Bookkeeping & Accounting for Event Planners, Event Management Company

When you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event Planning organizations always seem to neglect the accounting department that later becomes responsible for financial irregularities. Proper bookkeeping for event planners can help to properly record the financial information in proper places in the accounting books. This can help to simplify making different types of accounting books.

The working pattern of the event management company is different compared to other types of businesses. So, comparatively a little different accounting approach is essential for these companies. An experienced and proficient accountant is necessary here for these organizations. If you are finding it difficult to find such experts then you can outsource accounting for event Management Companies to expert agencies. They can help you to bring the required efficiency in accounting for your business organization.

Dashboards we prepare for bookkeeping for Event Planners Industry

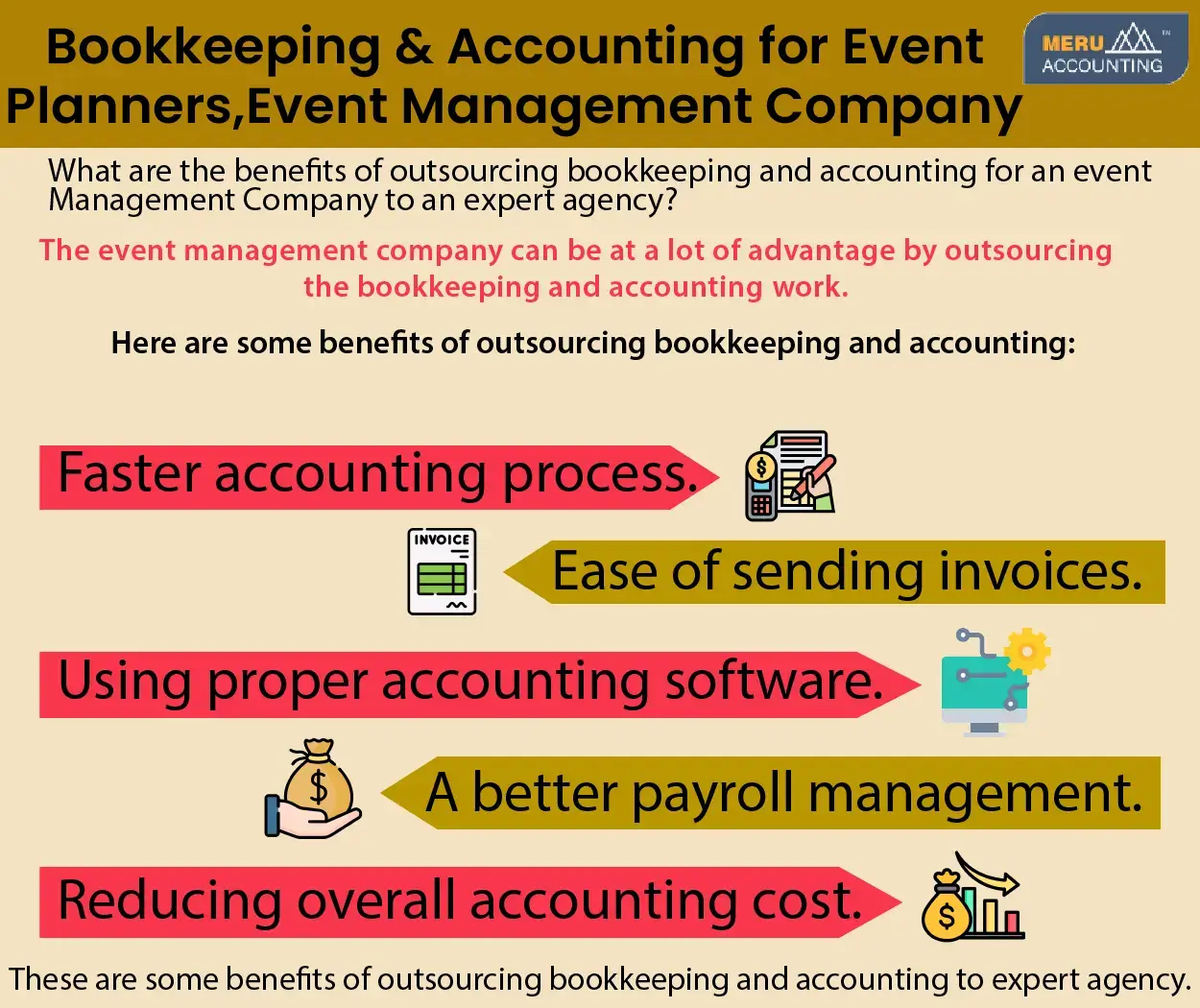

Benefits of Outsourcing Bookkeeping and Accounting for Event Management Company

When you outsource the accounting activities of an event Management Company to an expert agency, you can experience efficiency in the accounting.

