Table of Contents

- 1 Introduction to Construction Company Accounting

- 2 Key Accounting Methods for a Construction Company

- 3 Cash Basis Accounting

- 4 Accrual Basis Accounting

- 5 Percentage of Completion Method

- 6 Completed Contract Method

- 7 Comparing Different Accounting Methods

- 8 Pros and Cons of Each Method

- 8.1 1. Cash Basis Accounting

- 8.2 2. Accrual Basis Accounting

- 8.3 3. Percentage of Completion Method

- 8.4 4. Completed Contract Method

- 9 Why Choose Accounts Junction for Construction Company Accounting Services?

- 9.1 Expertise in Construction Accounting

- 9.2 Accurate Bookkeeping and Financial Management

- 9.3 Use of Industry-Specific Accounting Software

- 9.4 Custom Financial Reporting and Analysis

- 9.5 Tax Planning and Compliance

- 9.5.1 Conclusion Effective construction company accounting is essential for maintaining financial stability, tracking project costs, and ensuring compliance with tax laws. Choosing the right accounting for construction companies method depends on your business structure, project type, and financial goals.

- 9.5.2 FAQs

Which method of accounting is best for a construction company?

Introduction to Construction Company Accounting

Managing finances in the construction industry is a complex task. It requires specialized knowledge of both construction business and accounting. Construction company accounting differs from standard business accounting due to factors like long-term contracts, job costing, fluctuating expenses, and revenue recognition complexities. To ensure financial stability and compliance, it is crucial to implement a structured approach to accounting for construction companies.

Construction projects involve multiple stakeholders, various cost elements, and different billing methods. Hence, bookkeeping for construction companies is essential to track costs, manage budgets, and ensure profitability. A good accounting system in place improves payroll, expense tracking, and cash flow management, boosting financial performance.

Key Accounting Methods for a Construction Company

Accurate construction company accounting relies on selecting the right accounting method. Since construction projects often span multiple months or years, traditional accounting methods may not be sufficient. The most commonly used methods in accounting for construction company operations include:

- Cash Basis Accounting

- Accrual Basis Accounting

- Percentage of Completion Method

- Completed Contract Method

Each method offers distinct advantages and is chosen based on project duration, contract type, and financial reporting needs.

Cash Basis Accounting

Cash basis accounting is one of the simplest forms of bookkeeping for construction company operations. In this method:

- Revenue is recorded when cash is received.

- Expenses are recorded when payments are made.

- No accounts receivable or payable are recorded.

This method is beneficial for small construction companies with straightforward transactions. However, it may not provide an accurate financial picture for businesses managing multiple contracts simultaneously. Many companies prefer more detailed methods to track financial performance.

Accrual Basis Accounting

In accrual basis accounting, revenue and expenses are recorded when they are earned or incurred, regardless of cash transactions. This method ensures:

- A more accurate representation of financial status.

- Better matching of revenue with corresponding expenses.

- Improved financial planning and decision-making.

For businesses handling multiple projects with long payment terms, accrual accounting works better than cash basis. It provides a realistic view of financial performance, which is crucial for stakeholders and tax reporting.

Percentage of Completion Method

The percentage of completion method is widely used in construction company accounting, especially for long-term projects. In this approach:

- Revenue and expenses are recognized proportionally to the project's completion stage.

- Financial statements reflect work progress rather than waiting for project completion.

- Helps in smooth cash flow management.

This method provides a more accurate reflection of a company’s financial position, ensuring transparency and accountability. However, it requires precise tracking of project progress and cost estimates.

Completed Contract Method

The completed contract method records revenue and expenses only after project completion, unlike the percentage of completion method. This approach is ideal for short-term contracts or when revenue recognition is uncertain. Its key features include:

- Revenue is not recorded until project completion.

- Expenses are accumulated until the contract is finished.

- Ideal for tax deferral strategies.

