Accounting and Bookkeeping for Education Industry

Education is one the most vibrant industries, as it spreads knowledge and educates children. Along with educating, there are various other aspects associated with this industry that decides its long term survival; one of which is maintain the profit or gain. Without finance everything is void, and thus it becomes of at most importance to manage the finance and accounting parts in an articulated manner. A proper accounting has always been a challenge for the education institutions. Several accounting inefficiencies experienced by the education industry have impacted the working performance of the institutions. We understand that the education industry is very different from the other industries and requires regular financial attention to know the viability of this business. That’s the reason that we believe in updating and providing our clients with monthly financial statements and reports on the profitability as per their requirements.

Accounts Junction has a very good experience of providing accounting services for the education Industry for different institutions. Our experts CFOs understand the common requirements of the different types of the education institutions and have achieved efficiency in it. Our experts have vast knowledge and experience of this field along with sound hands on various accounting software such as Xero, Zoho Books, QuickBooks, MYOB and more.

Bookkeeping and Accounting Services for Education Institution

Accounts Junction has experience working on accounting for the education industry. We understand the different format of working style of the education industry. Education institutions have to understand the cash flow management system of their organization to ensure better financial position. While working for accounting for educational institutions, we first understand all the aspects about the educational institution. Then we plan out a proper accounting system that can bring accuracy in it. The accounting service for education industry aims to provide better financial reporting to institutions that can make them easier to understand.

All of the accounting activities are done on the proper accounting software. It can automate all the tasks in a very easy pattern. We understand the requirement of the education accounting as per the type of the institution.Our expert staff then plan out a proper pattern through which can make it easier to work on the accounting for educational institutions.

Accounting for Universities and Colleges

While providing the accounting services, we take care of all the related activities like online bookkeeping, payable & receivables, payroll management, taxes, etc. We aim at bringing accuracy in all the accounting activities properly. Accounts Junction expertise have years of experience working for accounting services for the education Industry which can help to improve the financial position of business. Their prompt reply to any of the clients accounting need can maintain a proper working process for the education institute. After years of experience and many satisfying clients all we can say is, be a part of our family, and experience the growth!

Benefits of Bookkeeping and Accounting for Education Sector in the USA:

Accounts Junction's bookkeeping and accounting services are well-suited for the specific needs of the education sector in the USA. By utilizing our services, educational institutions can experience the following benefits:

1. Accurate Financial Records:

- Accounts Junction ensures the accurate and precise recording of financial transactions for educational institutions. We maintain meticulous records of income from tuition fees, grants, and donations, as well as expenses related to salaries, facility maintenance, and supplies. This accuracy provides a solid foundation for financial management.

2. Grants and Funding Compliance:

- Accounts Junction's expertise helps educational institutions comply with the specific requirements of grants and funding sources. Our team ensures proper tracking and documentation of funds, adherence to spending guidelines, and the generation of comprehensive financial reports, thereby maintaining transparency and accountability.

3. Financial Reporting:

- Accounts Junction assists in generating accurate and timely financial reports for educational institutions. We prepare income statements, balance sheets, and other financial statements that provide a clear overview of the institution's financial health. These reports help administrators, board members, and stakeholders gain insights into financial performance and make informed decisions.

4. Compliance and Audit Readiness:

- The education sector is subject to regulatory compliance and periodic audits. Accounts Junction ensures that financial records are maintained in accordance with legal and regulatory standards. Our services facilitate smooth audits and minimize the risk of penalties or legal issues, ensuring institutions are prepared and compliant.

5. Budgeting and Planning:

- Accounts Junction supports educational institutions in budgeting and planning. Our expertise helps in setting realistic budgets, allocating resources effectively, and planning for future expenses. By utilizing accurate financial data, institutions can optimize their budget allocation, identify areas for cost-saving, and ensure financial sustainability.

6. Stakeholder Communication:

- Accounts Junction's financial reports and statements provide educational institutions with the tools for effective stakeholder communication. Clear and transparent financial information enhances communication with administrators, board members, donors, and government agencies. This fosters trust, strengthens relationships, and facilitates collaboration and support.

By leveraging the bookkeeping and accounting services of Accounts Junction, educational institutions in the USA can effectively manage their finances, maintain compliance, generate accurate financial reports, facilitate budgeting and planning, and enhance stakeholder communication. This allows institutions to focus on providing quality education while ensuring financial stability and success.

