Accounting and Bookkeeping for Influencers

Influencers have grown as an overwhelming force in branding and marketing. Influencers have made their passion successful enterprises by engaging and influencing big audiences on social media platforms. But even with the collaborations and endorsements, long-term success depends on sound financial management. Influencers must maintain good accounting and bookkeeping practices in order to succeed financially and sustainably.

Influencers that successfully implement strong financial management techniques will be able to handle the challenges of managing a business, adhere to tax laws, and make wise judgements that will strengthen their brand. Accounts Junction simplifies bookkeeping and accounting for influencers by providing customized solutions that cater to their unique needs.

Fundamental aspects of Bookkeeping and Accounting in the Influencer Industry

In the influencer industry, accounting and bookkeeping play crucial roles in managing finances, ensuring compliance, and fostering business growth. The following are some fundamentals of bookkeeping and accounting that are particular to influencers:

Income Tracking:

Influencers make money from a variety of sources, such as product sales, affiliate marketing, sponsored content, brand alliances, and advertising. Accurate tracking of money from all sources is necessary for accounting systems to comprehend revenue streams and evaluate profitability.

Expense Management:

Influencers must pay for marketing, travel, equipment, expert services, and content production. Tracking and classifying expenses is a necessary part of effective expense management in order to maximize profitability, optimize spending, and comprehend costs.

Separation of Personal and corporate funds:

To preserve transparency and enable accurate financial reporting, influencers must keep their personal and corporate funds apart. Using separate credit cards for business purchases and opening a dedicated business bank account might simplify accountancy procedures.

Financial Planning:

Influencers may better allocate resources, set spending priorities, and plan for upcoming investments in content development, marketing campaigns, and business growth activities by creating a budget. Influencers who prepare their finances are better able to meet their objectives and stay stable.

Maintaining Records:

Influencers must keep accurate and well-organized financial records in order to precisely manage their income, expenses, assets, and liabilities. Maintaining accurate records helps with tax preparation, audits, and financial analysis while offering financial health and performance information about the company.

Auditing:

To make sure they are in accordance with tax laws, advertising rules, and brand partner contracts, influencers may be audited by regulatory bodies or tax authorities. To reduce risks and uphold stakeholder trust, it is crucial to keep correct financial records and to abide by legal and industry requirements.

Expert Advice and Support:

Influencers can get knowledgeable advice on accounting, tax planning, and financial management issues by interacting with accounting professionals, such as Certified Public Accountants (CPAs) or financial advisors. Influencers can better handle difficult financial concerns and optimise their financial plans by seeking professional counsel.

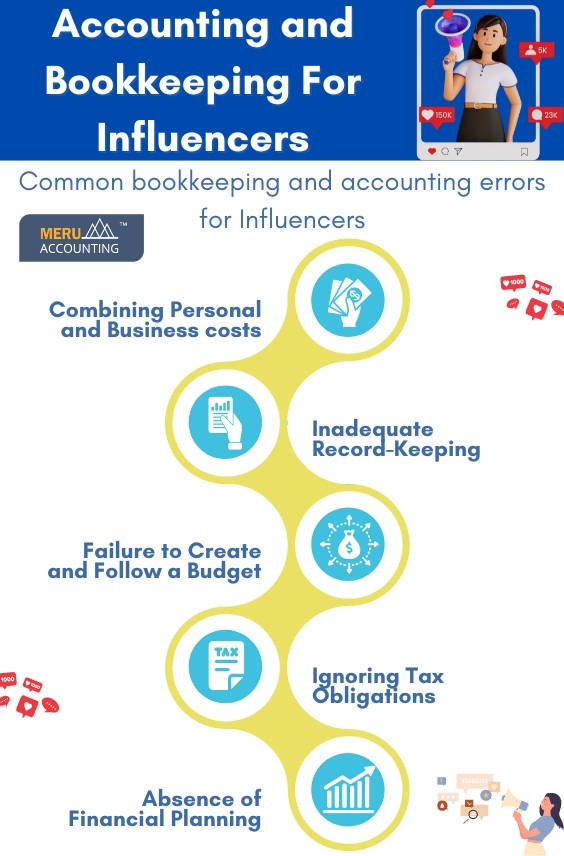

Common Bookkeeping and Accounting errors for Influencers

-

Combining Personal and Business costs: Influencers frequently make the error of combining their personal and business costs. Combining these costs can make tax filing more difficult and result in inaccurate financial records.

-

Inadequate Record-Keeping: Influencers could fail to recognise the need of accurate record-keeping, which could result in incomplete or missing financial information. Accurately tracking income, expenses, and overall financial performance is difficult without adequate documentation.

