Financial Planning and Analysis

Effective financial planning and analysis are crucial for making informed decisions. At Meru Accounting, we understand that financial planning and analysis is the foundation of effective business management. Our services are designed to help businesses make informed financial decisions, optimize their financial performance, and achieve their strategic goals. Our team of experienced financial professionals is committed to providing personalized financial planning and analysis services, precisely crafted to align with your specific requirements.

What is Financial Planning and Analysis?

Financial Planning and Analysis is an important business function that involves budgeting, forecasting, financial modeling, and performance analysis. It helps organizations to:

- Set financial goals Set defined and attainable financial goals that align with your business strategy.

- Develop financial plans Create detailed plans that outline how to achieve these financial goals.

- Monitor performanceTrack actual performance against the financial plans and goals.

- Make informed decisions Provide insights and recommendations based on financial data analysis to support decision-making.

Our Financial Planning and Analysis Services

At Meru Accounting, we offer comprehensive FP&A services custom to meet the unique needs of your business. Our services include:

- 1. Budgeting and Forecasting

- Effective budgeting and forecasting are essential for maintaining financial health and achieving business objectives.

- 1. Develop robust budgets: We create detailed budgets that align with your strategic goals.

- 2. Create accurate forecasts: We use historical data and market trends to predict future financial performance.

- 3. Adjust plans dynamically: We continuously revise budgets and forecasts to adapt to shifts in the business landscape.

- 2. Financial Modeling

- Financial models are vital tools for decision-making and strategic planning. We provide

- 1. Custom-built models: Develop tailored financial models that reflect your specific business operations and scenarios.

- 2. Scenario analysis: Test various scenarios to understand potential impacts on your business.

- 3. Sensitivity analysis: Evaluate how various factors influence your financial results.

- 3. Performance Analysis

- Evaluating how your business is performing against its financial goals is critical. Our performance analysis services include

- 1. Variance analysis: Compare actual performance to budgeted figures to identify deviations and their causes.

- 2. Key performance indicators (KPIs): Develop and track KPIs to measure and monitor your business’s financial health.

- 3. Trend analysis: Analyze historical data to identify trends and inform future planning.

- 4. Strategic Planning

- Strategic financial planning is essential for long-term success. Our services in this area include

- 1. Long-term financial planning: Develop financial plans that align with your strategic objectives over the long term.

- 2. Capital allocation: Advice on the optimal allocation of resources to maximize returns.

- 3. Risk management: Identify and mitigate financial risks to ensure stability and growth.

- 5. Management Reporting

- Clear and concise management reports are crucial for effective decision-making. We provide

- 1. Customized reports: Create customized reports that align with your business objectives and meet the needs of your stakeholders.

- 2. Dashboard creation: Develop dynamic dashboards that offer instant visibility into your financial performance.

- 3. Regular updates: Ensure that reports are updated regularly to reflect the latest data and insights.

