Accounting and Bookkeeping for Bookstores

Bookstores are establishments dedicated to the sale of literature, offering a wide range of books catering to various interests and genres. Accounting and bookkeeping play crucial roles in managing the financial aspects of bookstores and ensuring accurate records of sales, expenses, and inventory. These practices enable owners to make informed decisions, track profitability, and comply with regulatory requirements. Accounts Junction specializes in providing essential accounting services tailored to the unique needs of bookstores. From maintaining organized financial records to offering strategic financial advice, Accounts Junction supports bookstores in navigating their financial landscape with efficiency and clarity.

Core Aspects Of Bookstores

1. Educational Resources: These bookstores offer a wide range of educational materials, including textbooks, workbooks, and reference guides, catering to different levels of expertise. They provide essential resources for students studying accounting and bookkeeping, helping them understand complex concepts and principles.

2. Professional Development: Accounting and bookkeeping professionals rely on these stores for continuing education resources. Books on industry trends, regulations, and best practices help professionals stay updated and enhance their skills. They may also offer study materials for certification exams such as the CPA (Certified Public Accountant) or CMA (Certified Management Accountant).

3. Practical Guidance: For small business owners and entrepreneurs, understanding basic accounting and bookkeeping principles is crucial for financial management. These bookstores offer practical guides, software tutorials, and how-to manuals, empowering individuals to manage their finances effectively.

4. Specialized Topics: Accounting and bookkeeping cover a broad range of topics, including tax accounting, forensic accounting, auditing, and financial analysis. Specialized bookstores maintain a diverse selection of books on these topics, catering to niche interests and providing in-depth knowledge for professionals specializing in various areas.

5. Research and Reference: Professionals often need to delve into specific accounting standards, regulations, or case studies for their work. These bookstores stock comprehensive reference materials, including accounting standards manuals, tax code handbooks, and case studies, facilitating research and analysis.

6. Networking Opportunities: Bookstores often host events such as book signings, author talks, or workshops, providing networking opportunities for professionals in the accounting and bookkeeping community. These events enable individuals to connect with peers, mentors, and industry experts, boosting knowledge exchange and collaboration.

7. Online Resources: Many accounting and bookkeeping bookstores have online platforms where customers can access digital books, e-books, webinars, and online courses. This accessibility ensures that professionals and students can access resources conveniently from anywhere, at any time.

Importance of Accounting and Bookkeeping Bookstores

1. Financial Management:

Accounting helps bookstores keep track of their finances, including sales, expenses, and profits. This information is essential for making informed decisions about pricing, inventory management, and budgeting.

2. Tax Compliance:

Proper accounting ensures that bookstores comply with tax regulations by accurately reporting income and expenses. This helps prevent potential fines or legal issues related to tax non-compliance.

3. Inventory Management:

Bookstores deal with a large inventory of items, ranging from bestsellers to niche titles. Effective bookkeeping allows them to monitor inventory levels, track sales trends, and identify slow-moving or obsolete stock. This data enables them to make informed decisions about purchasing, stocking, and discounting inventory.

4. Budgeting and Planning:

Accounting provides the financial data necessary for creating budgets and forecasting future performance. Bookstores can use this information to set sales targets, plan marketing strategies, and allocate resources effectively.

5. Financial Reporting:

Financial statements produced by bookkeeping include balance sheets, income statements, and cash flow statements. These reports provide valuable insights into the financial health of the bookstore and are essential for communicating financial information to stakeholders such as investors, lenders, and owners.

6. Business Analysis:

By analyzing financial data, bookstores can identify areas of strength and weakness in their operations. They can pinpoint inefficiencies, identify opportunities for cost savings, and make strategic decisions to improve profitability.

7. Legal Compliance:

Accurate accounting helps bookstores comply with various legal and regulatory requirements, such as financial reporting standards and corporate governance regulations. This reduces the risk of legal disputes and ensures the bookstore operates within the boundaries of the law.

Special Considerations for Bookstores

1. Inventory Management: Bookstores typically deal with a large inventory of books. Properly accounting for inventory is crucial, including tracking stock levels, valuing inventory accurately (which might involve dealing with the cost of goods sold for individual books), and accounting for any shrinkage or damage.

2. Specialized Sales Tracking: Bookstores may have different categories of books (fiction, non-fiction, children's books, etc.) and may need to track sales and profitability by category. This requires more detailed sales tracking and reporting systems.

3. Author Royalties: If the bookstore sells books by authors who receive royalties, there may be additional accounting tasks related to tracking sales of specific titles and calculating and remitting royalties to authors.

4. Seasonality: Sales in bookstores can be seasonal, with fluctuations around holidays, back-to-school seasons, etc. Hence, we need to analyze and adjust for these seasonal variations when budgeting and forecasting.

5. Returns and Refunds: Bookstores often have return policies, so accounting for returns and refunds is important. This involves tracking returned inventory, issuing refunds, and adjusting financial records accordingly.