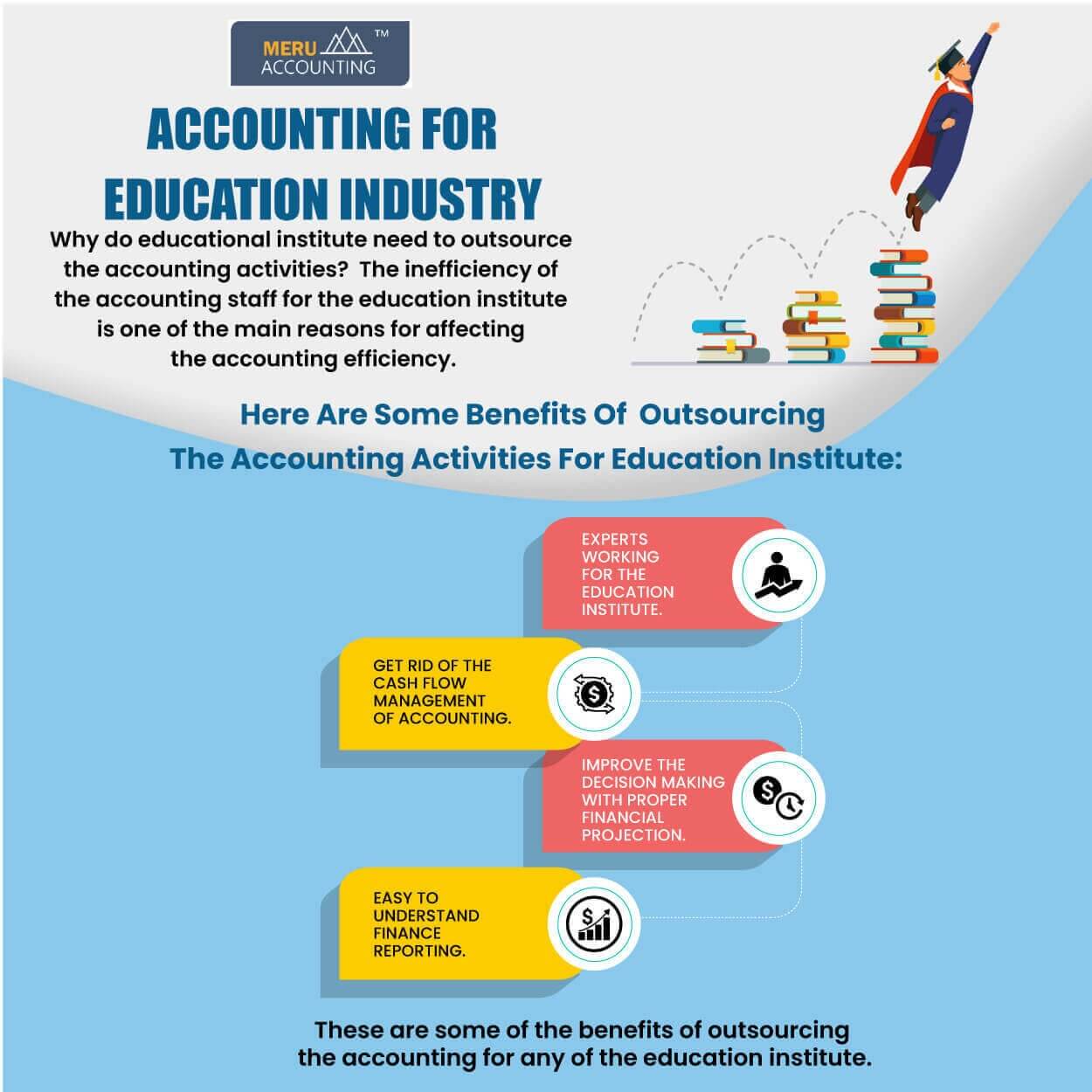

ACCOUNTING FOR EDUCATION INDUSTRY

Why do educational institute need to outsource the accounting activities?

The inefficiency of the accounting staff for the education institute is one of the main reasons for affecting the accounting efficiency.

Here Are Some Benefits Of Outsourcing the Accounting Activities For Education Institute:

- EXPERTS WORKING FOR THE EDUCATION INSTITUTE

- GET RID OF THE CASH FLOW MANAGEMENT OF ACCOUNTING.

- IMPROVE THE DECISION MAKING WITH PROPER FINANCIAL PROJECTION.

- EASY TO UNDERSTAND FINANCE REPORTING.

These are some of the benefits of outsourcing the accounting for any of the education institute.

