Reckon One Software Accounting Software

Reckon One is a cloud-based accounting program made to make money management easier for companies of all kinds. Reckon One provides a versatile solution that adjusts to specific business needs, whether it's payroll, cost tracking, invoicing, or thorough financial reporting. It does this with its easy-to-use interface and configurable modules. With the help of the program, companies may automate repetitive processes, enter data less manually, and see their financial situation in real time. Reckon One Software also easily interacts with other corporate tools, increasing productivity and efficiency. Being compatible with local tax rules and supporting multi-currency transactions, it is an adaptable option for firms operating in a variety of markets. All things considered, Reckon One gives businesses the ability to make wiser selections and handle their money more skillfully.

Key Features of Reckon One Software for Accounting and Bookkeeping

1. Monitoring Time

- Streamlined Time Recording: Reckon Users can quickly log work hours for individual tasks, projects, or billable work with One's time-tracking tool. This guarantees precise billing and timekeeping.

- Timesheets that are automatically generated based on tracked hours minimise errors in human entry and increase productivity.

- Payroll integration: Integrates seamlessly with payroll processing, enabling companies to quickly and precisely calculate wages.

2. Access via Mobile

- Access Anytime, Anywhere: With Reckon One's mobile app, customers can track expenses, create reports, and manage their finances while on the road.

- Updates in Real Time: Receive immediate alerts and updates regarding changes and transactions pertaining to your finances, enabling you to remain in touch with your company wherever you are.

- Offline Functionality: Complete necessary chores even in the absence of an online connection, coordinating the data once the device is online.

3. Permissions Granted to Users

- Controlled Access Levels: Assign users varying degrees of access to make sure that only authorized individuals have access to sensitive financial data.

- Permissions Based on Roles: To restrict who can see, change, or administer particular data, assign roles like "viewer," "editor," or "administrator."

- Encourage safe cross-departmental cooperation while upholding the confidentiality and integrity of data.

4. Repeat Business

- Automated Periodic Posts: To cut down on errors and human input, schedule regular tasks like bills, payments, and invoicing.

- Personal Scheduling: Depending on your company's demands, you can set a unique frequency for recurring transactions, such as daily, weekly, monthly, or annually.

- Enhanced Cash Flow Management: By automating regular financial activities, this approach assists firms in maintaining a steady flow of cash.

5. GST Monitoring

- Automatic GST Calculation: This feature streamlines tax compliance by automatically calculating Goods and Services Tax (GST) on transactions.

- BAS creation: Enables the creation and filing of Business Activity Statements (BAS), guaranteeing their accurate and timely submission to tax authorities.

- GST Reporting: Produces thorough GST reports that show input credits and tax liabilities.

6. Bank Feeds Automated

- Real-time bank reconciliation saves time and lowers manual error rates by importing and reconciling transactions automatically by establishing a direct connection with bank accounts.

- Better Cash Flow Management: By maintaining current financial data, this approach offers real-time visibility into cash flow.

- Fraud Detection: By supplying accurate and current records, it facilitates the prompt detection of inaccuracies or unlawful transactions.

7. Getting Ready for BAS

- Simplified Tax Filing: Accurately computes GST, PAYG, and other taxes, automating the compilation of Business Activity Statements (BAS).

- Timely Submission: Prevents penalties by guaranteeing that all BAS submissions are accurate and made on schedule.

- Tax Compliance: By monitoring all tax obligations and payments, this service assists firms in adhering to local tax laws.

8. Templates Customizable Quote

- Report Templates: Offers quote, invoice, and report templates that can be customised to help organisations keep their identity consistent.

- Save Time: By standardising recurrent documents, predefined templates assist save time.

- Ensures that all documents that are viewed by customers have a professional appearance and are consistent with the company's branding.

9. Integration of APIs

- Seamless Connectivity: Reckon One can interface with other company tools, including CRM, ERP, and e-commerce platforms, thanks to the API connectivity capability, which guarantees seamless data transfer across systems.

- Custom Solutions: To meet certain operational demands, businesses can expand Reckon One's capabilities by creating custom apps or integrating third-party solutions.

- Enhanced Productivity: Decreases the need for manual data entry, minimizes errors, and optimizes workflow procedures.