This method simplifies bookkeeping for construction companies but can cause financial fluctuations since revenue is recorded only at project completion.

Comparing Different Accounting Methods

Choosing the right accounting method is crucial for financial success in the construction industry. Below is a quick comparison of the most commonly used bookkeeping for construction companies methods:

|

Accounting Method |

Revenue Recognition |

Best for |

|

Case Basis |

When cash is received |

Small businesses, short-term projects |

|

Accrual Basis |

When earned |

Large businesses, long-term projects |

|

Percentage of Completion |

Based on the Project's progress |

Large-scale, multi-year projects |

|

Completed Contract |

At project completion |

Short-term contracts, tax deferral |

Pros and Cons of Each Method

1. Cash Basis Accounting

Pros:

- Simple to implement and maintain

- Records revenue and expenses only when money is received or spent.

- Helps with short-term cash flow management

Cons:

- Doesn't provide an accurate financial picture for long-term projects

- Revenue and expenses may not match the period in which they occur

- Not suitable for larger companies or those required to follow GAAP

2. Accrual Basis Accounting

Pros:

- Gives a clearer view of the company's financial status.

- Matches revenue with corresponding expenses, improving financial reporting

- Required for businesses following Generally Accepted Accounting Principles (GAAP)

Cons:

- More complex to implement and maintain

- Requires tracking accounts receivable and accounts payable

- Higher risk of reporting income before receiving payments, affecting cash flow

3. Percentage of Completion Method

Pros:

- Recognizes revenue and expenses as work progresses, ensuring accurate financial reporting

- Helps construction companies comply with tax regulations

- Provides better financial visibility for long-term projects

Cons:

- Complex to calculate and requires precise cost estimation

- Errors in estimating completion percentages can lead to inaccurate reporting

- Not ideal for smaller projects with short durations

4. Completed Contract Method

Pros:

- Defers tax obligations until project completion

- Simplifies accounting by recognizing revenue and expenses only when the project is finished

- Useful for short-term projects where costs and revenue are uncertain

Cons:

- Doesn't provide ongoing financial insights during the project

- Can create unpredictable cash flow issues

- Not suitable for large or long-term projects that require progressive revenue recognition