-

Failure to Create and Follow a Budget: Some influencers may fail to establish and follow a budget, which could lead to excessive expenditure or ineffective use of resources. Without a budget, it's challenging to manage cash flow effectively and plan for future expenses or investments.

-

Ignoring Tax Obligations: Influencers may fail to use tax planning techniques or undervalue their tax responsibilities, which could result in unanticipated tax bills or fines. Financial ramifications and legal problems may arise from breaking tax regulations.

-

Absence of Financial Planning: Some influencers might not bother with long-term financial planning in favor of just short-term objectives. Influencers risk missing out on chances for business investment, growth, or savings if they don't have a strategic financial strategy.

Account Junction�s Bookkeeping Services for Influencers

Specialized accounting services designed to meet the specific requirements of influencers in the digital marketing space are offered by Accounts Junction. Here's how influencers might benefit from bookkeeping and accounting assistance from Accounts Junction:

Knowledge of the Influencer Sector:

Accounts Junction is aware of the unique needs and difficulties that influencers in the field of digital marketing face. Our seasoned accountants are aware of influencer revenue streams, spending classifications, tax ramifications, and industry-specific regulatory compliance.

Personalized Accounting Solutions:

Accounts Junction provides personalized accounting solutions that are customized to each influencer's and their company's needs. We customize our services to meet the needs of influencers operating at various business scales and structures, regardless of whether they are lone content producers or oversee a group of partners.

All-inclusive Bookkeeping Services:

Accounts Junction takes care of influencers' financial reporting, bank reconciliations, cost management, income monitoring, and invoice processing. Our rigorous bookkeeping procedures guarantee accuracy, openness, and adherence to rules and guidelines for accounting.

Tax Planning and Compliance:

We assist influencers in minimizing their tax obligations, maximizing their deductions, and making sure that all tax laws and regulations are followed. We use tax-saving techniques and stay up to date on legislative changes to maximize influencers' financial results.

Budgeting and Financial Planning:

To help influencers reach their company goals and objectives, Accounts Junction offers budgeting and financial planning services. Influencers may make well-informed judgements regarding resource allocation and corporate growth strategies by using their analysis of income and expenses, cash flow projections, and identification of cost optimization opportunities.

Technology Integration:

To automate tedious activities, expedite bookkeeping procedures, and give real-time access to financial data, Accounts Junction makes use of technology and cloud-based accounting software. Influencers and our accounting team can work together more effectively and accurately with innovative accounting software.

Expert Support and Advice:

Accounts Junction acts as a reliable resource for influencers, providing individualized support and advice on financial concerns. We help influencers take advantage of possibilities for achievement and overcome financial obstacles by offering professional counsel, answers to accounting-related queries, and strategic recommendations.

Security and Confidentiality:

Accounts Junction places a high priority on the security and confidentiality of financial information about influencers. We put strong data security measures in place, follow tight confidentiality guidelines, and handle sensitive data with the utmost professionalism and integrity.

Influencers must handle finances and bookkeeping well in order to stay in compliance with legal requirements, support corporate expansion, and preserve financial stability. In order to make well-informed judgements and attain sustained success, influencers must maintain precise and well-organized financial records, given their varied revenue streams, expenses, and tax responsibilities. Influencers in the digital marketing space have specific needs, and Accounts Junction specializes in meeting those needs with customized accounting solutions. Influencers who want to manage their finances effectively can get professional advice and assistance from Accounts Junction. Using technology, individualized support, and in-depth knowledge of the influencer market, we enable influencers to build their businesses and produce content while putting their financial matters in competent hands.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 2000 | Accounts Payables | Accounts Payable |

| 2 | 2000 | Accounts Payables:Accounts Payable | Accounts Payable |

| 3 | 1200 | Accounts Receivables | Accounts Receivable |

| 4 | 1200 | Accounts Receivables:1 A/R - Consulting | Accounts Receivable |

| 5 | 1000 | Bank & Cash Accounts | Bank |

Influencers Industry Faqs

Frequently Asked Insights

1. Why is bookkeeping important for influencers?

Bookkeeping assists influencers in organizing their earnings from sponsorships, advertisement deals, and product sales, while also tracking expenses such as content creation costs.

2. Which expenses can influencers deduct for tax purposes?

Influencers can deduct expenses such as equipment (e.g., cameras, lighting), software subscriptions, travel, and promotional costs.

3. How can I track income across multiple social media platforms?

We offer systems that help consolidate earnings from platforms like YouTube, Instagram, TikTok, and others, allowing for better financial oversight.

