Accounting and Bookkeeping for Insurance Agencies

Accounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping.

Our team has years of experience working with insurance agencies. We understand the unique requirements and provide a customized solution.

We provide virtual bookkeeping services overcoming the barriers of time, place, and infrastructure. We provide a comprehensive range of services, including accounting reconciliation, tax preparation, bookkeeping, etc.

Our team comprises qualified CPAs, CAs, and accountants having years of experience working with insurance agencies.

Our experts with hands-on experience in the latest accounting software and technology take care of all your daily bookkeeping and accounting tasks.

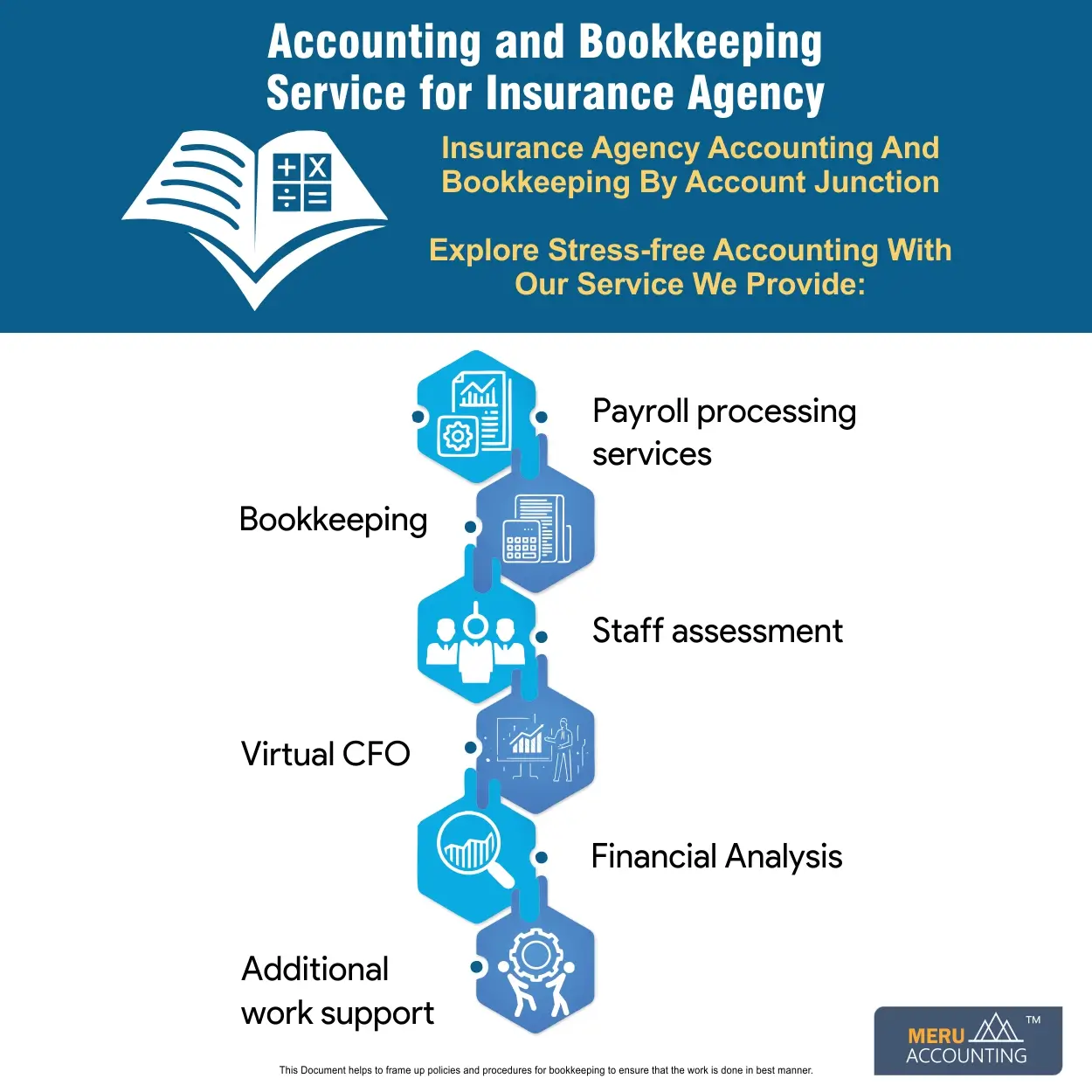

Insurance Agency Accounting and Bookkeeping Services

Payroll Processing Services:

Our payroll service helps insurance agencies to focus more on growth and core tasks. We provide end-to-end payroll processing services to our clients and have the flexibility to opt for any specific services. With our virtual services, you are free from infrastructure and staff restrictions. It helps to save time and cost without compromising on quality.

Financial Analysis:

Our team of insurance agency bookkeeping experts can go beyond the daily routine task; provide helpful business reports and analysis. It helps in making an informed business decision in running your agency well.

Bookkeeping:

As a leading pioneer in monthly accounting services, we offer a flexible and comprehensive range of services to meet the requirements of the insurance agency business.

Virtual CFO:

We boost the confidence of the agency owners through efficient management of financial functions. We provide accurate and meaningful reports and ensure quality accounting.

Accounts Receivables Services:

Accounts Junction provides accounts receivable services to clients across the globe at affordable rates. We provide flexibility to customers to opt for a wide range of services including accounts receivables as per their requirements.

