Bookkeeping and Accounting Services for Contractors

The Importance of Outsourcing Bookkeeping and Accounting for Contractors to Accounts Junction:

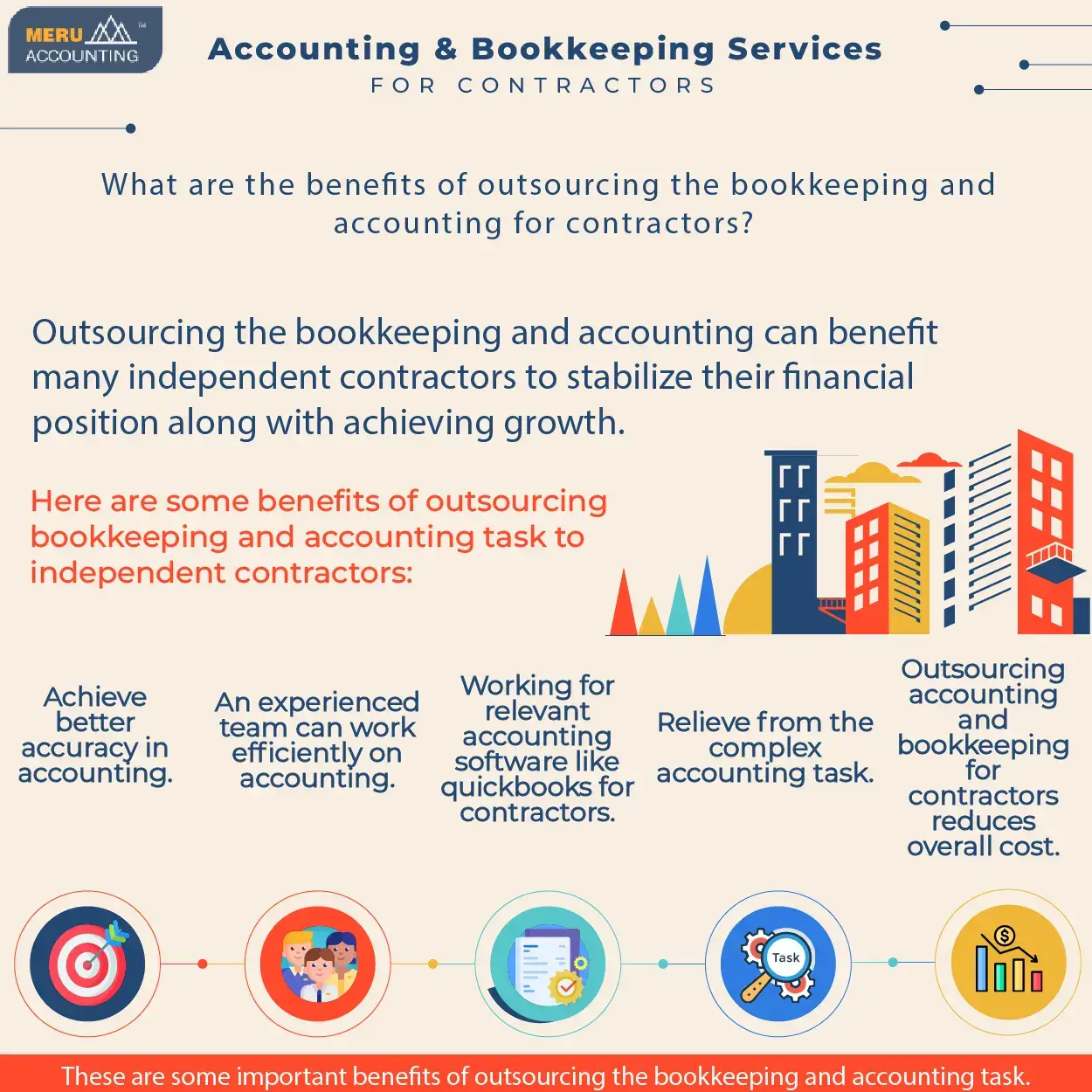

Here are some benefits of outsourcing bookkeeping and accounting for contractors to Accounts Junction:

1. Streamlined Cash Flow Management:

- Outsourcing bookkeeping and accounting ensures accurate and timely invoicing, payment tracking, and cash flow monitoring.

- Contractors can have a clear view of their receivables, payables, and overall cash flow position, helping them make informed financial decisions.

2. Reduction of Administrative Burden:

- By outsourcing accounting tasks, contractors can offload time-consuming administrative responsibilities.

- This allows contractors to focus on their core competencies, such as project management and client satisfaction.

3. Access to Industry Insights and Best Practices:

- Outsourced accounting professionals often have industry-specific knowledge and experience.

- Contractors can benefit from their insights, guidance, and best practices to optimize financial operations and stay ahead of industry trends.

4. Improved Financial Forecasting:

- Professional bookkeeping and accounting services provide accurate and up-to-date financial data for effective forecasting.

- Contractors can better anticipate future financial needs, plan for contingencies, and make strategic business decisions.

5. Risk Mitigation:

- Expert accounting services help contractors identify and mitigate financial risks associated with their operations.

- This includes monitoring financial ratios, ensuring compliance with regulatory requirements, and implementing internal controls.

6. Enhanced Vendor and Subcontractor Management:

- Outsourcing accounting tasks can streamline vendor and subcontractor management processes.

- Accounting professionals can handle payment processing, expense tracking, and maintaining accurate records, strengthening relationships with vendors and subcontractors.

7. Improved Project Costing and Profitability:

- Accurate job costing provided by outsourced accounting services helps contractors track project expenses and measure profitability.

- Contractors can make data-driven decisions, optimize resource allocation, and ensure projects remain within budget.

8. Increased Financial Transparency:

- Outsourcing bookkeeping and accounting promotes financial transparency, providing stakeholders, including clients and investors, with a clear view of the contractor's financial health and performance.

The Services Provided by contractor bookkeepers:

Here are the services provided by contractor bookkeepers:

1. Recording financial transactions:

Contractor bookkeepers accurately record income and expenses, ensuring that all financial data is properly entered into the books.

2. Bank and credit card statement reconciliation:

They compare the records in the books with bank and credit card statements to identify any discrepancies or errors, ensuring accurate financial records.

3. Financial report preparation:

Contractor bookkeepers prepare essential financial reports like balance sheets, profit and loss statements, and cash flow statements. These reports provide insights into the business's performance and help with decision-making.

4. Tax preparation:

They gather relevant financial information and ensure compliance with tax regulations. Contractor bookkeepers help organize receipts, categorize expenses correctly, and assist in filing taxes accurately and on time.

5. Payroll management:

Some contractor bookkeepers offer payroll management services, ensuring accurate calculation and distribution of employee wages.

6. Invoicing support:

Contractor bookkeepers may assist with generating invoices and managing the invoicing process, ensuring timely and accurate billing for clients.

Hiring a contractor bookkeeper can relieve contractors from financial management tasks, allowing them to focus on their core business operations and achieve greater efficiency.

Steps to set up a Bookkeeping and Accounting system for your Contracting Business:

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 1000 | Bank & Cash Accounts: | Bank |

| 2 | 1001 | Operating Bank Account | Bank |

| 3 | 1002 | Petty Cash: Bank | Bank |

| 4 | 1200 | Accounts Receivables: | Accounts Receivable |

| 5 | 1201 | Client Receivables | Accounts Receivable |