Bookkeeping Services for Gas Stations

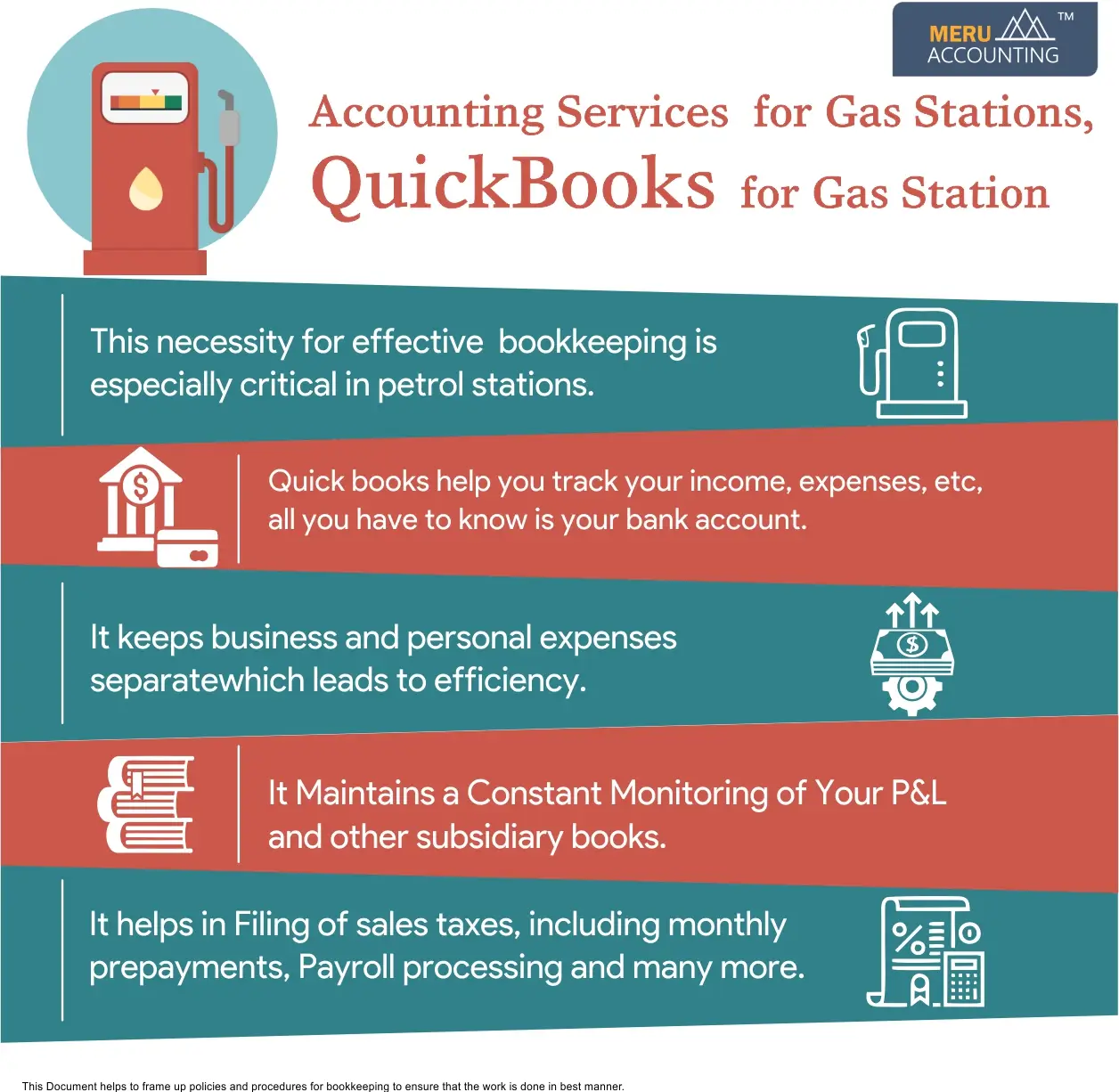

Every small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transactions occur each day. All of which must be meticulously documented.

