Accounting and Bookkeeping for Architects

Architect is a specialized field focused on designing and constructing buildings and structures. Accounting and bookkeeping play a crucial role in managing the financial aspects of architectural firms, ensuring transparency, accuracy, and compliance with regulations. Accounts Junction offers tailored services designed to meet the unique needs of architects, including comprehensive financial management, tax preparation, and strategic planning. With expertise in both accounting principles and the architectural industry, Accounts Junction provides invaluable support to architects, enabling them to focus on their core activities while ensuring financial stability and growth.

Dashboards we prepare for bookkeeping for Architects Industry​

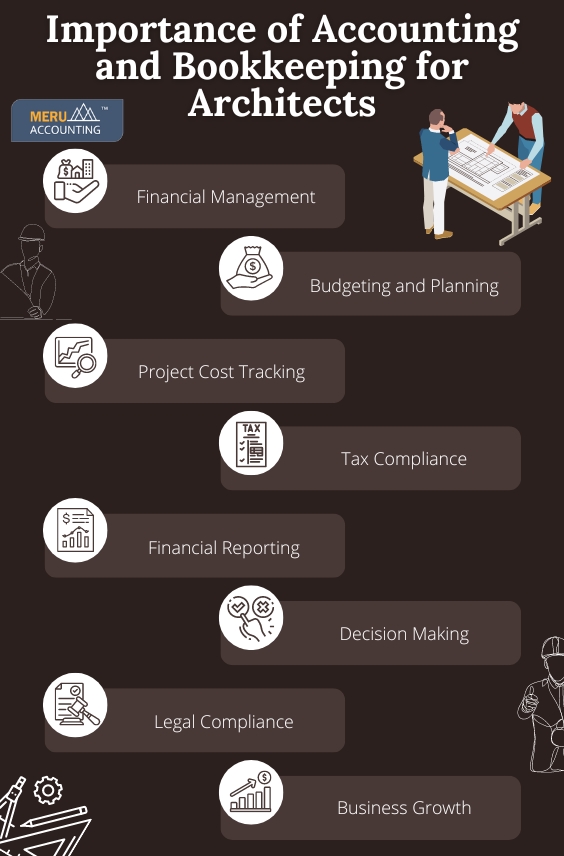

Importance of Accounting and Bookkeeping for Architects

1. Financial Management:

Effective accounting and bookkeeping help architects manage their finances efficiently. This includes tracking income, expenses, and cash flow, which are vital for maintaining financial stability and making informed business decisions.

2. Budgeting and Planning:

Architects need to create accurate budgets for their projects to ensure they are financially viable and profitable. Proper accounting practices provide the necessary financial data to develop realistic budgets and long-term business plans.

3. Project Cost Tracking:

Architectural projects often involve various expenses, including materials, labor, and subcontractor costs. Bookkeeping helps architects track these costs throughout the project lifecycle, ensuring that they stay within budget and remain profitable.

4. Tax Compliance:

Accounting helps architects comply with tax regulations by accurately recording income, expenses, and deductions. Proper record-keeping ensures that architects can file their taxes correctly and minimize the risk of audits or penalties.

5. Financial Reporting:

Architectural firms often need to provide financial reports to stakeholders such as clients, investors, or lenders. Accurate accounting records enable architects to generate comprehensive financial statements that reflect the firm's financial health and performance.

6. Decision Making:

Accounting data provides valuable insights that architects can use to make informed decisions about resource allocation, pricing strategies, and business expansion. By analyzing financial reports, architects can identify trends, assess profitability, and identify areas for improvement.

7. Legal Compliance:

Architects must comply with various legal and regulatory requirements related to financial reporting and taxation. Maintaining accurate accounting records helps architects meet these obligations and reduces the risk of legal issues or fines.

8. Business Growth:

Sound financial management facilitated by accounting and bookkeeping practices lays the foundation for sustainable business growth. By managing finances effectively, architects can reinvest profits, expand their operations, and pursue new opportunities.

Special Considerations For Architects

1. Project-Based Accounting: Architects often work on project-based contracts. Each project may have its budget, expenses, and revenue streams. Therefore, accounting for architects involves tracking costs and revenues specific to each project. This can involve project cost accounting, tracking billable hours, and monitoring project budgets.

2. Job Costing: Job costing is a significant aspect of accounting for architects. It involves allocating costs to specific projects or jobs. This helps architects understand the profitability of each project and make informed decisions about pricing and resource allocation.