Here are some benefits of outsourcing accounting and bookkeeping for event planners to an expert agency:

1. Faster accounting process

- An inefficient accountant mostly is not proficient in handling all the accounting activities faster. They mostly seem very slow in doing different accounting activities. Outsourcing to an expert accounting agency can streamline all accounting activities better and speed up the accounting process.

2. Easy to send invoices

- The organizations like event Management Companies need to handle different invoices. They have to deal with multiple vendors for different work and send the invoices as per the scheduled deal. Also, they need to send proper invoices to the customers as per the planned installments. Most experts would prefer automating the invoices wherever possible which can help improve the cash flow management.

3. Using relevant accounting software

- Unlike most businesses, event management companies businesses can also be implemented accounting software. Expert accounting agencies will mostly be using accounting software properly. Here, you do not have to buy separate accounting software and take any sort of training. Your company’s accounting will be directly implemented on proper accounting software.

4. Proper payroll management

- Proper management of the payroll system of the company is another challenge for most event planners.

- Outsourced accounting can manage the payroll system of the event management company in a better way.

5. Reduce overall accounting cost

- An in-house accounting team would cost more for the Event Management Company. The cost will mostly be related to recruitment, training, and allocating different resources. Outsourcing accounting will cost lesser comparatively which can help reduce the cost. It will also help the main managers and business owners of the event management company to focus more on the business.

These are some benefits of outsourcing bookkeeping and accounting for event management companies to expert agencies. They can relieve you from different complexities associated with accounting to bring better efficiency to it.

Accounts Junction provides bookkeeping and accounting for event management companies. They have expert individuals and experienced people to handle the accounting activities. They have relevant accounting software to handle accounting activities. Accounts Junction is a proficient accounting service-providing agency around the world.

Importance of Bookkeeping and Accounting for Event Management, event planners, and event companies:

1. Financial Insights for Success:

- Bookkeeping and accounting play a crucial role in driving the success of event management businesses by providing valuable financial insights and data-driven decision-making.

2. Accurate Record-Keeping:

- Maintaining precise records of income and expenses related to events is essential for event management companies to have a clear understanding of their financial health and make informed financial decisions.

3. Budgeting for Profit

- Effective bookkeeping and accounting enable event planners to create accurate budgets based on historical data, optimizing event finances to maximize profits and minimize financial risks.

4. Financial Statements:

- Utilizing financial statements like balance sheets and profit/loss statements helps event management companies evaluate their overall performance, identify areas of improvement, and track financial progress.

5. Cost Minimization and Revenue Enhancement:

- Through strategic financial analysis, bookkeeping and accounting can identify cost-saving opportunities and revenue generation strategies, helping event companies operate more efficiently and increase profitability.

6. Tax Compliance and Event Management:

- Specialized bookkeeping and accounting services ensure event planners navigate the complexities of tax compliance in the industry, reducing the risk of penalties and legal issues.

7. Outsourcing for Efficiency:

- Partnering with event-specific bookkeeping and accounting services allows event companies to focus on core competencies and deliver exceptional experiences while leaving financial tasks to experts, saving time and ensuring accuracy.

8. Industry Expertise:

- Working with event-specific bookkeeping and accounting professionals provides valuable insights into the unique financial challenges faced by event management companies, leading to better financial decision-making.

9. Peace of Mind:

- Knowing that financial records are managed by experienced professionals offers event planners and companies peace of mind, knowing their financial accuracy and compliance are well taken care of.

Bookkeeping and accounting play a vital role in the success of event management, event planners, and event companies in the USA. Accounts junction provides crucial insights into the financial health of events, allowing for informed decision-making, budget optimization, and improved profitability. With accurate bookkeeping, event professionals can track income and expenses, ensuring compliance with tax obligations and enhancing financial control. Accounting analysis offers valuable insights, enabling strategic planning, cash flow management, and business growth.

By partnering with Accounts Junction, event professionals can access expertise, streamline financial operations, and benefit from cost savings and efficiency. The professionalism, accuracy, and transparency provided by bookkeeping and accounting services instill confidence in clients, vendors, and stakeholders, enhancing credibility and fostering stronger relationships. Ultimately, embracing robust financial management practices ensures that events are executed seamlessly, financial goals are achieved, and the industry continues to thrive. With the support of dedicated bookkeeping and accounting professionals, event management professionals, planners, and companies can confidently navigate the financial complexities and focus on delivering exceptional experiences that leave a lasting impact.

Softwares used for Bookkeeping in Event Management Industry:

In the event management industry, bookkeeping is a critical aspect of financial management that requires accuracy, efficiency, and organization. To streamline and simplify the bookkeeping process, various software solutions have emerged to cater specifically to the needs of event planners and companies. These software tools are designed to handle financial transactions, record-keeping, budgeting, and reporting, providing comprehensive solutions for managing finances. Here are some popular software used for bookkeeping in the event management industry:

1. QuickBooks:

- QuickBooks is one of the most widely used accounting software globally. It offers specialized versions for small businesses and event companies, enabling users to manage income, expenses, invoices, and vendor payments efficiently. The software's user-friendly interface makes it easy for event planners to track finances and generate financial reports.

