Table of Contents

- 1 Introduction to Xero Accounting and Its Growing Popularity

- 2 Why Businesses Need a Reliable Accounting Software

- 3 How Xero Accounting Package Simplifies Financial Management

- 4 Main Features of Xero for Accounting and Bookkeeping

- 4.1 Xero Invoicing: Automating and Streamlining Your Payments

- 4.2 Bank Reconciliation and Expense Tracking

- 4.3 Financial Reporting and Compliance

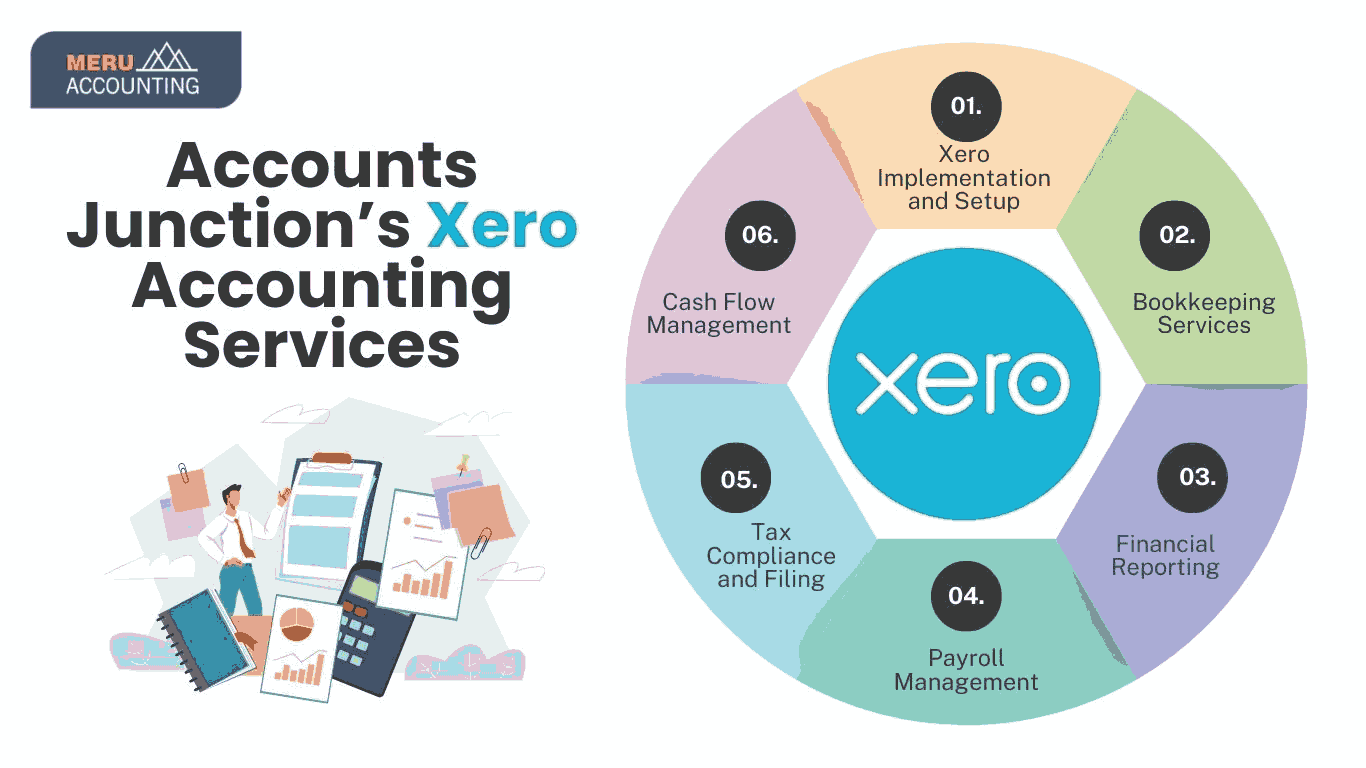

- 5 Accounts Junction’s Xero Accounting Services

- 5.1 1. Xero Implementation and Setup

- 5.2 2. Bookkeeping Services

- 5.3 3. Financial Reporting

- 5.4 4. Payroll Management

- 5.5 5. Tax Compliance and Filing

- 5.6 6. Cash Flow Management

- 5.6.1 Conclusion

- 5.6.2 FAQs

Why use XERO for bookkeeping and accounting?

