Table of Contents

- 1 What is the Accounts Payable Process?

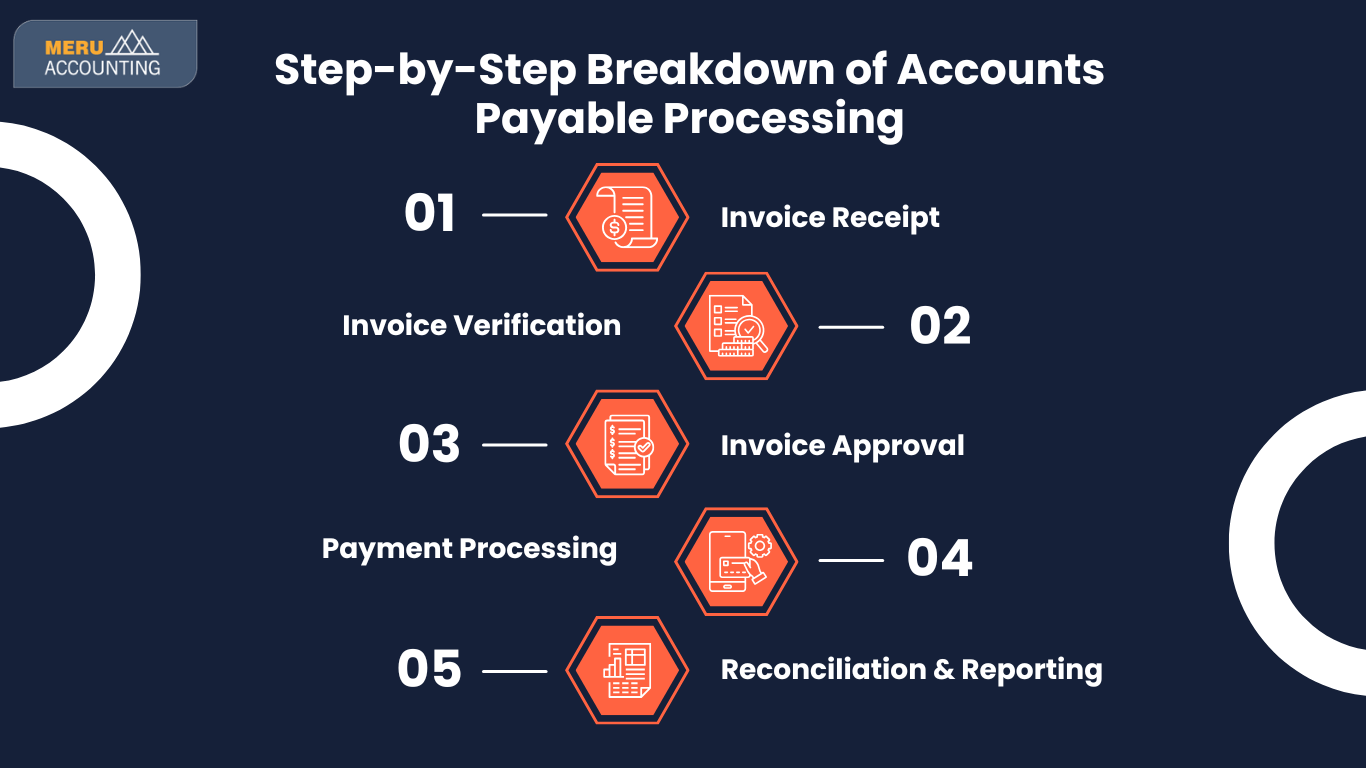

- 2 Step-by-Step Breakdown of Accounts Payable Processing

- 2.1 Step 1: Invoice Receipt

- 2.2 Step 2: Invoice Verification

- 2.3 Step 3: Invoice Approval

- 2.4 Step 4: Payment Processing

- 2.5 Step 5: Reconciliation & Reporting

- 3 Use of Robotic Process Automation in Accounts Payable

- 3.1 1. Reduction of Manual Data Entry Errors

- 3.2 2. Faster Invoice Processing and Approvals

- 3.3 3. Enhanced Fraud Detection and Compliance

- 3.4 4. Improved Vendor Relationships

- 3.5 5. Cost Reduction and Financial Efficiency

- 4 Why Choose Accounts Junction’s Automated Accounts Payable Solutions?

- 4.1 Conclusion

- 4.2 FAQs

What is the process life cycle of the accounts payable process?

What is the Accounts Payable Process?

The accounts payable process typically begins when a business receives an invoice from a supplier for goods or services rendered. The invoice is then verified for accuracy, including checking the quantity, price, and terms against purchase orders and delivery receipts. Once approved, the payment is scheduled according to the agreed-upon terms, ensuring timely disbursement while optimizing cash flow.

A well-structured accounts payable system helps businesses maintain financial stability and prevent fraud by implementing strict approval workflows and maintaining accurate records. Automating this process with accounting software can further improve efficiency, reduce errors, and provide real-time insights into outstanding liabilities.

Step-by-Step Breakdown of Accounts Payable Processing

To optimize the accounts payable process, businesses should follow these essential steps:

Step 1: Invoice Receipt

- The process starts when the company receives an invoice from a vendor

- Invoices can be received via email, mail, or electronic data interchange (EDI)

- Each invoice should contain essential details such as vendor name, invoice date, amount, and payment terms

Step 2: Invoice Verification

- Verifying invoices against purchase orders and receiving reports ensures accuracy and prevents discrepancies.

