Bookkeeping and Accounting for Lumberjacks

Skilled laborers who specialize in extracting and processing wood and wood products are known as lumberjacks. They play a vital part in the forestry sector by falling trees, chopping them into logs, and moving them to sawmills or other processing facilities. Even though their jobs are physically demanding, lumberjacks nevertheless have to run their businesses profitably. Logging and accounting are essential for woodcutters to monitor their earnings, control spending, adhere to tax laws, and make wise business choices.

Accounts Junction offers customized solutions made especially for woodcutters. These solutions include tracking and classifying earnings and outlays, balancing bank accounts, preparing and submitting tax returns, creating financial statements, and guaranteeing adherence to legal and regulatory obligations. Lumberjacks can concentrate on their primary company operations and leave the financial management to the professionals by outsourcing their bookkeeping and accounting responsibilities to Accounts Junction. This will ensure the long-term success and sustainability of the business.

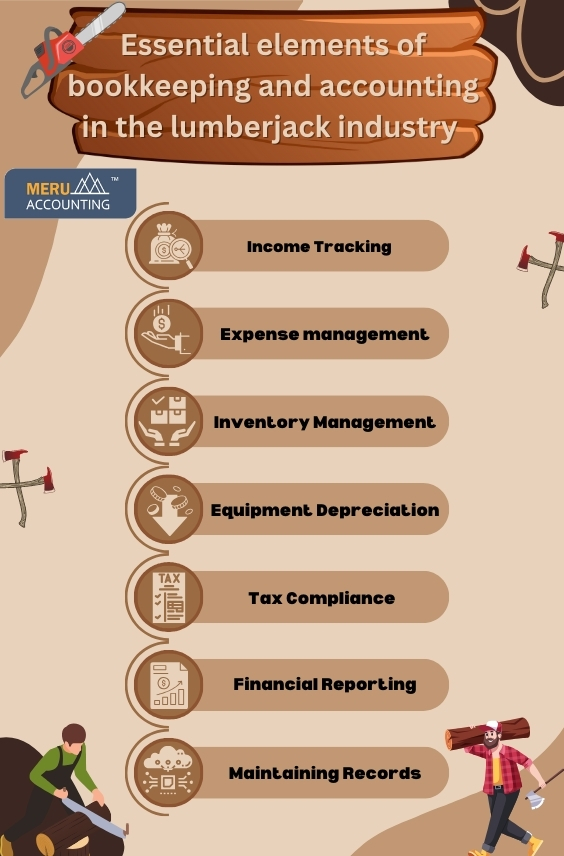

Essential Elements of Bookkeeping and Accounting for Lumberjack Industry

Accounting and bookkeeping are essential for overseeing financial transactions, monitoring resources, and guaranteeing regulatory compliance in the lumberjack sector. The following are the main facets of bookkeeping and accounting in the lumberjack sector:

-

Income Tracking: Lumberjacks get money from a variety of sources, including selling wood, doing logging work, and processing wood goods. Maintaining precise income tracking helps evaluate the business's financial performance by ensuring that all revenue is appropriately documented.

-

Expense management: Fuel, insurance, labor, permits, equipment upkeep, permits, and transportation are just a few of the many costs that lumberjacks must deal with. Monitoring these expenses, finding opportunities for cost optimization or reduction, and making sure that spending stays within financial limits are all necessary for effective expense management.

-

Inventory Management: Lumberjacks need to manage inventory levels of harvested timber and processed wood products. This includes tracking the quantity, quality, and value of inventory on hand, as well as monitoring stock levels to meet customer demand and minimize storage costs.

-

Equipment Depreciation: Lumberjacks rely heavily on specialized equipment such as chainsaws, trucks, skidders, and loaders. Accounting for equipment depreciation involves recognizing the decrease in value of these assets over time, which impacts profitability and tax liability.

5.Tax Compliance: At the municipal, state, and federal levels, lumberjacks are subject to a number of tax laws. This includes paying sales taxes due, completing tax reports, and abiding by the tax regulations pertaining to business income, payroll, and equipment depreciation.

6. Financial Reporting: The creation of financial reports, including cash flow, balance sheet, and profit and loss statements, offers important information on the state of the business company's finances. These reports help assess performance, identify trends, and make informed business decisions.

7. Maintaining Records: Maintaining accurate and organized financial records is essential for transparency, accountability, and audit readiness. Proper record-keeping ensures that all financial transactions are documented, archived, and easily accessible for reference or verification purposes.

What Distinguishes Accounting for Lumberjacks from General Accounting?

Although generic accounting concepts offer a basis that can be used by a multitude of businesses, accounting for lumberjacks involves certain subtleties and factors that are exclusive to the logging and forestry industry. The following are some significant distinctions between general accounting and accounting for woodcutters:

Job Costing:

Typically, lumberjacks work on distinct forestry or logging projects, each with their own expenses and earnings. In order to precisely estimate project profitability and assign costs, job costing entails keeping track of the direct and indirect costs related to each project, such as labor, equipment utilisation, supplies, and overhead.