Introduction to Xero Accounting and Its Growing Popularity

Xero is a cloud-based accounting software that simplifies financial management for businesses of all sizes. Launched in 2006, Xero became popular with small and medium-sized businesses due to its user-friendly interface, powerful features, and seamless tool integration. Unlike desktop software, Xero is accessible from anywhere with an internet connection, making it ideal for businesses looking to simplify accounting.

One of the key reasons for Xero’s growing popularity is its simplicity. It lets business owners, accountants, and teams access real-time data, track cash flow, generate reports, manage payroll, and handle taxes easily. Xero’s cloud-based system securely stores and updates financial data automatically, reducing errors and improving accuracy. Another reason for its rise is the robust integration capabilities Xero offers. It integrates with various third-party apps, like CRM systems and payment platforms, to create a smooth workflow for businesses. Xero’s scalability allows it to grow with a business, making it a great long-term financial solution. As more businesses see the advantages of cloud accounting, Xero remains a top choice in the accounting software market.

Why Businesses Need a Reliable Accounting Software

Reliable accounting software is essential for businesses to ensure financial accuracy, automate tasks, and gain real-time insights. It helps save time by streamlining invoicing, bank reconciliation, and tax calculations while reducing errors. Scalable and cloud-based solutions like Xero accounting offer flexibility, secure data management, and compliance with tax regulations. By minimizing manual work and improving efficiency, businesses can cut costs and focus on growth. Investing in reliable accounting software ensures better financial control, making it a crucial tool for long-term success.

How Xero Accounting Package Simplifies Financial Management

The Xero accounting package simplifies financial management by automating key processes and providing real-time insights into business finances. Automated bank feeds, invoicing, and expense tracking reduce manual entry, saving time and reducing errors. Xero's cloud-based system lets users access financial data anytime, anywhere for better decisions.

Additionally, the software offers intuitive dashboards and detailed reports, helping businesses track cash flow, manage expenses, and maintain compliance with financial regulations. With features like invoicing, bank reconciliation, and multi-currency support, businesses can efficiently handle transactions while improving overall financial accuracy.

Main Features of Xero for Accounting and Bookkeeping

The Xero Accounting Package offers a wide range of features that cater to the diverse needs of businesses. Some of the key features include:

Xero Invoicing: Automating and Streamlining Your Payments

One of the standout features of the Xero Accounting Package is Xero Invoicing. This feature simplifies billing by allowing businesses to create, send, and track invoices effortlessly. Xero Invoicing enables businesses to:

- Generate professional invoices with customizable templates.

- Automate invoice reminders to ensure timely payments.

- Accept online payments through multiple payment gateways.

- Monitor unpaid invoices and manage your cash flow efficiently.

By automating invoicing processes, businesses can reduce delays and improve overall efficiency. Xero Invoicing ensures that payments are received on time, reducing the risk of cash flow issues.

Bank Reconciliation and Expense Tracking

Xero Accounting simplifies financial record-keeping with easy bank reconciliation and expense tracking. The software automatically imports bank transactions, allowing users to match them with invoices and receipts effortlessly.

With real-time Xero Accounting Package tools, businesses can:

- Categorize transactions for better financial clarity.

- Reconcile bank statements with just a few clicks.

- Monitor expenses and identify cost-saving opportunities.

- Create reports that offer valuable insights into spending trends.

These features help businesses maintain accurate financial records while minimizing the risk of errors.

