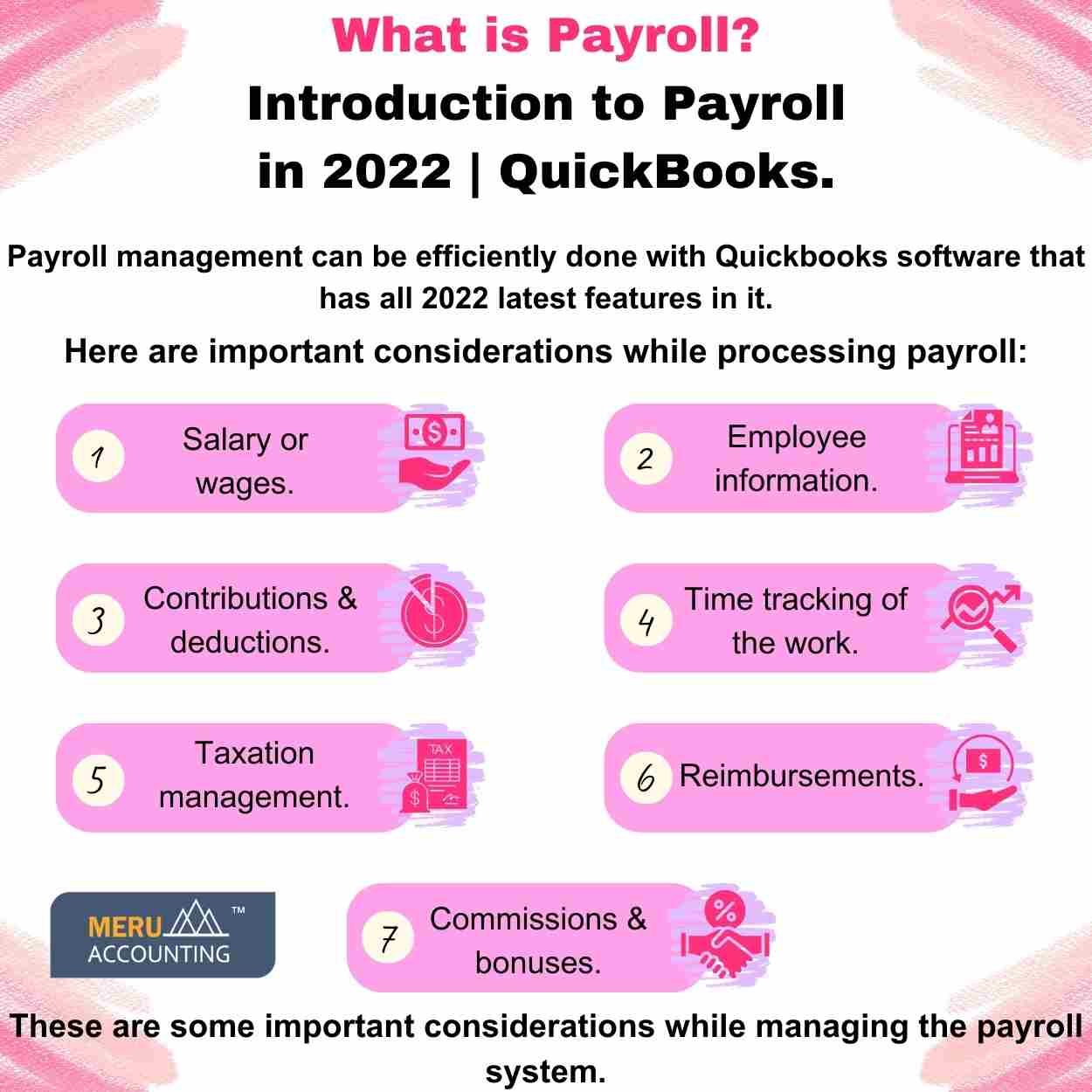

What is Payroll? Introduction to Payroll in 2022 | QuickBooks

A proper management of the payroll is one of the important aspect for every organization having employees. There are many aspects related to the payroll process that are complicated in nature. Many organizations find it difficult to deal with this and bring efficiency in it. So, several business organizations outsource payroll services to get an efficient payroll system. It helps them to get the quality services and achieve efficiency in it. While outsourcing the payroll management services, it is important to understand the effectiveness of the services provided by them. We will look in more detail about the payroll system in the organization.

What exactly is the payroll?

Payroll management includes the calculations of the employee’s earnings and deducting the necessary amount from them. Managing the payroll generally includes the activities like recording the employee’s earnings, distribution of the paychecks, and maintaining the annual records of the wages.

What are the important considerations while processing the payroll?

While processing the payroll, there are some important considerations.

Here are some important considerations while processing the payroll:

1. Salary or wages

The salary of the employee is considered initially here, whether it is fixed amount salary or hourly basis wages. If it is a salary then a fixed amount, it is paid to them accordingly. If the payment is on hourly basis then hourly rate, number hours worked, benefits, overtime payment, reimbursement, etc. are being considered.

2. Employee information

Before the payment, all the basic information of the employee is taken. This information will generally include address, name, social security number, etc. All the necessary bank details are updated here where the salary will be credited directly.

3. Contributions & deductions

All the necessary contributions & deductions are calculated directly while processing the payroll. All the details about the contributions & deductions are mentioned while making the payments for the employee.

4. Time tracking

The proper time tracking is done to know the working hours of the employee for calculating the pay period. Here, in some companies the overtime is also tracked to add up in the payment. This is more particularly important for the employees who are working on the wages.

5. Taxation

Depending on the earning slabs of the employee the taxation applied for the employee is calculated. All necessary taxes are deducted wherever applicable and payment is done accordingly.

6. Reimbursements

A proper reimbursement of all the extra spending is calculated. All these are then matched against invoices and then the reimbursements is done accordingly.

7. Commissions & Bonuses

Many companies have commissions for the extra performance which are calculated while making the payments. Also, other occasional bonuses included in the salary are added up in the salary while making the payments.

Can Quickbooks manage the Payroll system?

Quickbooks is very useful accounting software that can handle the payroll management of the organization. Quickbooks latest version has all the necessary features of the year 2022 needed to manage the payroll system.

So, while you outsource payroll services to other agencies, it is important that they have the Quickbooks software. Their payroll management services must be easy to handle which can make it simple for the organization.

If you are looking for an agency to outsource payroll services then Accounts Junction is a better choice. They provide payroll management services for businesses around the world. Experts’ staff here can give prompt services to meet your requirements. Accounts Junction is a proficient accounting service providing agency with clients around the world.