Bookkeeping and Accounting for Makeup Artists

Professionals with expertise in applying cosmetics and other beauty products to enhance the appearance of their clients are known as makeup artists. Salons, spas, fashion shows, movie and television sets, weddings, and special events are just a few of the places they work. Even though makeup artists work in a creative and artistic field, they nevertheless have to efficiently handle the financial side of their business. Makeup artists need bookkeeping and accounting to keep track of their earnings, control spending, adhere to tax laws, and make wise business decisions.

Accounts Junction offers customized solutions made especially for makeup artists. These solutions include services like bank account reconciliation, tax return preparation and filing, income and expense tracking, financial report generation, and guaranteeing adherence to legal and regulatory requirements.

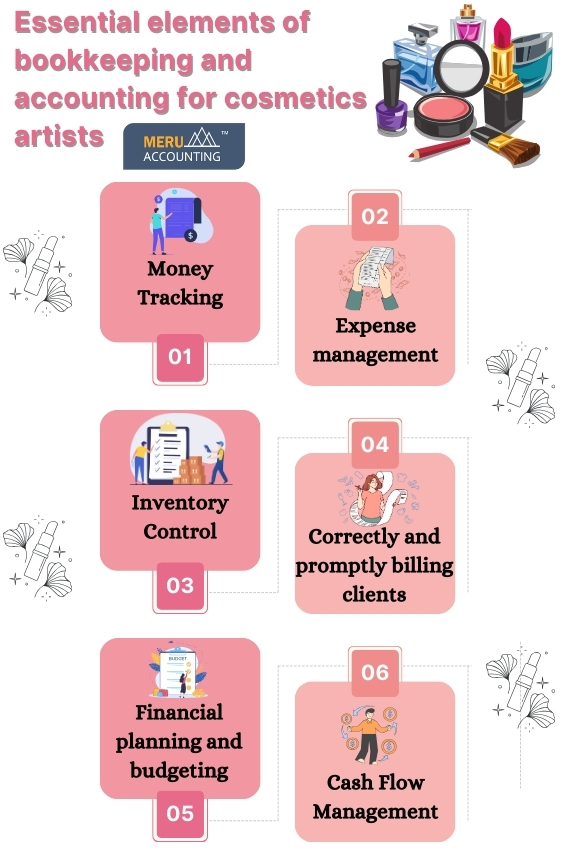

Essential elements of Bookkeeping and Accounting for Cosmetics Artists

For makeup artists to efficiently manage the financial side of their business, accounting and bookkeeping are crucial. Some fundamental elements are:

Money Tracking:

Makeup artists must keep precise records of all their earnings, including payments for services rendered, sales of products, and any additional money from workshops or bridal packages.

Expense management:

As part of their business, makeup artists have to pay for a variety of things, including supplies (brushes, mirrors, lighting), travel fees for on-location work, marketing and advertising charges, and studio rent (if any). Tracking these expenses is necessary for proper spending management to maintain profitability and efficiently manage cash flow.

Inventory Control:

This is a critical function for makeup artists who also sell products. This entails keeping tabs on sales patterns, keeping track of the numbers and values of beauty goods that are in stock, and refilling inventory as needed to satisfy demand from customers while reducing waste and carrying costs.

Correctly and promptly billing clients:

This entails preparing invoices for services given, outlining the nature of the work, the cost, and the terms of payment. Effective invoicing guarantees prompt payment and contributes to the preservation of good client relations.

Financial planning and budgeting:

These are helpful tools for makeup artists to use when making business decisions. This involves setting financial goals, projecting income and expenses, and identifying areas for growth and cost-saving opportunities.

Cash Flow Management:

In order to have enough cash on hand to pay bills and make investments in their company's expansion, makeup artists must effectively manage their cash flow. This entails keeping an eye on the comings and goings of cash, negotiating the best terms of payment with suppliers, and keeping a cash reserve for unforeseen circumstances.

What distinguishes accounting for makeup artists from regular accounting?

Accounting for makeup artists involves unique factors and subtleties not found in regular accounting procedures. The following are some significant variations:

-

Income Sources: Makeup artists frequently earn a variety of incomes from product sales, bridal packages, workshops, and freelance work at salons, weddings, fashion events, and movie sets, among other venues. It's important to precisely track and classify these many revenue streams when accounting for makeup artists.

-

Product Inventory: Unlike many service-based enterprises, makeup artists may offer their customers cosmetics and other beauty items. Keeping track of product sales, maintaining inventory levels, and restocking supplies to satisfy client demand while reducing waste and carrying costs are all part of accounting for makeup artists.

-

Client Montana: Makeup artists usually charge their customers for the services they provide, frequently on an event or session-by-session basis. Different billing procedures may be used depending on the clientele, geography, and industry norms. Effective invoicing and billing procedures are essential for makeup artists' accounting in order to guarantee on-time payment and preserve good client relations.

-

Travel Costs: When makeup artists work on-location for events like weddings, photo shoots, or movie productions, they may have to pay for their trip. Accounting for travel expenses entails keeping an account of expenditures for things like lodging, meals, incidentals, and transportation in addition to, if necessary, assigning costs to certain projects or clients.