3. Time Tracking: Architects typically bill clients based on the time spent on a project. Therefore, accurate time tracking is crucial for billing purposes. This may involve using specialized time-tracking software or systems to record billable hours for each project.

4. Overhead Allocation: Overhead costs such as office rent, utilities, and administrative expenses need to be allocated to each project to determine its true cost and profitability accurately. Architects may use different methods to allocate overhead costs, such as square footage allocation or direct labour hours.

5. Project Phases: Architectural projects typically go through different phases, such as schematic design, design development, construction documentation, and construction administration. Accounting tracks expenses and revenue separately for each phase and ensures proper billing at each milestone.

6. Specialized Software: While general accounting software can be used for basic accounting functions, architects may benefit from using specialized accounting software tailored to their industry. These tools often include features specific to project-based accounting, job costing, and time tracking.

7. Regulatory Compliance: Architects may have specific regulatory requirements or industry standards that govern their accounting practices. For example, they may need to comply with accounting standards set by professional organizations like the American Institute of Architects (AIA) or regulatory bodies overseeing architectural practices in their jurisdiction.

Common Mistakes in Accounting and Bookkeeping for Architects

1. Misclassification of Expenses: Failing to properly classify expenses can lead to inaccurate financial reporting. For example, expenses related to specific projects should be allocated correctly to ensure accurate project costing.

2. Not Tracking Time and Expenses Properly: Architects often work on multiple projects simultaneously, making it essential to accurately track time and expenses for each project. Failing to do so can result in underbilling or overbilling clients, leading to cash flow issues or client disputes.

3. Ignoring Accrual Accounting: Accrual accounting matches revenue and expenses when they are incurred, regardless of when cash exchanges hands. Ignoring accrual accounting principles can result in misleading financial statements, especially for long-term projects.

4. Incomplete Record-Keeping: Inadequate record-keeping can lead to lost receipts, missing invoices, and difficulty in reconciling accounts. This can result in inaccuracies in financial reporting and compliance issues during audits.

5. Neglecting Tax Compliance: Architects may overlook tax obligations specific to their industry, such as sales tax on architectural services or deductions related to business expenses. Failing to comply with tax regulations can lead to penalties and fines.

6. Relying Solely on Spreadsheets: While spreadsheets can be useful for basic accounting tasks, they may not be sufficient for managing complex project finances. Investing in accounting software tailored to the needs of architects can streamline processes and improve accuracy.

7. Underestimating Overhead Costs: Architects might focus solely on direct project costs and overlook overhead expenses such as rent, utilities, insurance, and administrative salaries. Ignoring these costs can lead to underpricing projects and reduced profitability.

8. Incomplete Project Documentation: Incomplete or inaccurate project documentation can lead to discrepancies between project budgets and actual costs. Architects should maintain detailed records of project contracts, change orders, and correspondence to ensure accurate financial reporting.

9. Failure to Monitor Cash Flow: Inconsistent cash flow management can lead to financial instability, especially during periods of slow project activity. Architects should regularly monitor cash flow, invoice clients promptly, and manage accounts payable to ensure sufficient liquidity.

10. Not Seeking Professional Help When Needed: Accounting and bookkeeping for architects can be complex, and attempting to manage finances without professional guidance can lead to costly errors. Seeking advice from an accountant or financial advisor familiar with the architecture industry can help avoid common pitfalls.

Why Choose Accounts Junction for Architects

1. Passion for Bookkeeping: At Accounts Junction, we harbour a genuine passion for bookkeeping. We thrive on meticulously managing financial records and ensuring accuracy, driven by our love for the craft.

2. Skilled Manpower and Realtime Accounting: With a pool of over 320 professionals, we offer skilled manpower to handle your accounting tasks. Our real-time accounting services keep your financial data up-to-date, thanks to our dedicated team.

3. Turnaround Time and Quality Service: We understand the importance of timely results. When you choose us, you can expect efficient service delivery without compromising on quality, ensuring your needs are met promptly and reliably.

Services offered by Accounts Junction for Architects

1. Outsource Bookkeeping Services:

Our comprehensive bookkeeping solutions are designed to adapt to the latest industry trends and software, ensuring that you receive affordable and reliable services directly from us.

2. GST Invoicing/Billing:

Our GST billing software empowers architects to create professional, GST-compliant invoices effortlessly. We provide the tools and support you need to streamline your invoicing process efficiently.

