Ceridian Dayforce Accounting Software

Ceridian Dayforce is a comprehensive Human Capital Management (HCM) platform designed to streamline HR, payroll, workforce management, and talent functions into one unified system. It empowers organizations to optimize their human resources processes, improve employee engagement, and enhance overall business efficiency.

This platform offers a comprehensive suite of tools for payroll, talent management, workforce management, and employee benefits, all within a single application. Ceridian Dayforce software provides real-time data analytics and reporting, enabling organizations to make informed decisions regarding their workforce. Its user-friendly interface allows employees to access their information, manage schedules, and submit requests easily.

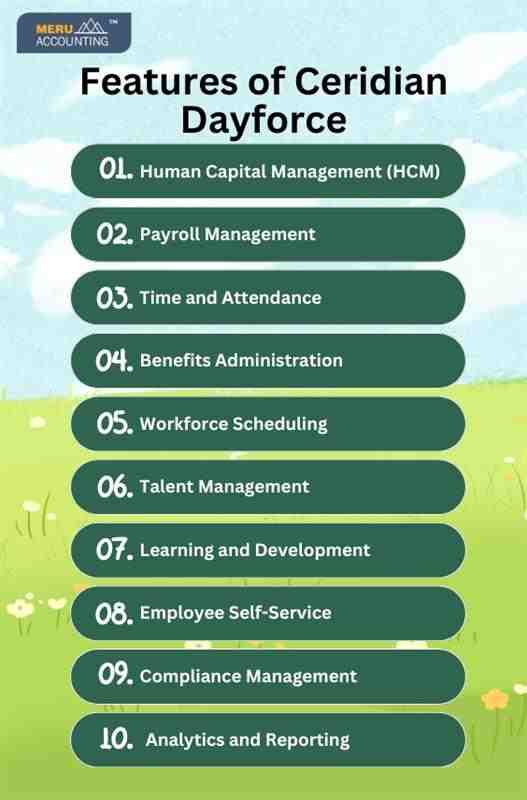

Features of Ceridian Dayforce

1. Human Capital Management (HCM)

- Streamlines employee lifecycle management from hiring to retirement.

- Integrates talent acquisition, performance management, and learning & development.

- Provides real-time insights into workforce data for informed decision-making.

2. Payroll Management

- Automates payroll processing for accuracy and compliance.

- Supports complex payroll scenarios including multi-state and international payroll.

- Provides detailed payroll reports for audit and financial analysis.

3. Time and Attendance

- Tracks employee attendance, work hours, and overtime automatically.

- Supports various time entry methods including mobile and biometric clocks.

- Generates real-time reports to ensure compliance with labor laws and business policies.

4. Benefits Administration

- Simplifies the management of employee benefits, including health, retirement, and wellness programs.

- Allows employees to manage and update their benefits preferences via self-service portals.

- Ensures compliance with regulations such as ACA and ERISA.

5. Workforce Scheduling

- Provides automated scheduling for employees, ensuring optimal staffing levels.

- Allows employees to view and modify their schedules via mobile or web.

- Integrates with attendance data to minimize scheduling conflicts and improve efficiency.

6. Talent Management

- Provides tools for performance management, employee development, and succession planning.

- Supports goal setting, performance reviews, and 360-degree feedback for employees.

- Tracks career progression and provides insights for workforce development.

7. Learning and Development

- Centralizes employee training records and learning resources in one platform.

- Offers personalized learning plans and development programs.

- Tracks training completion and certifications to ensure compliance and career growth.

8. Employee Self-Service

- Allows employees to manage their personal data, payroll, benefits, and more.

- Supports access to payslips, tax forms, and time-off requests through an intuitive portal.

- Increases employee engagement by empowering them to handle HR-related tasks independently.

9. Compliance Management

- Helps organizations stay compliant with local, state, and federal regulations.

- Provides automated updates to ensure adherence to changing labor laws and tax requirements.

- Generates compliance reports to reduce risk and support audits.

10. Analytics and Reporting

- Offers real-time dashboards for HR, payroll, and performance data.

- Customizes reports to track key metrics such as turnover, employee engagement, and payroll costs.

