What is the full cycle of the Accounts Payable Process Service?

As accounting is one of the important parts of any business, accounts payable is one of the critical components of it. A proper accounting payable process service ensures a healthy financial position of the organization and provides a better environment for growth.

It will ensure that all your clients, employees, and other vendors are satisfied working with you. Proper accounts payable helps build a better reputation for the organization.

Full Cycle Accounts Payable Defined

The full cycle here considers creating and paying for all the orders in a proper stepwise process. Here, all the invoices of the organizations are processed speedily in a proper step-wise way and ensure that the payments are given before duration.

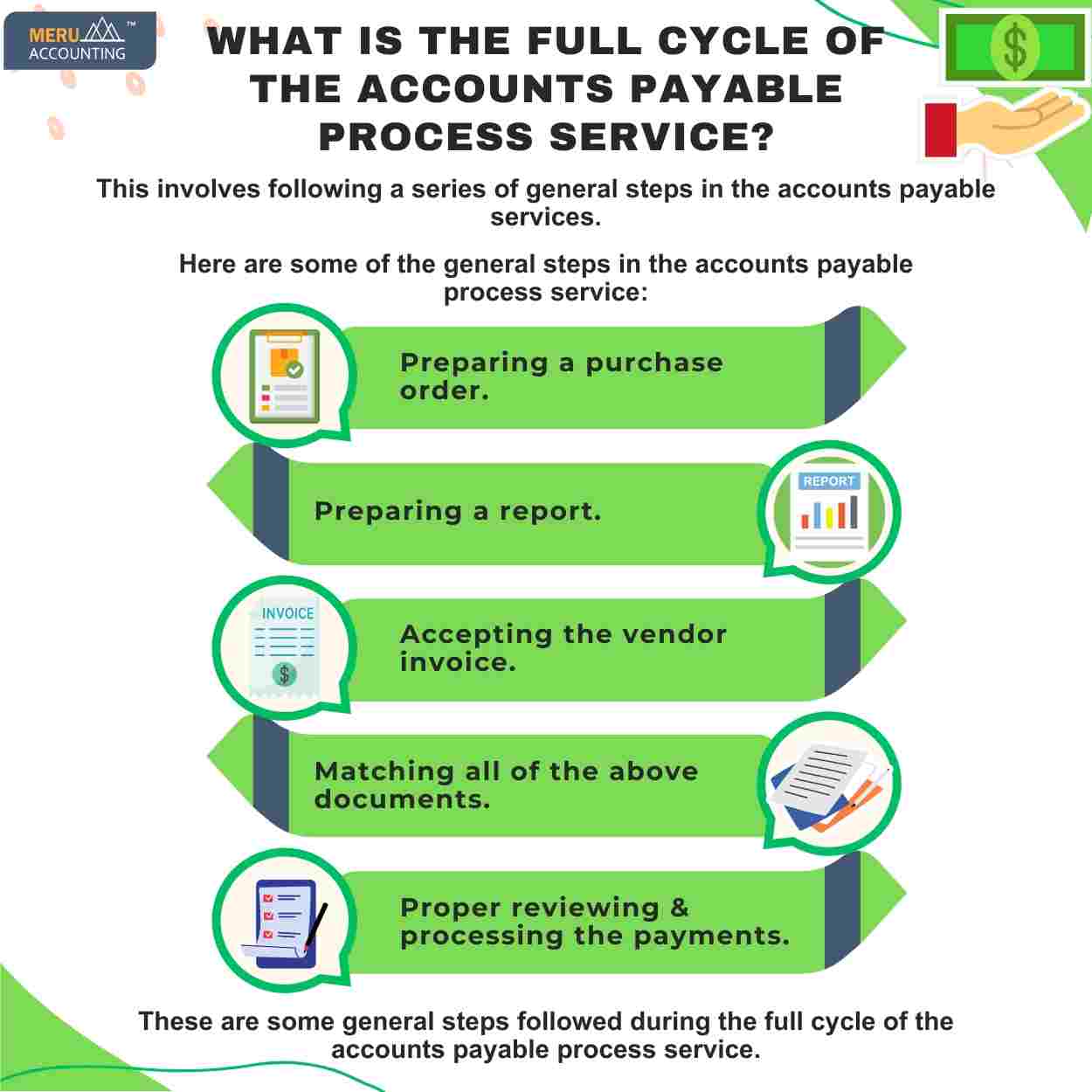

What are the general steps in the full cycle of the accounts payable process?

If you are looking to outsource the accounts payable process service to any expert agency then you need to consider the steps they follow during the accounts payable process.

Here are some simple steps followed in the process:

1. Purchase orders

A purchase order (PO) is the first step in the process that starts the purchase process. It is sent to the supplying vendor which can be either physical or digital in nature.

PO must consist of some general information like order date, description of the item, quantity, price, etc. It is important to note that PO is different from the invoice.

2. Receiving report

Once you receive the goods or services for the order given, a receiving report is given. The main information in this document includes the number of goods, list of received items, shipping details, the date of the received order, etc. Here, you can also provide different other details.

3. Vendor Invoice

After the vendor fulfills the desired requirement of the company, they need to send an official document for the payments. This document is called an Invoice which contains information like the amount that company owes to the vendor, taxes, freight or shipping charges, payment due date, etc. The accounts team needs to confirm the Invoice received and pave the way to process it further.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

4. Matching all the documents

At this stage, all three documents namely – Purchase Order, Receiving the report, and vendor Invoice need to be matched. This is generally called a three-way matching to ensure that there is no error that can lead to financial loss.

In case of any discrepancies, the account payable department must get it rectified properly. Once the Invoice is proper, it is then moved forward.

5. Review & process payments

This is the last step, where a final review of the Invoice is done and approval from the concerned authority is taken before payments. The organization then finally processes the payments.

Conclusion

These are some general steps in the accounts payable process service followed in most profit organizations. Obviously, this process is not as simple as it seems when most organization experiences problems.

So, they consider accounts payable outsourcing service option where experts can work on it. This helps them to achieve better efficiency in the accounts payable process with proper payments.

Accounts Junction provides accounts payable outsourcing services for the business organization. They have built up an efficient system to follow a proper stepwise process in the accounting payable process service.

They have a talented staff who can manage these aspects efficiently. Accounts Junction is a well-known accounting service-providing agency across the globe.