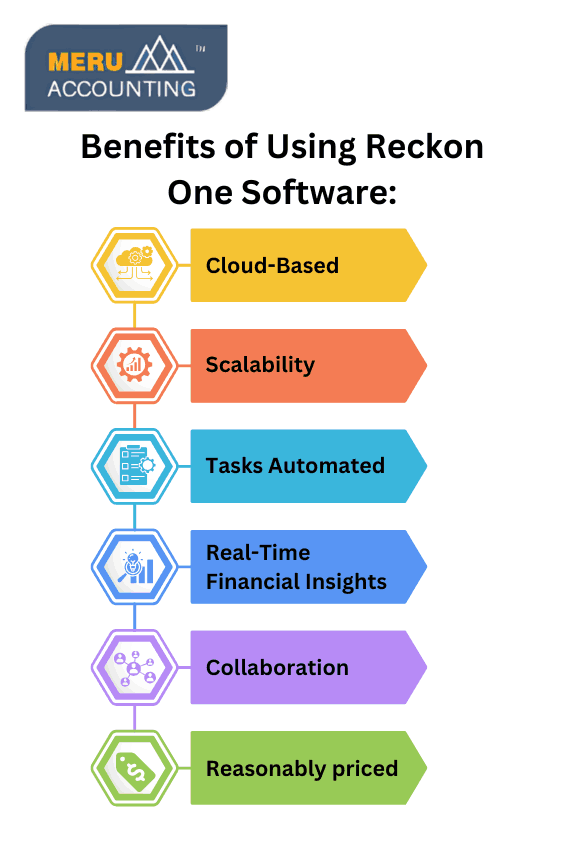

Benefits of Using Reckon One Software

1. Cloud-Based:

- Reckon One is a software that operates on the cloud, so customers can access their financial information whenever and from any location as long as they have access to the internet. This facilitates on-the-go access to financial information and collaboration with accountants and coworkers.

2. Scalability:

- Reckon One can expand to accommodate your company's needs. Users can simply upgrade or downgrade their plan as their business needs change, and it offers a variety of options to fit various business sizes and demands.

3. Tasks Automated:

- Reckon One has the ability to automate numerous standard accounting tasks, including data entry, invoicing, and reconciliations. Users are able to concentrate on more crucial tasks because this saves time and lowers the possibility of mistakes.

4. Real-Time Financial Insights:

- Reckon One Software gives consumers the ability to track their revenue, expenses, and cash flow in real-time. This aids in the decision-making process and financial management of businesses.

5. Collaboration:

- Reckon One facilitates seamless collaboration with coworkers, accountants, and bookkeepers by enabling several users to work together on financial tasks. Additionally, users have the ability to modify access levels and permissions to guarantee the security of private financial data.

6. Reasonably priced:

- Reckon One is a reasonably priced accounting solution, with monthly cost ranging as low as $10. This makes it a desirable choice for sole proprietors and small enterprises looking to handle their money wisely without going over budget.

Who should Use Reckon One Software?

1) E-commerce Companies: Reckon One helps e-commerce companies track inventory, handle online sales, and create invoices for clients.

2) Service-Based Businesses: Reckon One helps service-based businesses, like consultants, attorneys, and medical professionals, keep track of their spending, manage their accounts, and create invoices for their customers.

3) Retail Companies: Reckon One Software helps retail companies handle inventory, manage sales, and create bills for their clients.

4) Non-Profit Organisations: Reckon One is a tool that non-profit organisations can use to track donations, manage their accounts, and produce financial reports.

5) Real Estate Agents: Reckon One is a useful tool for real estate agents to track commissions, manage their money, and create customer invoices.

6) Anyone Looking for a Cloud-Based Accounting Solution: Anyone searching for an intuitive, scalable, cloud-based accounting solution and affordability can benefit from using Reckon One.

Accounts Junctions Expertise with Reckon One Software

1. Integration of Customer Relationship Management (CRM)

- Customer information management integrates with CRM software to handle interactions and data about customers.

- Monitors opportunities and sales activity.

2. Integration of Points of Sale (POS)

- Retail activities: Manages sales, inventory, and customer data by integrating with point-of-sale (POS) systems.

- Real-time updates: Offers current information on inventory levels and sales.