Staff Assessments:

Our accounting experts have years of experience in accounting for insurance agencies and are well-versed with the latest accounting software. They help in the utilization of this software to its full potential. We help our clients with enhanced efficiency and accuracy by reviewing existing workflows and procedures.

Additional Work Support:

Are you facing a shortage of staff? No worries, we can provide support and assistance when you need it the most.

Fixed Assets Management:

Our dedicated team of professionals helps in the effective management of fixed assets. It involves maintenance and tracking of the physical assets and equipment of the business.

Value-added Bookkeeping Services for Insurance Agencies

We not only provide standard insurance agency bookkeeping services; but also customized reporting services. We provide our clients with daily, weekly, and monthly reporting services. It includes:

- Cash reports

- Income statement and balance sheet reports

- Producer commission reports

- Expiration lists of CSR and agents

- Trust accounts reconciliation reports

- Missed renewal lost

- Operating account reconciliation services

Why Choose Us

At Account Junction, you get access to our talented and dedicated experts and quality services. You can have more time to focus by outsourcing your insurance agency bookkeeping to us

With us, you no longer need a full-time bookkeeper. We have hourly pay rates, so you only pay for the service hours received.

Benefits of Bookkeeping and Accounting for Insurance Companies:

1. Accurate Financial Transactions:

Bookkeeping ensures all financial transactions related to policies, premiums, and claims are accurately recorded, providing a clear audit trail and compliance with regulatory requirements.

2. Performance Assessment:

Accounting helps assess key financial performance metrics such as loss ratio, expense ratio, and combined ratio, enabling insurers to evaluate their profitability and efficiency.

3. Informed Business Decisions:

Reliable financial data analysis allows insurance agencies to make informed decisions based on the financial health of the company, helping optimize operations and drive growth.

4. Compliance with Regulations:

Bookkeeping and accounting in insurance ensure adherence to industry-specific regulations and compliance requirements, mitigating the risk of penalties and legal issues.

5. Transparency with Stakeholders:

Accurate financial reporting enhances transparency with stakeholders, including policyholders, shareholders, and regulatory bodies, fostering trust and credibility.

6. Financial Planning and Budgeting:

Bookkeeping and accounting provide the foundation for effective financial planning and budgeting, enabling insurers to set goals, allocate resources, and make strategic investments.

7. Risk Management:

Analyzing financial data helps insurers identify potential risks, such as high claim ratios or unsustainable expense levels, allowing proactive risk management strategies to be implemented.

8. Regulatory Compliance:

Bookkeeping and accounting assist insurers in meeting regulatory reporting and disclosure requirements, ensuring compliance with accounting standards and regulations specific to the insurance industry.

9. Investment Management:

Accurate financial records facilitate investment management activities, including tracking investment income, evaluating portfolio performance, and managing reserves or surplus funds.

10. Competitive Advantage:

Sound bookkeeping and accounting practices give insurance agencies a competitive edge by providing a clear financial picture, supporting strategic decision-making, and demonstrating financial stability to clients and partners.

Partnering with Accounts Junction can be a game-changer for insurance companies. With our expertise in bookkeeping and accounting services tailored specifically for the insurance industry, we provide invaluable support in navigating the complexities of financial management. By outsourcing these crucial tasks to professionals who understand the unique challenges faced by insurance companies, organizations can streamline operations, maintain accurate records, and ensure compliance with regulatory requirements. With Accounts Junction by their side, insurance companies gain the peace of mind to focus on their core business of providing comprehensive coverage and exceptional customer service. The collaboration with Accounts Junction empowers insurance companies to make informed decisions, optimize profitability, and unlock new growth opportunities, setting them on a path to sustained success in the dynamic world of insurance.

How Accounts Junction Helps Insurance Firms in Bookkeeping and Accounting

1. Industry Expertise:

Account Junction specializes in working with insurance firms, possessing in-depth knowledge of the unique financial requirements and regulatory compliance within the insurance industry.

2. Accurate Financial Records:

Account Junction ensures that financial records are meticulously maintained, including tracking income, expenses, and transactions specific to insurance operations, providing accurate and reliable financial data.

3. Timely Financial Reporting:

The firm provides regular financial reports, including balance sheets, income statements, and cash flow statements, giving insurance businesses a comprehensive understanding of their financial health.

4. Tax Compliance:

Account Junction assists insurance firms in meeting tax obligations by preparing and filing tax returns accurately and on time, ensuring compliance with relevant tax regulations.

5. Expert Financial Insights:

The firm offers expert advice and financial analysis, leveraging insurance-specific expertise to identify areas for improving profitability, reducing costs, and maximizing financial performance.

6. Effective Communication:

Account Junction maintains open lines of communication, responding promptly to client inquiries and providing clear explanations of complex financial matters to ensure a smooth and productive working relationship.

7. Technological Integration

The firm utilizes advanced software and technology solutions that streamline bookkeeping and accounting processes, enabling real-time access to financial data and enhancing efficiency.

8. Tailored Services:

Account Junction customizes its services to meet the specific needs and goals of insurance firms, providing personalized financial solutions aligned with their business objectives.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 1000 | Bank & Cash Accounts | Bank |

| 2 | 1001 | Operating Bank Account | Bank |

| 3 | 1002 | Petty Cash | Bank |

| 4 | 1200 | Accounts Receivables | Accounts Receivable |

| 5 | 1201 | Client Receivables | Accounts Receivable |

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services