Table of Contents

- 1 What is a Cash Management System?

- 2 Importance of Effective Cash Management for Businesses

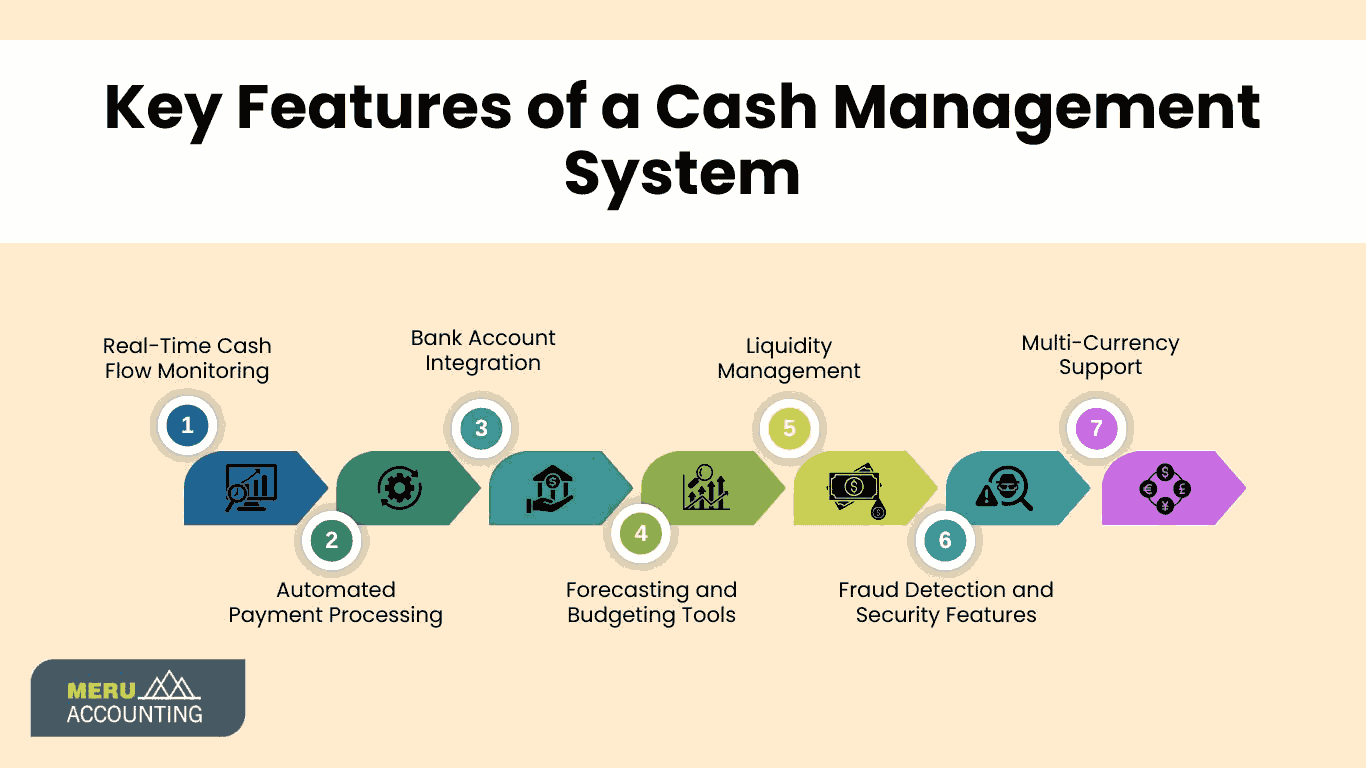

- 3 Key Features of a Cash Management System

- 3.1 Real-Time Cash Flow Monitoring

- 3.2 Automated Payment Processing

- 3.3 Bank Account Integration

- 3.4 Forecasting and Budgeting Tools

- 3.5 Liquidity Management

- 3.6 Fraud Detection and Security Features

- 3.7 Multi-Currency Support

- 4 Benefits of Implementing Cash Management Solutions

- 4.1 Improved Cash Flow Control

- 4.2 Enhanced Financial Planning and Forecasting

- 4.3 Increased Efficiency and Automation

- 4.4 Better Liquidity Management

- 4.5 Reduced Financial Risks

- 4.6 Stronger Fraud Prevention and Security

- 4.7 Optimized Working Capital Management

- 5 How Cash Management Software Simplifies Business Finances

- 6 Why Choose Accounts Junction for Cash Management Solutions?

