Accounting and Bookkeeping for Car Dealership

Are you looking for a bookkeeping and accounting solution that helps auto dealerships run their business more efficiently? Then look no further!

Accounts Junction provides automotive bookkeeping and accounting for auto dealerships. We know the unique business requirements of the auto dealership business, so we get customized and industry-specific solutions to our clients.

Like any other business, the auto dealership has many departments that work together to ensure efficiency and smooth operations.

Everything from sales to financing to after-sales service should be well executed and seamless. But one department that plays a vital role in its overall success is car dealership accounting.

Outsourcing Accounting for Auto Dealership

Outsourcing a car dealership accounting to a professional service provider like us gets you a comprehensive approach that plans to gain effective control over your business finance.

As a business, a car dealership faces many challenges, such as new legislation, manufacturer demand, real estate costs, technology challenges, etc. At Accounts Junction, we understand these challenges and get ready for them.

Things become easy if you have a capable advisor by your side. Our expert team has worked with more than 300 dealerships across the country.

We have a dedicated and knowledgeable team of CPAs, CAS, and accountants. We can help you start from monthly reconciliation to strategies to handle complex tax issues, we are equipped with the best people and technology to fuel your success journey.

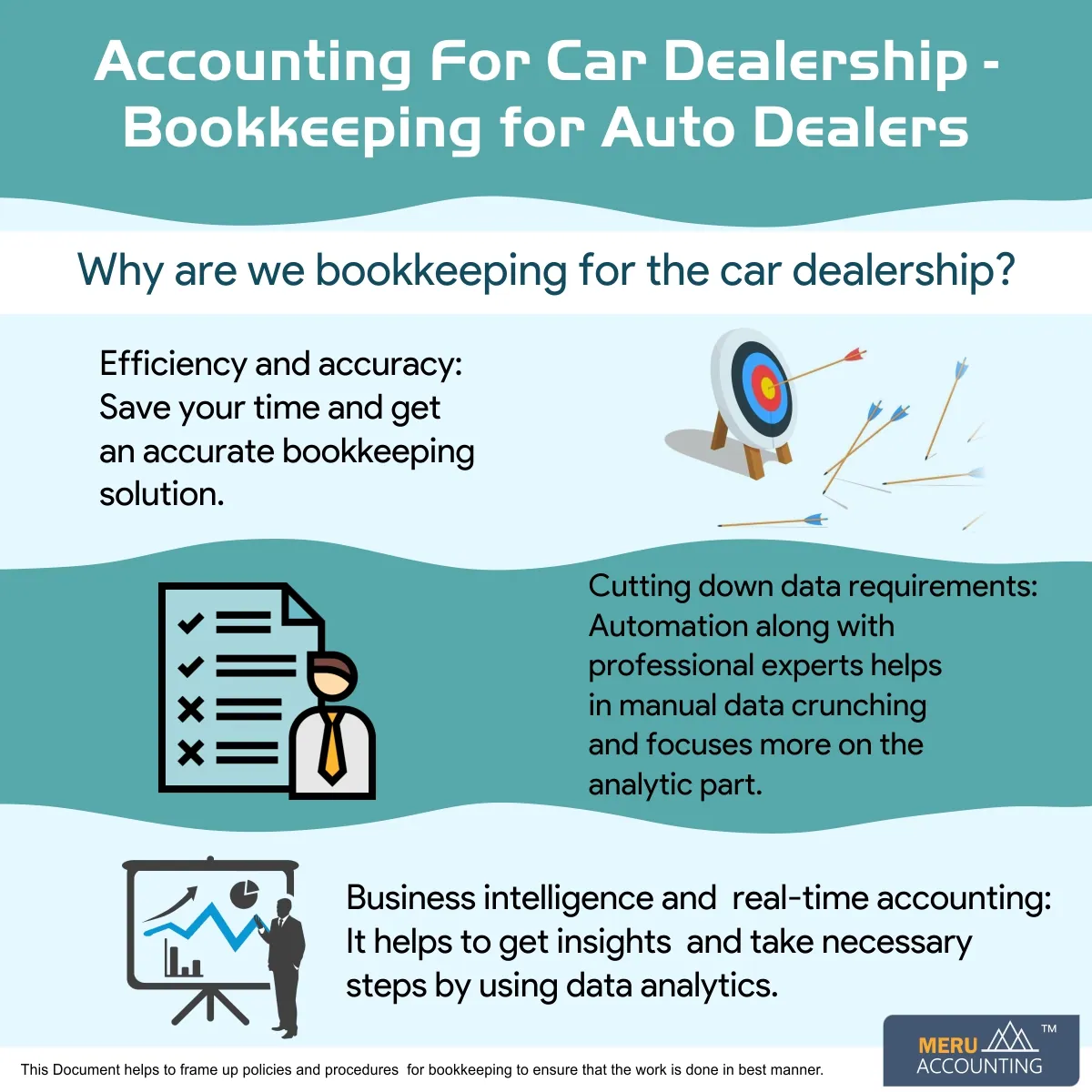

How Does Accounts Junction Help in Maintaining Future Bookkeeping Levels

Advancements in technology and accounting tools have changed bookkeeping for auto dealerships drastically. There has been a huge transition in the way the automotive industry does its accounting.

Tracking car sales and purchases, inventory, loans, payroll, and other related transactions are important for accurate financial records.

If the dealer also has to do auto repair shop bookkeeping for tracking the movements of spare parts and other inventories.

Accurate and appropriate books of records not only help with accurate tax filings but also help assess the performance of car dealerships.