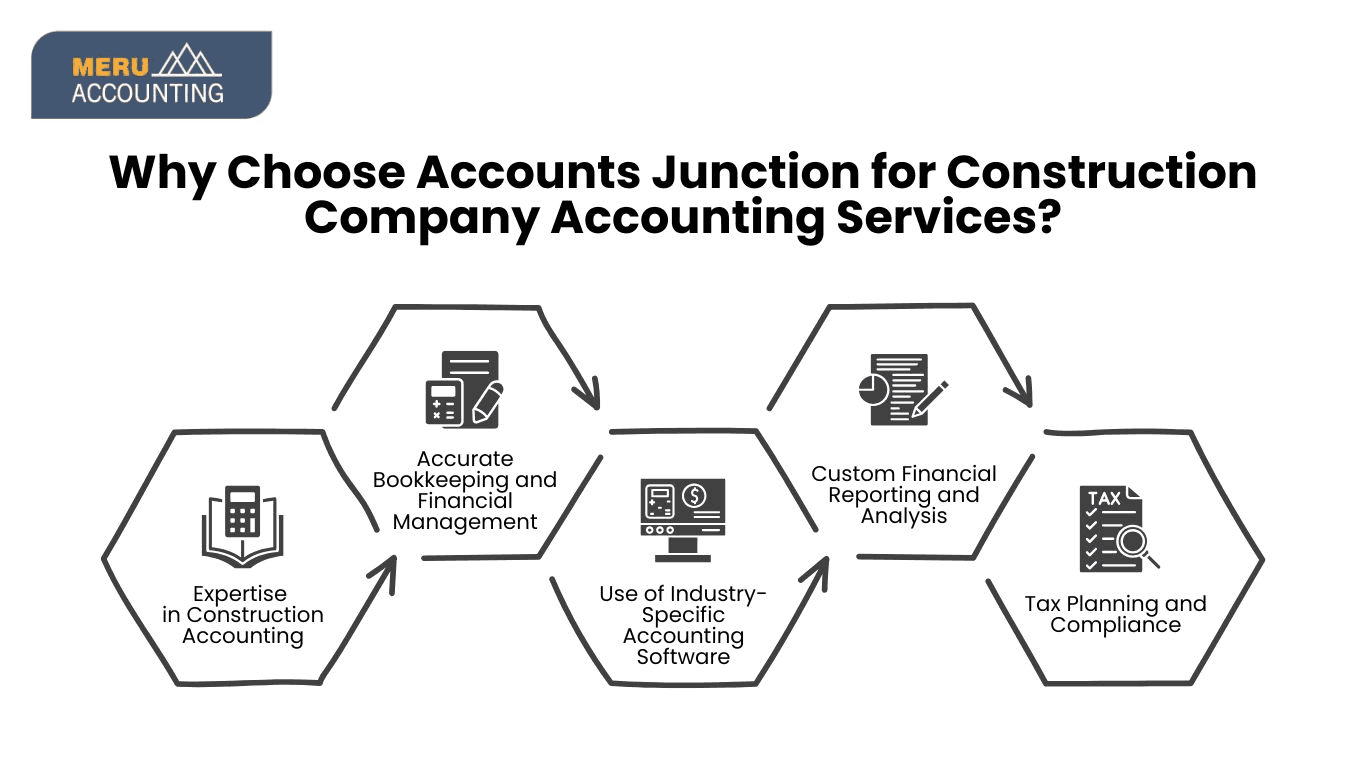

Why Choose Accounts Junction for Construction Company Accounting Services?

Expertise in Construction Accounting

- Specialized knowledge in construction company accounting, ensuring compliance with industry-specific financial regulations.

- Experience in managing financial complexities unique to accounting for construction company operations.

Accurate Bookkeeping and Financial Management

- Provides detailed bookkeeping for construction company records, ensuring accurate financial tracking.

- Manages project-wise financial records, tracking income and expenses efficiently.

Use of Industry-Specific Accounting Software

- Expertise in QuickBooks, Xero, Sage, and other accounting software tailored for construction company accounting.

- Ensures seamless integration with project management tools for real-time financial monitoring.

Custom Financial Reporting and Analysis

- Prepares customized financial reports, including profit & loss statements, balance sheets, and project-wise cost analysis.

- Helps in decision-making by providing detailed insights into profitability and cash flow management.

Tax Planning and Compliance

- Ensures compliance with local tax laws and regulations for accounting for construction company operations.

- Offers strategic tax planning to minimize liabilities and maximize deductions.

Conclusion

Effective construction company accounting is essential for maintaining financial stability, tracking project costs, and ensuring compliance with tax laws. Choosing the right accounting for construction companies method depends on your business structure, project type, and financial goals.

At Accounts Junction, we offer expert bookkeeping for construction companies to help contractors manage their finances efficiently. By selecting the right accounting approach, businesses can enhance cash flow management, optimize profitability, and achieve long-term growth.

FAQs

1. Which accounting method is best for a construction company?

The best accounting method depends on the project type. Small businesses may prefer cash-based accounting, while large construction firms typically use accrual or percentage of completion methods.

2. Why is construction accounting different from regular accounting?

Construction company accounting is more complex than regular accounting due to job costing, project-based revenue, and fluctuating expenses.

3. How can Accounts Junction help with construction bookkeeping?

Accounts Junction provides expert bookkeeping for construction companies, offering financial reporting, tax planning, and accounting software solutions tailored to construction businesses.

4. What are the tax implications of different accounting methods?

The completed contract method defers taxes, while the percentage of completion method ensures accurate revenue tracking and tax compliance.