Table of Contents

- 1 What Is Balance Sheet Reconciliation?

- 2 Why Businesses Need Regular Reconciliation

- 3 Key Benefits of Balance Sheet Reconciliation for Financial Health

- 4 Step-by-Step Balance Sheet Reconciliation Process

- 5 Essential Balance Sheet Reconciliation Checklist

- 6 Why Outsourcing Balance Sheet Reconciliation Can Benefit Your Business?

- 6.1 Conclusion

- 6.2 FAQs

Why Balance Sheet Reconciliation Is Crucial for Financial Health?

What Is Balance Sheet Reconciliation?

Balance sheet reconciliation is an important accounting process that ensures accuracy in financial records. It involves matching balances with bank statements. This ensures all transactions are recorded accurately. It also makes sure the balance sheet reflects the company's true financial position.

Reconciliation is essential because financial statements support business decisions and tax reporting. They also ensure compliance with accounting regulations. Any differences in financial records can cause errors in financial reporting and resource mismanagement. They can also lead to legal or regulatory issues. By conducting regular reconciliations, businesses can maintain accurate financial records, prevent costly mistakes, and ensure their financial health remains intact.

Why Businesses Need Regular Reconciliation

Regular balance sheet reconciliation helps businesses detect errors, prevent fraud, and ensure compliance with accounting standards. It provides financial transparency, allowing companies to identify differences early and resolve them before they escalate. Without periodic reconciliation, discrepancies can accumulate, leading to inaccurate financial statements, misinformed decision-making, and potential regulatory issues. Additionally, regular reconciliation helps in optimizing cash flow management and reducing financial risks.

Key Benefits of Balance Sheet Reconciliation for Financial Health

- Ensures Financial Accuracy: Regular reconciliation helps businesses maintain accurate and up-to-date financial records, preventing discrepancies that could impact financial statements.

- Enhances Fraud Detection: Identifies unusual transactions and unauthorized activities, reducing the risk of financial fraud.

- Improves Regulatory Compliance: Ensures that financial reporting aligns with accounting standards and legal requirements, helping businesses avoid penalties.

- Optimizes Cash Flow Management: Helps businesses track cash inflows and outflows, enabling better financial planning and liquidity management.

- Supports Better Decision-Making: Provides reliable financial data for management to make informed business decisions.

- Strengthens Investor and Stakeholder Confidence: Accurate financial statements build trust with investors, lenders, and other stakeholders.

- Minimizes Financial Risks: Reduces the risk of misstatements, errors, and financial losses by identifying and correcting inconsistencies early.