-

Marketing and Promotion: In order to draw customers and establish their brand, makeup artists may choose to spend money on marketing and promotion. Tracking advertising, social media marketing, website construction, and promotional material costs is part of accounting for marketing spending. It also entails assessing the return on investment (ROI) of marketing campaigns.

-

Professional Development: In order to stay up to date with the latest trends, methods, and product advancements in the business, makeup artists frequently invest in continuing education and training. Keeping track of the expenditures of conferences, seminars, training, certifications, and other events is part of accounting for professional development expenses. You also need to evaluate how these investments affect the expansion and profitability of your company.

-

Tax deductions: Makeup artists may be able to deduct some costs from their taxes as a result of their company, including supplies, home office expenses, professional licenses and memberships, and travel. To optimize tax savings and ensure compliance with tax authorities, accounting for tax deductions necessitates an awareness of pertinent tax laws and regulations.

Services we offer to Makeup Artists

A whole range of bookkeeping and accounting services from Accounts Junction is specifically designed to fulfill the demands of makeup artists working in the beauty sector. Accounts Junction offers cosmetics artists several essential services, some of which are as follows:

Income Tracking:

All forms of income for cosmetic artists, such as fees for makeup services, product sales, bridal packages, workshops, and freelance work, are precisely recorded and categorized by Accounts Junction. This guarantees accurate recording and accounting for all income in the financial records.

Expense Administration:

Accounts Junction keeps track of and oversees all costs related to makeup artist operations, such as buying beauty items and cosmetics, paying for on-location services through travel, paying for marketing and advertising, and paying studio rent (if any). Makeup artists can find ways to cut costs and make sure that their expenses stay within their budget by keeping an eye on their spending.

Inventory Control:

Keeping track of supplies is essential for makeup artists who sell goods. Accounts Junction helps makeup artists optimize inventory levels to meet consumer demand while minimizing storage costs, which helps them track quantities, values, and movements of cosmetics and beauty products.

Client billing and invoicing:

This includes generating invoices that clearly outline the services done, their costs, and the terms of payment. Prompt payment and a strong client relationship are guaranteed by effective invoicing.

Tax Compliance:

By preparing and filing tax returns, paying sales taxes (if applicable), and abiding by tax laws pertaining to business income, deductions, and self-employment taxes, Accounts Junction makes sure that makeup artists comply with tax requirements. Hence, makeup artists can stay out of trouble with the IRS and avoid penalties.

Financial Reporting:

Accounts Junction produces financial reports that include cash flow statements, balance sheets, and profit and loss statements. These reports offer insightful information about the company's financial performance, which assists makeup artists in determining trends, evaluating profitability, and formulating strategic plans.

Though accounting concepts serve as a basis for financial management in many businesses, makeup artists' accounting requires specific knowledge and skills to handle the particular issues and concerns that are particular to the beauty and cosmetics sector. Through comprehension and modification of accounting procedures to suit the particular requirements of makeup artists, enterprises can maximize their fiscal outcomes, uphold regulatory adherence, and secure enduring prosperity in the fiercely competitive beauty industry.

Accounts Junction provides a wide range of bookkeeping and accounting services aimed at helping makeup artists in the beauty business succeed financially. Accounts Junction handles bookkeeping and accounting for makeup artists so they may concentrate on their creative job and still have precise and compliant financial records. Contact us now and lead your profession toward growth and success.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 2000 | Accounts Payables | Accounts Payable |

| 2 | 2000 | Accounts Payables:Accounts Payable | Accounts Payable |

| 3 | 1200 | Accounts Receivables | Accounts Receivable |

| 4 | 1200 | Accounts Receivables:1 A/R - Consulting | Accounts Receivable |

| 5 | 1000 | Bank & Cash Accounts | Bank |

Makeup Artists Industry Faqs

Frequently Asked Insights

1. Why is bookkeeping important for makeup artists?

It helps track income from clients, product purchases, and travel expenses, ensuring financial clarity.

2. Can makeup artists deduct beauty supplies and tools on taxes?

Yes, expenses for makeup products, brushes, tools, and professional training can be tax-deductible.

3. How can bookkeeping assist with tracking freelance work?

Bookkeeping helps track income from different clients, including freelance gigs, events, and product sales.

4. What accounting tools work best for makeup artists?

QuickBooks Self-Employed or FreshBooks are great options to manage client invoicing and expenses.

5. How do I manage payments for recurring clients?

Bookkeeping systems can automate billing for repeat clients, helping you stay organized and ensuring timely payments.

6. Can bookkeeping help plan for slow seasons?

Yes, by reviewing cash flow trends, you can set aside savings for lean months or off-peak times.

7. What financial reports should makeup artists keep track of?

Profit and loss statements, income by client or event type, and expense breakdowns are useful for managing finances.

8. How can bookkeeping help with pricing my services?

By tracking costs, income, and profit margins, bookkeeping helps determine competitive pricing that covers expenses and ensures profitability.

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services