3. In-depth Understanding of the Product

- Thorough knowledge: The staff at Accounts Junction is extremely knowledgeable about all of Reckon One's features and modules.

- Product expertise: We know how to handle complicated bookkeeping and accounting chores with Reckon One.

4. Tailoring and Execution

- Customised solutions: Reckon One can be made to fit the needs of particular clients and business procedures by Accounts Junction.

- Efficient and successful implementation: We are skilled in the efficient and successful deployment of Reckon One software.

5. System Integration

- Smooth integration: Reckon One may be seamlessly integrated with various corporate systems, including ERP and CRM, thanks to Accounts Junction.

- Enhanced productivity: This integration can lessen the need for manual data entry and optimise procedures.

Services Offered by Accounts Junction Using Reckon One Software

1. Entire Bookkeeping Assistance

- Maintaining Accurate Records: Reckon One's double-entry accounting system is utilised by Accounts Junction to keep accurate financial records for every transaction.

- Frequent Reconciliations: To make sure all records are correct and current, we do recurring bank reconciliations utilising Reckon One's automated bank feed capability.

2. BAS preparation and GST compliance

- GST Calculation and Reporting: Using Reckon One to generate correct GST reports, Accounts Junction manages GST calculations and guarantees compliance with tax legislation.

- BAS Lodgment: By handling the creation and prompt lodgment of Business Activity Statements (BAS), we lower the possibility of penalties.

3. Services for Data Integration and Migration

- Easy Import/Export of Data: Oversee the transfer of data from other accounting programs to Reckon One, guaranteeing a seamless changeover without data loss.

- Support for API Integration: To improve corporate operations and data flow, offer integration with other business tools and apps, such as CRM or ERP systems.

4. Permissions for Advanced Users

- Role-Based Access Control: In Reckon One, set up personalised user permissions to manage who has access to see and modify particular financial data.

- Multi-User Collaboration: Provide safe access for several team members to work together on the same financial data.

5. Getting Ready for a Financial Audit

- Management of the Audit Trail: To ensure a transparent audit trail, keep track of all modifications made to the financial data using Reckon One's audit trail feature.

- Services Before Audits: Get your financial documentation ready for an outside audit, ensuring compliance and reducing the risk of discrepancies.

6. Management of Expense Claim

- Employee Expense Tracking: Make sure all claims are appropriately documented and handled by effectively managing and reviewing employee expense claims.

- Processing Reimbursements: Simplify the reimbursement procedure and include it straight into the accounting program to provide precise financial monitoring.

7. Combined Tax Estimation

- Automatic Tax Calculations: To ensure compliance with tax laws, use Reckon One's tax tools to automatically compute different taxes, such as GST and VAT.

- Help with Tax Filing: Accurate tax reports and summaries can be generated straight from Reckon One Software to simplify the filing process.

Conclusion

At Accounts Junction, we handle your bookkeeping and accounting requirements with Reckon One software. Whether you're a startup or an established company, Reckon One provides a robust yet adaptable solution that fits your needs. Reckon One's intuitive interface, adaptable modules, and smooth integration features enable us to deliver accurate and productive financial management services. It provides real-time financial data, guarantees adherence to regional tax laws, and assists in automating laborious operations. Through the use of Reckon One in conjunction with Accounts Junction, you can obtain professional bookkeeping service that improves financial transparency, lowers operating expenses, and fosters growth.

Other Software

Zoho Books is a sophisticated, cloud-based accounting software designed to simplify business finances and enhance operational efficiency. Ideal for freelancers, small businesses, and growing enterp...

Read MoreQuickBooks Online is a cloud-based accounting software developed by Intuit, tailored to meet the needs of small to medium-sized businesses, freelancers, and accounting professionals.

Read MoreIntuit ProConnect is a suite of professional tax software products developed by Intuit, tailored specifically for tax professionals and accountants.This is a cloud-based tax preparation software th...

Read MoreAccountEdge is a robust accounting software designed to simplify financial management for small and medium-sized businesses. AccountEdge offers detailed services to handle core accounting tasks eff...

Read MoreLess Accounting is an accounting software designed for small businesses that prioritizes simplicity and efficiency. It offers essential accounting functionalities without overwhelming users with un...

Read More