What are the benefits of virtual CFO

In the modern business environment, firms need clear money guidance. Many cannot hire a full-time CFO, so the benefits of a virtual CFO help firms get plans, budgets, and reports done with ease. A virtual CFO offers a smart and low-cost fix. A virtual CFO works online, part-time, or on contract. This setup gives skill, cuts costs, and lowers risk, which adds to the core benefits of a virtual CFO. In this blog, we outline the benefits of a virtual CFO, show how they differ from full-time CFOs, and explain why they help firms of all sizes.

What a Virtual CFO Does

A virtual CFO gives advice on money and growth, and the benefits of a virtual CFO can be seen in how they guide firms with clear plans. They do not handle daily bookkeeping. Instead, they focus on big-picture plans. By using online tools, a virtual CFO can act fast, and this speed shows the tech-based benefits of a virtual CFO.

Main Tasks of a Virtual CFO

- A virtual CFO plans budgets and tracks company spending.

- Cash flow and profits are watched closely for accuracy.

- Money risks are found and fixed before they cause issues.

- Reports are made for investors or business owners.

- Advice is given to help make smart money choices, and the benefits of a virtual CFO are clear in such focused guidance.

- Support is provided for growth and business expansion.

Unlike in-house CFOs, virtual CFOs work with different companies. This gives them broad experience that can help a business make smart choices.

A virtual CFO is useful for small or medium-sized businesses, startups, and firms with limited finance teams. They give top-level advice without the high cost of a full-time hire.

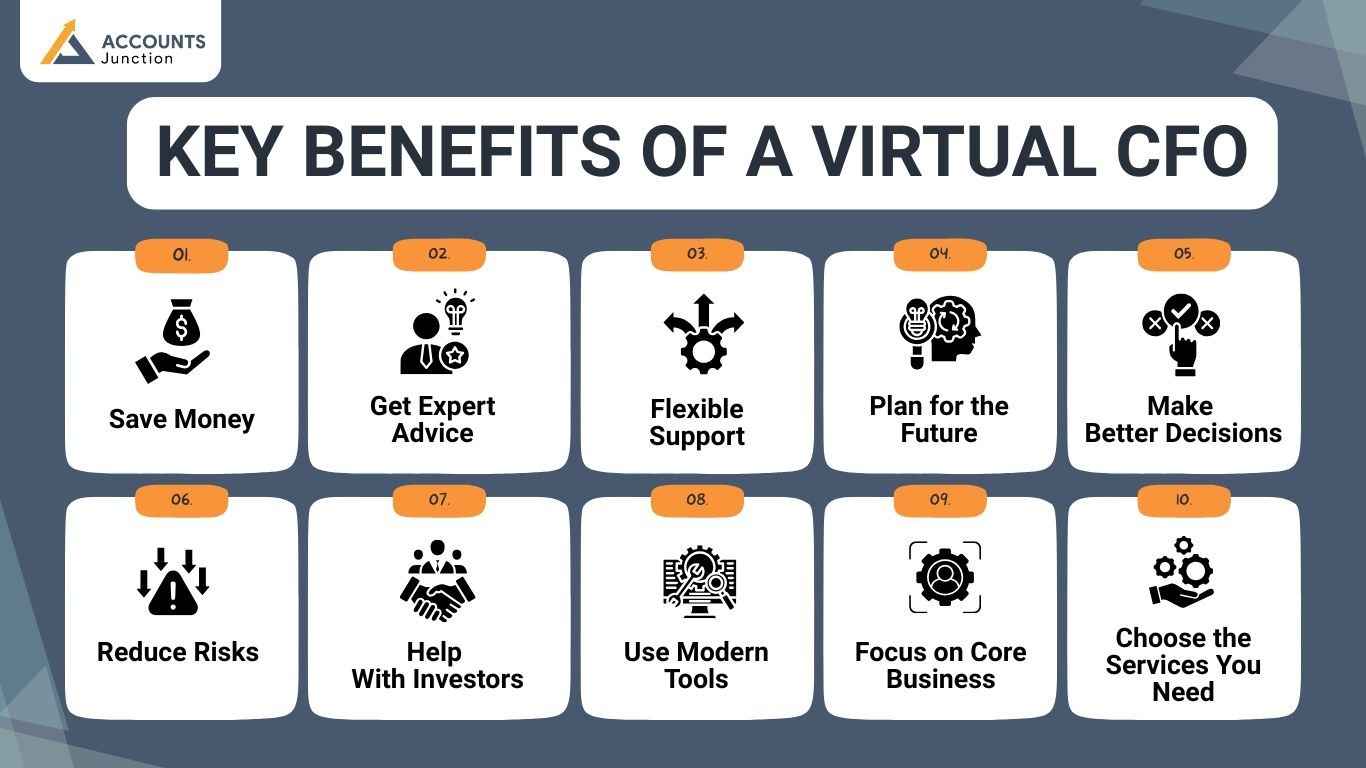

Key Benefits of a Virtual CFO

Here are the main benefits of a virtual CFO that show why firms pick this model for cost and growth needs.