How Do We Make a Difference in Car Dealership Accounting

Business Intelligence:

The auto dealer might think that business intelligence is not required and whether it will help in informed decision-making.

Business intelligence helps maintain strategic control over tasks and helps gain meaningful insights. It helps in analyzing the financial information, which helps further streamline the bookkeeping process.

Many dealers consider bookkeeping at the bottom of their priority list and might think of business intelligence services for front-level business tasks.

Contrary, business intelligence can help car dealers to figure out changes in the key financial indicators. It also helps to monitor shifting trends and translate them into analytical reports.

Thus, we help our clients with future bookkeeping levels. We go beyond traditional bookkeeping.

Real-time Accounting:

Every business needs to stay on top of its finances, but the traditional accounting approach makes it tedious and tiring. Real-time accounting provides immediate access to key financial indicators. It also aids in the quick translation of analytics reports at any time. Thus, we have a quick summary of bookkeeping.

In a nutshell, with real-time accounting, you have relevant data and reports at any given time. It also helps in the early detection of errors and timely reconciliation before any real damage occurs.

Cutting Down on Data Requirements:

Cutting down on data requirements helps to get the relevant information that further helps the business intelligence team process the data into meaningful insights and translate it into formats, evaluations, and reports.

When you spend less time crunching numbers and more time on analysis, you get an accurate and fair view of the business's growth and development.

The cherry on the cake is Account Junction had an affordable hourly rate per hour.

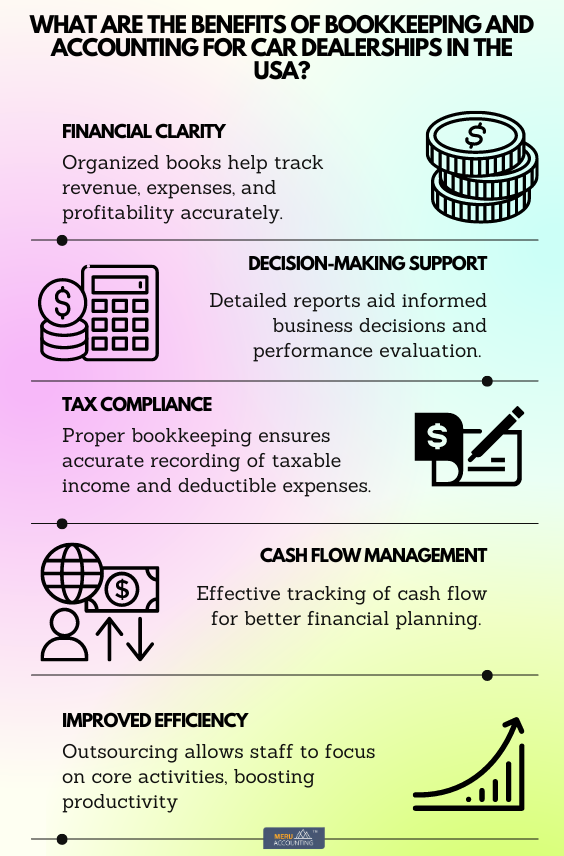

What are the Benefits of Bookkeeping and Accounting for Car Dealerships in the USA

Benefits of Bookkeeping and Accounting for Car Dealerships in the USA:

1. Financial Clarity:

With organized books, car dealerships can track sales revenue, expenses, and profitability accurately. This clarity enables them to identify areas where costs can be reduced or revenues increased.

