What is Finance and Accounting Automation and Outsourcing?

Understanding Finance and Accounting Automation and Outsourcing

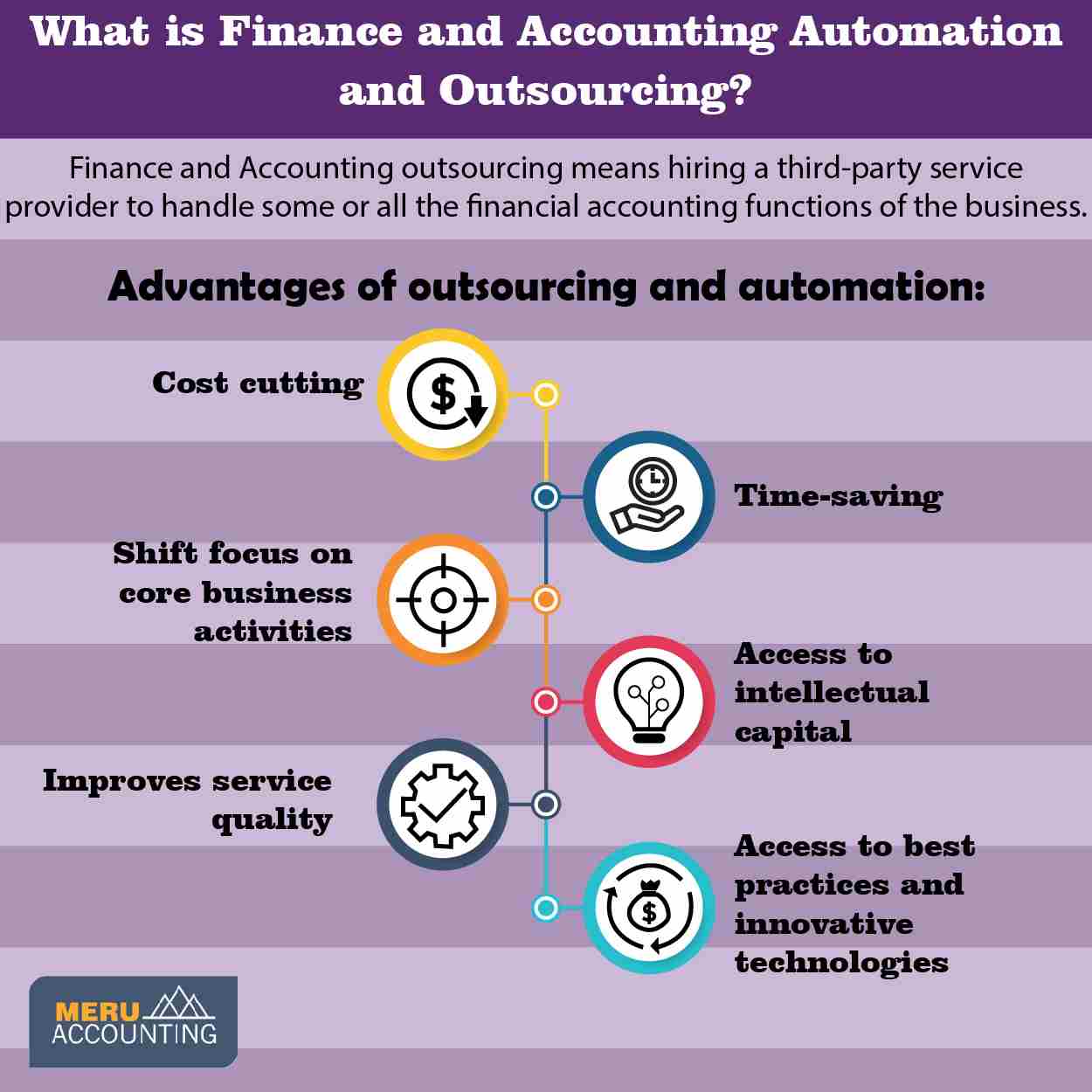

Finance and accounting outsourcing means hiring a third-party service provider to handle some or all the financial accounting functions of the business. Businesses view outsourcing as the best strategy that helps them optimize their accounting and finance departments. Third-party service providers are professional experts that take on any specific function, e.g., bookkeeping, to replace the entire finance function.

The following services can be outsourced to an external service provider:

- Accounts payable.

- Bookkeeping.

- Taxation.

- Payroll.

- Cash flow management.

- Financial statement preparation.

- Accounts receivable and many more.

How do financial and accounting automation and outsourcing work well for the business?

Accounting tasks involve various repetitive tasks and transactions that take a lot of time and effort; outsourcing and automation are the best alternatives to provide the support that a full-fledged in-house accounting department does. Businesses save a substantial amount of money by hiring a full-time employee. It also saves time for senior management in hiring and supervising new hires.

Automation of accounting and finance activities does not mean the replacement of professional accountants or CPAs. It helps professionals manage their workload effectively. Outsourcing accounting services use automation as a tool to perform their taskss smoothly and efficiently.

Why do companies opt for outsourcing accounting processes?

There are many advantages to outsourcing finance and accounting functions. Here are some of the advantages of outsourcing:

Focus on core business activities: Accounting is important but not the core business activity of the firm; the firm can rely on the expertise of the accounting service provider to perform specific business functions efficiently while taking care of statutory requirements and compliances. It helps in-house employees to focus more on the core business activities of the business.

Access to best practices and innovative technologies: Accounting is the core competency of outsourcing companies; thus; thus, they follow best industry practices and invest in the latest technologies to serve their clientss. It provides access to quality services and innovative technologies.

Improves performance: Outsourcing companies have a dedicated team of professional accounting experts who provide a much higher standard of performance than the internal accounting team. Thus, it helps to improve the performance of the business.

Minimize risk: Since accounting is handled by experts, it reduces uncertainty and the risk of error and fraud. It ensures a correct and accurate book of records of the finances of the company.

Cost-effective: Outsourcing helps companies save costs by around 30%–50%.

Flexibility and Scalability: Outsourcing gives businesses flexibility to opt for different services according to their needs. It makes the transition meet its changing requirements while cutting costs.

How can Accounts Junction help?

Learn about our bookkeeping and comprehensive range of outsourcing accounting services.

Contact us now to learn more about our services.