Table of Contents

- 1 Accounting Services for Startups

- 2 Startup Bookkeeping: Why It’s Essential for Growth

- 3 Here's why startup bookkeeping is essential for growth:

- 4 How Online Accounting Services Simplify Startup Finances

- 5 Why Choose Accounts Junction for Startup Accounting Services?

- 5.1 Best Online Accounting Services for Startups

- 5.1.1 Conclusion

- 5.1.2 FAQs

What is the best online accounting service for startups?

Accounting Services for Startups

Launching a startup is a fun journey. It includes many tasks, like product development, marketing, getting funding, and building a team. In all this activity, one important part often gets ignored: financial management. However, neglecting your finances can be detrimental to your startup's growth and long-term success. This is where robust accounting services for startups become indispensable.

Startup Bookkeeping: Why It’s Essential for Growth

Before diving into the specifics of online accounting services, it's vital to understand the fundamental role of startup bookkeeping. Beyond simply recording income and expenses, it's about creating a firm financial bedrock for your company. Accurate and consistent bookkeeping provides a clear picture of your startup's financial health, enabling you to make informed decisions.

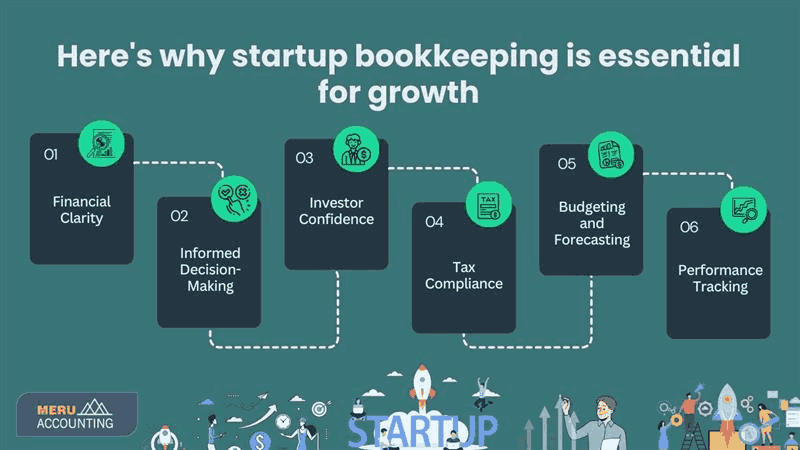

Here's why startup bookkeeping is essential for growth:

- Financial Clarity: It offers a comprehensive view of your cash flow, profitability, and overall financial performance.

- Informed Decision-Making: With accurate data, you can identify trends, analyze performance, and make strategic decisions regarding investments, pricing, and resource allocation.

- Investor Confidence: Well-maintained books instill confidence in potential investors, demonstrating your financial responsibility and transparency.

- Tax Compliance: Proper bookkeeping ensures accurate tax reporting, minimizing the risk of penalties and audits.

- Budgeting and Forecasting: Effective budgeting and financial forecasting are built on this foundation. This allows you to plan for future growth and mitigate risks.

- Performance Tracking: Bookkeeping allows you to track key performance indicators (KPIs) and measure your progress against financial goals.

How Online Accounting Services Simplify Startup Finances

Traditionally, accounting involved manual data entry, paper-based records, and time-consuming processes. However, the rise of online accounting services has revolutionized financial management for startups. These services offer a range of features that simplify bookkeeping, streamline workflows, and provide real-time financial insights.

Here's how online accounting services simplify startup finances:

- Automation: Many tasks, such as bank reconciliation, invoice generation, and expense tracking, are automated, saving time and reducing errors.

- Accessibility: You can access financial data from anywhere, at any time, using online platforms. This gives you the ability to manage your finances from anywhere."

- Collaboration: Multiple users can access and collaborate on financial data, facilitating teamwork and transparency.

- Real-time Insights: Dashboards and reports offer real-time insights into your financial performance. You can then make timely decisions.

- Scalability: Online accounting services can scale with your business, accommodating your growing needs and complexities.

