What is Virtual CFO Services and How its important for any business?

Virtual CFO Services give businesses remote access to high-level financial expertise. This removes the need to hire a full-time Chief Financial Officer (CFO). These services offer strategic financial planning, budgeting, forecasting, cash flow management, risk assessment, and compliance support. Businesses can optimize their financial performance with the best virtual CFO services. These services also ensure regulatory compliance and implement cost-effective financial strategies for growth.

One of the key advantages of using Virtual CFO Services is flexibility and affordability. Unlike traditional CFO roles, virtual CFOs work on a contract, part-time, or subscription basis. Businesses can hire virtual CFO services only when needed. This is an ideal solution for startups, small businesses, and mid-sized companies. It helps them scale without the high costs of a full-time CFO.

How Virtual CFOs Differ from Traditional CFOs

Virtual CFOs and traditional CFOs share the same purpose of providing financial leadership, but they differ in their approach and working models.

|

Aspect |

Virtual CFO |

Traditional CFO |

|

Work Model |

Works remotely, on-demand |

Works full-time, in-house |

|

Cost |

More affordable, typically contract-based |

Higher cost, full-time salary, benefits, and bonuses |

|

Flexibility |

Scalable, can be adjusted based on business needs |

Fixed commitment, not easily scalable |

|

Expertise |

Offers specialized expertise across multiple industries |

Expertise is typically limited to the company they work for |

|

Technology Use |

Utilizes cloud-based tools and automation |

Often relies on traditional financial systems |

|

Best For |

Startups, small to medium businesses needing financial advice |

Large corporations requiring hands-on financial leadership |

Which One Should You Choose?

- Virtual CFO services provide expert financial guidance for startups, small businesses, or growing companies. They are cost-effective compared to hiring a full-time CFO.

- For large corporations: A traditional CFO is the better choice, as it provides full-time, in-house financial oversight.

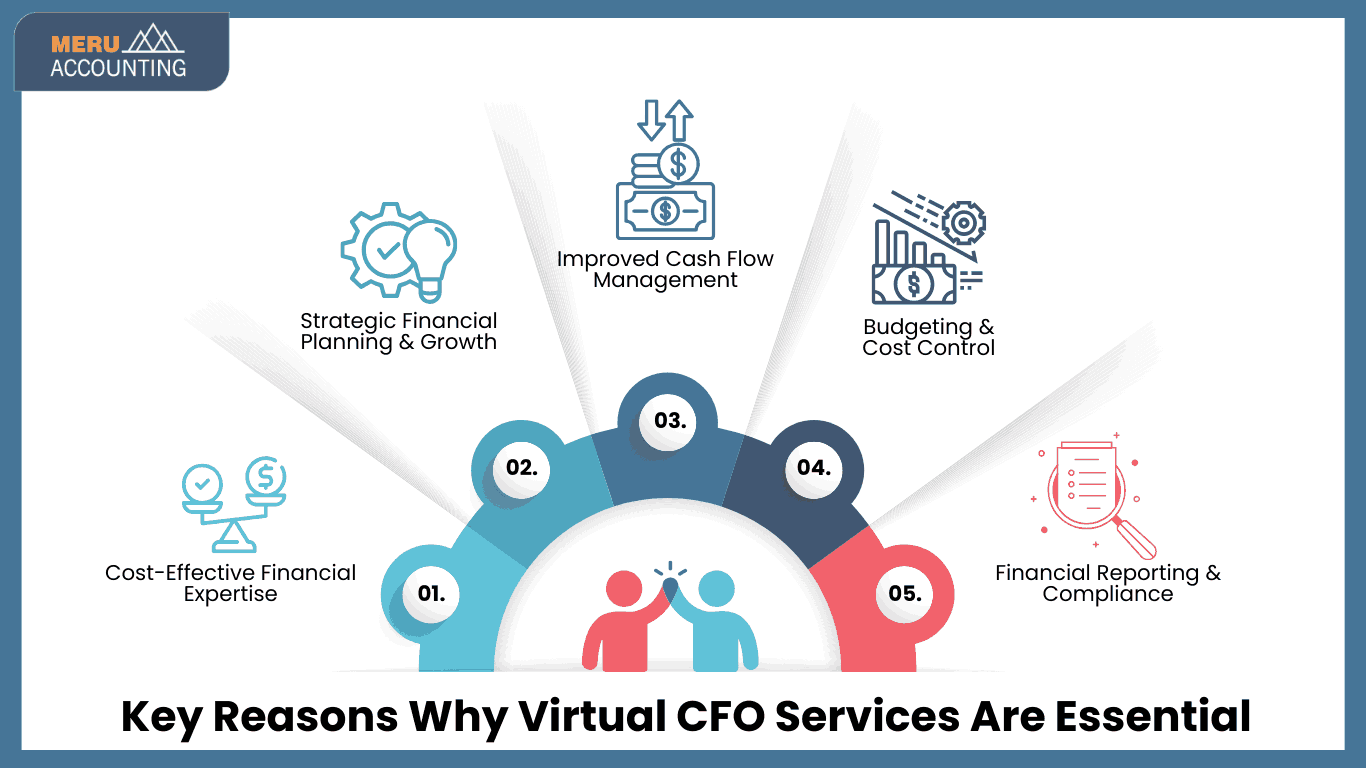

Why Virtual CFO Services Are Important for Businesses

1. Cost-Effective Financial Expertise :

Hiring a full-time CFO can be costly for small and medium-sized businesses (SMBs). Virtual CFO services provide expert financial guidance at a lower cost. This solution is cost-effective for businesses. It provides access to top-tier financial advice without needing a full-time, high-salary position.