4. What accounting software is most suitable for influencers?

Platforms like QuickBooks Self-Employed and Wave are designed to streamline tracking of income and expenses for influencers.

5. How should I handle taxes related to sponsorships and gifted products?

We help ensure that sponsorship income is correctly categorized for tax purposes and guide you through the proper reporting of gifted items.

6. Can bookkeeping help me identify my most profitable platforms?

Certainly. By analyzing income per platform, we can highlight which channels are yielding the highest returns.

7. How do I manage fluctuating cash flow due to irregular income?

We assist in creating cash flow strategies to ensure that unpredictable revenue is balanced against regular expenses.

8. What kind of financial reports should influencers review?

Key reports for influencers include breakdowns of revenue by platform, detailed expense tracking, and profitability assessments to inform business decisions.

KPI Of Influencers

- Income Source Analysis: Evaluate earnings from sponsorships, collaborations, affiliate marketing, and content monetization.

- Revenue Growth Trends: Monitor monthly or quarterly revenue growth to assess the effectiveness of monetization strategies.

- Campaign Performance: Track revenue generated from specific campaigns or partnerships with brands and sponsors.

- Cost of Revenue: Evaluate the expenses linked to revenue generation, such as content production and promotional costs, and calculate profit margins for various income streams to identify the most lucrative opportunities.

- Profitability Analysis: Calculate net profit margins considering all revenue sources and operational expenses.

- Cash Flow Management: Monitor cash flow to ensure sufficient liquidity for business operations and growth investments.

- Tax Compliance: Ensure compliance with tax regulations and optimize tax planning strategies to maximize deductions and minimize liabilities.

- Expense Tracking: Analyze and categorize operational expenses to identify cost-saving opportunities and enhance financial efficiency.

- Partnership ROI: Evaluate the return on investment (ROI) from brand collaborations and sponsored content.

- Partnership Growth: Monitor the growth of partnerships with brands and sponsors over time.

- Partnership Satisfaction: Gather feedback from brand partners to assess satisfaction levels and improve collaboration effectiveness.

- Follower Growth: Track the growth rate of followers or subscribers to gauge content relevance and audience expansion.

- Audience Demographics: Analyze audience demographics (age, gender, location) to tailor content and attract targeted partnerships.

- Engagement Rate: Measure likes, comments, shares, and overall engagement per post to understand audience interaction and content effectiveness.

- Influencer Impact: Measure the influencer's impact on brand awareness, customer acquisition, and audience engagement for sponsors.

- Platform-specific Metrics: Track platform-specific metrics (e.g., Instagram Insights, YouTube Analytics) to optimize content strategies.

- Social Listening: Monitor mentions, tags, and conversations related to the influencer's brand to gauge social sentiment and brand awareness.

- Competitive Analysis: Compare performance metrics against industry benchmarks and competitors to identify growth opportunities.

- Content Performance: Analyze which types of content (videos, posts, stories) perform best across platforms to refine content strategy.

- Repeat Engagement: Track the percentage of followers returning for new content or interactions.

- Community Growth: Measure growth in community platforms (e.g., Discord, Facebook Groups) where followers can engage directly with the influencer.

- Subscriber Retention Rate: Analyze the percentage of subscribers who remain over time to assess content value and loyalty.

- Content Feedback Loop: Gather audience feedback on content preferences to continuously improve engagement and retention strategies.

- Content Frequency: Monitor how often new content is produced and published to maintain audience engagement.

- Production Costs: Analyze the costs associated with content creation (e.g., video production, graphic design) to ensure profitability.

- Time Investment: Assess the time spent on content creation, engagement, and administration to optimize workflows.

Content Quality Assessment: Evaluate the quality of produced content through audience feedback, ratings, and shares to enhance production standards.

- Conversion Rates: Measure the effectiveness of promotional campaigns in converting followers into customers or subscribers.

- Referral Traffic: Track the amount of traffic directed to brands’ websites through influencer marketing efforts.

- Influencer Marketing Spend vs. Revenue: Analyze the total spend on influencer marketing campaigns relative to the revenue generated to ensure a positive return.

- Campaign Reach and Impressions: Assess the total reach and impressions generated by marketing campaigns to evaluate their visibility and effectiveness.

- Contract Compliance: Monitor adherence to contractual obligations with brands and sponsors to avoid potential disputes.

- Disclosure Metrics: Ensure compliance with regulations regarding sponsored content, such as proper disclosure of partnerships and sponsored posts.

- Risk Management: Identify potential legal risks associated with content creation and partnerships to mitigate liabilities.

- Intellectual Property Management: Track usage rights for content, including images, music, and videos, to protect against infringement and ensure proper licensing.

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services