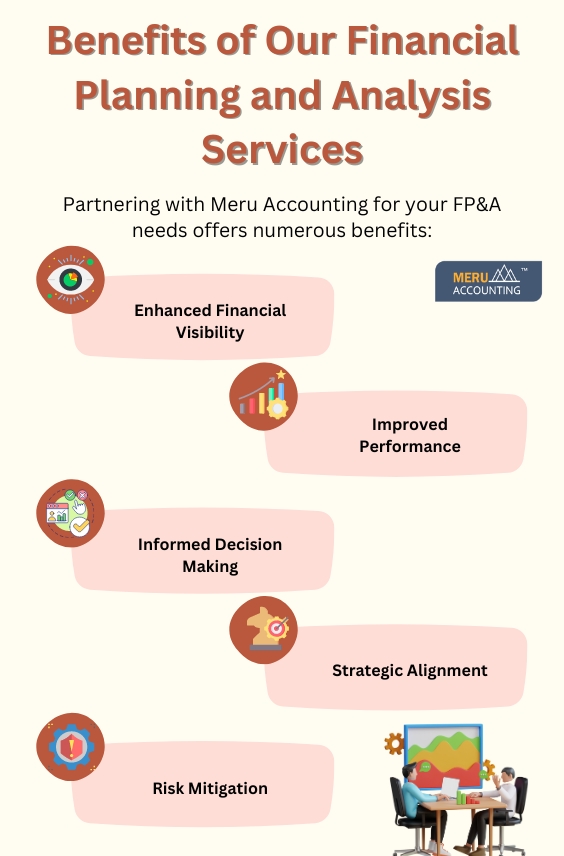

Benefits of Our Financial Planning and Analysis Services

Partnering with Meru Accounting for your FP&A needs offers numerous benefits

- Enhanced Financial Visibility you will gain a clear and comprehensive view of your financial situation, enabling better decision-making and strategic planning.

- Improved PerformanceIdentify areas for improvement and implement strategies to enhance financial performance and operational efficiency.

- Informed Decision MakingAccess to accurate and timely financial data allows you to make informed decisions that drive growth and profitability.

- Strategic Alignment Ensure that your financial plans and activities are aligned with your overall business strategy, facilitating the achievement of long-term goals.

- Risk MitigationIdentify potential financial risks early and develop strategies to mitigate them, ensuring the stability and sustainability of your business.

Why Choose Meru Accounting?

Choosing Meru Accounting for your FP&A needs means partnering with a team of dedicated and experienced professionals committed to your success.

You need to find a reliable Xero bookkeeping service-providing agency that can improve the quality of bookkeeping. They can handle the bookkeeping and accounting tasks with Xero. Proper Xero bookkeeping services providing agency can help achieve accuracy in it.

Expertise Our team comprises highly skilled professionals with extensive experience in financial planning and analysis across various industries. We stay ahead of the latest trends to provide you with advanced solutions.

Customized Solutions Our services are custom to meet your specific needs, ensuring that you receive the most relevant and effective solutions.

Advanced Technology We leverage the latest financial planning tools and technologies to provide accurate, efficient, and insightful services. Our use of advanced software ensures that you have access to real-time data and analytics.

Client-Centric Approach our clients are our top priority. We take the time to understand your business, goals, and challenges, and work closely with you to develop solutions that drive your success.

Proven Track Record We have consistently demonstrated our ability to provide outstanding FP&A services to a broad spectrum of clients. Our success stories speak to our commitment to excellence and client satisfaction.

At Meru Accounting, we empower your financial success by providing custom financial planning and analysis services that address your unique needs and challenges. By partnering with us, you can experience the transformative ability of strategic financial planning, navigate the difficulties of financial management, and seize opportunities.

Contact us to schedule a consultation and learn how our financial planning and analysis services can benefit your business.

Our Bookkeeping And Writeup Process

Your Need

Search the Service You need

Enquiry

For enquiring make a call or mail us

Confirm

Get your Quote and confirm us

Stay Calm

Feel free and Relax Yourself

As a business owner you might not think accounting is about adding value to your core business. Being a leading

Read More

For any business across various industries, finance stands to be the most important factor in running it smoothly and viably.

Read More

A proper management of the finances in any business including Ecommerce and Hospitality is very important for all the

Read More

As there is a considerable changes in the technological world, most of the business activities are now done with necessary

Read More

If you want your business to run efficiently then a proper payroll processing is very essential. For businesses such as Law Firms which has employees, it is very

Read More

Businesses now have realized the need for the separate entity for handling the finances of the organization. This has

Read More

we all know that key element of running a successful business is having a plan. Therefor you require a Business Plan

Read More

today’s rapidly changing world and fast moving industrial competition, a business has to think from the angle of 360 degre

Read More

QuickBooks is one of the best Accounting and Bookkeeping software having more than 3.3 million users across the globe

Read More

As a business owner, you certainly want to have a proper check regarding the cash flow in the business. The unchecked and

Read More

Bookkeeping is very important for every business which handles all the financial transactions properly. Using the software in the accounting has made it easier

Read More

Every business needs to keep a better level of accuracy in their bookkeeping to have a better financial position. Maintaining

Read More

Every business strives to achieve financial efficiency which further helps it to improve its performance. Bookkeeping and

Read More

Effective financial planning and analysis are crucial for making informed decisions. At Meru Accounting, we understand that

Read More