Save Money

- Hiring a full-time CFO costs too much. A virtual CFO works part-time or by the hour. Companies pay only for the work they need. Startups and small firms get expert help cheaply, and this is one of the key benefits of a virtual CFO.

Get Expert Advice

- Virtual CFOs know many types of businesses. They understand markets, models, and business risks. This helps companies grow and avoid money problems. Small firms often lack skills within their team. A virtual CFO guides leaders to make smart choices.

Flexible Support

- Businesses may not need a full-time CFO. During growth, funding, or busy times, help is key. A virtual CFO can scale work up or down. This saves money and avoids long contracts. Companies pay only for what they truly use.

Plan for the Future

- A virtual CFO helps plan budgets and cash flow. They advise on spending, saving, and future plans, and the benefits of a virtual CFO are clear in this forward view. Companies can stay ready for changes ahead.

Make Better Decisions

- Numbers alone do not make good choices. A virtual CFO turns numbers into clear advice. They make charts and reports showing money flow. Leaders can act with less risk and more confidence.

Reduce Risks

- Risks come from markets, rules, or daily work. A virtual CFO finds risks and shows solutions.

- For example, they warn that cash may run low. Early action keeps business safe and stable, which highlights the risk control benefits of a virtual CFO.

Help With Investors

- Startups need clear plans to attract investors. A virtual CFO makes reports, forecasts, and slides.

- Clear statements build trust with new and current investors, showing one of the strong benefits of a virtual CFO.

Use Modern Tools

- Virtual CFOs use online tools to track money. Companies see spending, cash flow, and profits fast. This reduces mistakes and speeds reporting, adding to the tech-based benefits of a virtual CFO.

Focus on Core Business

- Outsourcing finance lets owners focus on their main work. A virtual CFO handles money with skill and care. Clear role separation helps smooth growth and shows the time-saving benefits of a virtual CFO.

Choose the Services You Need

- Virtual CFOs can advise or manage finances fully. Companies pick services that fit their needs and budget. This avoids paying for work not required.

When a Virtual CFO Helps Most

Some companies gain more due to unique demands. A virtual CFO supports key needs with ease.

Startups Seeking Investors

- Startups seeking investors need clear plans and reports. Strong reports build trust and improve investor interest. A virtual CFO shapes forecasts with simple, clear data.

Growing Businesses

- Growing businesses need careful cash checks during expansion. Rapid growth strains funds and requires strong controls. A virtual CFO sets plans that guide safe scaling.

Small Finance Teams

- Small finance teams need extra support during key tasks. Added skill fills gaps and improves daily decisions. A virtual CFO strengthens processes with expert review.

Seasonal Businesses

- Seasonal businesses need short-term help during peak times. Busy periods bring spikes that demand tight oversight. A virtual CFO offers support without long-term cost.

These cases show that a virtual CFO is a flexible, cost-effective solution for many business needs.

Comparing Virtual CFOs and Traditional CFOs

|

Feature |

Virtual CFO |

Traditional CFO |

|

Cost |

Low, pay for work done |

High, full-time salary |

|

Work Focus |

Plans, growth, risk |

Daily finance tasks |

|

Access |

Remote, online |

Office, in-person |

|

Experience |

Many industries |

Single company focus |

|

Contract |

Short-term, flexible |

Long-term commitment |

Virtual CFOs are best for companies that need flexible, smart advice without high costs. Traditional CFOs work best in big firms needing daily hands-on finance control.

Challenges of a Virtual CFO

-

Not Always On-Site

A virtual CFO is not on-site for daily work. Some tasks may need face-to-face help at times.

-

Communication Gaps

Remote work can cause slow or unclear talk if not planned. Missed calls or gaps in chats can harm key tasks.

-

Limited Availability

A virtual CFO may not be free at all hours. Peak times can lead to waits or short delays.

-

How to Fix These Issues

Clear rules and set call times help work stay smooth. Good tools and steady check-ins keep all tasks on track.