- Leverages data insights to improve workforce planning, compensation, and operational efficiency.

Benefits of Using Ceridian Dayforce Payroll

1. Global Workforce Management

- Multi-Language Support: Provides a multilingual platform to support global teams, allowing employees to interact with the system in their preferred language.

- International Payroll Compliance: Manages payroll processing and compliance for multiple countries, ensuring that all international operations meet local tax laws and labor regulations.

2. Onboarding

- Automated Onboarding Workflows: Simplifies the onboarding process by automating paperwork collection, document verification, and training, reducing the time to productivity.

- Employee Engagement: Engages new hires by providing a user-friendly interface for accessing company culture, resources, and training materials from day one.

3. Mobile Accessibility

- Mobile App for Employees and Managers: Provides a mobile application to enable employees to access their data, request time off, and check schedules, while managers can approve requests and view team performance.

- Real-Time Notifications: Sends push notifications to employees and managers about important updates, such as scheduling changes, time-off requests, or payroll issues.

4. Absence Management

- Tracking and Reporting: Tracks employee absences due to illness, vacation, and other reasons, providing real-time visibility into absence patterns.

- Policy Compliance: Ensures that absence policies are followed and automatically adjusts balances based on company rules and regulations.

5. Labor Cost Management

- Cost Allocation: Allocates labor costs to specific departments, projects, or cost centers, providing detailed insights into workforce expenditures.

- Cost Forecasting: Uses historical data to predict labor costs and helps organizations plan their budgets accordingly, improving financial management.

6. Workforce Optimization

- Demand-Based Scheduling: Automatically generates schedules based on predicted business demand, ensuring optimal staffing levels and minimizing labor costs.

- Skill-Based Scheduling: Matches employee skills and availability to the needs of the business, improving productivity and performance.

7. Health and Safety Compliance

- Tracking Workplace Incidents: Allows organizations to track health and safety incidents, ensuring that they meet regulatory requirements and improve workplace safety.

- Training and Certifications: Manages safety training courses and certifications to ensure employees are compliant with occupational health and safety regulations.

8. Employee Engagement and Well-Being

- Surveys and Feedback: Provides tools to gather employee feedback through surveys, helping organizations identify areas for improvement and increase engagement.

- Wellness Programs: Supports wellness programs by tracking participation, progress, and offering incentives for employees who engage in healthy activities.

Streamline Your Taxation Process by Using Ceridian Dayforce

1. Automated Tax Calculations

- Automatically calculates federal, state, and local taxes for employees based on location and tax filing status.

- Keeps tax calculations up to date by incorporating real-time changes in tax rates and regulations.

2. Tax Filing and Compliance

- Simplifies the preparation and e-filing of tax forms like W-2, 1099, and other necessary documents.

- Ensures compliance with local, state, and federal tax laws, reducing the risk of penalties and audits.

3. Integrated Payroll and Tax System

- Combines payroll and tax functions in one system to ensure accurate tax deductions from the start.

- Minimizes errors by syncing payroll data directly with tax calculations, streamlining the entire process.

4. Real-Time Tax Rate Updates

- Automatically updates the system with the latest tax rate changes, ensuring your payroll remains compliant at all times.

- Provides notifications to keep you informed about significant changes in tax regulations.

5. Tax Withholding Management

- Facilitates the management of employee withholding preferences, including adjustments for federal and state taxes.

- Allows employees to update their W-4 preferences and ensures withholdings align with their selections.

6. Quarterly and Year-End Tax Filings

- Automates the generation of quarterly tax filings, ensuring timely and accurate submissions.

- Generates year-end tax documents, such as W-2s and 1099s, and submits them directly to tax authorities.

7. Audit Trail and Documentation

- Maintains a clear audit trail for all tax-related transactions, providing a transparent record for future audits or reviews.

- Ensures accurate documentation of tax filings and payments, which can be easily accessed for audit purposes.

8. Tax Reporting and Analytics

- Provides comprehensive tax reports for internal audits, tax planning, and compliance tracking.

- Offers insights into tax liabilities and deductions, helping organizations plan for the future and optimize tax strategies.

Why Choose Accounts Junction?

