What Are The Advantages of Virtual CFO Services?

Running a business today needs strong money planning and care. Many small and mid-sized firms struggle to track money well. Hiring a full-time CFO can cost more than expected. This is where the advantages of virtual CFO services may be useful. A virtual CFO gives expert help without full-time staff costs. They work remotely while giving smart advice to business leaders. This service helps companies manage growth, spending, and cash flow. Firms can make clear decisions while keeping costs very low.

Virtual CFO services mix expertise, flexibility, and digital tools for results. Companies of all sizes may benefit from this solution. It can change how firms handle planning, reports, and work with investors.

What Are Virtual CFO Services?

A virtual CFO is a finance expert who works online. They track budgets, plan money, and check cash flow closely.

Their role may also include spotting risks and following laws. Virtual CFOs work with accountants and staff to keep reports correct.

Using online tools, they provide real-time insight into the company's finances. These tools include dashboards, cloud software, and reports.

Businesses can make faster, smarter decisions with these live insights. Remote CFOs give the same advice as full-time leaders.

Why Companies Use Virtual CFO Services

Many firms cannot hire a full-time CFO because it costs too much. Yet, they still need smart advice to make choices. Virtual CFOs give flexible, low-cost access to expert guidance.

They may work part-time, on projects, or as ongoing helpers. This lets companies adjust help based on their current needs. Startups, growing businesses, and mid-sized firms often use these services.

Virtual CFOs help firms track money, cut risks, and plan better. They also free owners to focus on key business tasks. The next section explains ten main advantages of virtual CFO services clearly.

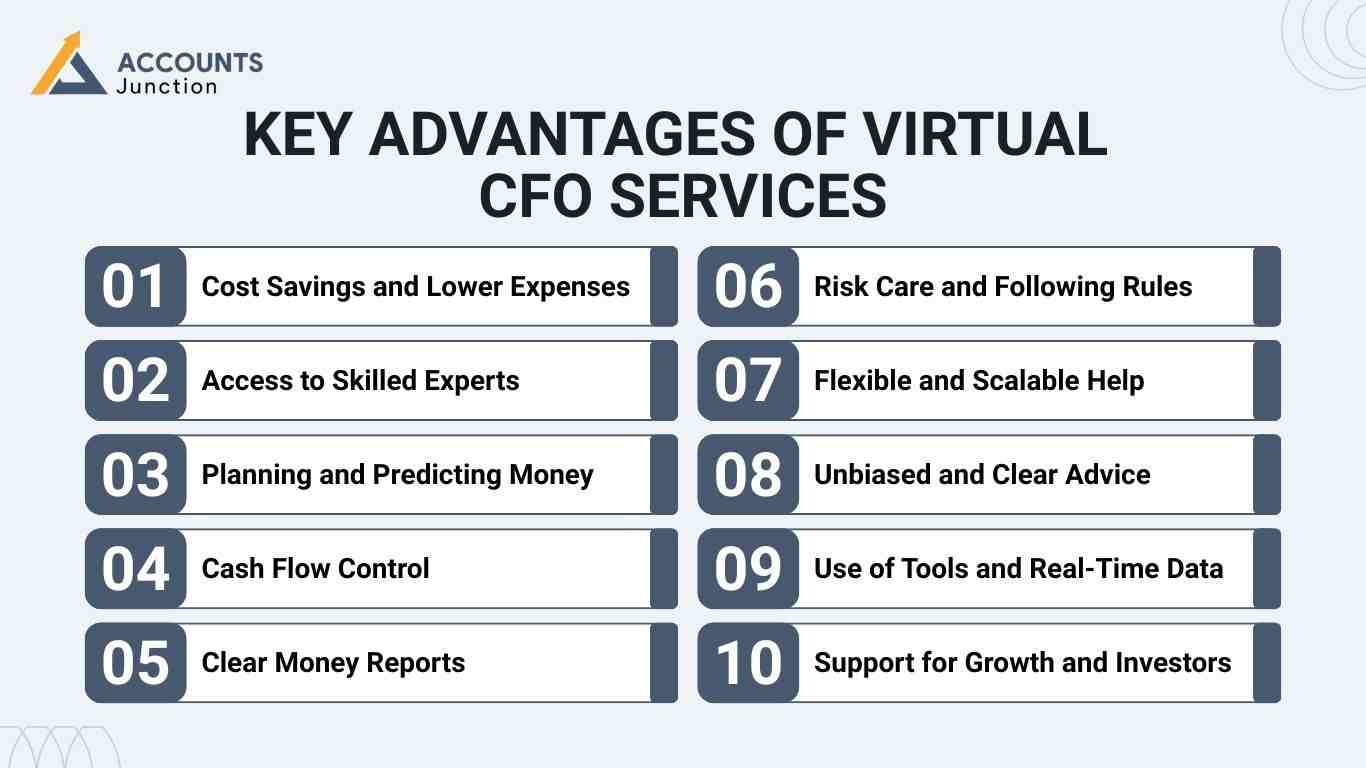

Key Advantages of Virtual CFO Services

1. Cost Savings and Lower Expenses

Hiring a full-time CFO may cost far too much money. Virtual CFOs give expert help at a smaller cost.

