Table of Contents

- 1 Understanding Accounting for Retail Business

- 2 Key Financial Metrics in Retail Bookkeeping

- 3 Cash Flow and Inventory Metrics for Retailers

- 4 Sales and Customer-Focused Accounting Metrics

- 5 How Retail Accounting Software Helps in Tracking Metrics

- 6 Why Outsource Retail Bookkeeping to Accounts Junction for Better Financial Insights?

- 6.1 1. Expertise in Accounting for Retail Business

- 6.2 2. Cost-Effective Solutions Compared to Hiring In-House Accountants

- 6.3 3. Access to Advanced Accounting Tools and Analytics

- 6.4 4. Comprehensive Financial Reports for Better Decision-Making

- 6.5 5. Enhanced Financial Insights to Drive Business Growth

- 6.6 6. Improved Tax Compliance and Audit Preparedness

- 6.6.1 Conclusion

- 6.6.2 FAQs

What Are the Key Metrics to Track in Retail Accounting?

Understanding Accounting for Retail Business

Retail accounting is important for managing the financial health of a business. Unlike other industries, retail businesses deal with large volumes of transactions, inventory management, and fluctuating sales cycles. Accurate accounting ensures profitability, compliance with tax regulations, and better decision-making.

Importance of Retail Bookkeeping in Business Success

Retail bookkeeping is the foundation of financial management for any retail business. Accurate bookkeeping helps retailers:

- Track revenue and expenses efficiently

- Maintain precise inventory records

- Ensure tax compliance and avoid penalties

- Monitor profit margins and cost control

- Prepare for audits and financial reporting

By implementing structured accounting for retail business, retailers can streamline operations and make informed strategic decisions.

