Table of Contents

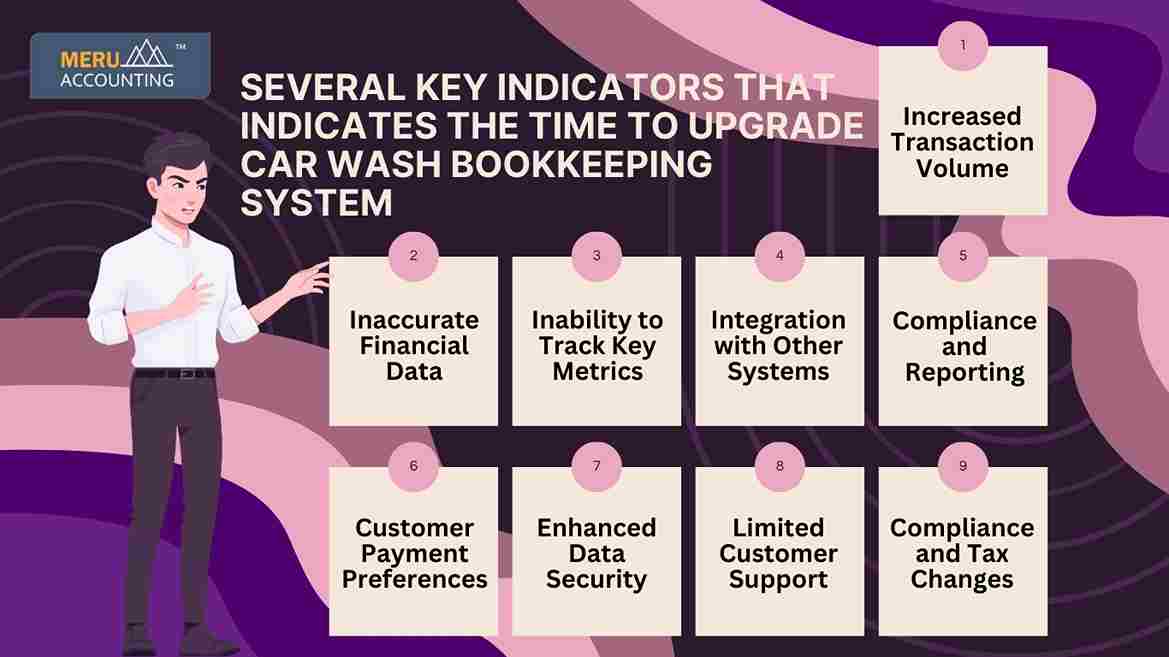

- 1 Several key indicators that indicates the time to upgrade Car Wash Bookkeeping System

- 1.1 Increased Transaction Volume

- 1.2 Inaccurate Financial Data

- 1.3 Inability to Track Key Metrics

- 1.4 Integration with Other Systems

- 1.5 Compliance and Reporting

- 1.6 Customer Payment Preferences

- 1.7 Enhanced Data Security

- 1.8 Limited Customer Support

- 1.9 Compliance and Tax Changes

- 1.9.1 Conclusion

When should you consider upgrading your car wash bookkeeping system?

Upgrading your car wash accounting system is crucial for keeping your business running efficiently and helping it grow. A modern system can save you time, reduce errors, and improve the security of your financial data. When you rely on an outdated bookkeeping system, you might spend too much time manually entering data, and errors can easily happen. This can lead to inaccurate financial records, making it harder to track your income and expenses. Additionally, as your business grows, you may find that your current system can’t handle the increase in transactions or the complexity of your finances. Let's check some key signs that indicate it’s time to upgrade your car wash bookkeeping system and how it can benefit your business.

Several key indicators that indicates the time to upgrade Car Wash Bookkeeping System

As your car wash attracts more customers, the volume of transactions will increase. If you're struggling to keep up with daily sales, service transactions, and customer payments, it may be time to consider an upgraded bookkeeping system. A robust system can help automate and simplify these processes, reducing the risk of errors and saving valuable time.

Frequent discrepancies in your financial reports or difficulty in accurately tracking your expenses and revenues suggest that your current car wash accounting system is outdated. Upgrading to a more sophisticated system will provide you with real-time, accurate financial data, helping you make better business decisions.

Also Read: Can I access my financial data from anywhere with digital bookkeeping services?

To grow your car wash, you need to monitor important metrics such as revenue per wash, customer retention rates, and operational costs. If your current bookkeeping system does not allow for easy tracking of these metrics, it's time for an upgrade. A more advanced system will provide dashboards and analytics that can help you identify trends and make data-driven decisions.

Modern car wash accounting systems offer integration with other important software, such as point-of-sale (POS) systems, inventory management tools, and customer relationship management (CRM) systems. If your current system doesn’t support these integrations, it can result in inefficiencies. Upgrading to a system that integrates with these tools will streamline your operations and save time.

Compliance with tax regulations and financial reporting standards is crucial for any business. If your car wash bookkeeping system is outdated, it may not be able to handle the latest compliance requirements. This can lead to errors in tax filings or financial reports, potentially causing legal issues. An upgraded system will ensure you stay compliant and generate accurate reports with ease.

More and more customers prefer digital payment methods. If your current system doesn’t support digital or contactless payments, you may be losing potential sales. An upgraded car wash accounting system will allow you to accept various payment methods, improving customer satisfaction and boosting sales.

Data security is a top concern, especially when dealing with sensitive financial information. Older car wash bookkeeping systems may not offer adequate protection against data breaches or cyber-attacks. Upgrading to a modern system will provide better security features, ensuring that your financial data is safe and secure.

If you find yourself struggling to get help or support from your current bookkeeping software provider, it’s a sign to look for a new solution. A reputable bookkeeping system should offer responsive customer support, including training resources, tutorials, and access to knowledgeable staff who can assist with any issues that arise.

Tax laws and compliance requirements can change frequently. If your current bookkeeping system does not keep up with these changes or lacks features for managing sales tax and payroll taxes, an upgrade is essential. A modern system will help ensure that you stay compliant with the latest regulations and make tax preparation easier.

Conclusion

A modern car wash accounting system can help you maintain accurate financial records, comply with regulations, and meet customer expectations. By upgrading, you will simplify your operations and ensure your business can grow smoothly.

For expert advice on upgrading your car wash accounting system, consider consulting with professionals like Account Junction, who specialize in helping businesses transition to more efficient bookkeeping systems. Investing in a better car wash bookkeeping solution today will position your business for long-term success.