Table of Contents

- 1 What is Wave Accounting?

- 2 Why Use Wave Accounting for Tax Return Preparation?

- 2.1 Free and Affordable Solution

- 2.2 Automated Income and Expense Tracking

- 2.3 Easy Invoice Management

- 2.4 Seamless Bank Reconciliation

- 2.5 Detailed Tax Reports

- 2.6 Sales Tax Tracking

- 3 Step-by-Step Guide to Tax Return Preparation Using Wave1

- 4 How a Tax Preparer Can Help with Wave Accounting

- 4.1 Ensuring Accurate Tax Filing

- 4.2 Maximizing Tax Deductions

- 4.3 Generating Essential Tax Reports

- 4.4 Handling Sales Tax Compliance

- 4.5 Reconciling Bank Transactions

- 4.6 Managing Payroll Taxes

- 5 Why Choose Accounts Junction for Wave Accounting and Tax Preparation?

- 5.1 Conclusion

- 5.2 FAQs

Wave accounting Tax return preparation

What is Wave Accounting?

Wave Accounting is a cloud-based accounting software designed for small businesses, freelancers, and entrepreneurs. Its user-friendly interface and powerful tools make it a cost-effective choice for businesses. Wave Accounting offers free core features for tracking income, expenses, invoices, and financial reports without monthly fees.

Wave Accounting seamlessly integrates with banks for automatic transaction imports and reconciliations. This reduces manual data entry and minimizes errors, ensuring accurate financial records. Additionally, Wave supports multi-currency transactions, making it suitable for businesses operating internationally.

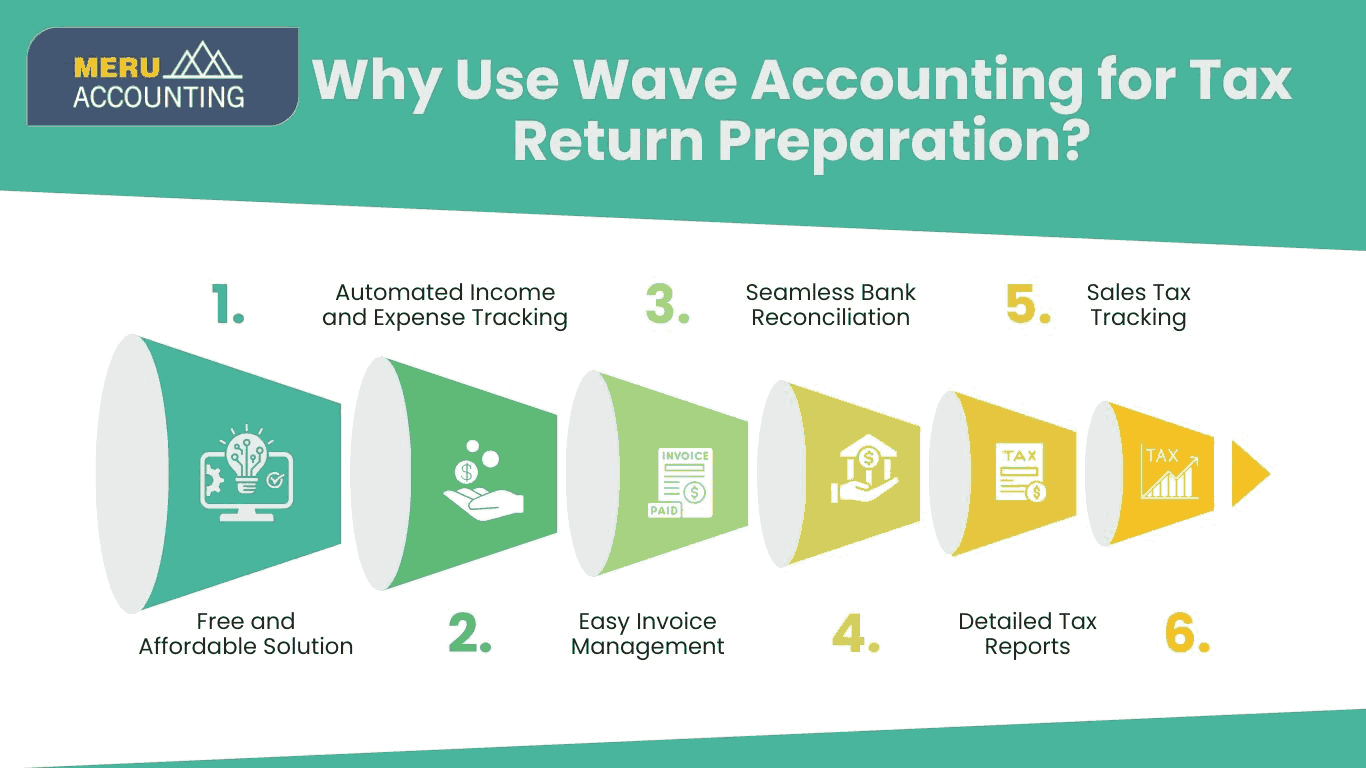

Why Use Wave Accounting for Tax Return Preparation?

Tax return preparation can be complex, but the Wave app makes it more manageable. Here are a few reasons why using Wave Accounting for tax return preparation is beneficial:

Free and Affordable Solution

- Wave Accounting provides free core accounting features, making it a cost-effective option for small businesses and freelancers.

- Unlike many other accounting platforms, it does not charge a subscription fee for essential bookkeeping tools.