Companies pay only for the hours or tasks they use. This cuts payroll, benefits, and office costs greatly.

Saved money can go to products, marketing, or hiring staff. Cost savings are one of the main advantages of virtual CFO services. Part-time services let companies get expert help without long-term costs.

2. Access to Skilled Experts

Virtual CFOs often have years of experience in many industries. They bring knowledge from small, mid-sized, and large companies.

This helps firms handle complex money challenges more easily. Companies get advice that would cost much full-time.

Expert help improves choices, risk care, and long-term planning. Access to skilled staff is a key advantage of virtual CFO services for any company. It also prepares firms for growth and market changes.

3. Planning and Predicting Money

Good planning helps firms grow and stay safe. Virtual CFOs make budgets and plans to guide decisions.

They study past results and predict income, costs, and cash. Leaders can plan spending, growth, and tasks clearly.

Better planning avoids surprises and keeps cash safe. It also helps firms lower risk and plan ahead. Planning and predicting money is a major advantage of virtual CFO services.

4. Cash Flow Control

Cash flow is key to business work and survival. Virtual CFOs watch money coming in and going out closely.

They find weak spots and suggest ways to fix them. Companies can handle payments, collections, and investments with care.

This avoids stress and keeps operations running steadily. Good cash flow care is an important advantage of virtual CFO services. Regular checks help businesses pay staff and bills on time.

5. Clear Money Reports

Reports help leaders make strong, safe choices. Virtual CFOs give accurate, detailed, and timely money reports.

Reports show income, costs, profits, and key trends. Clear reports help leaders spot issues and act fast.

Correct reports also improve trust with lenders, investors, and staff. Reliable reports are a main advantage of virtual CFO services. They make sure choices are based on facts, not guesses.

6. Risk Care and Following Rules

Every firm faces money and legal risks. Virtual CFOs spot risks and give ways to lower them.

They make sure the company follows tax laws and rules. This lowers the chances of fines or penalties.

Active risk care improves safety and keeps the firm’s name safe. Effective risk management is another important advantage of virtual CFO services. It also helps leaders plan for change or problems.

7. Flexible and Scalable Help

Business needs may change due to growth or slow periods. Virtual CFO services can increase or decrease as needed.

Companies can get more help in busy times or less when stable. This keeps resources matched to real needs.

Scalable help lets companies control costs without losing guidance. Flexibility and scalability are major advantages of virtual CFO services. It also helps long-term planning without hiring full-time staff.

8. Unbiased and Clear Advice

Virtual CFOs give advice from outside the company. They check money and work without being influenced by politics.

This helps leaders see real problems and areas to fix. Independent advice improves choices and increases accountability.

It also helps long-term planning and governance. Unbiased advice is an important advantage of virtual CFO services. Firms get clear recommendations based on facts, not opinions.

9. Use of Tools and Real-Time Data

Virtual CFOs use online tools and cloud software for money. Dashboards show live income, costs, and cash flow.

These tools reduce errors and help decisions happen faster. Managers can check results anytime, not only monthly.

Tech use also improves efficiency across finance and work. Real-time data is a key advantage of virtual CFO services. It ensures leaders can act on new problems or opportunities.

10. Support for Growth and Investors

Firms often need money to grow or start new projects. Virtual CFOs make clear reports and plans for investors.

They improve presentations and show firm value clearly. This builds trust and raises the chances of getting funds.

Virtual CFOs help plan long-term growth and safety. Support for growth and investors is a top advantage of virtual CFO services for startups and SMEs.They also guide firms in growing while lowering risks.

How Virtual CFOs Help Startups and SMEs

1. Support for Cash Flow Challenges

- Startups often face money and cash flow problems.

- Virtual CFOs give structure without high full-time cost.

- They track money coming in and going out.

2. Help with Budgeting and Planning

- Virtual CFOs help startups plan money and spending.

- They make budgets for short-term and long-term goals.

- Good planning reduces mistakes and keeps money safe.

3. Planning Growth and Future Needs

- CFOs help see future income, costs, and cash.

- This helps make better choices for spending and growth.

