What are the benefits of financial analytics tools?

If businesses want to grow, they need to keep a proper watch on their finances to ensure growth. Here, financial analytics plays a vital role in having a proper hold on the finances of the business.

It helps to collect the data and dissect the financial reports that can lead to profitability and stability of the business. Using proper financial analytics tools can give accurate insights which helps to make a proper business strategy.

You can improve the performance and implement proper business intelligence. A proper financial data analysis can be very advantageous for the business to make important decisions. It will be interesting to look at the benefit of using tools for financial analytics for business.

What benefits businesses can get by using financial analytics tools?

Financial analytics plays a vital role in the growth of the business.

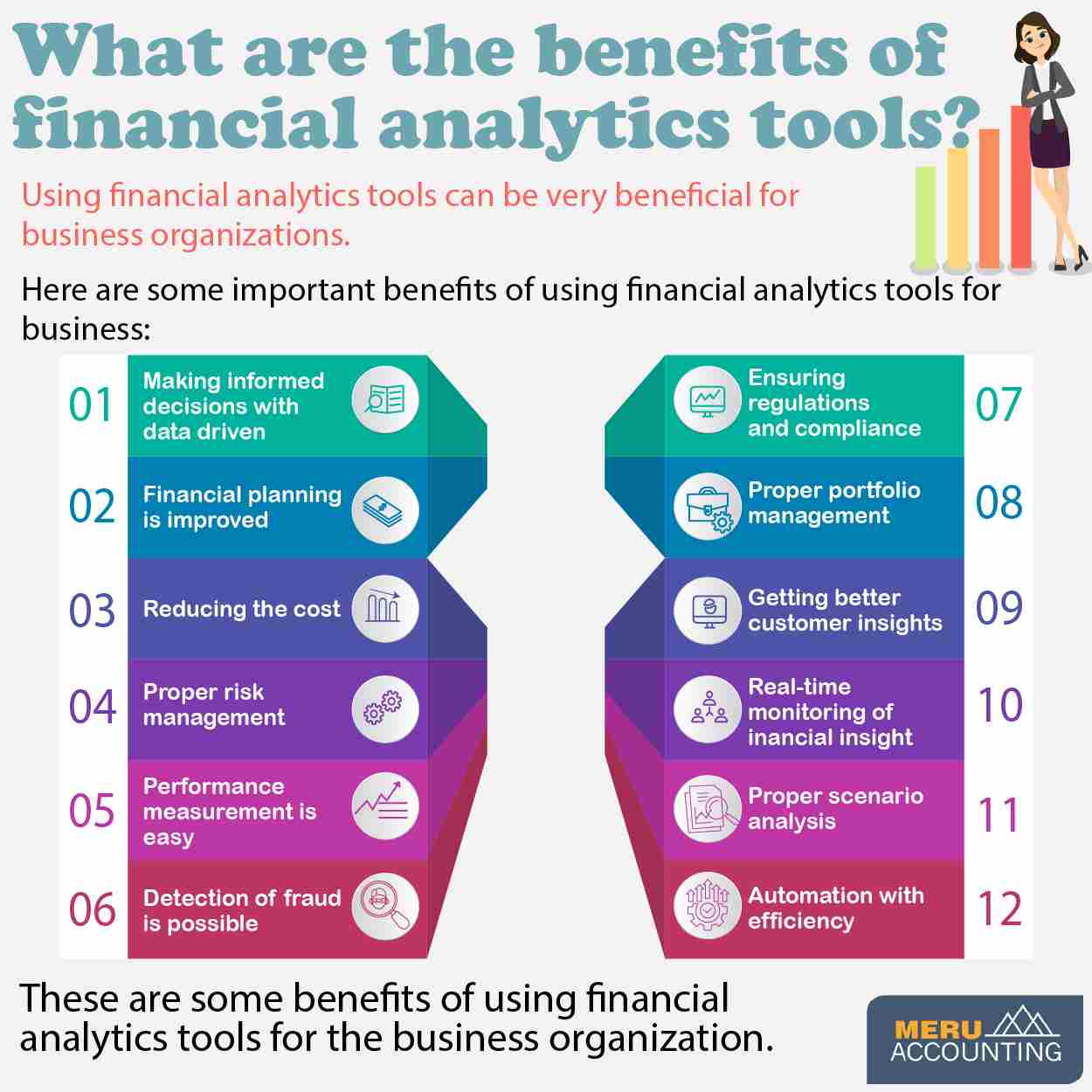

Here are some of the major benefits of it:

- Data-driven Decision Making:- Financial analytics tools enable users to analyze large volumes of financial data quickly and accurately. This data-driven approach helps organizations make informed decisions based on real-time or historical financial information.

- Improved Financial Planning:- These tools allow for better financial planning and forecasting. Users can create detailed budgets, cash flow projections, and financial models to assess the potential impact of various scenarios on their finances.

- Cost Reduction:- By identifying inefficiencies and areas where costs can be reduced. Analytics tools can help organizations optimize their spending and improve profitability.

- Risk Management:- Financial analytics tools can assess and quantify financial risks, helping organizations identify potential threats to their financial stability. This allows for the development of risk mitigation strategies.

- Performance Measurement:- Users can track key performance indicators (KPIs) and financial metrics to evaluate the financial health of their organization. This includes metrics like return on investment (ROI), profitability ratios, and liquidity ratios with proper financial data analysis.

- Fraud Detection:- These tools can detect unusual or suspicious financial transactions, potentially uncovering instances of fraud or financial misconduct.

- Compliance and Regulation:- Financial analytics tools can assist organizations in ensuring compliance with financial regulations and reporting requirements. They can automate the process of generating financial reports that adhere to regulatory standards.

- Portfolio Management:- In the context of investment and wealth management, these tools can help investors make informed decisions about asset allocation, diversification, and investment strategies.

- Customer Insights:- For businesses, financial analytics tools can provide insights into customer behavior and preferences. This information can be used to tailor marketing strategies and pricing models.

- Real-time Monitoring:- Many financial analytics tools offer real-time monitoring of financial data. This is especially important for organizations that need to react quickly to changing market conditions.

- Scenario Analysis:- Users can create and analyze different financial scenarios to assess the potential impact of various decisions or external factors on their finances.

- Automation and Efficiency:- Financial analytics tools can automate many financial processes, reducing manual data entry and the risk of human error. This leads to increased operational efficiency of the business organization.

These are some of the major benefits of using financial analytics tools for business organizations.

If you want to outsource the financial analytics task to the experts then Meru Accounting is a better choice.

Meru Accounting provides outsourced financial data analysis services for business organizations. They have excellent tools for financial analytics, they get the work done accurately. Meru Accounting is a well-known accounting services providing agency across the globe.