In any business with a retail component, you must ensure that your bookkeeping is precise, because proper bookkeeping is the first step in determining whether your organization is profitable or whether the expenses outweigh the revenues. Accurate bookkeeping can also provide further insights for gas station owners by indicating which sections of their business are operating well and which may require improvement.

Furthermore, good bookkeeping is required during tax season because tax preparers primarily analyze your bookkeeping data to determine how much taxes you owe and what deductions you have.

As you can see, excellent bookkeeping is a crucial element of running a successful gas station. That's why I'm writing this post to further elucidate recommendations that will help you manage your gas station's books successfully.

QuickBooks for Gas Stations:

If you want to handle your bookkeeping successfully and efficiently, you'll require accounting software. QuickBooks is the software I recommend and the one that works best for gas station accounting. QuickBooks is the market leader in accounting software. It simplifies the entire accounting process for you, allowing you to accomplish more with less work. QuickBooks for gas stations helps you track your income, expenses, and profitability, and all you have to do is connect your bank account.

Once you've linked your bank account to QuickBooks, all of your transactions will be immediately posted to your bank feed, and the only thing left for you to do is categorize them. Furthermore, QuickBooks for gas stations allows you to develop financial reports, which provide essential data about your firm.

Keep business and personal expenses separate:-

I cannot emphasize enough the need of keeping company and employee spending separate. Commingling is one of the most common causes for small business owners to make accounting blunders, as combining business and personal costs will drastically skew your records.

The fundamental objective of bookkeeping is to record company transactions in order to know how much taxes you will need to pay as well as how well your firm is operating. When you start incorporating personal spending into your corporate bank account, you defeat the entire purpose of bookkeeping.

Maintain Constant Monitoring of Your P&L:-

I always advise folks to keep an eye on their profit and loss statement. Your profit and loss statement, also known as your P&L, is your financial statement that shows all of your income and spending. You utilize this financial report to determine your net income at the end of the year. This report offers information on all expenses incurred by your company over a given time period. It is also the report most influenced by faulty bookkeeping.

Don't Rush Your Bookkeeping & accounting for gas stations:-

One reason many small business owners make mistakes with their bookkeeping and accounting for gas stations is that they become complacent and rush through it. To do bookkeeping & accounting for gas stations correctly, you don't need to be a rocket scientist, but the process is time-consuming and requires time and effort. I would recommend that you set some time each week to conduct your bookkeeping. For petrol stations, bookkeeping does not take much time, so setting aside 5 hours each week is sufficient.

Hire a Professional:-

If you do not understand accounting principles or how the bookkeeping process works, you might consider hiring an expert. A professional bookkeeper can provide you peace of mind by ensuring that all of your bookkeeping is done correctly. They can also free up your time so that you can focus on other elements of your business.

Other accounting Services:

- Bookkeeping and accounting for gas stations

- Fee returns for underground storage tanks

- The Diesel Tax Credit

- Filing of sales taxes, including monthly prepayments

- Tax preparation and planning

- Audit representation for the IRS and sales tax

- Payroll processing

- Assistance in obtaining commercial loans

- Assisting you as your new business advisor

Accounts Junction is a CPA firm that provides complete outsourced bookkeeping and accounting solutions such as accounting & QuickBooks for gas stations to CPAs and small and medium-sized businesses in the United States, United Kingdom, Australia, New Zealand, Hong Kong, Canada, and European countries.

Conclusion:-

- This necessity for effective bookkeeping is especially critical in petrol stations

- Quick books help you track your income, expenses, etc, all you have to know is your bank account.

- It Keep business and personal expenses separate which led to efficiency

- It Maintains a Constant Monitoring of Your P&L and other subsidiary books.

- It helps in Filing of sales taxes, including monthly prepayments, Payroll processing and many more.

Different types of bookkeeping and accounting for Gas Stations:

1. Cash Basis Accounting:

- Records transactions as they occur in real time.

- Tracks income and expenses based on actual cash inflows and outflows.

- Simple method, often used by smaller gas station businesses.

2. Accrual Basis Accounting:

- Recognizes revenue when it's earned, regardless of when payment is received.

- Provides a more accurate picture of financial health over time.