How to Pick a Virtual CFO

Choose a virtual CFO with care and thought. Strong choices help ensure stable long-term growth.

Experience

Check their industry skills and past work history. Solid experience shows skill in handling key tasks. A virtual CFO must match your business needs.

Clear Communication

They must explain numbers in simple, clear terms. Good communication builds trust and avoids costly errors. A virtual CFO should keep updates easy to understand.

Tech Skills

They must work well with online tools and reports. Strong tech skill improves speed and data accuracy. A virtual CFO uses tools that support smart decisions.

References

Past clients help show reliability and work quality. Client feedback offers proof of consistent good performance. A virtual CFO should have trusted past records.

Fit With Goals

Their advice must support your long-term plans. Good alignment helps steady growth, and this clear link adds to the goal-based benefits of a virtual CFO. A virtual CFO should guide choices that fit goals.

A good virtual CFO is more than a consultant; they become a trusted partner.

The benefits of a virtual CFO go beyond just saving money. They give advice, plan budgets, cut risks, and aid growth. Startups, small firms, and growing firms gain value from them. With clear agreements and regular talks, virtual CFOs work well. For modern business, a virtual CFO is skilled and cost-smart. Companies aiming to grow, attract investors, or run smoothly may find a virtual CFO the best choice for smart money.

FAQs

1. What is a virtual CFO?

- A virtual CFO is a money expert who works remotely, part-time, or on contract. They help businesses make smart money choices without being in the office every day.

2. How can a virtual CFO save my business money?

- They cut costs by avoiding full-time pay, benefits, and office expenses. Businesses only pay for the help they need.

3. Can a virtual CFO help small businesses grow?

- Yes, they guide budgets, spending, and money plans. They also find ways to make more profit.

4. How does a virtual CFO improve cash flow?

- They track money in and out, plan budgets, and give advice. This keeps bills paid and business running smoothly.

5. Can a virtual CFO help startups attract investors?

- Yes, they make simple reports and forecasts. This helps investors see a clear plan for growth.

6. What are the main benefits of hiring a virtual CFO?

- Save money, get expert advice, plan budgets, reduce risks, and support growth. They also let owners focus on core work.

7. Can a virtual CFO provide financial planning?

- Yes, they plan budgets, predict income, and guide spending. This helps the company reach long-term goals safely.

8. How does a virtual CFO help reduce risks?

- They spot money risks early and suggest ways to avoid them. This keeps the business safe during problems.

9. Can a virtual CFO work with small finance teams?

- Yes, they fill skill gaps and guide staff. They also show staff better ways to handle money tasks.

10. Can a virtual CFO help with investor relations?

- Yes, they make clear reports and updates. This builds trust and helps raise new funds.

11. Do virtual CFOs work in all industries?

- Yes, they help startups, shops, tech, factories, and services. Their advice fits many business types.

12. Can a virtual CFO help plan for business growth?

- Yes, they study finances and guide spending. This makes growth safe and steady.

13. How does a virtual CFO improve decision-making?

- They give clear money data and advice. Owners can see results before making choices.

14. Can a virtual CFO help during seasonal peaks?

- Yes, they give extra help in busy times. This avoids hiring full-time staff.

15. Can I hire a virtual CFO for specific tasks?

- Yes, you can pick reports, budgets, or full financial help. They work only where you need them.

16. How does a virtual CFO save time for business owners?

- They handle planning and reports. This frees owners to focus on other work.

17. Can a virtual CFO help with budgeting?

- Yes, they track past spending and plan future budgets. They help money stay under control.

18. Can a virtual CFO support mergers or acquisitions?

- Yes, they check finances and risks. This helps make safer business deals.

19. Do virtual CFOs help with long-term business strategy?

- Yes, they plan money to match goals. This keeps growth steady and safe.

20. Can a virtual CFO provide real-time financial insights?

- Yes, they use online tools to give fast reports. Owners can make quick decisions.

21. Are virtual CFOs suitable for growing businesses?

- Yes, they manage cash flow, spending, and expansion plans. They make growth safer and easier.

22. Can a virtual CFO help with cost reduction?

- Yes, they find waste and suggest better use of money. This saves cash and improves profit.

23. Do virtual CFOs replace in-house CFOs?

- Sometimes, for businesses that do not need daily support. They can act as the main money guide.

24. Can a virtual CFO improve business profitability?

- Yes, they guide spending, budgets, and investments. This helps earn more while controlling costs.

25. How long do businesses usually hire a virtual CFO?

- From a few months to several years, based on need. Companies can adjust the time for projects or growth.