Table of Contents

- 1 Accounting system used in France

- 1.1 Plan Comptable General (PCG)

- 1.2 Normes Comptables Françaises (NCF)

- 1.3 International Financial Reporting Standards (IFRS)

- 1.4 French GAAP (Generally Accepted Accounting Principles)

- 1.5 Autorité des Normes Comptables (ANC)

- 1.6 Sector-specific standards

- 1.6.1 Conclusion

What accounting system does France use?

The accounting services in France are designed to ensure precise and organized financial reporting, critical for maintaining the integrity of financial records. Whether you’re a business owner, accountant, or just curious about the financial landscape in France, understanding these systems is essential. French accounting is grounded in a few core elements, each with its purpose and scope, providing a comprehensive framework for businesses of all sizes and industries. Accounting services in France are vital in guaranteeing that all financial statements are accurate, transparent, and fully compliant with national regulations.

Bookkeeping in France involves maintaining accurate and detailed financial records to comply with the country's strict regulations. Businesses operating in France must adhere to the French Generally Accepted Accounting Principles (GAAP) and ensure that their bookkeeping is precise and up-to-date. The French Accounting Standards Board (ANC) sets the rules for how businesses should keep their financial records in France. They provide guidelines to ensure consistency and accuracy in bookkeeping for France.

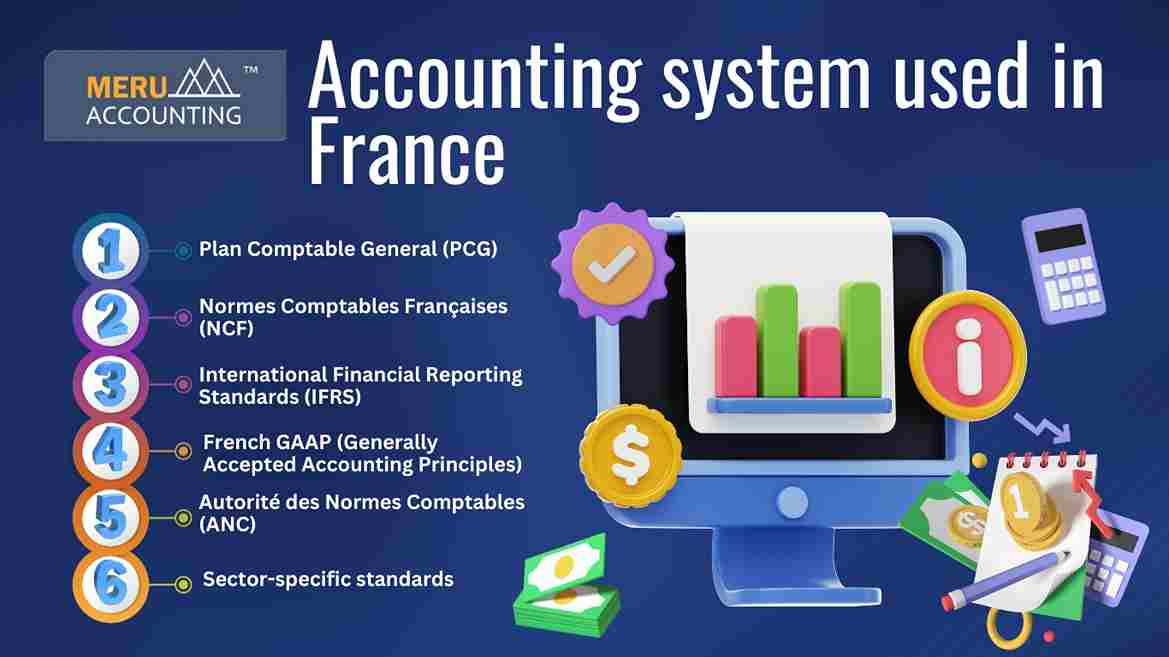

Accounting system used in France

The national accounting code in France. The ANC is crucial for accounting services in France because it gives businesses a standard list of account types and ready-made templates for financial statements. This ensures consistency across businesses, making financial reporting clear and comparable, which is especially important in a country with a diverse economy like France. Every business in France, regardless of its size, relies on the PCG as the foundation of its accounting practices, ensuring that all financial activities are recorded uniformly.

French accounting standards are set by the Autorité des Normes Comptables (ANC). These standards incorporate specific rules tailored to French regulations and ensure that companies operating in France comply with local laws. The NCF is where bookkeeping for France gets its unique identity, as it integrates both national standards and international principles, allowing businesses to meet domestic requirements while also being compatible with broader European and global practices. This dual focus helps French businesses maintain compliance and also engage effectively in the international market.

For companies listed on the stock exchange, the International Financial Reporting Standards (IFRS) come into play. These are global accounting standards that are required for consolidated financial statements of listed companies. IFRS is crucial for French companies that operate in international markets. It helps make French financial reports match global standards, so investors, regulators, and others can easily understand and compare them with reports from other countries.

For most other companies that are not required to use IFRS, French GAAP (Generally Accepted Accounting Principles) guides bookkeeping in France. French GAAP ensures that even smaller or non-listed companies maintain high standards of financial reporting. These principles are tailored to the needs of businesses that operate primarily within the French market, offering a framework that is both rigorous and adaptable to the specific needs of these companies. By adhering to French GAAP, businesses can ensure that their financial statements are accurate, reliable, and meet the expectations of French regulators and stakeholders.

Autorité des Normes Comptables (ANC) issues further regulations and guidelines to ensure compliance with both national and international standards. These regulations are vital for maintaining the integrity of financial reporting in France, as they help businesses stay up-to-date with changes in accounting practices and ensure that all financial reports follow the highest standards of accuracy and transparency. The ANC plays a crucial role in the ongoing development and refinement of French accounting standards, ensuring that they remain relevant in a rapidly changing global economy.

Certain industries in France, such as banking, insurance, and public sector entities, have sector-specific standards that impose additional accounting requirements. These standards are designed to address the requirements and regulations of specific sectors, ensuring that financial reporting in these industries is both specialized and precise. For businesses operating in these sectors, understanding and complying with these additional requirements is crucial for maintaining accurate and compliant financial records.

Conclusion

By adhering to these standards, businesses maintain transparency and protect themselves against financial risks. Understanding Accounting services in France is crucial for businesses operating in France. The complexities of these accounting frameworks highlight the importance of having the right accounting services in place.

Accounts Junction leverages its expertise in French accounting standards, including the Plan Comptable Général (PCG) and French GAAP, to provide precise and compliant bookkeeping services tailored to the needs of businesses in France.

By following these standards, French businesses not only stay compliant but also gain credibility and trust, locally and internationally, making these systems a cornerstone of the business world in France. Effective bookkeeping in France is crucial for tax compliance, financial reporting, and making informed business decisions.