2. Decision-Making Support:

Detailed financial reports provide essential information for making informed business decisions such as purchasing inventory or expanding services. They allow dealership owners to evaluate performance indicators like gross profit margin or inventory turnover ratio.

3. Tax Compliance:

The automotive industry has specific tax requirements that must be met to avoid penalties or audits from tax authorities. Proper bookkeeping ensures accurate recording of taxable income while keeping track of deductible expenses.

4. Cash Flow Management:

Good bookkeeping allows car dealerships to monitor cash flow effectively by tracking incoming revenues against outgoing expenses daily.

5. Improved Efficiency:

Outsourcing bookkeeping tasks to professionals frees up time for dealership staff to focus on core activities like sales and customer service instead of spending hours managing paperwork.

In conclusion, bookkeeping and accounting are indispensable for the smooth functioning and financial success of car dealerships in the USA. Accurate record-keeping and a thorough understanding of the dealership's financial health enable informed decision-making and compliance with tax regulations.

Accounts Junction, with its experience in serving automotive businesses, understands the unique challenges faced by car dealerships. By leveraging our expertise, car dealerships can streamline their financial processes and gain valuable insights into their financial performance.

Outsourcing bookkeeping and accounting to Accounts Junction empowers car dealerships to focus on their core competencies, providing them with the peace of mind that their financial matters are handled efficiently and professionally. By collaborating with Accounts Junction, car dealerships can build a solid foundation for growth and long-term success in the highly competitive automotive industry.

How to get started

1. Establish a dedicated system for recording all financial transactions, including sales receipts, invoices, expenses, and payroll records.

2. Utilize specialized software designed for car dealerships, offering features such as inventory management, vehicle tracking, and integrated payment processing.

3. Regularly reconcile your books by comparing recorded transactions against bank statements to identify discrepancies and ensure accurate financial reporting.

4. Understand and comply with sales tax obligations specific to car dealerships based on the state where your dealership operates.

5. Implement strong internal controls, including segregation of duties, to reduce the risk of fraudulent activities and promote accountability within the finance department.

6. Monitor financial records consistently to gain a clear understanding of your dealership's performance metrics and make informed business decisions.

7. Seek professional assistance from experienced accountants or bookkeeping firms with expertise in the automotive industry to ensure compliance and optimize financial management.

8. Stay updated with industry regulations and best practices to adapt your bookkeeping and accounting processes accordingly.

9. Conduct regular financial reviews and analyses to identify areas for improvement, such as cost reduction or revenue enhancement.

10. Embrace technology solutions that streamline bookkeeping and accounting processes, improving efficiency and accuracy in financial management

What type of Records do you Need to Keep for your Dealership

- Sales invoices for proof of vehicle sales and charges.

- Inventory reports to track stock levels and prices.

- Records of all business-related expenses.

- Bank statements and regular reconciliations for accuracy.

- IRS forms related to payroll, sales, and income taxes.

What are Some Common Mistakes Made when Bookkeeping and Accounting for car Dealerships in the USA

- Not properly tracking expenses, leading to discrepancies in the books.

- Neglecting to reconcile bank statements regularly, resulting in unaccounted transactions.

- Inaccurate categorization of income and expenses, affecting financial reporting.

- Failure to maintain detailed records, leading to incomplete documentation.

- Over Reliance on manual processes instead of utilizing software or technology for bookkeeping.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 1000 | Bank & Cash Accounts | Bank |

| 2 | 1001 | Operating Bank Account | Bank |

| 3 | 1002 | Petty Cash | Bank |

| 4 | 1200 | Accounts Receivables | Accounts Receivable |

| 5 | 1300 | Inventory | Inventory |

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services