- 6.1 Expertise in Financial Management

- 6.2 Customized Cash Management Software Solutions

- 6.3 Seamless Bank Integration

- 6.4 Enhanced Security and Fraud Prevention

- 6.5 Automation for Greater Efficiency

- 6.6 Real-Time Financial Insights and Reporting

- 6.6.1 Conclusion

- 6.6.2 FAQs

Why do we need cash management system?

What is a Cash Management System?

A cash management system is a financial solution that helps businesses monitor, manage, and optimize their cash flow effectively. It provides real-time insights into an organization's financial position, ensuring that funds are utilized efficiently to meet operational needs, investments, and future obligations. By automating various financial tasks, such as payment processing, invoicing, and bank reconciliations, a cash management system reduces manual effort and enhances accuracy.

It helps businesses track cash flow, ensuring better control over liquidity. It helps companies manage accounts payable and receivable efficiently, ensuring timely collections and payments to vendors. Additionally, many systems integrate with banking platforms, enabling seamless transaction reconciliation and fraud detection. With automated financial processes, businesses can reduce the risk of errors, improve compliance, and make informed financial decisions.

Cash management systems are useful for all businesses. Small firms manage cash flow. Large corporations use treasury solutions. Retailers track daily transactions, while service firms manage recurring payments and invoices. By implementing a cash management system, organizations can enhance financial stability, optimize liquidity, and achieve long-term growth.

Importance of Effective Cash Management for Businesses

A well-organized cash management strategy helps businesses maintain a positive cash flow, reducing reliance on external financing. By tracking incoming and outgoing cash, businesses can predict future financial needs and make informed investment decisions. It also enables companies to take advantage of early payment discounts from suppliers and avoid unnecessary borrowing costs.

Moreover, strong cash management practices improve financial transparency and accountability. Businesses with clear visibility into their cash position can plan better for expansion, acquisitions, or unexpected financial challenges. Good cash management helps reduce risk. It finds cash flow gaps and ensures businesses have reserves for tough times.

Key Features of a Cash Management System

A cash management system offers a range of features designed to simplify financial management and enhance efficiency. Some key features include:

Real-Time Cash Flow Monitoring

- Offers up-to-the-minute visibility into cash movements.

- Helps businesses track their financial position at any given moment.

Automated Payment Processing

- Streamlines vendor payments, payroll, and other financial transactions.

- Reduces manual errors and ensures timely payments.

Bank Account Integration

- Connects with multiple bank accounts for seamless fund transfers.

- Allows centralized cash management across different accounts.

Forecasting and Budgeting Tools

- Helps businesses predict future cash needs and plan accordingly.

- Aids in setting budgets based on historical financial data.

Liquidity Management

- Ensures businesses maintain adequate cash reserves for operational needs.

- Prevents cash shortages and improves financial stability.

Fraud Detection and Security Features

- Implements secure access controls and encryption to protect financial data.

- Identifies suspicious transactions and prevents fraudulent activities.

Multi-Currency Support

- Enables businesses to manage international transactions efficiently.

- Helps in dealing with exchange rate fluctuations and foreign payments.

Benefits of Implementing Cash Management Solutions

Improved Cash Flow Control

- Ensures businesses maintain a steady cash flow by tracking income and expenses in real time.

- Helps prevent cash shortages and enhances financial stability.

Enhanced Financial Planning and Forecasting

- Provides accurate cash flow projections, allowing businesses to plan future investments and expenses effectively.