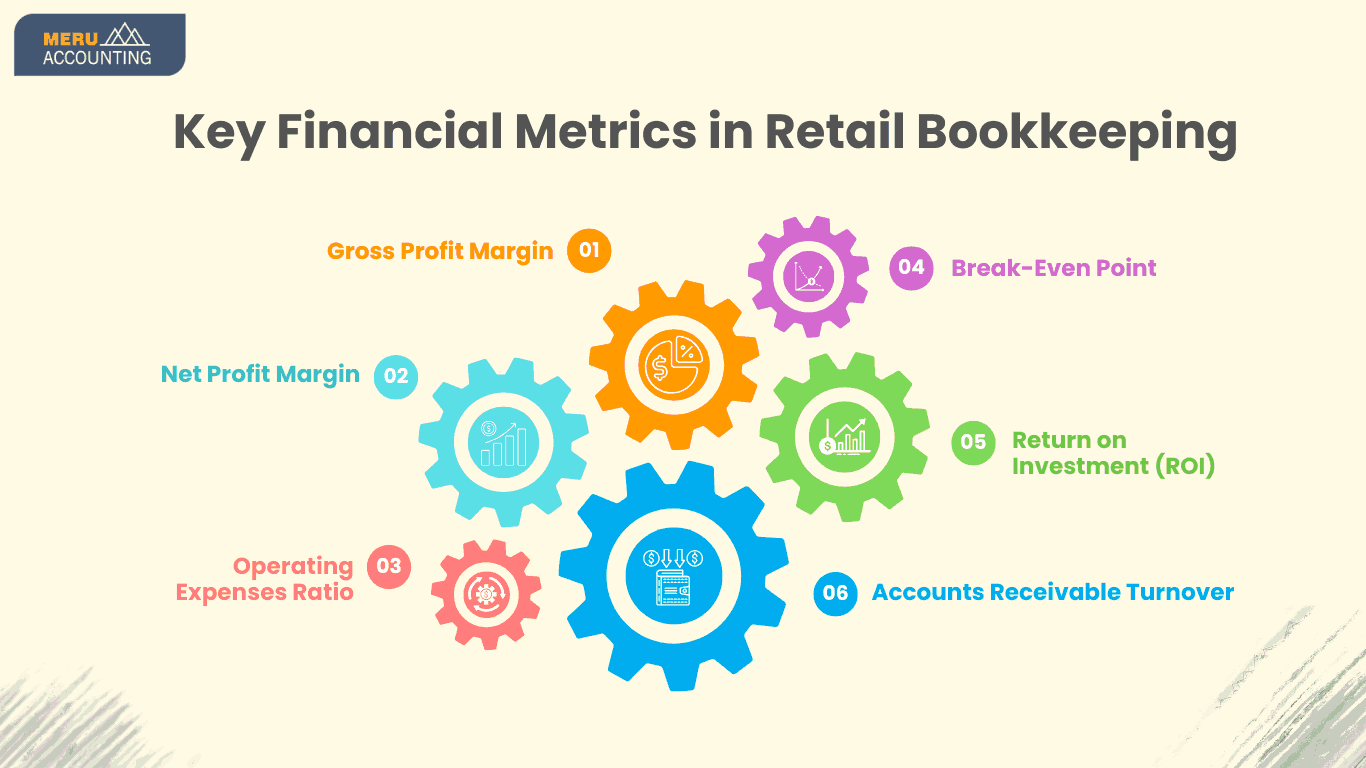

Key Financial Metrics in Retail Bookkeeping

Tracking financial metrics helps retailers evaluate their profitability and efficiency. Key financial metrics include:

- Gross Profit Margin: Measures the profitability after deducting the cost of goods sold. It shows how much profit a business earns from its core operations. This is before deducting expenses like rent, salaries, and utilities. A higher gross profit margin suggests efficient pricing and cost control.

- Net Profit Margin: Shows the overall profitability after all expenses, including operating costs, interest, and taxes. This metric provides insight into how well a business is converting revenue into actual profit. A low net profit margin may indicate high expenses or inefficient operations.

- Operating Expenses Ratio: Assesses cost efficiency in business operations by comparing operating expenses to total revenue. A lower ratio suggests better cost control and higher profitability. Retailers need to monitor this closely to ensure their expenses do not eat away at their profits.

- Break-Even Point: Determines the sales volume required to cover costs. Knowing the break-even point helps retailers set realistic sales targets and pricing strategies. It also provides insights into whether the business needs to cut costs or boost sales.

- Return on Investment (ROI): Evaluate the profitability of business investments like new store locations, marketing campaigns, or technology upgrades. Analyze how these investments impact revenue and overall growth. A strong ROI shows that the investment is making good profits. A low ROI may indicate the need for better resource allocation.

- Accounts Receivable Turnover: It evaluates how effectively a business collects payments from its customers. A high turnover rate indicates that customers are paying quickly, ensuring a steady cash flow. A low turnover rate may signal issues with credit policies or delayed payments, which can negatively impact liquidity.

Cash Flow and Inventory Metrics for Retailers

Managing cash flow and inventory is essential in accounting for retail business. Poor cash flow management can cause liquidity problems. Inefficient inventory management leads to stock shortages or excess stock.

- Cash Flow Statement: It helps monitor cash inflows and outflows. This ensures the business has enough liquidity to cover expenses like rent, payroll, and supplier payments. Regular cash flow analysis helps retailers plan for seasonal fluctuations and avoid cash shortages.

- Inventory Turnover Ratio: Tracks how frequently inventory is sold and restocked within a specific period. A high turnover means strong sales and efficient inventory management. A low turnover indicates overstocking or slow-moving products.

- Days Sales of Inventory (DSI): Indicates how long inventory sits before being sold. A lower DSI means faster inventory turnover, which is ideal for retailers dealing with perishable or seasonal goods. A high DSI may suggest inefficient stock management.

- Shrinkage Rate: Tracks inventory loss due to theft, damage, or mismanagement. High shrinkage rates can cause significant financial losses. It is important to implement security measures and track stock accurately.

- Stock-to-Sales Ratio: Evaluate the balance between inventory levels and sales. A high ratio suggests excess inventory. A low ratio may indicate stock shortages, leading to missed sales opportunities.

- Sell-Through Rate: A high sell-through rate shows that the stock is moving efficiently. It helps reduce the risk of markdowns and unsold inventory.

Sales and Customer-Focused Accounting Metrics

Sales performance and customer-related metrics help retailers improve revenue and customer retention. Important metrics include:

- Sales Per Square Foot: Evaluates how efficiently a store utilizes its space to generate revenue. This metric helps retailers assess store layout and merchandising effectiveness.

- Customer Acquisition Cost (CAC): Calculates the total expense of gaining a new customer, covering marketing and advertising costs. A lower CAC suggests cost-effective marketing strategies.

- Average Transaction Value (ATV): Monitors the average spending per transaction. Increasing ATV through upselling and bundling strategies can boost overall revenue.

- Customer Lifetime Value (CLV): Predicts the total revenue expected from a customer over their entire relationship with the business.