- Ensuring that the quantity, price, and terms align with the purchase agreement

- Identifying discrepancies and resolving them before processing the payment

Step 3: Invoice Approval

- Forwarding invoices to the respective department or manager for approval.

- Establishing a streamlined approval process to reduce delays

- Using robotic process automation accounts payable solutions to speed up approvals

Step 4: Payment Processing

- Scheduling payments based on due dates and cash flow availability

- Making payments through checks, bank transfers, or digital payment systems

- Following company rules and financial regulations to stay compliant and accountable.

Step 5: Reconciliation & Reporting

- Reviewing transactions to confirm all payments are accurate and recorded

- Identifying and resolving any payment discrepancies

- Generating financial reports to analyze payment trends and cash flow

Use of Robotic Process Automation in Accounts Payable

Businesses are increasingly adopting Robotic Process Automation (RPA) solutions in Accounts Payable (AP) to streamline financial operations. Implementing RPA in AP offers several benefits, including:

1. Reduction of Manual Data Entry Errors

- Automates invoice data extraction and entry

- Minimizes human errors in financial transactions

- Enhances accuracy in payment processing

2. Faster Invoice Processing and Approvals

- Speeds up invoice validation and approvals

- Reduces processing time from days to minutes

- Enables seamless integration with existing accounting systems

3. Enhanced Fraud Detection and Compliance

- Identifies duplicate or fraudulent invoices

- Ensures adherence to regulatory and compliance standards

- Provides real-time audit trails for financial transparency

4. Improved Vendor Relationships

- Ensures timely and accurate payments to vendors

- Reduces disputes and delays in invoice settlements

- Strengthens supplier trust and long-term partnerships

5. Cost Reduction and Financial Efficiency

- Lowers operational costs by reducing manual labor

- Optimizes working capital through efficient payment cycles

- Enhances cash flow management and financial planning

Why Choose Accounts Junction’s Automated Accounts Payable Solutions?

Managing the accounts payable process efficiently is essential for businesses to ensure smooth financial operations, maintain vendor relationships, and optimize cash flow. Accounts Junction provides advanced accounts payable processing solutions powered by robotic process automation (RPA) to enhance efficiency, reduce errors, and improve overall financial management.

- Increased Efficiency with Robotic Process Automation (RPA): Our robotic process automation accounts payable solutions streamline invoice approvals and payments, reducing manual intervention. By automating data extraction, validation, and entry, businesses can process invoices faster and minimize operational delays.

- Enhanced Accuracy and Reduced Errors: Automation eliminates human errors in invoice processing, approvals, and reconciliation. Our system ensures compliance with financial regulations by performing automated checks, reducing the risk of discrepancies and miscalculations.

- Cost Savings on Accounts Payable Processing: With automation, businesses can cut administrative costs by minimizing manual data entry and processing time. Automated payments help avoid late penalties while enabling companies to take advantage of early payment discounts.

- Improved Vendor Relationships: Timely and accurate payments build trust with suppliers and improve long-term vendor relationships. Automated payment tracking and communication provide transparency, reducing disputes and ensuring smooth financial transactions.

- Seamless Integration with Accounting Software: Our accounts payable process solutions integrate effortlessly with leading accounting platforms like Xero, QuickBooks, and Odoo. This ensures a seamless data flow between financial systems, reducing errors and improving efficiency.

- Real-Time Data and Analytics for Better Decision-Making: Businesses gain access to real-time dashboards that display pending invoices, payment schedules, and cash flow insights. This data-driven approach helps companies make informed financial decisions and improve overall financial planning.

Conclusion

A well-managed accounts payable process is crucial for maintaining financial stability, improving vendor relationships, and optimizing cash flow. By utilizing automation and robotic process automation (RPA), businesses can streamline invoice processing, reduce errors, and ensure timely payments. Accounts Junction’s advanced accounts payable solutions help businesses achieve efficiency, accuracy, and cost savings while integrating seamlessly with popular accounting software. With real-time insights and automated workflows, businesses can make better financial decisions and focus on growth. Investing in an automated AP system not only simplifies financial operations but also enhances overall business success.

FAQs

1. What is the importance of the accounts payable process?

Ans: The accounts payable process ensures accurate and timely supplier payments, helping businesses maintain strong vendor relationships and financial stability.

2. How does robotic process automation help in accounts payable?

Ans: Robotic process automation accounts payable solutions automate invoice processing, reduce errors, and speed up approvals, making the process more efficient.

3. How can I improve my accounts payable processing?

Ans: You can enhance accounts payable processing by implementing automation tools, streamlining approvals, and regularly reconciling financial records.

4. Why should businesses choose automated accounts payable solutions?

Ans: Automated solutions reduce manual effort, improve accuracy, and ensure timely vendor payments, making the accounts payable process more efficient.

5. How does automation improve the accounts payable process?

Ans: Automation streamlines invoice processing, reduces errors, and ensures timely payments, leading to greater efficiency and cost savings.

6. How do Accounts Junction’s accounts payable solutions benefit businesses?

Ans: We enhance accuracy, optimize cash flow, and integrate seamlessly with accounting software, providing real-time insights for better financial decisions.

7. Why should businesses invest in an automated AP system?

Ans: It simplifies financial operations, strengthens vendor relationships, and supports business growth by improving efficiency and financial stability.