6. Special Orders: Bookstores may fulfill special orders for customers, which can involve tracking orders, managing deposits, and accounting for any additional costs associated with fulfilling special orders.

7. Online Sales and E-commerce: Many bookstores now sell books online, either through their websites or through third-party platforms like Amazon. Managing e-commerce sales involves additional accounting tasks, such as tracking online sales revenue, managing shipping costs, and reconciling online payment processing fees.

8. Sales Tax: Bookstores must comply with sales tax regulations, which can vary by jurisdiction. Accountants need to ensure that sales tax is collected and remitted correctly for both in-store and online sales.

9. Loyalty Programs and Discounts: If the bookstore offers loyalty programs or discounts, accountants need to track and account for these promotions, including any associated liabilities or deferred revenue.

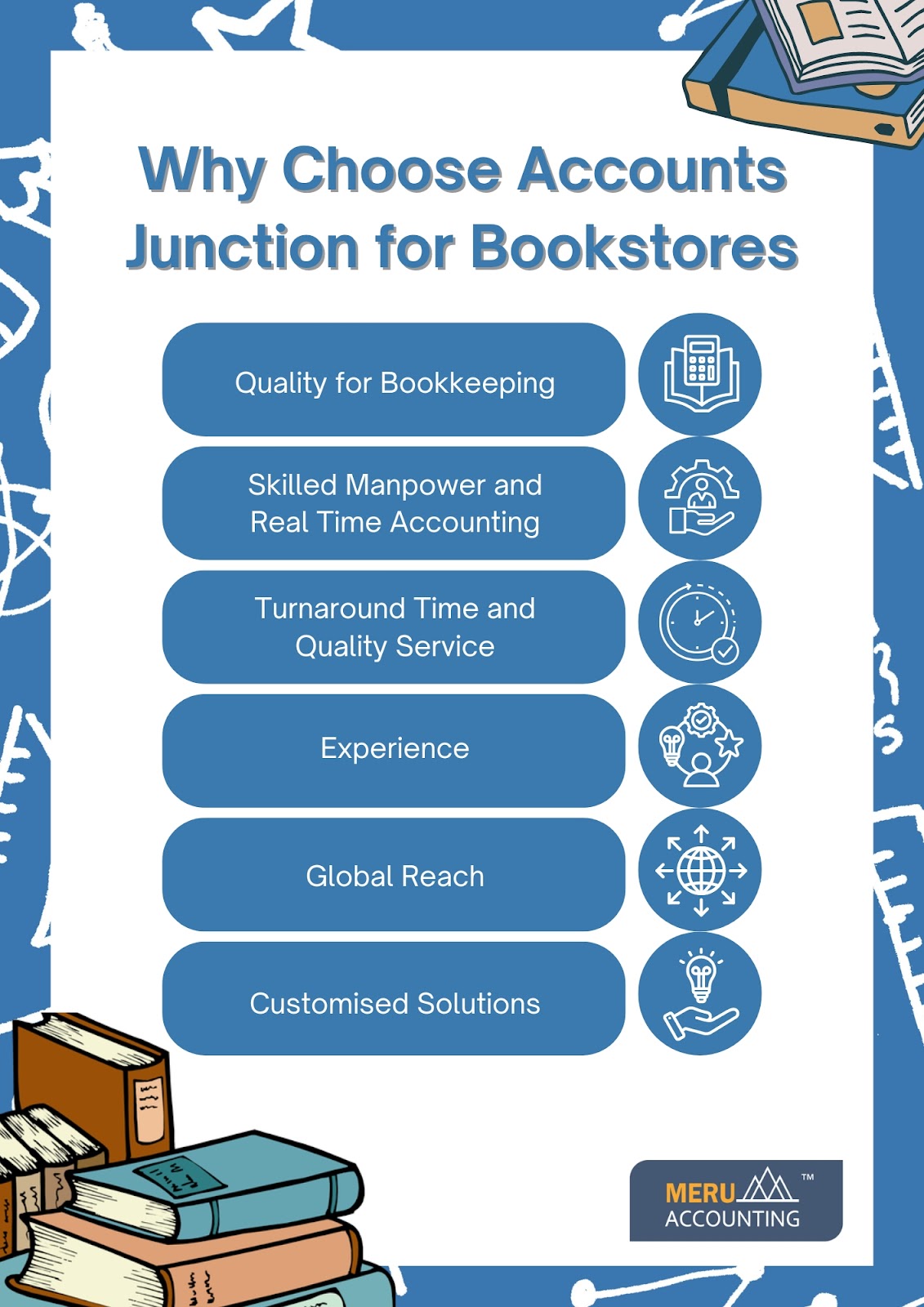

Why Choose Accounts Junction for Bookstores

1. Quality for Bookkeeping: At Accounts Junction, we are deeply passionate about providing top-notch bookkeeping services. Our dedication to quality ensures that your bookstore's financial records are meticulously managed and accurately maintained.