- Conversion Rate: Measures the percentage of store visitors or online users who complete a purchase. A higher rate indicates successful sales strategies and strong customer engagement.

- Cart Abandonment Rate: For online retailers, this metric shows the percentage of customers who add items to their cart. However, they do not complete the purchase. Reducing cart abandonment can lead to increased sales.

How Retail Accounting Software Helps in Tracking Metrics

Retail accounting software simplifies tracking and analyzing key metrics. It offers features such as:

- Automated bookkeeping to reduce manual errors.

- Real-time financial reports for better decision-making.

- Inventory management integration for accurate stock tracking.

- Tax compliance tools to streamline tax filing and reporting.

- Multi-location tracking for businesses operating in multiple stores.

- Point-of-sale (POS) system integration for seamless transaction recording.

- Budgeting and forecasting to predict future financial performance.

Using accounting software simplifies accounting for retail businesses, reducing manual errors and improving financial accuracy.

Why Outsource Retail Bookkeeping to Accounts Junction for Better Financial Insights?

Retail businesses require accurate financial management to ensure profitability and long-term success. Outsourcing retail bookkeeping to Accounts Junction offers many benefits. It helps retailers streamline operations, reduce costs, and make informed financial decisions.

1. Expertise in Accounting for Retail Business

Accounts Junction specializes in accounting for retail businesses, ensuring accurate financial record-keeping, tax compliance, and financial reporting.

2. Cost-Effective Solutions Compared to Hiring In-House Accountants

Hiring an in-house accounting team can be expensive for retail businesses. This is especially true for small and medium-sized enterprises (SMEs). Salaries, benefits, training, and software expenses add to operational costs.

3. Access to Advanced Accounting Tools and Analytics

With technological advancements, accounting for retail business has become more data-driven and automated. Accounts Junction uses industry-leading retail accounting software to provide real-time insights into financial performance.

4. Comprehensive Financial Reports for Better Decision-Making

Retail businesses thrive on data-driven decision-making. Accounts Junction provides detailed financial reports that include profit and loss statements, balance sheets, and cash flow reports.

5. Enhanced Financial Insights to Drive Business Growth

Accounts Junction helps retailers analyze their financial health and develop strategies for expansion. Whether it's opening a new store, investing in digital marketing, or optimizing supplier contracts, outsourced retail bookkeeping provides data-backed recommendations to maximize profitability.

6. Improved Tax Compliance and Audit Preparedness

Tax compliance is a crucial aspect of accounting for retail business. Mistakes in tax filing can lead to penalties and legal complications. Accounts Junction ensures that retailers comply with local tax regulations, including VAT, sales tax, and income tax requirements.

Conclusion

Effective accounting for retail businesses is essential for financial stability, profitability, and long-term growth. Retailers handle a high volume of daily transactions, fluctuating sales cycles, and complex inventory management. By utilizing retail accounting software, businesses can streamline bookkeeping processes, minimize errors, and generate real-time financial reports.

At Accounts Junction, we provide several benefits through our expert retail bookkeeping services. Professional bookkeeping services provide accurate financial reporting, cost-effective solutions, advanced analytics, and better tax compliance, allowing retailers to focus on growing their business. Access to detailed financial insights and data-driven decision-making helps retailers optimize pricing strategies, control expenses, and maximize profitability.

FAQs

1. Why is tracking financial metrics important in retail accounting?

Ans: Tracking financial metrics helps retailers monitor profitability, manage costs, optimize inventory, and make informed business decisions. It also ensures compliance with tax regulations and improves cash flow management.

2. What is the most important financial metric for retail businesses?

Ans: There isn’t just one key metric. Gross Profit Margin, Net Profit Margin, Inventory Turnover Ratio, and Cash Flow are crucial for a retail business. These metrics directly impact its financial health.

3. What role does accounting software play in tracking retail metrics?

Ans: Retail accounting software automates financial reporting, tracks inventory, and streamlines tax compliance. It provides real-time financial insights, reducing manual errors and improving decision-making.

4. How can retailers improve their cash flow management?

Ans: Retailers can enhance cash flow by optimizing inventory levels, reducing operational expenses, negotiating better payment terms with suppliers, and closely monitoring accounts receivable turnover.

5. What is Customer Lifetime Value (CLV) in retail accounting?

Ans: CLV measures the total revenue a business expects from a single customer over its lifetime. A high CLV reflects strong customer loyalty and successful retention strategies.