- Helps in setting realistic financial goals based on historical data.

Increased Efficiency and Automation

- Automates routine financial tasks such as payments, invoicing, and reconciliations.

- Decreases the need for manual work, leading to time efficiency and fewer mistakes.

Better Liquidity Management

- Ensures businesses have sufficient liquidity to meet operational needs.

- Helps optimize the use of available cash reserves and prevent unnecessary borrowing.

Reduced Financial Risks

- Helps identify potential cash flow gaps before they become critical issues.

- Minimizes risks related to late payments, overdrafts, and financial penalties.

Stronger Fraud Prevention and Security

- Implements security protocols such as encryption and multi-level authentication.

- Detects suspicious transactions, reducing the risk of financial fraud.

Optimized Working Capital Management

- Enables businesses to balance receivables and payables efficiently.

- Helps reduce dependency on short-term loans and credit facilities.

How Cash Management Software Simplifies Business Finances

Cash management software simplifies finances. It makes it easier to manage cash flow. Here’s how it helps:

- Automates Financial Transactions – The software automates payments, collections, and reconciliations, reducing manual work.

- Provides Real-Time Insights – Businesses get instant access to cash flow reports, transaction histories, and financial forecasts.

- Reduces Financial Risks – With fraud detection and security features, businesses can prevent unauthorized transactions.

- Enhances Collaboration – Teams can work together on financial planning, ensuring smooth operations.

- Integrates with Accounting Systems – Many cash management solutions seamlessly integrate with existing accounting software for better financial management.

Why Choose Accounts Junction for Cash Management Solutions?

Expertise in Financial Management

- Accounts Junction has expert financial professionals. We specialize in cash management solutions for different businesses.

- We offer strategic insights to improve cash flow, optimize working capital, and ensure financial stability.

Customized Cash Management Software Solutions

- We provide cash management software that is adaptable to businesses of all sizes.

- Customization options ensure that businesses can manage cash flow efficiently based on their unique requirements.

Seamless Bank Integration

- Accounts Junction’s solutions integrate with multiple banking systems, allowing businesses to monitor and manage transactions in real time.

- This feature helps streamline reconciliations, track expenses, and improve financial transparency.

Enhanced Security and Fraud Prevention

- We prioritize data security by using encrypted storage, multi-factor authentication, and advanced fraud detection tools.

- Businesses can safely manage their financial data with a reduced risk of unauthorized access.

Automation for Greater Efficiency

- Our cash management system automates routine tasks such as invoicing, payment processing, and reconciliations.

- Automation helps businesses save time, reduce manual errors, and increase productivity.

Real-Time Financial Insights and Reporting

- Use strong financial reporting tools. Access real-time dashboards, analyze trends, and make smart decisions.

- Detailed reports assist in budgeting, forecasting, and financial planning.

Conclusion

Effective cash management is the backbone of any successful business, ensuring financial stability, operational efficiency, and long-term growth. Implementing cash management solutions helps businesses maintain control over their finances, streamline transactions, and optimize working capital. Use a good cash management system to improve liquidity, reduce risks, and make better decisions.

With the use of advanced software for forecasting, integrations, and security, you can improve your finances. Cash management tools are helpful to stop manual errors, improve accuracy, and save time. With such tools in place, companies can focus on growth, not daily cash problems.

FAQs

1. What is a cash management system?

A cash management system is a financial tool that helps businesses track cash flow, automate transactions, and optimize liquidity.

2. How does cash management software help businesses?

Cash management software automates financial processes, reduces manual errors, enhances security, and provides real-time financial insights.

3. Can cash management solutions help prevent fraud?

Yes, cash management solutions include security features that detect and prevent fraudulent activities, ensuring safer financial transactions.

4. Is a cash management system suitable for small businesses?

Absolutely! A cash management system benefits businesses of all sizes by improving financial efficiency and ensuring smooth operations.

5. How do I choose the right cash management solution?

Find the right software. Make sure it has features like automation, real-time tracking, and integration.