Equipment Depreciation:

Chainsaws, skidders, loaders, and trucks are just a few examples of the specialized tools and machinery that lumberjacks use on a daily basis. For financial statements, tax liabilities, and equipment replacement plans to appropriately reflect the deterioration of these assets over time, depreciation of equipment must be taken into account.

Revenue Recognition:

Revenue recognition in the forestry industry may be influenced by factors such as timber harvesting contracts, stumpage fees, and timber sales agreements. Lumberjacks may recognize money as they harvest and process trees over time, as opposed to at the time of sale, in contrast to standard sales transactions.

Seasonality:

Demand, weather, and harvesting operations are all frequently impacted by seasonal variations in the forestry sector. To account for seasonal variations in revenue and expenses, accounting for lumberjacks may involve making adjustments to financial projections, budgeting, and cash flow management.

Environmental Aspects:

When operating, lumberjacks need to take the conservation and sustainability of the environment into account. In order to appropriately account for environmental consequences, such as the costs associated with reforestation, habitat restoration, and carbon offset programmes, certain accounting techniques might be needed.

Risk management:

The logging industry presents special risks to lumberjacks, such as equipment failures, worker safety issues, natural calamities, and changes in the market. Assessing and reducing these risks through insurance coverage, backup plans, and cash reserves are all part of accounting for risk management.

What Accounting and Bookkeeping Services are Offered by Accounts Junction?

A wide range of bookkeeping and accounting services are provided by Accounts Junction, specifically designed to satisfy the demands of lumberjacks in the forestry sector. The following are some of the main services that Accounts Junction offers to lumberjacks:

Income Tracking:

ales of wood products, logging services, and timber are just a few of the sources of income that Accounts Junction precisely tracks and classifies for lumberjacks. This guarantees accurate recording and accounting for all income in the financial records.

Expense Management:

Accounts Junction keeps track of and oversees the costs of labor, gasoline, permits, insurance, and transportation in addition to equipment upkeep for lumberjack operations. By monitoring expenses, lumberjacks can identify cost-saving opportunities and ensure that expenses are within budgetary constraints.

Inventory Control:

Accounts Junction helps lumberjacks keep track of the amount of harvested and processed wood products they have on hand. This entails monitoring the amounts, prices, and movements of inventory in addition to adjusting inventory levels to maximize client demand and reduce storage expenses.

Equipment Depreciation:

By precisely documenting and monitoring the depreciation costs connected to their machinery and equipment, Accounts Junction assists lumberjacks in accounting for equipment depreciation. By doing this, the equipment's cost is guaranteed to be fairly distributed during its useful life and to be represented in the financial statements.

Work Costing:

Lumberjacks can monitor the expenses related to individual logging or forestry projects by using Accounts Junction's work costing services. In order to help lumberjacks evaluate the profitability of their projects and make wise business decisions, this comprises labor costs, equipment utilization, materials, and administrative expenses.

Taxes:

By preparing and filing tax forms, paying sales taxes (if applicable), and abiding by tax laws pertaining to business income, payroll, and equipment depreciation, Accounts Junction makes sure that lumberjacks comply with tax requirements. In doing so, lumberjacks are able to stay out of trouble with the tax authorities and avoid penalties.

Financial Reporting:

For lumberjacks, Accounts Junction produces financial reports that include cash flow statements, balance sheets, and profit and loss statements. These reports give lumberjacks insightful information about the company's financial performance, which they can use to evaluate profitability, spot patterns, and formulate strategic plans.

Although generic accounting concepts offer a structure for managing finances in various businesses, lumberjack accounting necessitates specific knowledge and proficiency to tackle the distinct obstacles and factors present in the forestry and logging domain. Businesses may maximize their financial performance, guarantee regulatory compliance, and manage natural resources responsibly for future generations by comprehending and customizing accounting procedures to fit the unique requirements of lumberjacks.

Accounts Junction provides a full range of bookkeeping and accounting services aimed at helping lumberjacks in the forestry sector succeed financially. Lumberjacks may concentrate on their core business operations while maintaining accurate and compliant financial records by contracting with Accounts Junction to handle their bookkeeping and accounting needs.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 2000 | Accounts Payables | Accounts Payable |

| 2 | 2000 | Accounts Payables:Accounts Payable | Accounts Payable |

| 3 | 1200 | Accounts Receivables | Accounts Receivable |

| 4 | 1000 | Bank & Cash Accounts | Bank |

| 5 | 1000 | Bank & Cash Accounts:Savings Account | Bank |

Lumberjacks Industry Faqs

Frequently Asked Insights

1. Why do lumberjacks require bookkeeping services?

Bookkeeping assists in monitoring income from logging contracts, managing equipment maintenance expenses, and tracking fuel costs to maintain accurate financial records.

