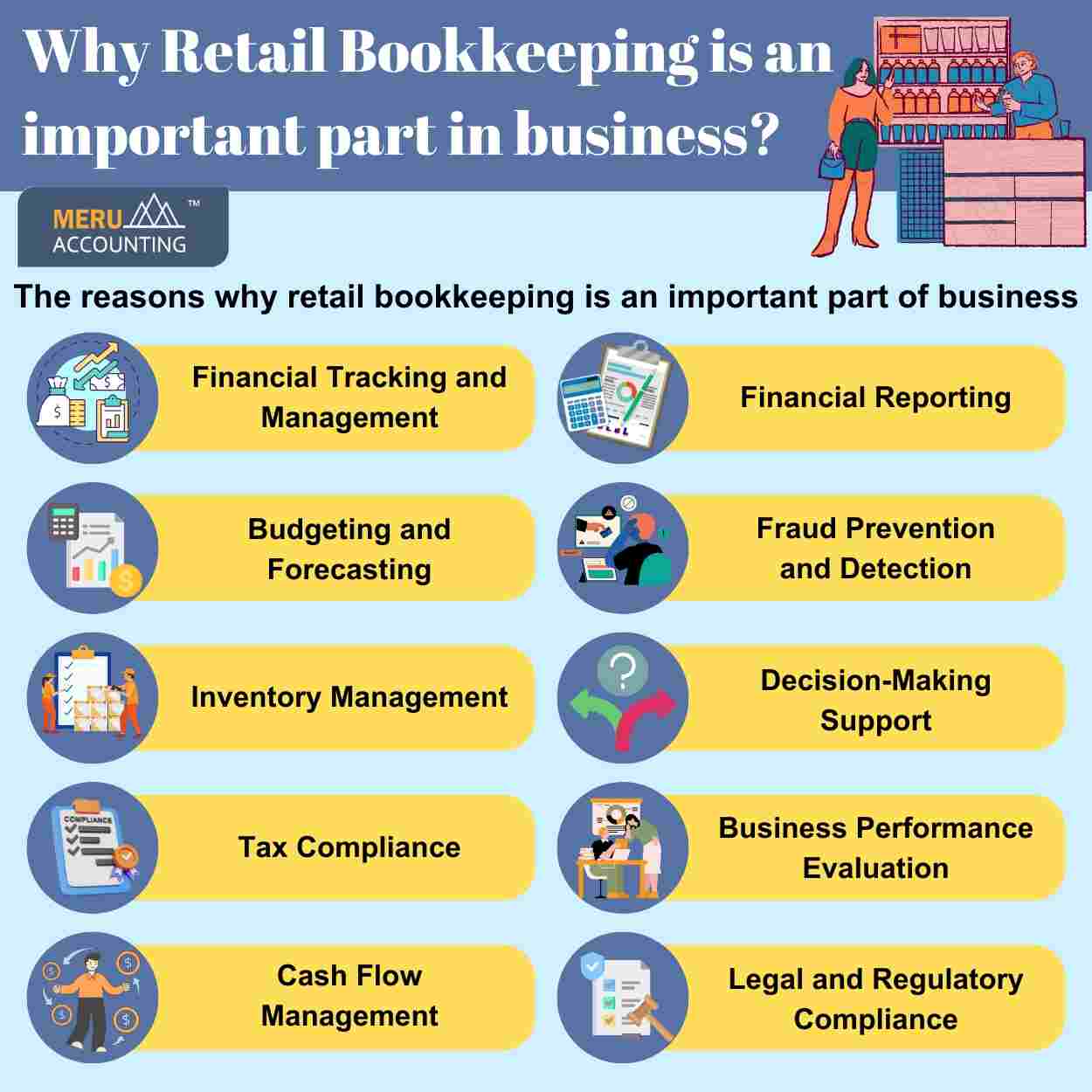

Why Retail Bookkeeping is an important part in business?

In the retail business environment, where transactions occur quickly and inventory fluctuates regularly, competent bookkeeping is critical to a company's smooth operation and financial health.

Let's discuss why retail bookkeeping is an important part of business:-

Financial Tracking and Management:

Retail bookkeeping is a systematic approach to tracking all financial transactions, including sales, expenses, and mergers. Businesses that keep precise records of income and expenses can receive useful insights into their financial health and make informed decisions to maximize profitability through retail bookkeeping services providers.

Budgeting and Forecasting:

Detailed bookkeeping allows retailers to generate realistic budgets and forecasts based on previous data. Businesses by using retail bookkeeping services can set attainable goals, efficiently manage resources, and plan for development or expansion by assessing previous performance trends and estimating future financial scenarios.

Inventory Management:

In businesses, effective retail bookkeeping is related to inventory management. By precisely monitoring inventory purchases, sales, and stock levels, businesses may avoid stockouts, reduce excess inventory, and optimize reorder points to maintain a consistent supply of products to satisfy customer demand.

Tax Compliance:

Retail businesses must pay a variety of taxes, including sales tax, income tax, and payroll tax. Proper retail bookkeeping services ensure that all financial activities are accurately recorded and categorized, making tax returns easier to prepare and comply with. Failure to keep correct records can lead to severe penalties and fees.

Cash Flow Management:

Cash flow is essential for any retail business. Effective retail bookkeeping enables merchants to track cash inflows and outflows, recognize cash flow patterns, and manage working capital more efficiently. Businesses can avoid cash flow problems and ensure smooth operations by keeping appropriate cash reserves on hand and optimizing payment plans.

Financial Reporting:

Retail bookkeeping requires accurate financial statements such as income statements, balance sheets, and cash flow reports. These financial reports provide stakeholders, such as investors, creditors, and management, with essential information on the company's financial performance and stability.

Fraud Prevention and Detection:

Robust bookkeeping standards prevent fraud and misconduct in retail businesses. Businesses that implement internal controls, reconcile accounts on a regular basis, and conduct periodic audits can uncover deviations and improper transactions early on, reducing the risk of financial losses and reputational damage.

Decision-Making Support:

Accurate and up-to-date financial records allow retailers to make data-driven decisions that promote business growth and profitability. Whether it's evaluating the performance of specific product lines, examining client purchasing habits, or assessing the impact of pricing schemes, timely financial data enables businesses to make informed decisions.

Business Performance Evaluation:

Retailers can use comprehensive bookkeeping to assess their overall business performance against key performance indicators (KPIs) and benchmarks. By tracking measures like gross margin, inventory turnover, and return on investment (ROI), firms can discover areas of strength and weakness and execute improvement strategies.

Legal and Regulatory Compliance:

Retail businesses must comply with several legal and regulatory obligations, ranging from consumer protection regulations to accounting standards. Proper bookkeeping assures compliance with these rules by keeping accurate records, meeting reporting deadlines, and documenting transactions according to set guidelines.

If you want to simplify the management of your financial information, contact Accounts Junction. We not only provide financial outsourcing but also a wide range of other bookkeeping and accounting services.