- Expertise in Tax Compliance: Accounts Junction has extensive experience in managing federal, state, and local tax filings, ensuring that all requirements are met accurately and on time.

- Up-to-Date with Tax Laws: We stay informed about the latest changes in tax regulations, ensuring businesses remain compliant with any updates or revisions in tax law.

- Automated Tax Calculations: With automated tax calculations integrated into the system, Accounts Junction minimizes errors and reduces the administrative workload associated with tax filings.

- Customized Tax Solutions: Accounts Junction tailors tax strategies based on specific business needs, optimizing deductions and minimizing liabilities for each client.

- Seamless Integration: The integration of payroll and tax systems ensures that all tax deductions and filings are synchronized, reducing the risk of errors and delays.

- Real-Time Tax Updates: Accounts Junction provides real-time updates regarding changes in tax laws, ensuring continuous compliance without the need for manual tracking.

- Year-End Tax Reporting: We streamline the preparation and generation of year-end tax forms such as W-2s and 1099s, ensuring that the tax season runs smoothly and on time.

- Audit Support: In the event of an audit, Accounts Junction provides comprehensive documentation and full support, ensuring that businesses have all the necessary records for a successful resolution.

Services Offered by Accounts Junction Using Ceridian Dayforce Software

1. Automated Payroll Processing

- Automates the calculation of employee salaries, deductions, and benefits based on Ceridian Dayforce's integrated payroll system.

- Ensures timely and accurate salary payments, minimizing errors and administrative overhead.

2. Real-Time Tax Updates

- Provides real-time updates regarding changes in tax laws, keeping businesses aligned with the latest regulations.

- Automatically updates tax configurations in Ceridian Dayforce, ensuring ongoing compliance.

3. Employee Self-Service Portal

- Offers a user-friendly self-service portal for employees to access their pay stubs, benefits information, and tax forms.

- Empowers employees to make updates to their personal information and tax preferences, reducing HR workload.

4. Tax Withholding and Deduction Management

- Manages and adjusts employee tax withholdings based on W-4 forms and ensures proper deductions are made.

- Customizes deductions for various benefits and retirement plans, improving overall tax compliance.

5. Audit Support and Documentation

- Provides detailed records of all payroll and tax-related transactions to support audits or tax investigations.

- Keeps accurate documentation of tax filings and payments, ensuring transparency and ease of access during audits.

6. Direct Tax Payments

- Facilitates direct payments to tax authorities for federal, state, and local taxes, ensuring timely and accurate submissions.

- Tracks and sends reminders for upcoming tax payment deadlines, minimizing the risk of missed payments.

7. Year-End Tax Reporting

- Simplifies the preparation and generation of year-end tax forms (W-2, 1099, etc.) to ensure timely filing.

- Automates year-end tax reporting, reducing the administrative burden for businesses.

8. Custom Tax Solutions

- Offers tailored tax solutions to accommodate specific business needs, including multi-state or regional operations.

- Configures tax rates, deductions, and exemptions according to industry requirements or location-based tax regulations.

Conclusion

Accounts Junction offers comprehensive tax solutions using Ceridian Dayforce, ensuring seamless payroll and tax management. With automated tax calculations, real-time updates, and tailored strategies, businesses stay compliant with the latest regulations. The integration of payroll and tax functions reduces errors and administrative burden, while year-end reporting and audit support streamline the tax process for businesses.

Other Software

Zoho Books is a sophisticated, cloud-based accounting software designed to simplify business finances and enhance operational efficiency. Ideal for freelancers, small businesses, and growing enterp...

Read MoreQuickBooks Online is a cloud-based accounting software developed by Intuit, tailored to meet the needs of small to medium-sized businesses, freelancers, and accounting professionals.

Read MoreIntuit ProConnect is a suite of professional tax software products developed by Intuit, tailored specifically for tax professionals and accountants.This is a cloud-based tax preparation software th...

Read MoreAccountEdge is a robust accounting software designed to simplify financial management for small and medium-sized businesses. AccountEdge offers detailed services to handle core accounting tasks eff...

Read MoreLess Accounting is an accounting software designed for small businesses that prioritizes simplicity and efficiency. It offers essential accounting functionalities without overwhelming users with un...

Read More