Table of Contents

- 1 What is Accounts Receivable Management?

- 2 Challenges in Handling Accounts Receivable Internally

- 3 When Should You Outsource Your Accounts Receivable Management Service?

- 4 How Accounts Receivable Management Software Improves Efficiency

- 4.1 1. Automated Invoicing and Reminders

- 4.2 2. Better Cash Flow Management

- 4.3 3. Reduced Errors

- 4.4 4. Easy Tracking and Reporting

- 4.5 5. Integration with Accounting Systems

- 5 Why Choose Accounts Junction for Accounts Receivable Management Service?

- 5.1 1. Expertise You Can Trust

- 5.2 2. Tailored Solutions for Your Business

- 5.3 3. Advanced Technology for Accuracy

- 5.4 4. Cost-Effective and Scalable Services

- 5.5 5. Improved Cash Flow and Financial Stability

- 5.5.1 Conclusion

- 5.5.2 FAQs

When To Outsource Your Accounts Receivable Management Service?

What is Accounts Receivable Management?

Accounts receivable management is the process of tracking and collecting outstanding payments from customers. It ensures that businesses receive payments on time, maintain a healthy cash flow, and reduce bad debts. Effective accounts receivable management service helps businesses improve financial stability and minimize the risks associated with unpaid invoices.

Managing accounts receivables efficiently requires proper invoicing, timely follow-ups, and accurate financial reporting. Many businesses struggle with this process due to delayed payments, incorrect billing, and resource constraints. This is why companies often consider outsourcing their accounts receivable management service.

Challenges in Handling Accounts Receivable Internally

Managing accounts receivable in-house can be complex, especially for small and medium-sized businesses. Some common challenges include:

1. Late Payments: Many customers delay their payments, affecting cash flow and business operations.

2. Errors in Invoicing: Mistakes in invoices can lead to disputes, further delaying payments and causing frustration for both businesses and customers.

3. Lack of Skilled Staff: Handling accounts receivable management requires expertise in finance and collections, which not all businesses have in-house.

4. Time-Consuming Process: Manually managing invoices, sending reminders, and following up with customers can take up valuable time and resources.

5. Poor Cash Flow Management: Inefficient accounts receivable management service can lead to inconsistent cash flow, making it difficult for businesses to plan expenses and investments.

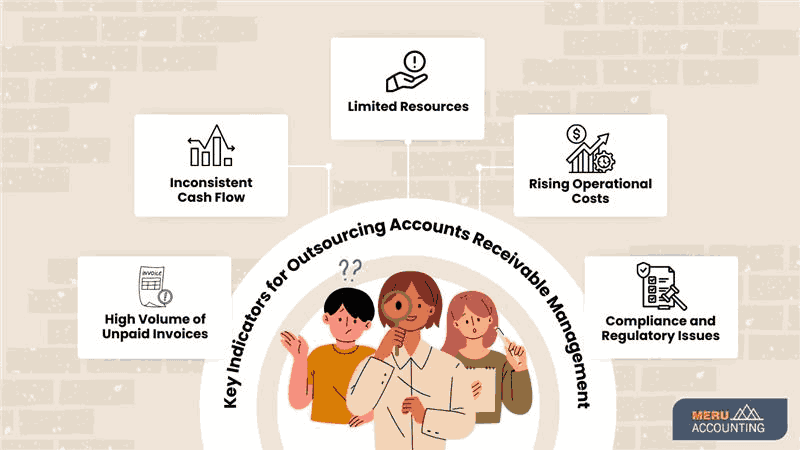

When Should You Outsource Your Accounts Receivable Management Service?

Outsourcing accounts receivable management services can help businesses simplify processes, reduce errors, and improve cash flow.

- High Volume of Unpaid Invoices: If your business has a growing number of unpaid invoices, it’s a sign that your internal team may not be handling collections effectively. Delayed payments can damage your financial stability and hinder growth opportunities.

- Inconsistent Cash Flow: Struggling with unpredictable cash flow can affect your ability to pay suppliers, meet payroll obligations, and invest in business expansion. Outsourcing ensures timely collections and provides a steady stream of income, improving financial planning.