- Integration: Online accounting services often integrate with tools like CRM and e-commerce platforms. This streamlines data flow and improves efficiency.

- Cost-Effectiveness: Online accounting services are a cheaper option than hiring an in-house accountant. This is most relevant to startups in their initial phase.

Why Choose Accounts Junction for Startup Accounting Services?

Selecting the right accounting partner is crucial for your startup's financial success. Accounts Junction knows the unique challenges that startups face. Our team of skilled experts is committed to helping startups manage their finances and reach their growth goals.

Best Online Accounting Services for Startups

Accounts Junction empowers startups by transforming standard accounting software into strategic financial tools. This can lead to a startup's growth and efficiency.

- Software Integration: We help you choose the right online accounting software. This ensures seamless data flow and efficient financial management.

- Customized Setup and Training: We offer personalized setup and training. This helps you get the most out of your accounting platform. We ensure you understand how to use the tools to track your finances effectively.

- Ongoing Support and Optimization: We offer continuous support and optimization, adapting your accounting systems as your startup grows. This includes regular reviews, updates, and troubleshooting to maintain peak efficiency.

- Real-time Financial Insights: We provide real-time dashboards and reports. This helps you make quick, informed decisions. We also help you understand the data." We help you understand the data, not just see it.

- Automation and Efficiency: We automate bookkeeping, invoicing, and expense tracking. This frees up your time for core business activities.

Best Online Tax Preparation Services for Startups

Tax compliance is crucial for startups, and Accounts Junction ensures you manage its complexities:

- Expert Tax Planning and Preparation: Our experienced tax professionals provide comprehensive tax planning and preparation services, ensuring you maximize deductions and minimize liabilities. We stay up-to-date with the latest tax laws to keep you compliant.

- Software Proficiency: We are proficient in using leading tax preparation software, such as TurboTax Business, H&R Block Premium & Business, and TaxAct Business, to accurately and efficiently file your taxes.

- Proactive Tax Advice: We provide proactive tax advice, helping you anticipate and plan for future tax obligations. This includes guidance on tax credits, deductions, and compliance requirements specific to startups.

- Audit Support and Representation: We offer expert audit support and representation. This protects your rights and resolves tax matters efficiently.

- Year-Round Tax Strategy: We develop year-round tax strategies. This optimizes your finances and minimizes your tax burden.

Accounts Junction delivers the best online tax preparation experience by combining expert knowledge with advanced software.

Conclusion

Effective financial management is of utmost importance for startup success. Utilizing online accounting services for startups can streamline operations, provide crucial insights, and ensure compliance. Accounts Junction provides startup bookkeeping services, including online accounting and tax services. Having an expert bookkeeping firm by your side will greatly help your startup grow and sustain the competition.

FAQs

Q: What are the key benefits of using online accounting services for startups?

A: Online accounting services offer automation, accessibility, collaboration, real-time insights, scalability, integration, and cost-effectiveness.

Q: How do I choose the best online accounting service for my startup?

A: To choose effectively, factor in your budget, your business's specific requirements, and your technical skills. Don't hesitate to use free trials to experiment with different platforms.

Q: What is the importance of startup bookkeeping?

A: Startup bookkeeping provides financial clarity, enables informed decision-making, instills investor confidence, ensures tax compliance, and facilitates budgeting and forecasting.

Q: Can online accounting services handle complex financial transactions?

A:Yes, You can do complex accounting tasks, such as multi-currency and inventory, with many online accounting services.

Q: Are online accounting services secure?

A: Reputable online accounting services employ robust security measures to protect your financial data, including encryption and multi-factor authentication.

Q: What are the best online tax preparation services for startups?

A: TurboTax Business, H&R Block Premium & Business, and TaxAct Business are among the top contenders.

Q: How often should I reconcile my bank accounts?

A: It's recommended to reconcile your bank accounts at least monthly to ensure accuracy and identify any discrepancies.

Q: Can I access my financial data from my mobile device?

Yes, You can use mobile apps to see your financial data on your phone or tablet. Most online accounting services offer these apps.