- It builds trust with investors and aids funding.

4. Managing Growing SMEs

- Growing SMEs face more money tasks as they grow.

- Virtual CFOs handle reports, risks, and planning well.

- They keep work correct, legal, and clear for leaders.

5. Improve Planning, Stability, and Choices

- In both startups and SMEs, CFOs guide planning.

- They make money work stably and work daily smoothly.

- Leaders get clarity to make better business choices.

Common Concerns About Virtual CFO Services

1. Understanding Business Work

- Some owners worry that remote CFOs cannot work well.

- Tools let them see accounts, software, and all data.

- CFOs can track work and give advice on time.

2. Reliability and Long-Term Support

- Some think remote help may be short-term or weak.

- Most work lasts long and focuses on clear results.

- Companies can trust steady help and advice.

3. Accuracy and Guidance

- Virtual CFOs give constant advice and keep work correct.

- They track risks, reports, and laws and rules regularly.

- Flexible help keeps work smooth and growth on track.

Virtual CFOs help firms manage money, risks, and growth. They mix skill, low cost, and flexible support for results.

The advantages of virtual CFO services include cost savings, cash control, risk management, reporting, and planning. Leaders get insight and clarity for smart choices.

Startups and growing firms gain strong financial foundations. Virtual CFOs support growth, investors, and long-term stability.

At Accounts Junction, we provide virtual CFO services along with accounting, bookkeeping, and financial management. Our certified experts deliver precise and timely financial solutions tailored to your business. We ensure efficient processes, accurate records, and clear financial insights. Partner with us to strengthen your business and financial operations.

FAQs

1. What are the main benefits of hiring a virtual CFO?

- A virtual CFO provides cost savings, cash control, and expert guidance. They help businesses plan, report, and manage risks efficiently.

2. How does a virtual CFO reduce business expenses?

- They eliminate the need for a full-time executive and high payroll costs. Companies pay only for the services they use.

3. Can virtual CFO services improve financial decision-making?

- Yes, they offer accurate reports, forecasts, and expert advice. Leaders can make informed choices for growth and stability.

4. How do virtual CFOs help with cash flow management?

- They track money coming in and going out carefully. This helps prevent shortages and ensures timely payments.

5. Do virtual CFOs assist with business planning and forecasting?

- Yes, they create budgets and financial plans. This helps companies predict revenue, costs, and growth opportunities.

6. Can virtual CFO services help startups attract investors?

- Yes, they prepare clear financial reports and projections. Investors can assess the company’s performance and potential confidently.

7. How do virtual CFOs manage business risks?

- They identify financial and legal risks and suggest ways to reduce them. This protects companies from penalties and losses.

8. Are virtual CFO services suitable for small and mid-sized businesses?

- Yes, they provide expert guidance without high full-time costs. Startups and growing firms can scale services as needed.

9. How do virtual CFOs improve financial reporting accuracy?

- They coordinate with accountants and use digital tools for live reporting. This ensures reliable data for decision-making.

10. Can virtual CFOs support business growth strategies?

- Yes, they help plan expansion, investments, and funding needs. Their insights guide sustainable growth and strategic decisions.

11. What tools do virtual CFOs use to provide insights?

- They use dashboards, cloud software, and real-time reporting tools. These show cash flow, costs, and profits clearly.

12. How flexible are virtual CFO services?

- They can work part-time, for projects, or as ongoing advisors. Companies adjust support based on current needs.

13. How can virtual CFOs improve investor confidence?

- By providing accurate reports, forecasts, and growth plans. Investors can see the company is well-managed and transparent.

14. Are virtual CFO services cost-effective compared to full-time CFOs?

- Yes, firms gain the same expertise at a lower cost. There are no long-term salary or benefits obligations.

15. What industries benefit most from virtual CFO services?

- Small and mid-sized firms in tech, retail, healthcare, and services gain maximum benefit. Growth-focused companies especially value these services.

16. How quickly can a virtual CFO deliver financial insights?

- Most virtual CFOs provide reports and analysis within days. This allows fast decisions without long delays.

17. Can virtual CFOs help improve profit margins?

- Yes, they analyze costs, identify savings, and optimize spending. This can boost overall profitability efficiently.

18. Do virtual CFOs help with compliance and tax planning?

- Yes, they ensure financial practices follow laws and work with accountants. This reduces the risk of penalties or fines.

19. How do virtual CFOs support long-term business strategy?

- They provide forecasts, growth plans, and risk advice. Leaders can plan investments and expansion with confidence.

20. Can virtual CFO services work alongside an existing finance team?

- Yes, they complement accountants and bookkeepers. They provide oversight and strategic guidance without replacing staff.