3. Receivables & Payables Management:

Managing finances is crucial for the smooth operation of your architectural firm. We take care of receivables and payables, allowing you to focus on your core business activities while ensuring financial stability.

4. Payroll Processing:

Timely payment of employees is vital for any business. Our payroll processing services guarantee that your staff receives their dues accurately and on time, eliminating any payroll-related stress for you.

5. Virtual CFO Services:

As your trusted financial partner, we offer virtual CFO services to assist you in making informed financial decisions and developing effective strategies to drive your architectural business forward.

6. Business Plan Preparation:

Whether you're a startup or an established firm, we provide expert assistance in crafting business plans tailored to the architectural industry. Our customized plans help you manage the market and achieve your business objectives effectively.

7. Financial Analytics:

Gain valuable insights into your architectural firm's financial performance with our financial analytics services. From cash flow analysis to strategic planning, we help you make data-driven decisions for sustainable growth.

8. Conversion Services:

Transitioning to digital accounting platforms like Xero and QuickBooks Online has never been easier. We offer seamless conversion services to help you harness the benefits of digitalization, streamlining your accounting processes for greater efficiency.

Conclusion

Effective accounting and bookkeeping are essential for architects to manage their finances efficiently, ensure compliance with regulations, and make informed business decisions. Accounts Junction offers specialized services tailored to the unique needs of architects, providing comprehensive financial management, tax preparation, and strategic planning support. By partnering with Accounts Junction, architects can focus on their core activities while ensuring financial stability and facilitating business growth. With a dedicated team of professionals and a passion for precise bookkeeping, Accounts Junction offers reliable and timely accounting solutions for architects, empowering them to thrive in their industry.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 1000 | Demo Account | Damo Accounts Type |

| 2 | 2000 | Accounts Payables | Accounts Payable |

| 3 | 2000 | Accounts Payables:Accounts Payable | Accounts Payable |

| 4 | 1200 | Accounts Receivables | Accounts Receivable |

| 5 | 1200 | Accounts Receivables:1 A/R - Consulting | Accounts Receivable |

Architects Industry Faqs

Frequently Asked Insights

1. Why is bookkeeping critical for architects?

Accurate bookkeeping ensures that project costs are tracked, budgets are managed efficiently, and profitability is maintained, all while ensuring compliance with tax laws.

2. Can you manage accounting for long-term architectural projects?

Yes, we specialize in monitoring income and expenses over the course of long-term or multi-phase projects, ensuring financial oversight throughout.

3. How do you handle reimbursable expenses in accounting for architects?

We track reimbursable costs such as travel, printing, and third-party services, ensuring they are billed correctly and reflected in your financial records.

4. Do you provide financial analysis for project bidding and proposals?

Yes, we assist in creating budgets and evaluating costs to ensure your project bids are competitive and financially sound.

5. Which accounting software do you suggest for architects?

We recommend tools like QuickBooks, Xero, and other industry-specific software to help streamline your accounting processes.

6. How do you manage payroll for architectural firms with both employees and contractors?

We handle payroll processing, ensuring that both employees and contractors are classified correctly and that payroll complies with tax regulations.

7. Can you track income from various project types, such as residential and commercial?

Yes, we separate and track revenue by project type, providing you with in-depth insights into the performance of each segment.

8. How do you manage finances for projects across multiple states or internationally?

We manage taxes across different states and handle currency conversions for international projects, ensuring compliance and accuracy across borders.

KPI Of Architects

- Total Revenue: Monitor the total income generated from architectural projects, including residence, commercial, and industrial designs.

- Revenue by Project Type: Monitor revenue contributions from various kinds of projects such as home renovation, office buildings, and infrastructure for public use.

- Revenue by Client Type: Monitor revenue streams through various client types, including individual, corporate, or governmental units to identify which are profitable.

- Project Profitability: Measure profit margins for each project as revenue made compared to design, material, and operational costs.

- Revenue Growth Rate: Track the percentage increase or decrease in revenue earned over time to actually assess and judge performance and growth.

- Project Completion Rate: Measure the percentage of projects completed on time versus those experiencing delays, ensuring efficient project timelines.

- Budget Adherence: Track expenses on the project against the original budget to pinpoint areas of overruns and adjust the financial planning.

- Change Order Frequency: Track the number of project changes during execution, triggered by client requirements or unexpected conditions. This enhances scope management.