Financial Reporting and Compliance

Staying compliant with tax laws and financial regulations is a major concern for businesses. The Xero Accounting Package offers powerful reporting tools that help companies stay on top of their financial obligations. Users can generate detailed reports such as:

- Profit and Loss Statements

- Balance Sheets

- Cash Flow Reports

- Tax Reports

These reports provide valuable insights into business performance and ensure that financial records are up to date. Additionally, Xero Accounting integrates with tax filing systems, making it easier for businesses to comply with tax regulations.

Accounts Junction’s Xero Accounting Services

1. Xero Implementation and Setup

- Initial Setup: Accounts Junction helps businesses set up Xero by creating charts of accounts, tax rates, and connecting bank accounts.

- Customization: Customizing Xero to fit the business' needs, including invoicing, reporting, and industry-specific settings.

2. Bookkeeping Services

- Daily and Monthly Bookkeeping: Regularly updating Xero with financial transactions such as sales, purchases, receipts, and payments.

- Bank Reconciliation: Automatically syncing and reconciling bank accounts with Xero, ensuring that all transactions are accurately recorded and discrepancies are promptly identified.

3. Financial Reporting

- Profit and Loss Statements: Generating P&L statements to provide businesses with a clear view of income, expenses, and profitability for any period.

- Balance Sheet: Creating balance sheets to display the business’s financial position, including assets, liabilities, and equity.

4. Payroll Management

- Payroll Integration: Setting up payroll in Xero to ensure timely calculation and payment of salaries, wages, and tax deductions.

- Employee Management: Maintaining employee records, including tax information and payment history, in line with compliance regulations.

5. Tax Compliance and Filing

- VAT/GST Filing: Ensuring timely VAT/GST tracking and filing to avoid penalties and keep businesses compliant with tax rules.

- Tax Reporting: Preparing tax reports, such as sales tax and payroll tax, for accurate and timely submissions.

6. Cash Flow Management

- Cash Flow Forecasting: Using Xero’s forecasting tools to predict cash flow, helping businesses plan expenses and manage working capital.

- Receivables and Payables Management: Streamlining the management of accounts receivable and accounts payable to ensure timely collections and payments, helping businesses maintain liquidity.

Conclusion

Xero Accounting is an essential tool for businesses looking to streamline financial management. Xero Accounting Package helps companies automate invoicing, track expenses, reconcile bank statements, and create financial reports easily. Xero Invoicing further enhances efficiency by ensuring timely payments and improving cash flow management.

By using Xero Accounting, businesses can reduce manual work, minimize errors, and make informed financial decisions. Xero provides the flexibility and reliability for managing bookkeeping, whether in-house or outsourced to experts like Accounts Junction. Investing in Xero Accounting is a smart choice for businesses wanting to boost efficiency and keep accurate financial records.

FAQs

- What makes Xero a popular accounting software?

Ans: Xero is cloud-based, user-friendly, and offers real-time financial insights with automated features like invoicing and bank reconciliation.

- How does Xero help with invoicing?

Ans: Xero automates invoicing, allowing businesses to create, send, and track payments, ensuring faster collections and reduced cash flow issues.

- What are the benefits of Xero’s bank reconciliation feature?

Ans: Xero automatically imports and categorizes transactions, making it easy to match invoices and receipts, reducing manual work and errors.

- How does Xero ensure financial compliance?

Ans: Xero provides tax reports, and profit and loss statements, and integrates with tax filing systems to help businesses stay compliant with financial regulations.

- Can Xero help manage payroll?

Ans: Yes, Xero integrates payroll management, ensuring accurate salary calculations, tax deductions, and employee record-keeping.

- What financial reports can be generated in Xero?

Ans: Xero offers Profit & Loss statements, Balance Sheets, Cash Flow reports, and Tax Reports for better financial tracking and decision-making.

- Why choose Accounts Junction for Xero accounting services?

Ans: Accounts Junction offers Xero setup, bookkeeping, payroll management, and tax compliance services to streamline businesses' financial processes.

- Does Accounts Junction provide cash flow management using Xero?

Ans: Yes, Accounts Junction helps businesses with cash flow forecasting and receivables/payables management using Xero’s advanced tools.