Automated Income and Expense Tracking

- The software automatically categorizes income and expenses, reducing manual entry errors.

- Users can link their bank accounts to import transactions, ensuring accuracy in financial records.

Easy Invoice Management

- Wave allows users to create and send professional invoices, track payments, and follow up on overdue invoices.

- It provides a clear record of business revenue, which is essential for tax reporting.

Seamless Bank Reconciliation

- The bank reconciliation feature ensures that all transactions are recorded accurately, reducing discrepancies.

- It simplifies the process of verifying income and expenses for tax return preparation.

Detailed Tax Reports

- Wave generates essential financial reports, such as profit and loss statements, balance sheets, and expense summaries.

- These reports provide clear insights into tax liabilities and deductions, making tax filing easier.

Sales Tax Tracking

- Businesses that collect sales tax can set up tax rates in Wave and track taxable transactions.

- This feature helps in accurately reporting sales tax collected and owed during tax filing.

Step-by-Step Guide to Tax Return Preparation Using Wave1

1. Set Up Your Wave Accounting Profile:

- Sign up for a free Wave app account.

- Enter business details and customize tax settings.

2. Connect Your Bank Accounts and Payment Sources:

- Sync bank accounts for automatic transaction imports.

- Review and categorize income and expenses regularly.

3. Generate and Send Invoices:

- Use Wave Accounting to create invoices and track payments.

- Set up automatic reminders for outstanding payments.

4. Track Business Expenses:

- Upload receipts or manually enter expenses in the Wave app.

- Categorize expenses to ensure accurate deductions during tax return preparation.

5. Review Financial Reports:

- Generate profit and loss statements.

- Analyze cash flow and ensure all transactions are recorded correctly.

6. Prepare for Tax Filing:

- Use Wave Accounting’s tax reports to gather necessary information.

- Identify eligible expenses for deductions and ensure adherence to tax regulations.

7. Export Data or Share with a Tax Preparer:

- Download financial reports.

- Share data with a tax preparer for professional review.

How a Tax Preparer Can Help with Wave Accounting

While the Wave app simplifies tax return preparation, a tax preparer can provide valuable insights and ensure compliance. Here’s how a tax professional can help:

Ensuring Accurate Tax Filing

- A tax preparer reviews financial records in Wave Accounting to ensure all income, expenses, and deductions are correctly recorded.

- They help prevent errors that could lead to audits, penalties, or delays in tax processing.

Maximizing Tax Deductions

- Tax preparers analyze transactions and categorize expenses to identify deductible costs.

- They ensure businesses take advantage of deductions related to office expenses, travel, marketing, and business-related purchases.

Generating Essential Tax Reports

- Wave Accounting provides reports such as profit & loss statements, balance sheets, and cash flow statements.

- A tax preparer helps interpret these reports, ensuring accurate tax return preparation.

Handling Sales Tax Compliance

- Tax preparers ensure accurate sales tax rates, track taxable sales, and file returns correctly.

- They ensure compliance with state and federal sales tax regulations.

Reconciling Bank Transactions

- A tax preparer verifies that all transactions imported into Wave from bank accounts match actual business expenses and income.

- This prevents discrepancies and ensures complete financial records.

Managing Payroll Taxes

- If using Wave’s payroll feature, a tax preparer ensures payroll taxes are correctly calculated and filed.

- They help businesses comply with employment tax regulations and avoid payroll tax penalties.

Why Choose Accounts Junction for Wave Accounting and Tax Preparation?

Accounts Junction offers expert services in Wave Accounting and tax return preparation. Here’s why businesses trust us:

- Experienced Professionals: Our team has extensive experience handling tax return preparation using Wave Accounting.

- Personalized Support: We customize our services to meet the unique needs of small businesses and freelancers.

- Seamless Wave App Integration: We ensure your financial records are accurate and up to date.

- Maximized Deductions: Our tax preparers identify all possible deductions to reduce tax liabilities.

- Reliable and Affordable Services: We provide cost-effective solutions for Wave Accounting users.

Conclusion

Wave Accounting is a powerful tool for small businesses, making financial management and tax return preparation easier. By utilizing the Wave app, businesses can automate bookkeeping, track expenses, and generate tax-ready reports. However, working with a tax preparer further enhances accuracy and compliance. Accounts Junction provides expert assistance in Wave Accounting and tax return preparation, ensuring a stress-free tax season. Whether managing finances alone or with a tax preparer, Wave Accounting ensures smooth financial operations.

A tax preparer plays a crucial role in ensuring accuracy, optimizing deductions, and keeping your business tax-compliant. They reconcile transactions, generate tax reports, and manage payroll and sales tax, minimizing errors and penalties. With professional tax preparation services, business owners can confidently prepare and file their taxes while focusing on growth.

FAQs

1. Is Wave Accounting free?

Yes, the Wave app offers free accounting, invoicing, and expense tracking features.

2. Can I use Wave Accounting for tax return preparation?

Yes, Wave Accounting provides financial reports and tax summaries to help with tax filing.

3. Do I need a tax preparer if I use Wave Accounting?

While Wave simplifies tax preparation, a tax preparer ensures accuracy and compliance.

4. How do I share my Wave Accounting data with a tax preparer?

You can export financial reports from the Wave app and share them securely.

5. Why should I choose Accounts Junction for Wave Accounting services?

We offer expert support, ensuring your tax return preparation is efficient and accurate.