- Limited Resources: If your team lacks the necessary skills, tools, or time to manage accounts receivable efficiently, outsourcing to experts can free up internal resources for other essential business functions. This allows your staff to focus on customer relationships and revenue-generating activities.

- Rising Operational Costs: Managing accounts receivables in-house involves hiring staff, investing in software, and handling collection efforts, all of which add to operational costs. Outsourcing can reduce these expenses while improving efficiency and collection rates.

- Compliance and Regulatory Issues: Professional accounts receivable management services ensure compliance with financial regulations, reducing the risk of legal issues. They stay updated on industry standards and help businesses avoid penalties and disputes related to payment collections.

How Accounts Receivable Management Software Improves Efficiency

Using advanced accounts receivable management software can enhance efficiency and accuracy.

1. Automated Invoicing and Reminders

Modern software automates the invoicing process and sends timely reminders, reducing the chances of late payments.

2. Better Cash Flow Management

By providing real-time insights into outstanding invoices, businesses can plan finances more effectively.

3. Reduced Errors

Manual data entry can lead to mistakes. Accounts receivable management software minimizes errors by automating calculations and data entry.

4. Easy Tracking and Reporting

Businesses can track payments, monitor overdue invoices, and generate reports with ease.

5. Integration with Accounting Systems

Many accounts receivable management software solutions integrate with accounting tools like QuickBooks and Xero, ensuring seamless financial management.

Why Choose Accounts Junction for Accounts Receivable Management Service?

Managing accounts receivable is important to keep any business financially healthy. Late payments can affect cash flow, but with the right team, you can stay on top of your invoices. Accounts Junction makes the process easy and efficient.

1. Expertise You Can Trust

With years of experience in financial management, our team ensures efficient handling of invoices, timely follow-ups, and reduced payment delays. We bring industry knowledge and best practices to optimize your accounts receivable process.

2. Tailored Solutions for Your Business

Every business has unique financial needs. We offer customized accounts receivable management solutions designed to fit different industries and business sizes, ensuring efficiency and effectiveness.

3. Advanced Technology for Accuracy

We utilize modern accounts receivable management software to automate invoicing, track payments, and improve collection efficiency. This minimizes errors and accelerates the payment process.

4. Cost-Effective and Scalable Services

Outsourcing your accounts receivable management to Accounts Junction reduces operational costs and provides a scalable solution that adapts to your business growth. This ensures long-term financial efficiency.

5. Improved Cash Flow and Financial Stability

Our proactive approach to collections, including systematic follow-ups and professional communication, helps businesses maintain a healthy cash flow. This enhances financial stability and allows for better resource planning.

Conclusion

Outsourcing your accounts receivable management can significantly enhance your business’s financial efficiency. By assigning this important function to experienced professionals, you can ensure timely invoice processing, reduce outstanding payments, and improve overall cash flow. A well-managed accounts receivable process minimizes financial risks, enhances liquidity, and allows businesses to focus on strategic growth rather than administrative challenges.

At Accounts Junction, we offer structured, technology-driven solutions tailored to your industry’s needs. Our team ensures systematic follow-ups, timely collections, and accurate financial reporting, helping you maintain a steady revenue stream. With our expertise, businesses can reduce operational costs, optimize working capital, and strengthen financial stability.

Partner with Accounts Junction today to simplify your receivables, enhance cash flow, and achieve long-term financial success.

FAQs

1. What are the benefits of outsourcing accounts receivable management?

Ans: Outsourcing ensures timely collections, reduces errors, improves cash flow, and allows businesses to focus on growth.

2. How do accounts receivable management software help businesses?

Ans: It automates invoicing, tracks payments, sends reminders, and integrates with accounting tools for better financial management.

3. Is outsourcing accounts receivable management cost-effective?

Ans: Yes, outsourcing reduces operational costs, eliminates the need for additional staff, and ensures consistent cash flow.

4. How do I know if my business needs accounts receivable management services?

Ans: If you struggle with late payments, cash flow issues, or invoice errors, outsourcing can be a great solution.

5. Why should I choose Accounts Junction for accounts receivable management service?

Ans: Accounts Junction offers expert solutions, cost-effective services, and the latest technology to streamline your accounts receivable process.