2. Strategic Financial Planning & Growth :

A Virtual CFO helps businesses create and implement long-term financial strategies. These strategies include budgeting, forecasting, financial modeling, and investment planning. They are essential for driving growth and ensuring profitability. With expert financial planning, businesses can scale sustainably.

3. Improved Cash Flow Management :

Virtual CFOs offer real-time insights into income and expenses, helping businesses optimize cash flow and maintain financial stability.

4. Budgeting & Cost Control :

Virtual CFO Services identify unnecessary expenses and find opportunities for cost savings, allowing businesses to operate more efficiently. Their expertise ensures that resources are allocated wisely to maximize profits.

5. Financial Reporting & Compliance :

Maintaining accurate financial records is essential for transparency, investor confidence, and legal compliance. A Virtual CFO helps businesses stay on track with financial reporting. They also ensure compliance with regulations, reducing the risk of financial penalties.

Who Should Hire Virtual CFO Services?

Virtual CFO services offer expert financial guidance to businesses. This helps them avoid the cost of a full-time Chief Financial Officer. Whether you're a startup, a growing business, or an established company, a Virtual CFO can help. They optimize profitability, manage risks, and ensure financial stability.

1. Startups & Small to Medium-Sized Businesses

For startups and small to medium-sized businesses, having a dedicated CFO may not be financially viable. Hire Virtual CFO Services for expert financial advice and strategic planning. Get financial forecasting tailored to your company’s unique needs.

2. Businesses Looking to Scale

Scaling a business requires strong financial direction. Virtual CFO Services provide insights into budgeting, forecasting, and investment planning to support business expansion. With the best virtual CFO services, companies can make data-driven financial decisions. This helps them achieve long-term growth.

3. Industries That Benefit from the Best Virtual CFO Services

Many industries require specialized financial expertise to manage cash flow, reduce costs, and improve financial health. Virtual CFO services cater to a wide range of industries, including:

- E-commerce – Managing online sales, inventory, and tax compliance.

- Healthcare – Navigating complex billing, insurance, and regulatory requirements.

- Real Estate – Financial planning for property investments and market fluctuations.

- Manufacturing – Optimizing supply chain costs and production budgets.

- Professional Services – Assisting consultants, agencies, and law firms in financial management.

4. Businesses Facing Financial Challenges

Companies struggling with financial planning, cash flow management, or cost control can greatly benefit from hiring Virtual CFO Services. If your business faces declining profits, inefficient budgeting, or a weak financial strategy, a Virtual CFO can help. They provide expert guidance to improve your financial health.

5. Entrepreneurs Seeking Financial Expertise

Entrepreneurs often juggle multiple responsibilities and may lack the time or expertise to focus on financial planning. Hire Virtual CFO Services to gain access to high-level financial strategies that ensure long-term stability and growth.

Why Choose Accounts Junction for Virtual CFO Services?

Accounts Junction is renowned for providing the best virtual CFO services. Here's why:

- Expert Financial Guidance

Gain valuable insights and advice from experienced financial professionals with years of industry experience.

- Cost-Effective Solution

Access expert CFO services at a fraction of the cost of hiring a full-time executive.

- Budgeting & Forecasting

Accounts Junction offers accurate financial planning, ensuring your business maintains a healthy cash flow and can scale effectively.

- Profitability Optimization

Identify cost-saving opportunities and maximize your business's profitability.

- Compliance & Risk Management

Ensure your business remains compliant with tax laws and financial regulations, reducing risks.

- Customized Financial Strategies

Tailored solutions to meet your business's unique financial needs and goals.

- Advanced Reporting & Analysis

Real-time business insights with detailed financial reporting, helping you make informed decisions.

- Seamless Integration with Accounting Software

Works with popular tools like Xero, QuickBooks, and other financial management software to provide efficient, integrated solutions.

Conclusion

Virtual CFO services are crucial in driving business growth and providing strategic financial guidance at an affordable cost. Whether you're running a startup or a small-to-medium-sized business (SMB), hiring virtual CFO services can help. It can improve your financial operations. It helps streamline budgeting, enhance cash flow management, and ensure compliance with tax laws. Partnering with top virtual CFO services gives businesses expert financial insights. This allows them to make informed decisions without needing a full-time, in-house CFO.

Accounts Junction is one of the best virtual CFO service providers. We offer tailored solutions to meet the unique needs of businesses in various industries. With years of expertise, our team offers expert financial guidance. They also provide seamless integration with accounting tools like QuickBooks and Xero, supporting long-term growth. If you're looking to hire virtual CFO services, Accounts Junction is the right choice. We specialize in strategic planning, profitability optimization, and risk management. We can help you manage your financial future.

FAQ’s

1. What Are Virtual CFO Services?

Ans: Virtual CFO services provide remote financial expertise, including strategic advice, budgeting, and cash flow management. They also offer compliance support without the need for a full-time CFO.

2. How Do Virtual CFOs Differ from Traditional CFOs?

Ans: Virtual CFOs work remotely on a contract or subscription basis. They are usually more affordable than full-time, in-house CFOs who manage daily operations.

3. Why Are Virtual CFO Services Essential for Businesses?

Ans: Virtual CFO services help businesses with strategic planning, profit optimization, cash flow management, and compliance. They offer these benefits at a fraction of the cost of a traditional CFO.

4. Who Should Hire Virtual CFO Services?

Ans: Virtual CFO services help startups, small businesses, and growing companies. They provide financial expertise for scaling operations and increasing profitability.

5. Why Choose Accounts Junction for Virtual CFO Services?

Ans: Accounts Junction provides expert financial guidance and cost-effective solutions. They also offer customized strategies that integrate seamlessly with your accounting software to support business success.