and Wave Accounting. This ensures seamless and efficient financial management. Our technology-driven approach enables real-time tracking, automated financial reporting, and easy access to financial records from anywhere, ensuring accuracy and efficiency.

- Customized Solutions

We know that each business has its own financial needs. That's why we offer tailored bookkeeping solutions to meet your needs. Whether it's basic transaction recording, payroll processing, tax preparation, or full financial management, we've got you covered.

- Secure and Confidential

Data security is our top priority. We implement advanced encryption and multi-layer security protocols to protect your sensitive financial information. Our commitment to confidentiality ensures that your financial records remain safe from unauthorized access or data breaches.

- Affordable Pricing

Get high-quality bookkeeping services without the cost of hiring an in-house team. Our virtual bookkeeping solutions are cost-effective and accessible to all businesses. They help you save on salaries, benefits, and overhead expenses.

- Scalability and Flexibility

Our virtual bookkeeping services are designed to scale with your business. Whether you are a freelancer, a startup, or a large business, we tailor our services to your financial needs. We adjust our support as your business grows. We handle everything from basic bookkeeping to complex financial reporting. As your business grows, we also manage multi-currency accounting and compliance.

By choosing Accounts Junction, you get a reliable and secure bookkeeping service. Our experts ensure your financial records are accurate, compliant, and up to date.

Conclusion

Switching to a virtual bookkeeping service can revolutionize how you manage your business finances. With cost savings, improved accuracy, and remote access, businesses of all sizes can benefit from hiring a virtual bookkeeper. Whether you're a startup, freelancer, or established business, we offer reliable online bookkeeping services. Our services are efficient and tailored to your needs.

FAQs

1. What does a virtual bookkeeper do?

Ans: A virtual bookkeeper manages financial records, reconciles accounts, processes invoices, and ensures tax compliance using cloud-based software.

2. How secure are virtual bookkeeping services?

Ans: Highly secure! Reputable online bookkeeping services use encrypted cloud storage and multi-factor authentication to protect financial data.

3. What software do virtual bookkeepers use?

Ans: Most virtual bookkeeping services use platforms like Xero, QuickBooks Online, FreshBooks, and Wave Accounting.

4. Can I hire a virtual bookkeeper for a small business?

Ans: Absolutely! Small businesses benefit the most from virtual bookkeeping services as they reduce costs while ensuring accurate financial tracking.

5. How do I get started with Accounts Junction?

Ans: Contact us, and we’ll discuss your business needs. We’ll recommend the right virtual bookkeeping service and set up a seamless accounting system for you.