2. Xero:

- Xero is another cloud-based accounting software that provides robust features for bookkeeping in the event management industry. It allows users to reconcile bank transactions, handle payroll, and manage invoicing. Xero's multi-currency support is particularly beneficial for companies dealing with international events.

3. FreshBooks:

- FreshBooks is a user-friendly accounting software designed for small businesses and self-employed professionals, including event planners. It offers easy invoicing, expense tracking, time tracking, and financial reporting capabilities. With mobile apps available, event organizers can manage their finances on the go.

4. Zoho Books:

- Zoho Books is part of the Zoho suite of business software. It provides event management companies with a comprehensive platform to handle accounting tasks, track expenses, create invoices, and manage cash flow effectively. It also integrates seamlessly with other Zoho applications.

5. Sage Intacct:

- Suitable for medium to large-sized event management companies, Sage Intacct offers advanced financial management solutions. The software includes features for project accounting, revenue recognition, and multi-entity management, ideal for complex event projects and accounting needs.

6. Wave:

- Wave is a free accounting software that caters to small businesses, freelancers, and startups, making it a cost-effective option for event planners on a budget. It provides bookkeeping, invoicing, and receipt scanning capabilities, simplifying financial management tasks.

7. Event-specific software:

- Some event management software solutions incorporate built-in bookkeeping features to cater to the specific financial needs of the industry. These platforms often integrate registration, ticketing, and financial management, making it easier to track event-related income and expenses.

8. Expensify:

- Managing expenses is a crucial aspect of bookkeeping in the event management industry. Expensify simplifies expense tracking and reporting, allowing event planners to scan receipts, categorize expenses, and create expense reports seamlessly.

In conclusion, the event management industry can benefit significantly from using specialized accounting software to handle bookkeeping tasks efficiently. These software solutions save time, reduce errors, and provide valuable financial insights that aid event planners and companies in making informed decisions for successful events and sustainable financial management.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 2000 | Accounts Payables | Accounts Payable |

| 2 | 2000 | Accounts Payables:Accounts Payable | Accounts Payable |

| 3 | 1200 | Accounts Receivables | Accounts Receivable |

| 4 | 1200 | Accounts Receivables:1 A/R - Consulting | Accounts Receivable |

| 5 | 1000 | Bank & Cash Accounts | Bank |

EVENT PLANNERS Industry Faqs

Frequently Asked Insights

1. Why is bookkeeping essential for event planners?

Effective bookkeeping helps keep track of client payments, vendor costs, and ensures each event remains financially viable.

2. How do you manage advance payments and deposits for events?

We record and allocate deposits accurately, ensuring smooth financial planning for event expenses and cash flow management.

3. What bookkeeping software is best suited for event planners?

Platforms like QuickBooks, Xero, and Zoho Books help automate invoicing, expense tracking, and financial reporting for event businesses.

4. Can you analyze profitability for individual events?

Absolutely! We break down costs and revenue per event to help you maximize profits and optimize future pricing strategies.

5. What tax write-offs are available for event planners?

Eligible deductions include venue fees, transportation, marketing, professional services, and office-related expenses.

6. Do you assist with payroll for event staff and contractors?

Yes, we handle payroll for both full-time employees and freelance workers, ensuring compliance with tax and labor laws.

7. How do you manage cash flow for event planning businesses?

We develop cash flow forecasts, helping you budget for vendor payments, staffing, and unforeseen expenses.

8. Can you help event planners with tax preparation?

Yes, we organize financial records, identify deductions, and ensure timely tax filings to reduce liabilities and maximize savings.

9. Why is bookkeeping essential for event planners?

Effective bookkeeping helps keep track of client payments, vendor costs, and ensures each event remains financially viable.

10. How do you manage advance payments and deposits for events?

We record and allocate deposits accurately, ensuring smooth financial planning for event expenses and cash flow management.

11. What bookkeeping software is best suited for event planners?

Platforms like QuickBooks, Xero, and Zoho Books help automate invoicing, expense tracking, and financial reporting for event businesses.

12. Can you analyze profitability for individual events?

Absolutely! We break down costs and revenue per event to help you maximize profits and optimize future pricing strategies.

13. What tax write-offs are available for event planners?

Eligible deductions include venue fees, transportation, marketing, professional services, and office-related expenses.

14. Do you assist with payroll for event staff and contractors?

Yes, we handle payroll for both full-time employees and freelance workers, ensuring compliance with tax and labor laws.

15. How do you manage cash flow for event planning businesses?

We develop cash flow forecasts, helping you budget for vendor payments, staffing, and unforeseen expenses.

16. Can you help event planners with tax preparation?

Yes, we organize financial records, identify deductions, and ensure timely tax filings to reduce liabilities and maximize savings.

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services