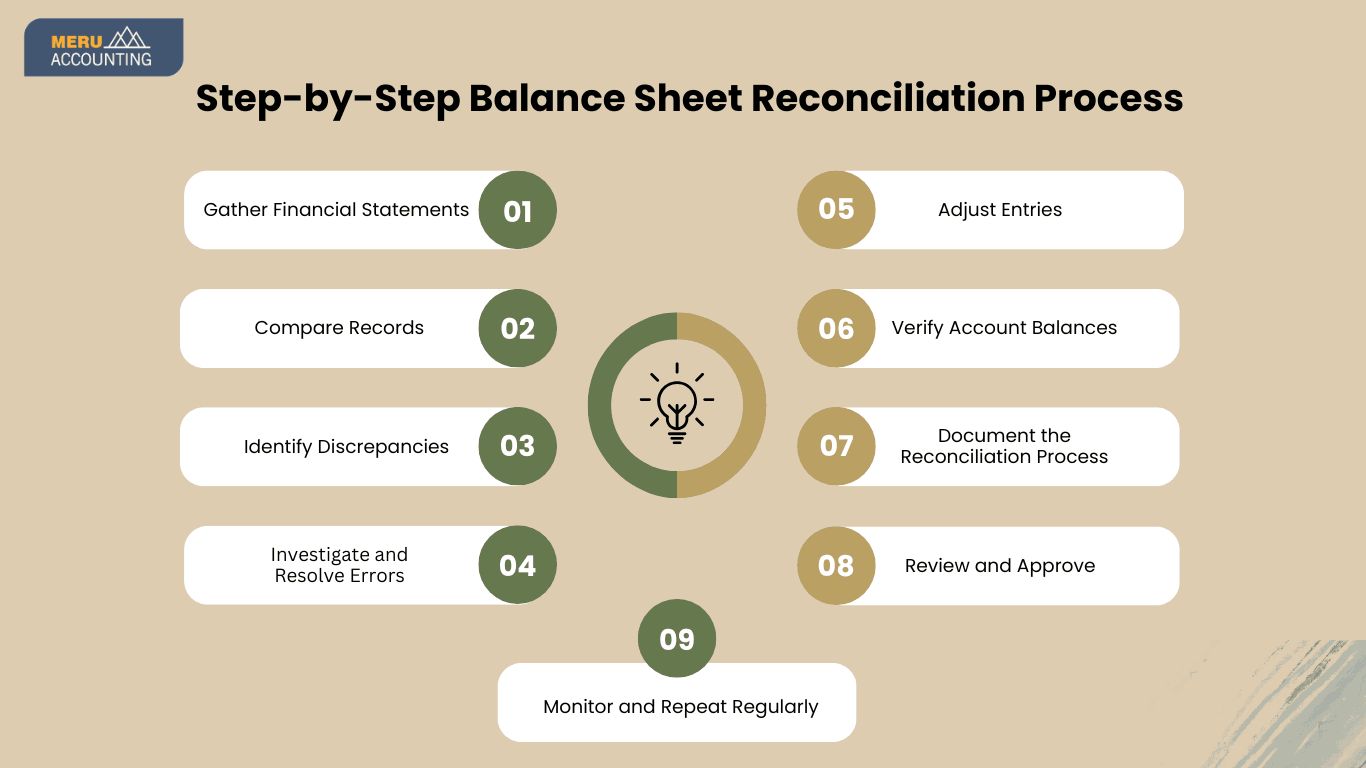

Step-by-Step Balance Sheet Reconciliation Process

- Gather Financial Statements: Collect all relevant financial documents, such as bank statements, general ledger reports, and invoices. Also, gather loan statements and tax records.

- Compare Records: Match the balances in internal financial records with external sources, such as bank statements and supplier accounts.

- Identify Discrepancies: Look for any inconsistencies, such as missing transactions, duplicate entries, or incorrect amounts.

- Investigate and Resolve Errors: Identify the cause of any discrepancies. Take corrective action, such as adjusting journal entries or communicating with banks and vendors.

- Adjust Entries: Record necessary adjustments in the accounting system to reflect accurate balances.

- Verify Account Balances: Ensure that all accounts, including cash, accounts receivable, accounts payable, inventory, and loans, reconcile correctly.

- Document the Reconciliation Process: Maintain a detailed report outlining the reconciliation process, including identified discrepancies and corrective actions taken.

- Review and Approve: Have a manager or auditor review the reconciliation. This ensures accuracy and completeness.

- Monitor and Repeat Regularly: Establish a routine for performing reconciliations, typically monthly or quarterly, to maintain accurate financial records.

Essential Balance Sheet Reconciliation Checklist

A well-structured balance sheet reconciliation checklist ensures financial accuracy, compliance, and transparency. Follow this comprehensive guide to maintain precise financial records:

- Verify all bank account balances against bank statements.

- Reconcile accounts payable and accounts receivable records.

- Check fixed assets and depreciation schedules.

- Validate loan balances and outstanding debts.

- Review tax liabilities, prepayments, and deferred tax accounts.

- Confirm inventory valuation and adjustments.

- Examine accrued expenses and deferred revenue.

- Cross-check intercompany transactions and eliminations.

- Verify payroll liabilities, including wages, benefits, and tax withholdings.

- Ensure equity accounts reflect accurate shareholder transactions and retained earnings.

- Check prepaid expenses and amortization schedules.

- Document and address any discrepancies found during reconciliation.

- Maintain proper records for audit and compliance purposes.

- Conduct a final review and obtain approval from management or an independent reviewer.

A balance sheet reconciliation checklist is a vital tool in safeguarding financial integrity. By following these steps consistently, businesses can detect errors, prevent fraud, and ensure accurate reporting.

Why Outsourcing Balance Sheet Reconciliation Can Benefit Your Business?

- Expertise and Accuracy: Outsourced professionals have specialized knowledge in accounting and reconciliation, ensuring accuracy and compliance with financial regulations.

- Time-Saving: Outsourcing reconciliation tasks helps businesses focus on their core operations. It saves valuable time that would otherwise be spent on financial reviews.

- Cost-Effective: Outsourcing eliminates the need for additional in-house accounting staff, reducing overhead costs while maintaining efficiency.

- Access to Advanced Tools: Professional firms use the latest accounting and reconciliation software, improving efficiency and reducing errors.

- Risk Mitigation: External specialists can identify and address financial discrepancies more effectively, minimizing the risk of misstatements and fraud.

- Reduced Workload for Internal Teams: Outsourcing frees internal finance teams from routine reconciliation tasks. This allows them to focus on strategic financial planning and analysis.

- Improved Compliance: External accountants stay updated on the latest financial regulations and industry standards. They ensure full compliance with legal and tax requirements.

Conclusion

Balance sheet reconciliation plays a vital role in maintaining accurate financial records, detecting discrepancies, and ensuring compliance with accounting regulations. A structured reconciliation process enhances financial transparency, minimizes errors, and supports better cash flow management.

While in-house reconciliation provides direct control over financial data, outsourcing can offer efficiency, expert insights, and cost savings. Regardless of the approach, a well-executed reconciliation process strengthens financial stability and builds confidence among investors, stakeholders, and regulators. Prioritizing balance sheet reconciliation helps businesses mitigate financial risks and improve decision-making. It also builds a strong foundation for long-term growth.

FAQs

1. How often should balance sheet reconciliation be performed?

Ans: Ideally, businesses should reconcile their accounts monthly. However, they can also do it quarterly or annually, depending on their size and complexity.

2. What are the common errors found in balance sheet reconciliation?

Ans: Common errors include missing transactions, duplicate entries, incorrect classifications, and timing differences.

3. Can small businesses benefit from balance sheet reconciliation?

Ans: Yes, even small businesses need reconciliation to track cash flow, prevent fraud, and ensure accurate financial reporting.

4. What tools can be used for balance sheet reconciliation?

Ans; Accounting software like QuickBooks, Xero, and SAP can automate and streamline the reconciliation process.

5. Is outsourcing balance sheet reconciliation a good option?

Ans: Yes, outsourcing can improve efficiency, reduce errors, and ensure compliance while saving time and resources.