- Requires more complex record-keeping and tracking of accounts receivable and accounts payable.

3. Specialized Industry Software:

- Some gas stations may choose to use industry-specific software designed for petroleum businesses.

- These software solutions offer features tailored to the unique needs of gas stations, such as fuel sales tracking, inventory management, and regulatory compliance.

4. Professional Bookkeepers or Accountants:

- These experts provide valuable insights and ensure compliance with tax regulations.

- They can handle complex financial tasks and help owners make informed decisions based on accurate financial data.

- Gas station owners may hire professional bookkeepers or accountants specializing in the petroleum industry.

5. Detailed Record-Keeping:

- Regardless of the chosen method, maintaining detailed and accurate records is crucial for gas stations.

- Records should include fuel sales, inventory levels, payroll expenses, and other financial transactions.

- Organized record-keeping allows owners to monitor performance, make informed decisions, and comply with reporting requirements.

Benefits of bookkeeping and accounting for Gas Stations:

1. Clear Understanding of Cash Flow:

- Track income and expenses to identify revenue patterns and trends.

- Make informed decisions about pricing, inventory management, and cost control.

2. Tax Compliance:

- Accurate financial records facilitate easy calculation of taxable income.

- Claim eligible deductions and prevent potential issues with tax authorities.

3. Financial Health Monitoring:

- Organized financial statements help assess profitability and track expenses.

- Compare against budgets or benchmarks to identify areas for improvement.

4. Informed Decision-Making:

- Access valuable financial data to drive strategic decision-making.

- Analyze trends and patterns to optimize operations and increase profitability.

5. Time and Resource Efficiency:

- Delegate bookkeeping or accounting tasks to professionals.

- Free up time to focus on other crucial aspects of your business.

6. Transparency and Accountability:

- Maintain accurate records to provide transparency to stakeholders.

- Establish accountability in financial management and reporting.

7. Financial Planning and Forecasting:

- Use historical financial data to project future performance.

- Develop effective business plans and set realistic goals.

8. Improved Business Relationships:

- Showcase financial stability and professionalism to potential investors or lenders.

- Build trust with suppliers, customers, and business partners.

9. Risk Mitigation:

- Identify potential financial risks and take proactive measures to mitigate them.

- Identify irregularities or discrepancies early to prevent fraud or financial losses.

10. Growth and Expansion Opportunities:

- Sound financial management attracts potential investors and lenders.

- Demonstrate the viability of your gas station business for future growth and expansion.

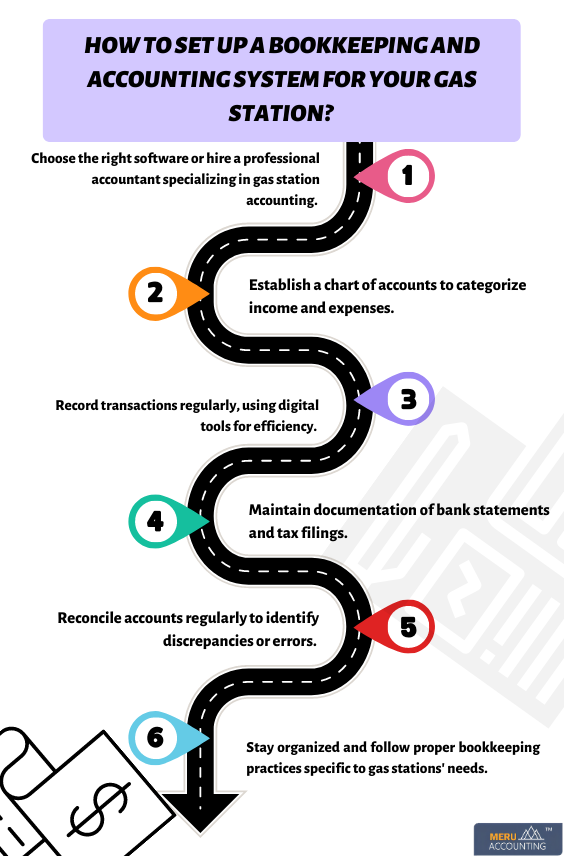

How to set up a bookkeeping and accounting system for your gas station?