- Project Timeline Accuracy: Evaluate how well projects meet planned schedules and whether there are bottlenecks in the design and construction process.

- Client Approval Rate: Track the percentage of clients who approve initial design concepts without significant revisions, indicating good communication and design alignment.

- Billable Hours Utilization: Monitor the percentage of billable hours in comparison to the total hours worked to ensure optimum resource allocation and employee productivity.

- Design Draft Accuracy: Measure the number of design revisions required before project approval to improve drafting efficiency and reduce rework.

- Material Use Efficiency: Track how materials are used in a project to eliminate waste and contain costs.

- Meeting Effectiveness: Assess the number of meetings needed to conclude project details while ensuring effective communication and time management.

- Software Utilization Rate: Evaluate the number of times architectural design software and project management tools are leveraged to better facilitate efficiency and workflow.

- New Client Acquisition Rate: This is the number of new clients acquired via marketing, referral, and networking.

- Client Retention Rate: This is a measure of the ratio of repeat clients, which usually indicates that they trust and are satisfied with architectural services.

- Proposal Acceptance Rate: Measure how many proposals for projects have been accepted out of those submitted to determine whether or not a firm is succeeding in acquiring clients.

- Social Media Engagement: Monitor likes and shares and comments on social media platforms to follow up on brand visibility and engagement.

- Website Conversion Rate: Focus on the number of visitors that request consultation or submit their inquiries through the website and change the lead generation strategies accordingly.

- Publications and Awards: Monitor the number of architectural features that appear in magazines, industry awards, or recognitions and thereby increase brand reputation.

- Gross Profit Margin: Calculates profit from the projects before adding the operating cost to determine profitability in general.

- Net Profit Margin: Determines how much of revenue is left after paying all costs, thus creating a sustainable path for financial growth.

- Cash Flow Management: Monitor inflow and outflow of cash to achieve stability in financial position and carry out projects.

- Accounts Receivable Turnover: It tracks how fast outstanding accounts are collected so that cash management is improved.

- Budget Variance Analysis: Compare actual financial performance against budgeted expectations to manage financial resources effectively.

- Debt-to-Equity Ratio: Assess financial leverage by comparing total debt to shareholders' equity, ensuring balanced financial health

- Client Satisfaction Score: Surveys and feedback are used to measure the overall satisfaction with architectural services.

- Project Referral Rate: Number of new clients that were acquired from referrals from the existing clients; a sign of excellent client relationship.

- Customer Complaint Resolution Time: Measure the average time it takes to resolve client concerns, ensuring efficient client service.

- Review and Testimonial Count: Monitor online reviews and testimonials that bring in a count towards maintaining a good repute.

- Client Communication Response Time: Monitor the average time taken to respond to client queries and concerns, thereby improving customer service.

- Employee Productivity Rate: Measure the number of projects handled per employee to ensure effective workload distribution.

- Training Participation Rate: Measures the percentage of employees attending professional development courses to enhance skills and knowledge about the industry.

- Employee Retention Rate: Track the rate of employee turnover to ensure job satisfaction and a stable work environment.

- Team Collaboration Efficiency: Assess how well team members work together on projects, ensuring seamless workflow and communication.

- Work-Life Balance Satisfaction: Surveys of the employees to gauge job satisfaction and maintain a happy work environment.

- Website Traffic Analytics: Determine visitor numbers, session duration, and all interaction on the website of the architectural firm.

- Online Portfolio Engagement: Measure views and interactions on digital project portfolios to assess online impact.

- Software integration efficiency: Analyze the level of adoption for new technologies in the firm, such as AI-assisted design tools.

- Virtual Consultation Requests: Track the number of clients who take virtual design consultations, keeping pace with the times.

- Sustainability Initiative Adoption: Monitor the adoption of green designs and energy-efficient solutions to achieve sustainability goals.

- Market Trend Analysis: Continuing market trend analysis for strategic project types and services as a basis for decision-making.

- Long-Term Revenue Projections: The company will prepare long-term revenue projections using prior year performance and market analysis.

- Competitor Benchmarking: The company will compare performance metrics with the actual performance of competitors to suggest strategic decision-making

- Diversification Opportunities: Identify new service lines, for instance, sustainable architecture, smart buildings, and urban planning.

- Number of Projects Incorporating Green Building Design Materials: Keep track of how many projects will adopt sustainable material usage and sustainable design principles.

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services