What are payroll processing services - Processes & Solutions

Every business with employees needs to manage payroll. So, what is payroll processing? It means working out employee pay, applying tax deductions, handling benefits, and making sure payments go out on time.

It also includes keeping proper records, following tax rules, and sharing reports with the government. Since this job takes time and effort, many businesses choose payroll processing services. These services take care of all payroll work and help keep the business accurate and on track.

One of the crucial aspects for any business having employees is payroll processing. Be it a small enterprise with fewer employees or a large enterprise with a number of employees, a proper Payroll Process is very important for them. It ensures that all the employees get proper payments and the company follows all the compliance relating to it. However, most companies are prone to errors while processing the payroll in their organization. Here, if you find it difficult to handle the payroll services in-house, then you can outsource Payroll Processing Services to experts. It can give you better services for your payroll processing.

What Are Payroll Processing Services?

Payroll processing services help businesses manage employee pay. They calculate wages, deduct taxes, and send payments on time. These services also follow tax laws and keep clear records. By using them, companies avoid mistakes and save time for other tasks.

Payroll processing services are expert solutions that handle pay for a business. They help save time, cut down on mistakes, and follow the law. These services may come from accountants, payroll firms, or online tools. The level of help can change with the size, field, or staff of the business.

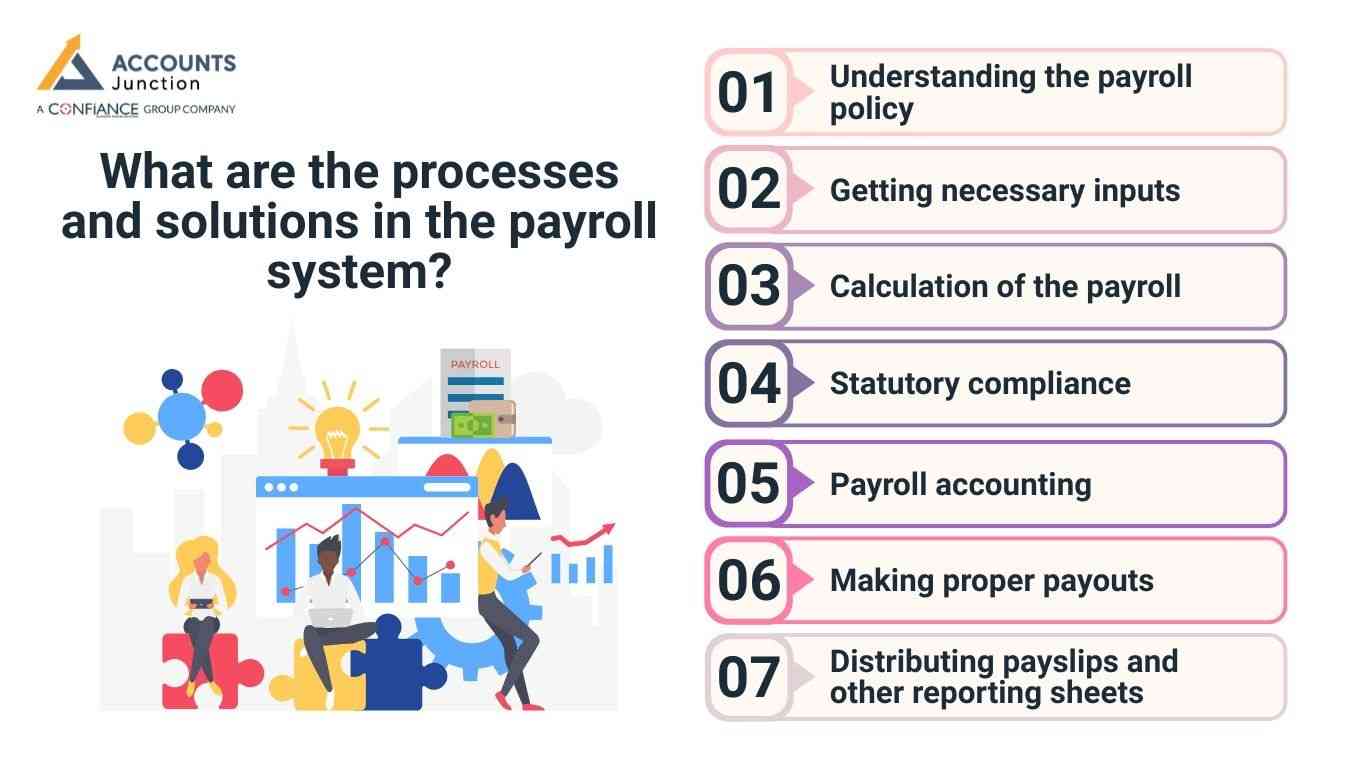

What are the processes and solutions in the payroll system?

When you are looking for Payroll Processing Companies to outsource the task, then you need to check whether they are following the proper Payroll Process. It will help you to get a proper payroll system in your organization.

Looking to improve your payroll process? Here are some key steps and practical tips to help you streamline payroll and avoid common issues.

1. Understanding the payroll policy

- Understanding the payroll policy is one of the first steps in the Payroll Process. These policies are approved by the managers and the CEO of the company. Its policy involves aspects like attendance, payments, leave, benefits, etc.

2. Getting necessary inputs

- To calculate payments correctly, you need the right details. These include tax information, salary, benefits, work shifts, attendance, and transport services.

3. Calculation of the payroll

- After getting the correct inputs, you need to calculate the proper payroll. Here, the calculation of the salary is done as per the employee's working hours, taxes, deductions, payslip of the salary, etc. A proper amount to be paid needs to be defined here accordingly.

4. Statutory compliance

- Adhering to statutory rules during payroll processing is very important when making payments. Deductions like TDS, EPF, and ESI are taken out. These amounts are then paid to the relevant government bodies.