2. What expenses can lumberjacks claim on taxes?

Tax-deductible expenses may include chainsaw purchases, safety equipment, vehicle-related costs, and professional training or certification fees.

3. How can bookkeeping help track seasonal income?

We establish systems to track income and expenses throughout the busy and off-season logging periods, helping you manage seasonal fluctuations.

4. Which accounting software is suitable for lumberjacks?

Accounting software such as QuickBooks Self-Employed or Wave is well-suited for freelancers, allowing them to easily track income and expenses.

5. How do I manage repair and replacement costs for my equipment?

Bookkeeping helps set aside funds for routine equipment maintenance and ensures you have financial reserves for equipment replacement when necessary.

6. What reports are important for lumberjack businesses?

Key financial reports, including equipment cost summaries, contract income breakdowns, and cash flow projections, are essential for effective financial management.

7. How can I track earnings from various logging contracts?

We implement systems to categorize income by project or client, making it easier to manage financial records for multiple logging contracts.

KPI Of Lumberjacks

- Timber Sales Analysis: Monitor income from different types of timber sales, identifying which wood varieties and grades generate the highest revenue.

- Market Price Trends: Track market price fluctuations for timber, helping lumberjacks time their sales to maximize profits.

- Contract Revenue: Evaluate income from long-term contracts with mills, construction companies, and other buyers to ensure steady cash flow.

- Seasonal Revenue Patterns: Analyze how revenue varies across different seasons, helping plan for peak periods and slowdowns.

- Equipment and Maintenance Costs: Track expenses for machinery, tools, and maintenance, ensuring efficient allocation of resources and preventing costly breakdowns.

- Fuel and Transportation Costs: Monitor fuel usage and transportation expenses to identify savings opportunities and optimize routes.

- Labor Costs: Analyze wages and benefits for logging crews, balancing labor costs with productivity to maintain profitability.

- Licensing and Permit Fees: Track costs associated with obtaining and renewing necessary licenses and permits, ensuring compliance with forestry regulations.

- Harvest Yield Metrics: Measure the volume of timber harvested per unit of time or effort, identifying areas for improvement in efficiency and output.

- Waste Reduction: Analyze the amount of timber waste generated during the harvesting process, implementing strategies to minimize waste and maximize usable product.

- Time Management: Track the time spent on different tasks, from tree felling to transportation, optimizing workflows to reduce downtime and increase productivity.

- Safety Incident Tracking: Monitor safety incidents and related costs, implementing preventive measures to protect workers and reduce liabilities.

- Profit Margin Analysis: Calculate net profit margins to assess overall financial health, factoring in all revenues and expenses.

- Cash Flow Management: Monitor cash inflows and outflows to ensure sufficient liquidity for ongoing operations and future investments.

- Debt and Liability Tracking: Evaluate the levels of debt and liabilities, helping to manage financial risks and plan for debt repayment.

- Savings and Investment Tracking: Track savings and investments to help lumberjacks plan for long-term financial stability and growth.

- Market Demand Forecasting: Analyze market demand trends for different types of timber, guiding strategic decisions on harvesting and sales.

- Customer Satisfaction Metrics: Gather feedback from buyers and partners to understand satisfaction levels and improve service quality.

- Innovation and Technology Adoption: Track the adoption of new technologies and their impact on efficiency and profitability, staying ahead in the industry.

- Regulatory Impact Analysis: Track changes in forestry regulations to ensure compliance and adapt operations proactively.

- Emerging Market Opportunities: Identify new markets for timber products, diversifying revenue streams and reducing risks.

- Reforestation Efforts: Monitor the number of trees replanted versus harvested, ensuring compliance with sustainable forestry practices and contributing to environmental conservation.

- Carbon Footprint Analysis: Track carbon emissions from fuel, machinery, and transportation, implementing measures to reduce environmental impact.

- Sustainable Certification Tracking: Monitor progress towards obtaining and maintaining certifications such as FSC (Forest Stewardship Council), which can enhance reputation and marketability.

- Soil and Water Conservation Metrics: Evaluate the impact of logging activities on soil erosion and water quality, implementing strategies to minimize adverse effects.

- Wildlife Impact Monitoring: Track any effects on local wildlife due to logging activities, ensuring compliance with wildlife protection regulations.

- Logistics Efficiency Metrics: Measure the speed and cost-effectiveness of transporting timber from forests to mills or buyers, optimizing for fuel savings and shorter delivery times.

- Supply Chain Lead Time: Track the time taken from order placement to timber delivery, identifying delays and bottlenecks in the supply chain.

- Vendor Performance Metrics: Monitor the reliability and quality of services provided by third-party vendors, such as equipment suppliers or transport companies.

- Timber Quality Tracking: Measure the quality of timber delivered to buyers, ensuring it meets customer expectations and contractual specifications.

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services