Challenges Faced in Bookkeeping and Accounting for Education Sector in the USA:

Bookkeeping and accounting in the education sector in the USA can present several challenges. Here are some common hurdles faced:

Overcoming these challenges requires a combination of expertise, technological solutions, and effective financial management strategies. Engaging professional bookkeepers, accountants, or specialized accounting services like Accounts Junction can help navigate these complexities, ensuring compliance, financial transparency, and effective financial management in the education sector.

Benefits of EDUCATION :

Accurate Financial Records

Accounts Junction ensures the accurate and precise recording of financial transactions for educational institutions. We maintain meticulous records of income from tuition fees, grants, and donations, as well as expenses related to salaries, facility maintenance, and supplies. This accuracy provides a solid foundation for financial management.

Compliance and Audit Readiness

The education sector is subject to regulatory compliance and periodic audits. Accounts Junction ensures that financial records are maintained in accordance with legal and regulatory standards. Our services facilitate smooth audits and minimize the risk of penalties or legal issues, ensuring institutions are prepared and compliant.

Budgeting and Planning

Accounts Junction supports educational institutions in budgeting and planning. Our expertise helps in setting realistic budgets, allocating resources effectively, and planning for future expenses. By utilizing accurate financial data, institutions can optimize their budget allocation, identify areas for cost-saving, and ensure financial sustainability.

Methods of EDUCATION :

Accrual accounting is a method that records income and expenses when they are earned or incurred, regardless of when the cash is received or paid. Educational institutions can utilize this method to track tuition fees, grants, and expenses accurately, providing a more comprehensive financial picture.

Accrual accounting is a method that records income and expenses when they are earned or incurred, regardless of when the cash is received or paid. Educational institutions can utilize this method to track tuition fees, grants, and expenses accurately, providing a more comprehensive financial picture.

Fund accounting is specifically designed for the unique needs of the education sector. It involves segregating financial activities into different funds, such as general funds, scholarship funds, and capital funds. This method allows for clear tracking and reporting of funds and ensures compliance with specific spending restrictions.

Fund accounting is specifically designed for the unique needs of the education sector. It involves segregating financial activities into different funds, such as general funds, scholarship funds, and capital funds. This method allows for clear tracking and reporting of funds and ensures compliance with specific spending restrictions.

Budgetary accounting focuses on comparing actual financial results with the budgeted amounts. Educational institutions can use this method to monitor their financial performance against planned objectives, identify variances, and make necessary adjustments to ensure fiscal responsibility.

Budgetary accounting focuses on comparing actual financial results with the budgeted amounts. Educational institutions can use this method to monitor their financial performance against planned objectives, identify variances, and make necessary adjustments to ensure fiscal responsibility.

Educational institutions may choose to outsource their bookkeeping and accounting tasks to professional accounting service providers like Accounts Junction. We specialize in the education sector, ensuring compliance with industry-specific regulations and providing comprehensive financial management services, including transaction recording, payroll processing, and financial reporting.

Educational institutions may choose to outsource their bookkeeping and accounting tasks to professional accounting service providers like Accounts Junction. We specialize in the education sector, ensuring compliance with industry-specific regulations and providing comprehensive financial management services, including transaction recording, payroll processing, and financial reporting.

Implementing strong internal controls and conducting regular audits are essential in the education sector. These measures ensure transparency, prevent fraud, and maintain the integrity of financial records. Internal controls can include segregation of duties, approval processes, and regular review of financial transactions.

Implementing strong internal controls and conducting regular audits are essential in the education sector. These measures ensure transparency, prevent fraud, and maintain the integrity of financial records. Internal controls can include segregation of duties, approval processes, and regular review of financial transactions.

Educational institutions may choose to outsource their bookkeeping and accounting tasks to professional accounting service providers like Accounts Junction. We specialize in the education sector, ensuring compliance with industry-specific regulations and providing comprehensive financial management services, including transaction recording, payroll processing, and financial reporting.

Educational institutions may choose to outsource their bookkeeping and accounting tasks to professional accounting service providers like Accounts Junction. We specialize in the education sector, ensuring compliance with industry-specific regulations and providing comprehensive financial management services, including transaction recording, payroll processing, and financial reporting.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 2000 | Accounts Payables | Accounts Payable |

| 2 | 2000 | Accounts Payables:Accounts Payable | Accounts Payable |

| 3 | 1200 | Accounts Receivables | Accounts Receivable |

| 4 | 1000 | Bank & Cash Accounts | Bank |

| 5 | 1000 | Bank & Cash Accounts:Savings Account | Bank |

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services