Table of Contents

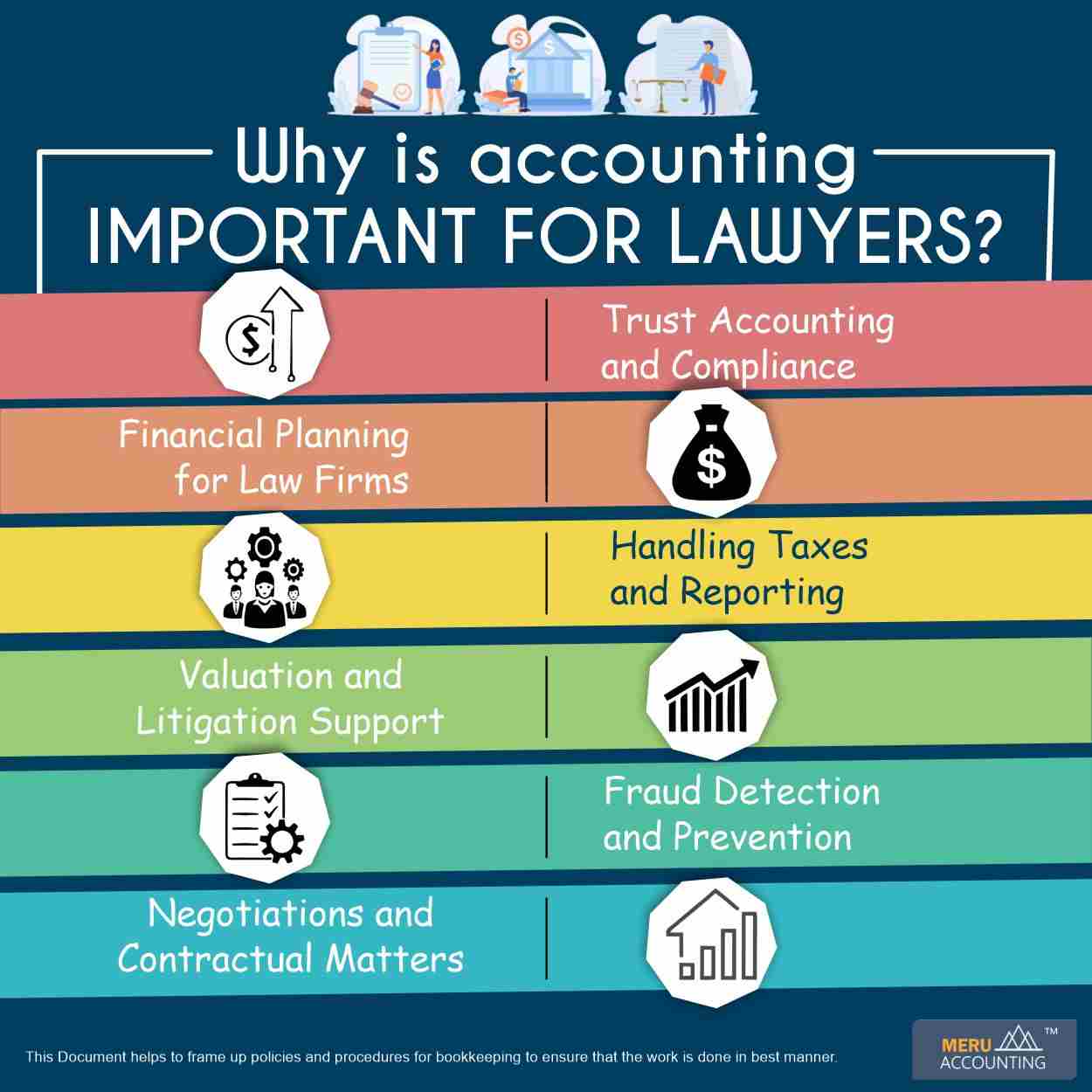

Why is accounting important for lawyers?

Accounting is indispensable in any business, profession, or organization, and the legal profession and industry are no exception.

While lawyers are primarily known for their expertise in law and litigation, understanding accounting principles and financial management is equally pivotal to their professional success.

Through this article, let's explore the significance of accounting for lawyers and how it enhances their ability to provide effective legal services.

The importance of accounting for lawyers

-

Trust Accounting and Compliance

-

One of the most critical aspects of accounting for lawyers is trust accounting. Lawyers often handle client funds as retainers, and settlements should be maintained separately from the attorney's funds. Failure to adhere to strict trust accounting rules can lead to severe consequences, including ethics violations, malpractice claims, and even disbarment. Bookkeeping for lawyers is necessary to adhere to accounting laws. By grasping accounting principles, lawyers can ensure compliance with these regulations, promoting transparency and trust between clients and legal practitioners.

-

-

Financial Planning for Law Firms

-

For lawyers running their own law firms or involved in partnership structures, accounting knowledge helps in effective financial planning. Understanding financial statements, cash flow analysis, and budgeting helps lawyers make informed decisions about their business operations, investment opportunities, and resource allocation. Bookkeeping for lawyers helps them understand the different transactions of the client's business. Proper financial planning ensures that law firms remain economically stable and sustainable, allowing them to serve their clients better in the long run.

-

-

Handling Taxes and Reporting

-

Taxation can be complex, especially for lawyers with multiple income sources, including salaries, client fees, and business profits. Adequate accounting skills enable lawyers to navigate the intricacies of tax laws, maximizing deductions and minimizing tax liabilities. Furthermore, lawyers must comply with various reporting requirements, and accurate accounting practices ensure to meet these obligations without any hitches.

-

-

Valuation and Litigation Support

-

In some legal cases, lawyers are required to assess the value of assets, businesses, or damages. Understanding accounting principles is crucial for conducting accurate valuations, particularly in complex cases involving mergers and acquisitions, divorce settlements, or economic damages in litigation. Proper valuation ensures that clients receive fair compensation and that legal arguments are supported by sound financial evidence.

-

-

Fraud Detection and Prevention

-

In their line of work, lawyers may encounter cases of fraud, embezzlement, or financial misconduct. Understanding accounting allows lawyers to identify suspicious financial activities, discrepancies, or irregularities, thus protecting their clients from potential losses. It also equips lawyers with the knowledge to develop effective strategies to prevent such instances and, if necessary, to work with forensic accountants or financial experts to investigate and resolve such matters.

-

-

Negotiations and Contractual Matters

-

Legal disputes often involve negotiations and the formulation of contracts. Lawyers with accounting expertise can better comprehend the financial implications of different settlement options and contractual terms. It allows them to negotiate from a more informed standpoint, ensuring that their client's financial interests are safeguarded and that they achieve the best possible outcomes.

-

Conclusion

Accounting skills help lawyers in various aspects of their professional practice. From managing trust accounts and complying with regulations to conducting financial planning and supporting litigation, understanding accounting principles elevates a lawyer's ability to provide top-notch legal services. Furthermore, it enhances their overall credibility and trustworthiness among clients and colleagues.

-

How can we help?

Meru Accounting is among the best outsourcing accounting and bookkeeping service providers. We provide customized bookkeeping and accounting solutions specific to the client's requirements. Our team includes experienced and professionally qualified CPAs, CAs, and accountants providing quality service to legal professionals and firms

Book a no-obligation call with us today.