2. Skilled Manpower and Real-Time Accounting: Our team comprises highly skilled professionals who excel in real-time accounting solutions. When you partner with us, you can rely on our expertise to streamline your bookstore's financial processes efficiently.

3. Turnaround Time and Quality Service: At Accounts Junction, we prioritize prompt service delivery without compromising on quality. We understand the importance of timely financial reporting for your bookstore, and our commitment to excellence ensures that you receive exceptional service every time.

4. Experience: With over a decade of experience, we have successfully served a diverse range of industries, including law firms, educational institutions, CPA firms, and more. Our extensive experience equips us with the knowledge and expertise to cater to the unique accounting needs of your bookstore effectively.

5. Global Reach: Our team is well-versed in various accounting software and stays updated with the latest trends in the industry. Whether your business operates locally or globally, you can trust us to provide comprehensive accounting solutions tailored to your bookstore's specific requirements.

6. Customised Solutions: At Accounts Junction, we understand that every business is unique. That's why we offer customized solutions that are customized to meet the specific needs of your bookstore. By partnering with us, you gain access to personalized financial insights that empower you to make informed decisions and drive growth.

Services offered by Accounts Junction for Bookstores

Outsourced Bookkeeping Services:

At Accounts Junction, we specialize in providing comprehensive bookkeeping and accounting solutions tailored to the specific needs of bookstores. Our services are designed to adapt to the latest industry trends, ensuring accurate financial records and streamlined operations.

Cloud Accounting Solutions:

Our affordable cloud accounting services are ideal for bookstores looking to maintain optimal financial management practices. By utilizing cloud technology, we offer efficient solutions that enable bookstores to access their financial data anytime, anywhere.

Tax Preparation Services:

With our extensive experience in handling tax returns for both the US and Canada, we offer a range of tax preparation services tailored to the unique requirements of bookstores. Whether it's individual tax preparation or complex corporate taxes, we ensure compliance and minimize tax liabilities.

Complex Accounting, Reporting & Consulting:

Our team specializes in providing expert guidance on US GAAP & IFRS standards, offering advisory services, accounting implementation, and period-end accounting support. We assist bookstores in developing robust accounting policies and delivering accurate financial reporting.

Audit Support Services:

Bookstores can rely on us for comprehensive audit support, whether it's for US or IFRS audits. From basic audit assistance to complex audit planning and execution, we provide the necessary expertise to ensure a smooth audit process.

Conclusion

Accounts Junction stands out as a trusted partner for bookstores seeking reliable accounting and bookkeeping solutions. With a passion for precise financial management, skilled professionals, and a commitment to timely service delivery, Accounts Junction offers tailored services to meet the unique needs of bookstores. From outsourced bookkeeping to cloud accounting solutions, tax preparation, and expert consulting, we provide comprehensive support to ensure accurate records, compliance with regulations, and informed decision-making. With over a decade of experience and a global reach, Accounts Junction is well-equipped to empower bookstores with personalized financial insights and drive growth.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 2000 | Accounts Payables | Accounts Payable |

| 2 | 2000 | Accounts Payables:Trade Payables | Accounts Payable |

| 3 | 2000 | Accounts Payables:Utility Payables | Accounts Payable |

| 4 | 2000 | Accounts Payables:Rent Payables | Accounts Payable |

| 5 | 1200 | Accounts Receivables | Accounts Receivable |

Bookstores Industry Faqs

Frequently Asked Insights

1. How do you manage revenue from book sales and related products?

We categorize income from book sales, stationery, and merchandise, ensuring a clear distinction between various revenue streams for better financial tracking.

2. Can you assist with tracking book inventory and stock levels?

Yes, we provide inventory management solutions to help track stock levels, monitor book demand, and prevent overstocking or stockouts.

3. How do you handle accounting for discounts and promotional offers?

We record discounts, promotional campaigns, and loyalty program expenses accurately to assess their impact on profitability.

4. Do you provide payroll management for bookstore employees?

Yes, we process payroll for employees, including part-time workers and seasonal staff, ensuring compliance with tax and labor regulations.

5. How do you manage cash flow for bookstores with fluctuating sales?

We analyze seasonal trends, forecast sales, and optimize cash flow to ensure financial stability even during low-sales periods.

6. Can you help with sales tax compliance for books and educational materials?

Yes, we assist in determining applicable tax rates, tracking taxable and non-taxable sales, and filing accurate sales tax returns.

7. How do you account for book returns and unsold inventory?

We set up a structured system to record returns, manage restocking, and update financial statements accordingly.

8. What accounting software is best for bookstores?

We recommend Xero or QuickBooks, as they offer specialized features for retail inventory, multi-channel sales tracking, and expense management.

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services