What is Individual Tax Return Australia?

Introduction to Individual Tax Return Australia

Filing an individual tax return in Australia is an essential task for Australian taxpayers. The Australian Taxation Office (ATO) requires individuals to declare their income and claim eligible deductions each financial year. Understanding the process can help you maximize your refunds and stay compliant with tax laws.

Who Needs to Lodge an ATO Individual Tax Return?

The ATO individual tax return applies to most Australian residents who are earning income. You will required to lodge a tax return if you:

- Earn more than the tax-free threshold ($18,200 per year)

- Have tax withheld from your wages or salary

- Receive rental income, investment earnings, or foreign income

- Run a business or are self-employed

- Want to claim tax deductions or offsets

- Have capital gains or losses to report

Special Cases for Lodging a Tax Return

Some individuals may need to lodge a tax return even if their income is below the threshold. This includes those who:

- Are foreign residents with Australian-sourced income

- Have been requested by the ATO to lodge a return

- Received government benefits that require tax reporting

- Paid Pay As You Go (PAYG) installments during the year

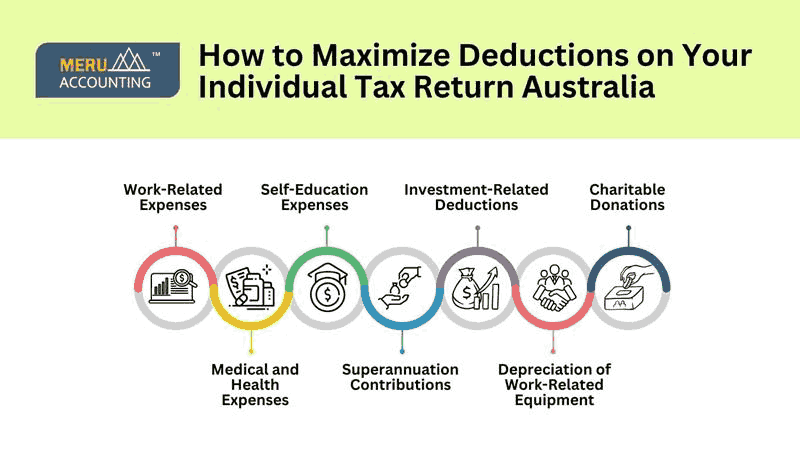

How to Maximize Deductions on Your Individual Tax Return Australia

One of the easiest ways to lower your taxable income and get a bigger tax refund in Australia is by claiming deductions on your tax return. Here are some common deductions you can claim:

1. Work-Related Expenses

If you spend money on work-related items that are not reimbursed by your employer, you can claim them, including:

- Work uniforms and protective clothing

- Home office expenses (for remote workers)

- Work-related travel and vehicle expenses

- Tools and equipment related to your job

2. Self-Education Expenses

If you’re studying to improve your job skills, you can claim some costs on your tax return. This includes tuition fees, textbooks, and stationery.

3. Investment-Related Deductions

If you earn income from investments, you can claim deductions for:

- Interest paid on investment loans

- Management fees for investments

- Depreciation of rental property assets

4. Charitable Donations

Donations over $2 to registered charities are tax-deductible, provided you have a receipt.

5. Medical and Health Expenses

Some medical expenses, such as disability aids and aged care services, may be deductible under specific conditions.

6. Superannuation Contributions

If you make voluntary contributions to your super fund, you may be eligible for a tax deduction.

7. Depreciation of Work-Related Equipment

Laptops, phones, and tools used for work purposes can be claimed as deductions, with depreciation spread over multiple years.

To maximize your deductions, keep all receipts and maintain detailed records of expenses related to your ATO tax return.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Common Mistakes to Avoid When Filing an ATO Individual Tax Return

Filing an ATO individual tax return can be complex, and making errors can result in delays or penalties.

1. Failing to Declare All Income

Ensure you report all income sources, including salary, rental income, interest, dividends, and foreign income.

2. Claiming Ineligible Deductions

Only claim deductions for expenses directly related to your income. Over-claiming or making false claims can lead to an audit.

3. Not Keeping Proper Records

The ATO requires evidence for deductions. Keep receipts, invoices, and work logs to support your claims.

4. Missing the Lodgement Deadline

The due date for most tax returns is October 31 each year. If you use a registered tax agent, you may get an extension.

5. Ignoring ATO Notices

If the ATO requests more information, failing to respond can lead to penalties or additional tax liabilities.

6. Forgetting to Claim All Possible Deductions

Many taxpayers miss out on deductions they are eligible for, such as home office expenses or professional memberships.

How Accounts Junction Can Help with Your Individual Tax Return Australia

Lodging an individual tax return in Australia can be complex. Professional assistance ensures a smooth and accurate process. Accounts Junction offers expert tax return services to ensure compliance and maximize refunds.

1. Expert Tax Advice

Our tax professionals provide personalized guidance on deductions and tax-saving strategies.

2. Hassle-Free Lodgement

We handle the entire process, ensuring accurate and timely submission of your ATO individual tax return.

3. ATO Compliance

We ensure your tax return meets all ATO requirements, minimizing the risk of audits or penalties.

4. Maximized Refunds

With our expertise, we help you claim every eligible deduction to increase your tax refund.

5. Support for Complex Tax Situations

Whether you are a freelancer, investor, or have multiple income sources, we can handle complex tax scenarios with ease.

6. Ongoing Tax Support

Beyond tax return lodgement, we provide ongoing support for tax planning and compliance.

By choosing Accounts Junction, you get peace of mind knowing that your ATO tax return is in expert hands.

Conclusion

Filing your individual tax return in Australia doesn’t have to be stressful. By understanding the process, keeping your records organized, and avoiding common mistakes, you can make tax time much easier. Claiming all eligible deductions can also help reduce your taxable income and increase your refund.

If you’re unsure about the process, seeking professional help from Accounts Junction can save you time and effort. Our experts guide you through every step, ensuring accuracy and compliance with tax laws. With the right support, you can have a smooth and hassle-free tax return experience.

FAQs

1. When is the deadline for lodging an ATO individual tax return?

Ans: The deadline is October 31 for most individuals. If using a registered tax agent, you may get an extension.

2. Can I lodge my tax return myself?

Ans: Yes, you can lodge it online via MyTax, but using a professional can help you maximize deductions and ensure accuracy.

3. What happens if I don’t lodge my tax return?

Ans: Failing to lodge on time may result in penalties, interest charges, or ATO enforcement actions.

4. How long does it take to get a tax refund?

Ans: Most refunds are processed within two weeks if lodged online.

5. Can I claim deductions without receipts?

Ans: You need receipts for most claims, but the ATO allows some work-related expenses up to $300 without receipts.

6. Why should I choose Accounts Junction for my tax return?

Ans: Accounts Junction offers expert tax return services, ensuring you claim all eligible deductions while remaining compliant with ATO regulations. Our team handles everything from record-keeping to tax lodgement, making the process smooth.