5. Payroll accounting

- After making the payments, it needs to be updated in the proper accounting books. The salary paid is a very important entry for any company in accounting terms, so Payroll Processing Companies must do it properly.

6. Making proper payouts

- After following all the different steps, the salary payments are made with either a cheque, cash, or bank transfer. Most companies prefer to have a salary account for the employees and directly transfer the amount there. The salary payment is made, and particulars of the employee are recorded.

7. Distributing payslips and other reporting sheets

- This is the last step in the payroll processing where the payslips and other reporting sheets must be documented. If the automated systems are used, it is not necessary to give payslips separately, the employees can simply Login in and find it.

These are some Payroll Processing Tips that can be effective in getting better companies to outsource payroll tasks. As a small or big enterprise, payroll processing is always a hectic task, so you can outsource it to experts.

Benefits of Using Payroll Processing Services

1. Saves Time

- Business owners can focus on growth rather than managing payroll tasks.

2. Reduces Errors

- Manual payroll processing can lead to mistakes. Services use automation to reduce such risks.

3. Ensures Compliance

- Tax laws change often. A payroll service keeps up with these updates and ensures your business stays compliant.

4. Improves Employee Satisfaction

- On-time, correct payments boost trust and employee morale.

5. Secure Data Handling

- They store sensitive payroll data securely and protect it from theft or misuse.

Why Payroll Processing Is Important

Now that we understand what is payroll processing, it’s easy to see why it plays a key role in any business. Payroll mistakes can lead to delays, upset employees, and even legal trouble. A strong payroll process helps avoid these issues and keeps the business on track.

Payroll processing helps your business in many ways. It ensures that workers are paid the correct amount on time. It also helps you follow tax and labor laws. A smooth payroll system helps you avoid common problems like errors, fines, or audits.

Common Payroll Challenges Solved by Services

Many businesses face issues in payroll due to manual errors, lack of updated systems, or unfamiliarity with tax laws. Using payroll processing services can solve these problems quickly.

|

Problem |

How Services Help |

|

Manual Errors |

Automation reduces mistakes in calculations. |

|

Compliance Risks |

Services stay updated with tax laws, ensuring compliance. |

|

Time Consumption |

Speeds up monthly payroll tasks, saving valuable time. |

|

Poor Record Keeping |

Digital records are safe and simple to access. |

|

Employee Queries |

Self-service portals give employees quick access to payslips and details. |

Choosing the Right Payroll Processing Service

Selecting a payroll service can be challenging due to many options. Businesses need to ensure the service fits their needs and handles compliance, automation, and benefits efficiently.

Key Factors to Consider

1. Reliability and Reputation

- Check reviews and testimonials from other businesses.

- Verify the provider’s experience and track record in payroll management.

2. Features That Match Your Business Needs

- Ensure the service supports your company size and industry requirements.

- Look for features like automated payroll, tax calculation, and benefits management.

3. Data Security

- Confirm that sensitive employee data is stored securely.

- Look for encryption, access control, and secure servers.

4. Integration Capabilities

- Ensure smooth integration with existing HR and accounting systems.

- Check if the service can sync attendance, leave, and payroll records automatically.

Payroll Compliance and Legal Responsibilities

Payroll processing services involve more than just paying employees. They also help businesses follow all required laws. This includes income tax, social security, and other rules set by the government.

Reliable payroll providers keep track of legal updates. They ensure all payments, filings, and deductions comply with the rules. They also prepare the forms and reports needed for tax filing and audits.

At Accounts Junction, we make payroll processing easy. We ensure employees are paid correctly, on time, and that all tax rules are followed. Whether you manage payroll in-house or use our expert help, we keep the process simple and free of errors.

FAQs

1. What is payroll processing in simple terms?

- It is the method of calculating employee salaries, deducting taxes, and issuing payments.

2. Why do companies use payroll processing services?

- They help manage salaries and taxes accurately and save time.

3. Are payroll services only for large companies?

- No, even small and mid-sized businesses can benefit from them.

4. Can payroll services handle tax filing?

- Yes, most services include automatic tax calculation and filing.

5. Is cloud payroll better than manual payroll?

- Yes, it is more secure, faster, and user-friendly.

6. How do payroll services ensure data safety?

- They use encryption and safe servers to protect sensitive information.

7. What are the key features of a good payroll service?

- Automation, compliance, employee access, reporting, and support.

8. Can payroll services manage employee benefits?

- Yes, they may handle health insurance, retirement funds, and leave balances.

9. Do payroll services prevent mistakes in salary calculation?

- They reduce errors through automation and expert review.

10. How often is payroll processed?

- It may be weekly, bi-weekly, or monthly depending on company policy.

11. What is statutory compliance in payroll?

- It ensures all government rules for taxes and deductions are followed.

12. Can payroll services improve employee satisfaction?

- Yes, timely and accurate payments boost trust and morale.

13. Do businesses still need accountants if they use payroll services?

- Yes, accountants may handle financial integration and audits alongside payroll services.

14. Can payroll software integrate with HR systems?

- Yes, many solutions link payroll with attendance, leave, and HR records.

15. Are payroll reports helpful for business decisions?

- Yes, they provide insights into labor costs and financial planning.

16. Can payroll services handle multi-state or multi-country taxes?

- Yes, many providers manage local tax rules across regions.

17. What is the difference between gross and net salary?

- Gross is total earnings; net is what employees take home after deductions.

18. Can outsourcing payroll reduce legal risks?

- Yes, expert services may prevent compliance errors and fines.

19. Do payroll services keep historical employee records?

- Yes, digital records are stored securely for future reference.

20. Can employees access their payslips online?

- Yes, cloud and automated systems often allow self-service access.